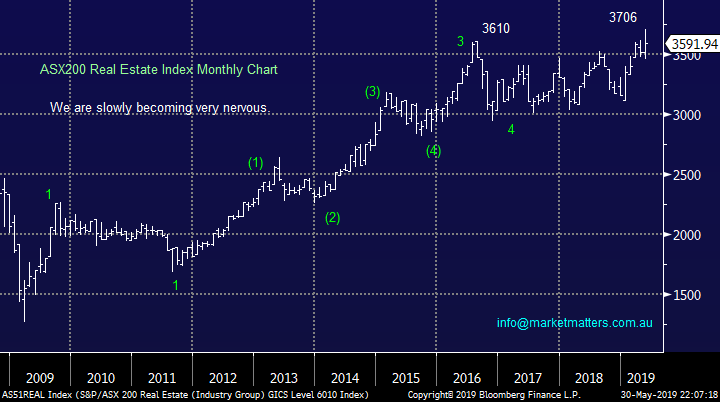

Has the Mirvac (MGR) capital raise signalled its time to depart the Real Estate sector? (ILU, EHL, CGC, MGR, GMG, CLW, SCG, LLC)

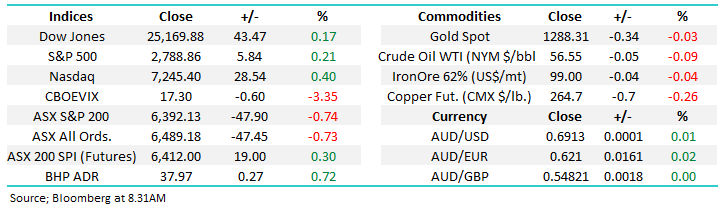

The ASX200 was sold off relatively hard again yesterday finally closing down 48-points, registering very similar damage to an index based portfolio as on Wednesday. By the close every sector except the Telco’s had closed in the red with the Energy & Resources stocks coming under the most pressure led by Fortescue (FMG) and RIO Tinto (RIO), both of whom fell well over 3%, not a great surprise following iron ores massive gains and current minor consolidation.

Today is the last day of May and unless we see any major surprises the combination of the Liberal election victory and RBA’s ever increasing dovish stance looks set to produce a positive month up over 1%, shrugging off the usual seasonal weakness i.e. over the last decade the local markets fallen -2.8% in May followed by -1.8% in June. This has come as no great surprise to MM and our feeling remains a decent market correction will unfold later rather than sooner this year.

Overnight we saw Melco Resorts and Entertainment buy 19.99% of Crown Resorts (CWN) from James Packer for $1.76bn at $13, less than a 1% premium to the stocks last trade at $12.92. This appears to confirm a quick return by suitor Wynn Resorts is highly unlikely – goodbye $14.75! However further down the track with Mr Packer an apparent keen seller a full blown takeover by the new buyer may occur but the price feels likely to be significantly lower than Steve Wynn’s April (sort of) bid.

MM remains bullish the ASX200 technically while the index can hold above 6350, a break of 6450 will look great.

Overnight US stocks finally held their ground closing up +0.2% and the SPI futures are calling the ASX200 to enjoy a bounce of ~20-points, retracing half of yesterdays losses. BHP closed up 30c in the US even when iron ore, copper and crude oil all closed in the red.

NB When we talk about how BHP closed in the US its always relative to how it closed on the ASX and currency adjusted, hence the theoretical price it will open at 10am today.

In today’s report we are going to look at the Real Estate sector following Mirvac’s (MGR) announced $750m capital raising.

ASX200 Chart

Firstly looking at “The Good, the Bad & the Ugly of the MM Growth Portfolio”, Mays been a good month for the MM Portfolios and SMA’s – up 1.75% to yesterdays close. Unfortunately the Costa Groups (CGC) downgrade yesterday through a little cold water over things. I have briefly looked at 3 stocks today that both fit the profile and MM members have been questioning over the last few days.

1 Iluka (ILU) $9.91

The “good” - ILU has rallied nicely since we went long a few weeks ago at $8.55, happily the reasons for the position discussed at the time all remain intact. Now the mineral sands stock has broken to fresh 2019 highs we remain bullish initially targeting a rally towards $11 but a break back below $9.60 is likely to see us take our $$.

MM remains bullish targeting another 10% upside.

Iluka (ILU) Chart

2 Emeco Holdings (EHL) $1.86

The “bad” slot could easily have been taken by Pact Group (PGH) but we mentioned that culprit yesterday hence we’ve looked at the leaser of earth moving equipment EHL.

Yesterday’s large disappointment by CGC appears to have reignited some selling in stocks that experienced downgrades in 2019 as fears increased of a 2nd, or even 3rd to follow. However at this stage we still believe EHL is a potentially excellent turnaround story but like PGH we are watching this one carefully. The next month is generally a risk period for further downgrades across the ASX.

MM remains cautiously bullish EHL.

Emeco Holdings (EHL) Chart

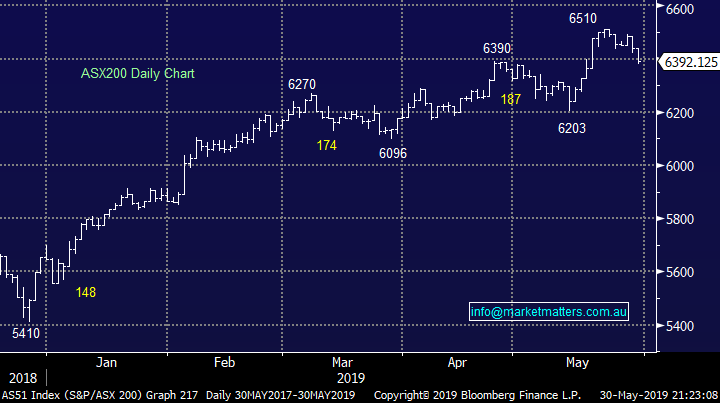

3 Costa Group (CGC) $3.75

CGC was hammered almost 28% yesterday following its downgrade which we discussed in yesterday afternoons report but the selling felt too severe in our opinion. As I said last night “It felt like there was a large holder with an axe to sell the stock and the massive volume supports that thesis. Of the top five holders of CGC only Bennelong has been a major seller during calendar 2019. They’re also the major holder of the stock with 27m shares on board. Being a substantial holder, it will be interesting if we see any changes here over the coming day – we’ll keep you posted.”

MM added to our holding yesterday and in support I bought some raspberries for the kids last night – made me feel better!

NB We have said for months that we would add to our CGC ~$4 so this was not “hit and hope” stuff but simply following our plan.

MM remains bullish around $4 but its clearly high risk at the moment.

Costa Group (CGC) Chart

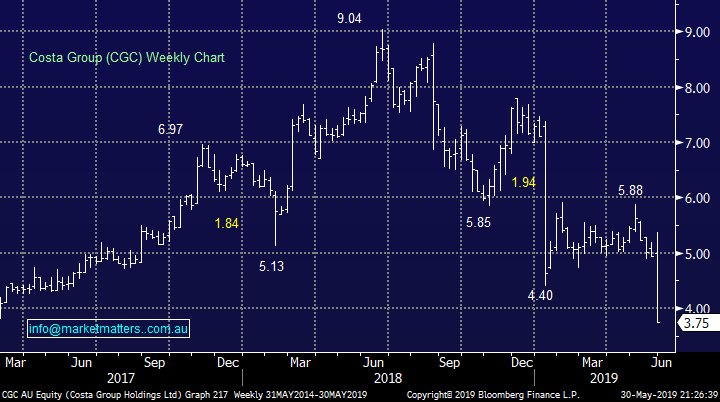

Is the Real Estate Sector approaching its zenith?

The Australian REIT’s are investment businesses that invest in and usually operate income producing real estate assets e.g. in the ASX200 Cromwell Group (CMW), Charter Hall (CHC), National Storage (NSR) and Shopping Centres Australia (SCP).

The sector has really enjoyed the post GFC environment of “cheap money” advancing over 150% , while the BRW Rich list out this morning also highlights the money made in commercial property over the past 12 months. However, technically we are now very wary that a decent pullback is on the horizon.

MM is neutral / bearish the REIT’s as an index following their impressive post GFC gains.

ASX200 A-REIT Index Chart

The Australian Real Estate sector as a whole includes a broader scope of stocks than just the REIT’s, it also includes the likes of Mirvac (MGR), Aveo Group (AOG) and Lend Lease (LLC).

Similarly MM is neutral / bearish the Real Estate sector as an index following their impressive post GFC gains.

ASX200 Real Estate Index Chart

Now moving onto a few stocks within the group to see if any nuggets of opportunity exist or signs that this sectors party is coming to an end, just as the picture of the respective indices suggests.

1 Mirvac (MGR) $3.01

Mirvac announced a substantial $750m capital raising this week as the pessimism towards housing declined, albeit slightly. The funding is intended for MGR to expand its build and rent business plus a couple of major inner city projects in Sydney & Melbourne.

The stock has defied the housing slump helped by its forecast that FY19 earnings will be 4% above the previous year. The stocks currently trading on a Est P/E for 2019 of 18x while yielding 3.75% unfranked. Boringly we see no decent risk / reward opportunity in MGR at present.

MM is neutral MGR at present.

Mirvac (MGR) Chart

2 Goodman Group (GMG) $13.28

Goodman Group (GMG) has been an enormous success within the ASX200 over the last few years basically doubling over the last 12-months. The appreciation in the integrated property provider is undoubtedly justified as we saw in the First Half of FY2019 a greater than 10% rise in operating profit to $465m. The shares are currently trading on a fairly rich Est P/E for 2019 of 25.8x while yielding only 2.33% unfranked.

The business has prospered from the greater customer demand for quality industrial centres close to high density living areas. Fundamentally we believe GMG is a great business but technically we feel the shares have rallied little too far too fast – we called it a sell ~$14 a few weeks ago and again and this is looking on the money at present, our initial target is ~5% lower.

MM is currently neutral to bearish GMG.

Goodman Group (GMG) Chart

3 Charter Hall (CLW) $4.90

CLW completed a $150m institutional placement early last month but the shares have continued to appreciate well above the placement price. The monies were used by the REIT to purchase Rockdale Plaza in NSW for $142m.

My concerns with CLW are to the potentially late cycle appreciation of the company’s assets – we’ve all seen what’s happened to residential real estate over the last 6-months. However, there are no technical sell signals while its Est P/E of 18.2x is not too demanding plus its 5.4% unfranked dividend remains attractive. Hence after liking the stock around $4 we are now neutral.

MM is currently neutral CLW.

Charter Hall (CLW) Chart

4 Scentre Group (SCG) $3.79

SCG has been an ugly duckling within the sector as its portfolio of shopping centres in Australia and New Zealand has not excited investors.

Comparatively the stocks cheap trading on an Est P/E for 2019 of 14.6x while the stock yields 5.85% part franked – great compared to bond yields.

MM is now neutral SCG after being bearish for the last 12-months.

Scentre Group (SCG) Chart

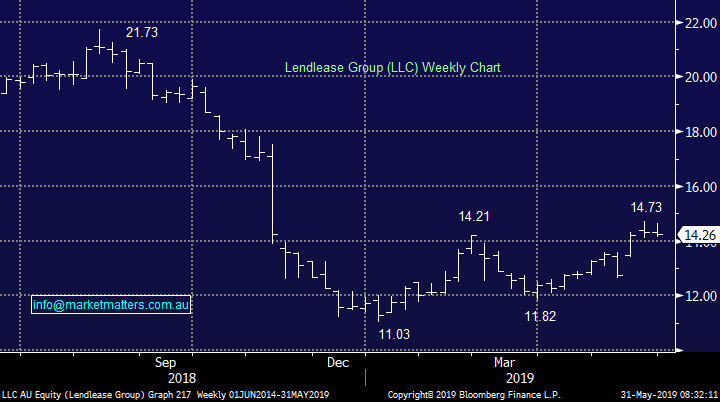

5 Lendlease Group (LLC) $14.26

Lastly developer / operator of both property and infrastructure projects LLC which as endured an awful year – the basic numbers are unexciting with the shares trading on an Est P/E for 2019 of 18x while the stock yields 3.3% unfranked.

Technically LLC is now 50-50 making this an easy leave alone, we want some better risk / reward before walking into this lion’s den.

MM is neutral LLC.

Lendlease Group (LLC) Chart

Conclusion (s)

Due to our bigger picture view of the sector we intend to avoid the Real Estate space for the foreseeable future.

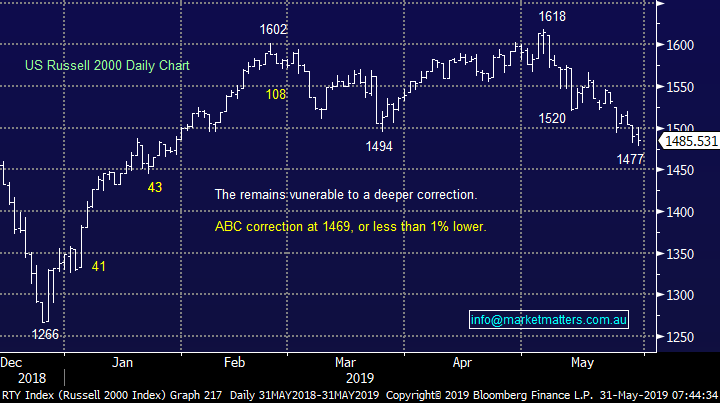

Global Indices

Nothing new with our preferred scenario the current pullback is a buying opportunity although we are only looking for a test of / slight new 2019 highs from US indices.

US Russell 2000 (small cap) Index Chart

No change again with European indices, we remain cautious European stocks but the tone is improving fast.

German DAX Chart

Overnight Market Matters Wrap

· The Australian market should end the week on a positive note, after a calmer, less volatile night on equity markets, with Wall St closing slightly higher, despite ongoing concerns about the US-China trade wars and its impact on slowing global growth. The three key Wall St indices closed between 0.2% and 0.3% higher after a late rally. Bond yields, however, continued to slide to near 20-month lows, with the ten year benchmark falling to 2.23%, which weighed on the US bank sector - Bank of America fell 2% and JP Morgan dropped 1%.

· Oil prices, plummeted 4% after a smaller than expected decline in US crude stockpiles, which fell around 300,000 barrels (vs expectations of a 900,000 drop). The benchmark Brent price fell US$3 to US$66.40/bbl, dragging the key energy stocks lower.

· The broader commodity market was mixed, with iron ore dropping 2.3% back below US$104/t, gold was about 0.5% higher at US$1293/oz and copper about 0.5% lower at US$2.65/lb. The A$ continues to hold above US69.1c despite expectations of a rate cut by the Reserve Bank next week of 0.25%. The chances of a rate cut were raised by the weaker than expected building approvals slump yesterday of 4.7%, led by a drop in both apartments and detached housing. The ASX futures are currently about 0.3% higher.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.