Has Malcolm Turnbull created a buying opportunity in the Energy Sector?

Yesterday the local banks yet again rallied, gaining a further 0.7%, taking the sector back towards its July 2015 level. However, this time it was the turn of the energy sector to limit the gains of the ASX200 following Malcolm Turnbull's "gas intervention", which hit Santos 5.5% and Origin Energy 3.6%. The PM announced plans to reduce gas exports in the event of domestic shortages. The potentially impacted stocks are scrambling for more details of how the policy will work, especially following Mr Turnbull's comments on ABC radio that local prices should be halved. The essence of the plan is that if an exporter draws more from the domestic market than they put in, they will need to show how they will fill the shortfall as part of their overall production and exports. Clearly there is a shortage of gas available for domestic consumption and this is pushing up prices, a major problem which BlueScope Steel’s chief executive warned us about in February. It does sound crazy that we are the world's largest exporter of LNG, but we are experiencing severe shortages at home that leads to blackouts!

The US made local energy security a priority some time ago and had set up a structure during the infancy of country’s gas development. They provided a framework for producers that was clear, hence all new facilities were developed knowing the economic backdrop. A government altering the regulatory environment after massive investments have been made, sends a dangerous message both locally and globally. Clearly Australia needs billions to be invested in this space, but this "moving of the goal posts" creates sovereign risks for energy companies, just when we need them to spend money. A thought provoking angle is Australia spent billions of dollars subsidising Holden because they couldn’t compete and here we have an almost opposite situation where we are telling companies they cannot sell their product to the highest bidder, perhaps the government should offer assistance here by plugging the gap, or at least offering tax incentives.

Today we are going to evaluate whether this politically generated weakness has created some bargains, especially following falls in global energy stocks overnight e.g. the US S&P500 energy sector fell 1.1% following crude oil lower towards $US49/barrel.

There is no change in our current outlook for the ASX200 which has rallied 1.7% for the month. Technically, major overhead resistance continues to evolve just under the psychological 6,000 area, which has attracted plenty of press as stocks push higher. Our view remains that a "pop" over this month's high of 5,950 will represent ideal / excellent selling on a risk / reward basis.

ASX200 Daily Chart

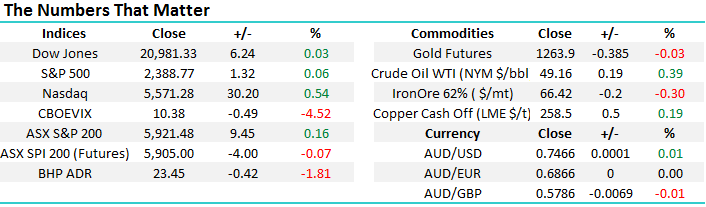

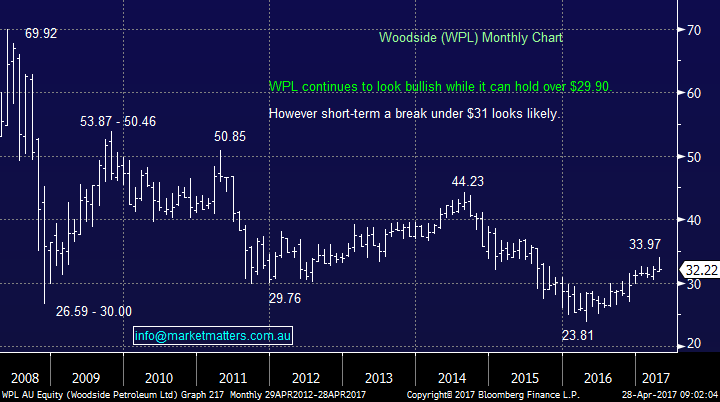

This morning, US stocks have closed more or less unchanged with the exception of the NASDAQ, which again powered to fresh all-time highs, gaining another 0.54%. Importantly, US equities remain extremely close to our initial upside target and risk/reward no longer favours general buying:

1. US stocks look poised to only rally another ~2% over next few days/weeks.

2. A 5% correction is now looming rapidly on the horizon, it now feels like we are heading towards a classic "sell in May and go away" scenario.

3. Assuming we get a 5% correction over May/June, similar to last year, we will be keen buyers into this weakness, targeting further gains later in 2017.

Dow Jones Daily Chart

Today we are going to look at four Australian energy companies who have different levels of exposure to Malcolm Turnbull's "gas intervention policy".

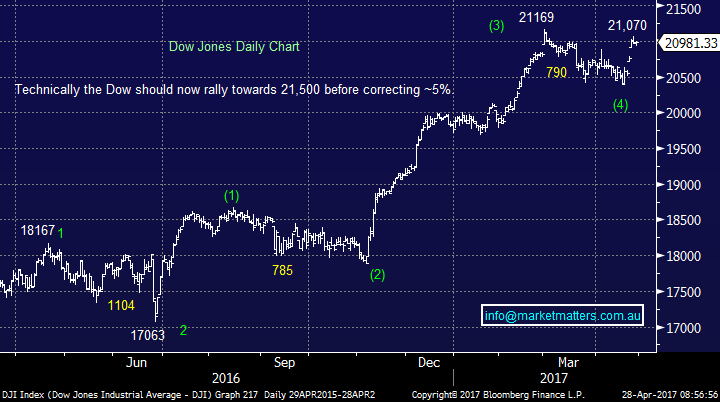

1. Santos (STO) $3.44

Santos is firmly in the cross hairs of the PM's policy, as it uses significant domestic gas to feed its Gladstone LNG project and theoretically, the gap could limit the amount of LNG they are subsequently permitted to export. STO were vocal yesterday about the new Govt plans and you can understand why – they’ve planned and built a multi-billion dollar project under one set of government regulations and by the time it starts to kick into gear, the regulations will have changed. This is called sovereign risk and the last time it received media attention was during the Government’s plan to tax the ‘super profits’ in the mining sector - just as the top was forming in iron ore. Sovereign risk is something far more associated with Africa and parts of Asia, as opposed to Australia and cannot be good for the corporate world’s perception of us in general.

Specifically, STO is a company we have not liked for many years and these fresh uncertainties look to be just another reason to steer clear of this market/sector underperformer. The main reason for our negative stance is the cost structure of their asset base – and that also speaks to the quality of their assets. Santos is more exposed to the ebbs and flows of the Oil price and will come under more pressure than most, when Oil trades nearer to $40. The other aspect is around management and their lack of credibility. We were vocal around the handling of the recent capital raising, and that view has not changed.

Santos (STO) Weekly Chart

2. Origin Energy (ORG) $7.26

Last year, we took a ~27% profit from the rally in ORG to the $7 region, although in hindsight, our exit was a touch premature. While the PM's policy changes do not look as dramatic for ORG compared to STO given the composition of ORG’s business (having production and retail operations), we remain neutral ORG and comfortable with our recent exit from the stock.

Origin Energy (ORG) Monthly Chart

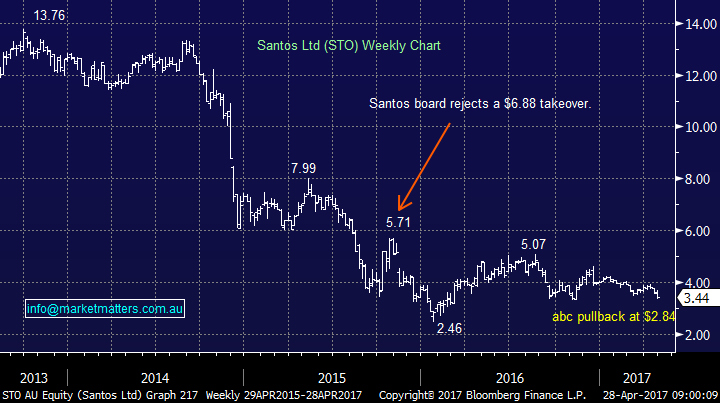

3. Woodside Petroleum (WPL) $32.22

The largest player in the pure energy space is Woodside and the stock has looked technically healthy since it rallied over $30. WPL is our preferred "play" of the 3 stocks discussed to-date, but short-term a pullback under $31 (~4%) looks a strong possibility. We will re-evaluate WPL if this weakness unfolds as it will offer good risk/reward entry.

Woodside Petroleum (WPL) Monthly Chart

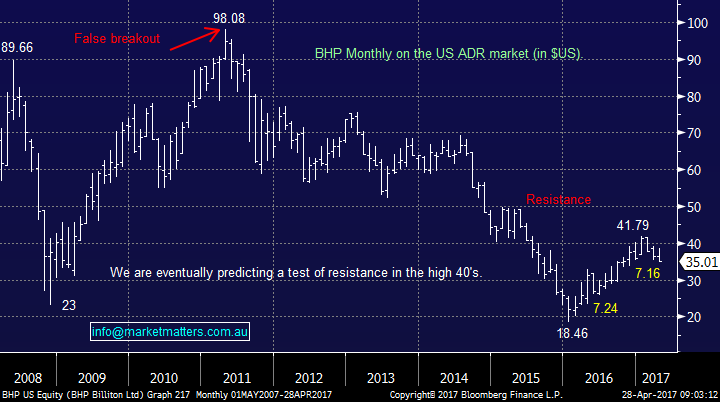

4. BHP Billiton (BHP) $23.87

As we all know, BHP is a diversified miner, but it has a significant footprint within the energy space. We currently have a 5% holding in BHP from just over $24. Yesterday, BHP reversed earlier small gains to close around 1% lower and assuming the stock follows the US ADR's, it should open almost 2% lower today. We remain medium-term bullish the stock, believing it to be undervalued within both the sector and market. The stock is currently paying a 3% fully franked yield with the potential for positive buybacks in the near future as the stock evolves into a "cash cow".

Today we will look to average our BHP under $23.50, buying an additional 2.5%.

$US BHP Billiton (BHP) on the ADR's Monthly Chart

Conclusion

Stand out conclusions today:

1. We do not believe that the PM's "gas intervention" has created buying opportunities into the overall gas / energy sector.

2. We remain bullish BHP and will look to average our position under $23.50, taking our holding to 7.5%.

3. We will no longer consider averaging our RIO position following our recent foray into OZ Minerals (OZ).

Overnight Market Matters Wrap

· A marginal close to the upside was seen with the major indices in the US overnight, as we head towards the tailwind of the earnings season.

· Commodities were the flavour of the day, with the energy and miners sector being hit. We expect BHP to underperform the broader market today, after closing and equivalent of -1.81% in the US overnight.

· The June SPI Futures is indicating the ASX 200 to open 8 points higher this morning, testing the 5,930 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/04/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here