Going against the crowd, as it’s often wrong!

The "crowd" has had a tough time over recent years whether its panic selling of resources last Christmas, buying the banks at crazy levels mid-last year or chasing the yield play only a few months ago it's been an uncomfortable ride. As investors we need to look 6-12 months ahead and always consider how the market is positioned. If everyone is already long there will simply be no buyers left however good the story, and when the horizon becomes vaguely cloudy the storm that follows can be ugly.

Importantly we are not advocating being contrarian for the sake of it but simply more individualist and open minded. Below is our video shot yesterday around the subject – click on the image to view. The vast majority of market analysts are motivated by not being wrong, hence we get so many market upgrades to a stock once it has already appreciated 10-20% - and vice versa on the downside. This morning's report will focus on 3 market calls that are 100% Market Matters and will dictate much of our investments over coming months:

1. Global Indices

Last night the US S&P500 again made fresh all-time highs breaking over 2200 and similarly the Dow has closed over the psychological 19,000. As we have pointed out over the last few months global fund managers have been sitting on their largest stockpiles of cash in many years looking to buy stocks at lower levels but markets often move in the path of most pain - in this case up. The Dow has rallied 1133 points (6.3%) this month alone since the Donald Trump victory and people are missing out. We have the perfect scenario for a blow off top. Be very conscious of when the media get bullish as the top will be close at hand.

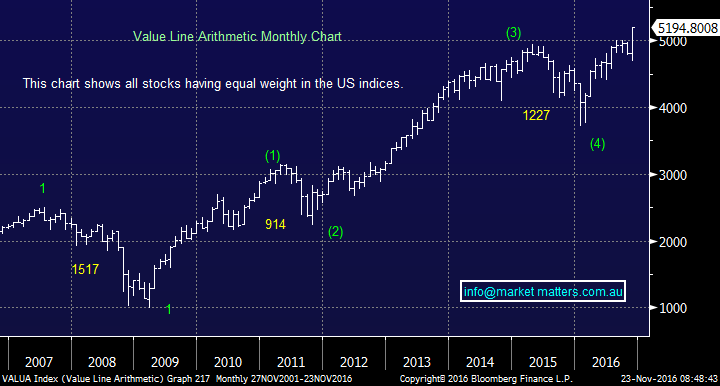

This morning we have included a chart that many people have probably never seen before, the Value Line Arithmetic Chart, which shows 1700 US stocks equally weighted i.e. it's not all about APPLE! This clearly shows the average US stock looks excellent, actually led by the small caps, and we believe this is because of excess liquidity (cash looking for a home).

"We believe this is a blow off top that may easily extend another 5-10% BUT a horrible +25% correction is on the horizon" - Market Matters.

Value Line Arithmetic Monthly Chart

2 Aged Care and Private Health

The Australian Government simply will not be able to afford the growing financial burden of both the aged and general health requirements of our increasing + aging population in the years ahead. In Sydney alone, the number of residents aged over 80 will almost double in the next 10 years. To reinforce our view today the Financial Review has kindly led with the S&P ratings agency warning that our budget deficit must not blow out further and we need to return to surplus by 2020-21. Simply the pressure is on and cuts to government Health spending will be high on the priority list - and this inevitably will lead to greater participation by private operators (The Northern Beaches Hospital in Sydney is a clear illustration of this).

Healthscope (HSO) has gone from hero to villain in the last few months after a drop off in visits to its private hospitals over one tough quarterly period saw the company warn on growth projections leading to a rerating of the stock - these visits have been deferred, people still need operations. HSO is an excellent business operating 45 private hospitals which is now trading on a valuation of under 20x estimated 2017 earnings - we believe cheap considering the future growth and (despite the short term blip) the predictability of earnings.

"HSO is one stock we are happy to buy into weakness on a medium term view even with our concerns over the markets position into 2017/8" - Market Matters.

Healthscope Ltd (HSO) Weekly Chart

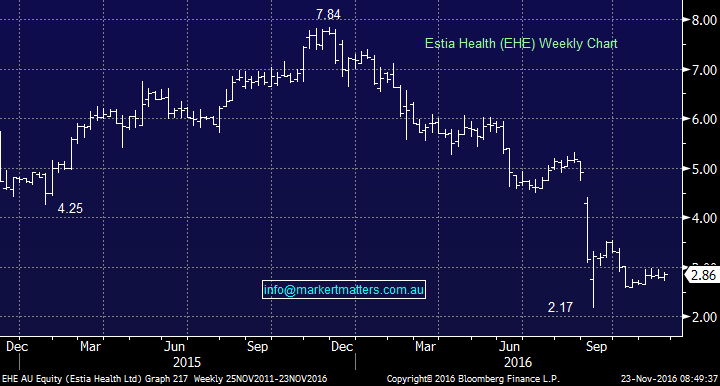

Secondly a stock we mentioned in Mondays report - Estia Health Ltd (EHE), our thoughts remain essentially the same:

It’s been a very poor time for Estia and the other aged care stocks with Estia falling from ~$8 to now trade at $2.86. The stock now seems cheap however there is a lot of uncertainty in terms of short term Government funding as well as within the company itself. We think the longer term drivers for this sector remain sound, and the Government need a strong aged care sector, however we’d be buyers of a new low ~$2 – which seems a long way off however as we’ve seen, these stocks can have big moves.

Estia Health (EHE) Weekly Chart

3 The defensive yield stocks

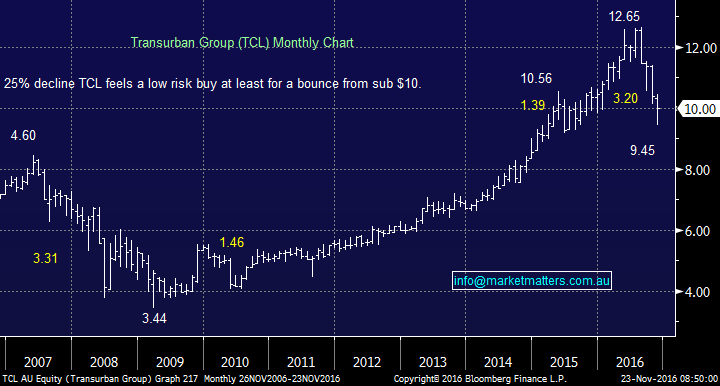

The defensive yield stocks were chased hard into mid this year as everybody jumped on board "rates will be lower for longer". Suddenly this all changed as US wages started growing taking bond yields up and then as we all know the capitulation punch came from the Trump victory - most of the well owned names were a whopping 25% lower in only 4-5 months.

People like to buy what is perceived to be cheap, especially when they on high cash levels – Fund Managers are almost forced into stocks. After their recent pullback the defensive yield stocks are / will be popping up on investor radars - WFD has rallied 11.8% and TCL 5.8% from the recent lows.

"We are long WFD and TCL and believe they have further upside but this a countertrend rally and we will not be afraid to take profits on our positions in the weeks ahead" - Market Matters.

Transurban Group (TCL) Monthly Chart

Westfield Group (WFD) Monthly Chart

Summary.

- We are short term bullish equities which is illustrated by our only 6% holding in cash – however, we are wearing are sellers hat over the weeks ahead.

- We remain positive aged and healthcare stocks as a general thematic. We remain comfortable averaging our HSO position if the opportunity arises ~$2.10.

- We believe the defensive / yield stocks have further to bounce / run but believe this is a countertrend rally to sell, not one for the long term.

*Watch for alerts*

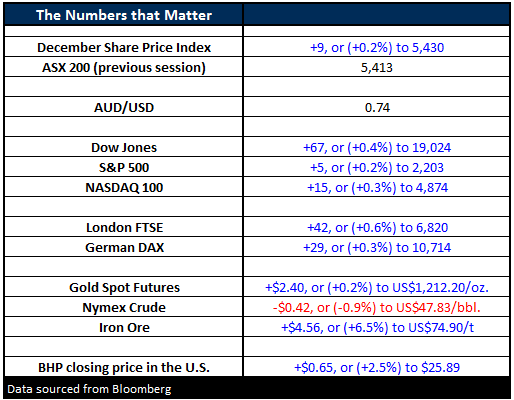

Overnight Market Matters Wrap

- The US indices continue to hit new highs this week, amid trader speculations that the economy is strong enough to withstand borrowing costs i.e. increased interest rates).

- The Dow up 67 points (+0.4%) to 19,024 and the broader S&P 500 up 5 points (+0.2%) to 2,203. Interest rate prob of rate hike in December is now at 100%

- The major miners extended their gains as Iron rallied 6.5% higher to US$74.90/t. BHP is shaping to outperform the broader market today after closing an equivalent of 2.5% higher to $25.89 in the US from Australia’s previous close.

- Oil was volatile overnight, with a range of +/- $2.03, a high of US$49.20, a low of US$47.17 and currently US$47.83/bbl., down $0.42 (-0.9%).

- The ASX 200 is expected slightly higher, up 12 points to the 5,425 level as indicated by the December SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/11/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.