Four More Big Movers as Reporting Season Kicks Off

The ASX200 rallied very strongly yesterday, which is often the case on the first trading day of the month. We thought the market might advance ~20-points considering the firmness overnight in BHP and RIO, but the 0.9% gain was over double our thoughts as the heavyweight banks came to the party, rallying over 1.2% as data showed Australian property prices show no signs of collapsing, defying many bearish predictions.

Two days ago, we witnessed the market being savaged on huge volume selling as our targeted 5500-area for the index felt just around the corner, but here we are today and most of those losses have been recouped and the market has a distinct strong feel. In hindsight, our market accurately predicted a couple of strong days on global bourses. The local market simply remains range bound between 5629 and 5836 with the sentiment swinging from bullish to bearish almost daily. Our preference is for a correction as we enter the seasonally bearish August / September but no sell triggers have surfaced to-date.

ASX200 Daily Chart

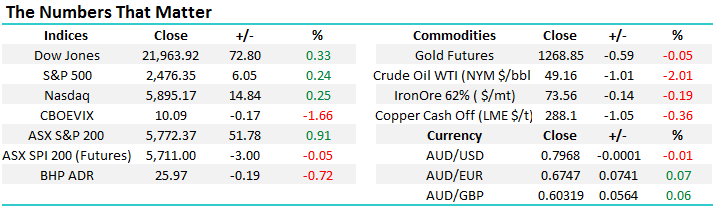

US Stocks

Last night the broad US market remained firm while the Dow Jones traded and closed at an all-time high. The market has certainly well and truly moved on from any concerns around Donald Trump, even as talk of war with North Korea escalates. We remain short term bearish US stocks after being bullish all year, but no sell signals have yet materialised – ideally, we are targeting ~5.5% correction for the Dow.

US Dow Daily Chart

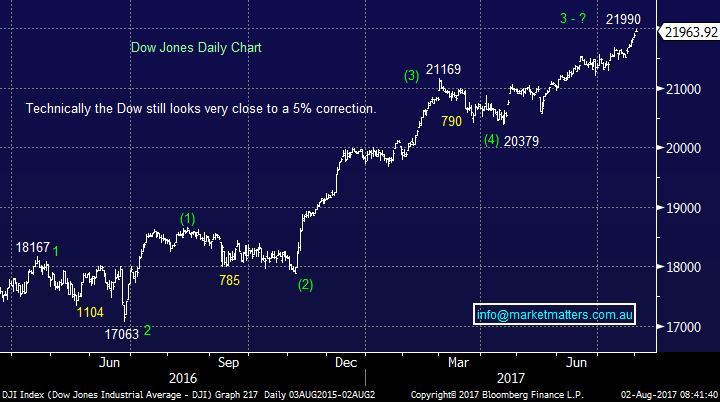

European Stocks

Again, no change with the German DAX holding strong support in the 12,000-area following a 6.2% correction, whereas the UK FTSE looks vulnerable to further declines, as investors understandably get increasingly concerned around BREXIT.

German DAX Weekly Chart

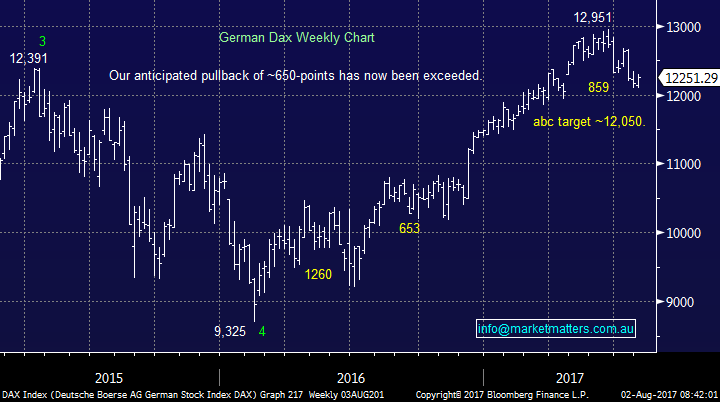

1 Credit Corp (CCP) $18.09

Firstly, starting off on a positive note with debt collector CCP, which rallied a very strong 6.7% yesterday following an excellent result. CCP’s revenue rose 17% to $266m, generating a net profit after tax of $55m leading to the company now paying a 3.5% yield.

Overall, we like how the company is positioned in the market as unfortunately Australians look set to feel the pinch if interest rates rise. While CCP may find debt collecting a touch harder moving forward, this is likely to translate into buying such debt cheaper if financial stress does increase.

We are overall bullish CCP initially targeting ~$21.

Credit Corp (CCP) Monthly Chart

2 Treasury Wine (TWE) $12.18

As readers know, TWE is a stock we’ve been watching over recent weeks, looking for a decent correction to present a buying opportunity. TWE reaffirmed guidance into yesterday and the stock bounced, as expected, over 3.3%. However, we do not see value at current levels especially as the Asia expansion forecasts look to have definite room for disappointment. We remain buyers of TWE but at lower levels.

Treasury Wines (TWE) Monthly Chart

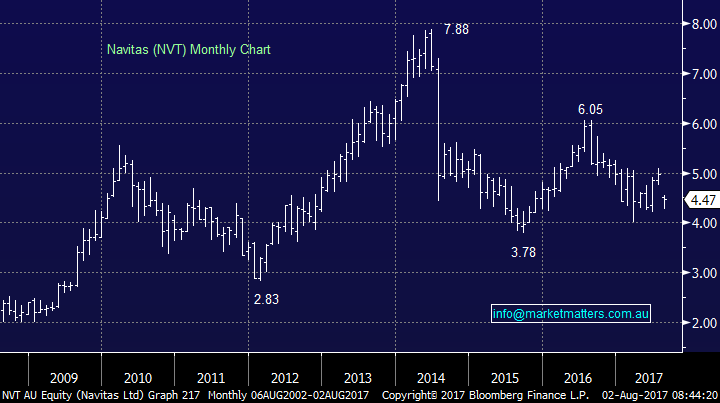

3 Navitas (NVT) $4.47

NVT reported numbers that even the CEO described as messy, with a profit decline of 11% catching the eye. The education company simply showed nothing in its result that we liked, hence MM has no interest in NVT.

Navitas (NVT) Monthly Chart

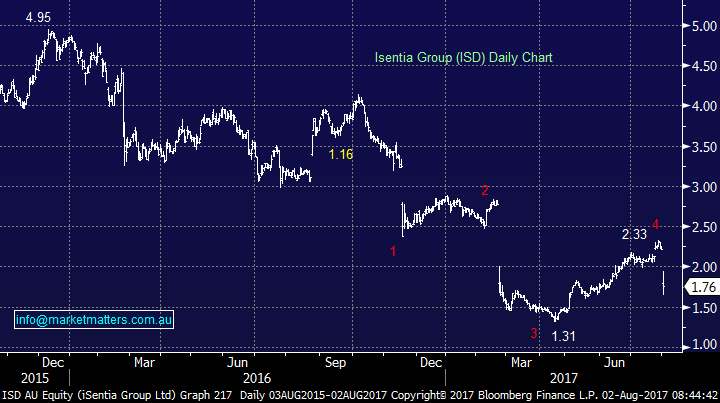

4 ISentia Group (ISD) $1.76

Yesterday ISentia yet again smashed investors with a profit downgrade and revealed the shutdown of King Content, a media monitoring and content company it bought for $48 million two years ago. The stock plummeted a huge 20.7% to close at $1.76 and technically it looks headed lower towards $1. Not surprisingly, MM has no interest in ISD.

ISentia Group (ISD) Daily Chart

Conclusion (s)

With the MM portfolio sitting on 23.5% cash we are obviously on the lookout for buying opportunities however we’re in no great rush. From the 4 stocks that caught our eye following reports yesterday we only interest in one at current levels:

1. We like CCP at current prices targeting a gain of over 10%.

2. We remain keen on TWE but only at lower levels.

3. We currently have no interest in NVT, or ISD.

*Watch for alerts*

Overnight Market Matters Wrap

· A firmer night on Wall St saw the Dow set another new high of 21963 and both the S&P 500 and NASDAQ within a whisker of record levels. Apple reported better than expected earnings after market which saw the stock 3% stronger in extended trading.

· Commodities were generally easier with the oil price retreating 2% and most base metals, including iron ore drifting lower on profit taking after their recent strong run.

· CYB reported overnight, with better than expected quarterly earnings number, sending the stock soaring 9.3% in U.K. Trading – we expect this to flow in the Aussie session.

· The June SPI Futures is indicating the ASX 200 to open with little change, above the 5770 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here