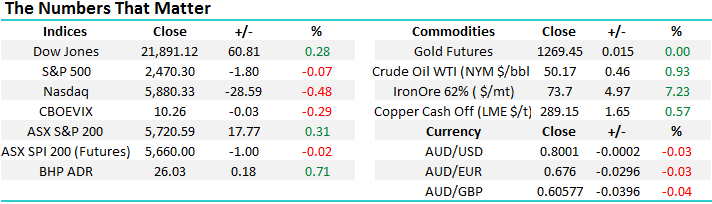

Four Big Movers that Caught Our Eye on Monday

The ASX200 almost belligerently managed to end July in exactly the same choppy manner it had traded all month. Initially rallying almost 50-points after a disappointing opening, as iron ore soared, only to fall away fairly sharply in the last hour of trade to close smack in the middle of the day’s range. A final gain of under 18-points is not exciting when we consider iron ore was limit up 8% during our trading session, sending the sector’s heavyweights, BHP and RIO to their highest levels since February.

The local market actually managed to close July unchanged within a point, probably not a surprising result considering it had the lowest monthly range since mid-2014. However, when we consider the average July performance since the GFC prior to this, July was up over 4% it’s definitely been a lacklustre performance on a relative basis, especially as the Dow was up almost 500-points basis Friday’s close.

Our current short-term bearish view for the ASX200 is unchanged as we enter the seasonally weak August / September months, but the market needs to close under 5650 to suggest a decent correction is unfolding.

1. The ASX200 remains range bound between 5629-5655 support and 5836-5810 resistance.

2. Our preference is still for a further correction back towards 5500 in August / September and the more begrudging the pullback, the keener MM will become to buy the retracement.

ASX200 Weekly Chart

US Stocks

Last night, the broad US market again reversed early gains led by the tech NASDAQ, which closed down 0.48%. We remain short term bearish US stocks after being bullish all year – we are targeting a 7% correction for the NASDAQ.

Importantly for local investors, when the NASDAQ corrected sharply over 5% in June / July, the ASX200 basically ignored the move. The broad S&P500 will need to correct before we are likely to take notice, MM is looking for a slightly smaller 5% correction here.

US NASDAQ Weekly Chart

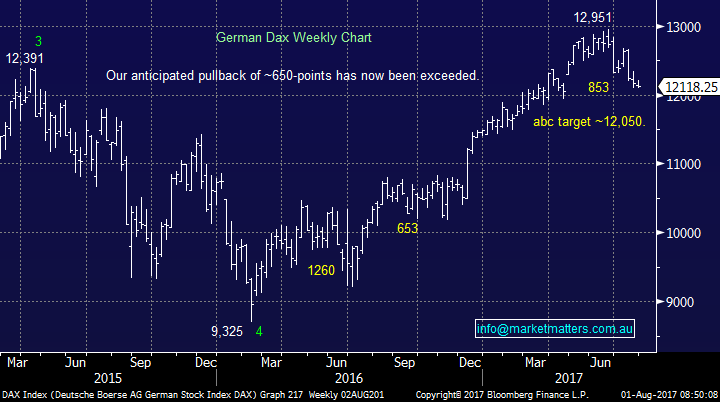

European Stocks

No change, Europe has recently been tricky of late with the German DAX now approaching strong support in the 12,000-area, following a 6.2% correction, whereas the UK FTSE looks vulnerable to further declines, especially as investors understandably get increasing concerned around BREXIT.

German DAX Weekly Chart

1 BHP Billiton (BHP) $25.85

Firstly, starting off on a positive note with resource heavyweight BHP, which rallied over 2% yesterday as iron ore surged – a stock we happily own with a 7.5% weighting. Last night in US trading, the old “big Australian” closed only 0.3% below levels not seen since mid-2015, but alas the strong $A has restrained the gains on the local bourse.

No change, we are targeting a break of $28 for BHP in 2017 – our best guesstimate for a target is ~$29. Subscribers please note, we will have no hesitation in selling BHP at our target area. The stock has already experienced two significant corrections of 18.7% and 21.1% respectively since its major low early in 2016, as the ASX200 continues to witness huge sector rotation, a characteristic we believe investors should become accustomed to for at least a few years. Hence, we will continue to sell stocks when they hit our targeted areas unless their circumstances have clearly changed.

BHP Billiton (BHP) Weekly Monthly Chart

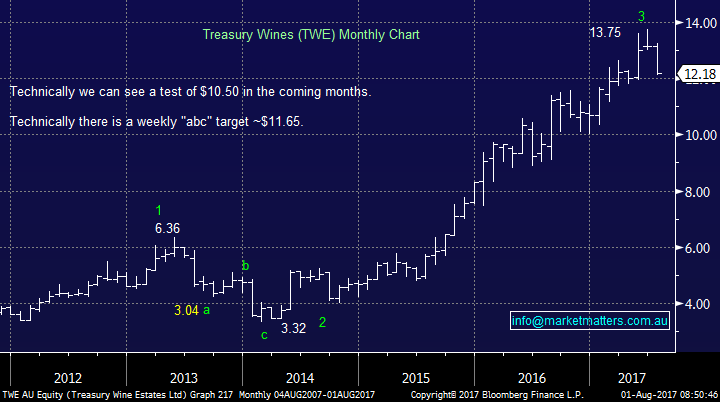

2 Treasury Wine (TWE) $12.18

TWE is a stock we’ve been watching over recent weeks, looking for a decent correction to present a buying opportunity – the stock fell almost 5% yesterday. We like TWE moving forward and are keen buyers of weakness. We have 2 potential pullback target areas of $11.65 and $10.50 and may consider allocating a % of the MM portfolio at each level. However, we are very aware the market is “comfortably long” TWE hence a decent shake out is our preferred scenario.

Interestingly, TWE reaffirmed guidance overnight, its impact on the stock will be very interesting this morning, in theory it should bounce.

Treasury Wines (TWE) Monthly Weekly Chart

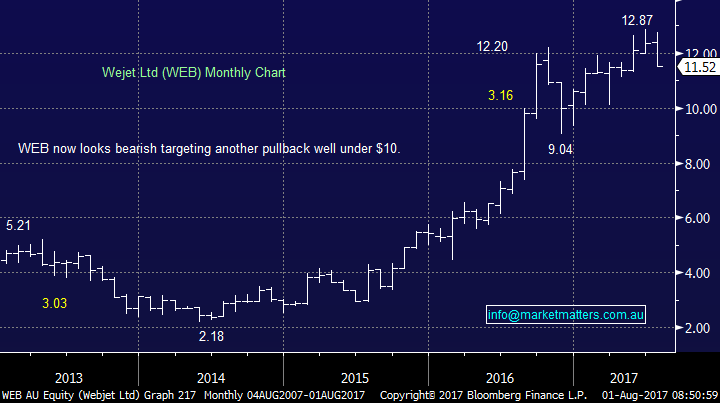

3 Webjet (WEB) $11.52

WEB shares have fallen away after the online travel agency flagged an accounting dispute that could hurt its full-year earnings. Technically the stock looks horrible, targeting a +10% correction to potentially test December 2016 lows. A correction of this nature would coincide with our targeted sharp ~7% correction by the US tech NASDAQ index.

Webjet (WEB) Monthly Chart

4 Ramsay Health Care (RHC) $70.58

July may have seen the ASX200 close basically unchanged, but some meaningful damage unfolded in the healthcare space with major names experiencing a tough time e.g. Cochlear -8.1%, Ansell -7.4%, CSL Ltd -8.7% and RHC slightly better at -4.1%. We continue to see these “go to” stocks of the last few years struggling, but it does not mean we wouldn’t become buyers if an individual stock was whacked ahead of the bunch.

RHC has been trading around the $70 area since late last year and while there are no sell signals at present, we believe there is a strong possibility the stock will trade well under $60 in 2017 /18.

Ramsay Health Care (RHC) Monthly Chart

Conclusion (s)

With the MM portfolio sitting on 23.5% cash, we are obviously on the lookout for buying opportunities, but we are will not be suckered into a “FOMO – fear of missing out” scenario. Of the 4 stocks which caught our eye yesterday, 2 are companies we like at lower levels, one we are technically bearish and the other, BHP, is rallying nicely towards our profit area.

1 Sell - BHP ~$29 plus sell RIO ~$70.

2 Buy – TWE $10.50 and perhaps $11.50, plus RHC ~$55.

3 Bearish WEB, targeting a decline of ~10%.

Overnight Market Matters Wrap

· On Wall St, the Dow once again set record highs of 21890 driven by moves in Chevron and Home Depot, while the S&P 500 was flat and the tech heavy NASDAQ eased back slightly. Wall St faces the busiest week of earnings quarterlies, with over 1200 companies due to report.

· The strong surge in the iron ore price continued from Asia to the US overnight, rallying 7.23% to just US$73.70/t on the back of yesterday’s China economic data. BHP is expected to outperform the broader market again, after rallying an equivalent of 0.71% in the US from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open with little change from yesterday, around the 5720 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here