“fire and fury” plus disappointing results rattle equity markets

Yesterday the ASX200 was sold off aggressively from the opening bell, erasing good early gains, to finally close down -30-points / 0.5%. Intra-day the market actually reversed 70-points / 1.2% at its worst point. The weakness was across the board although Financial Services company IOOF Holdings (IFL) bucked the trend, managing to rally 6.1% following its full-year profit report. Even the in-favour resources sector was unable to hold onto early gains e.g. BHP was up over 1.2% in the early morning only to close marginally in the red down -0.2%.

ASX200 Weekly Chart

The market is the midst of reporting season which as we have said previously often leads to market inefficiencies and hence opportunities, if only briefly. Today we will focus on 5 of yesterday’s major movers as we hunt for stocks to buy utilising our 23.5% cash weighting in the MM Portfolio. While the market remains in its very clear 12-week holding pattern between 5629 and 5836 our “gut feel” is a breakout is now extremely close at hand, with the preference still a correction back towards the 5500 area, but we’ve been here before!

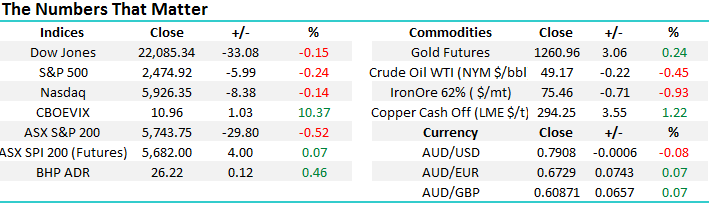

CBA’s profit report which came out this morning is likely to set the tone for our large banking sector over the next week. The metrics of the result versus consensus numbers are below. A beat on earnings plus the dividend was better, and importantly with a lot of focus on bank capital, their CET 1 was ahead of expectations at 10.1%. All up, a good result from CBA this morning.

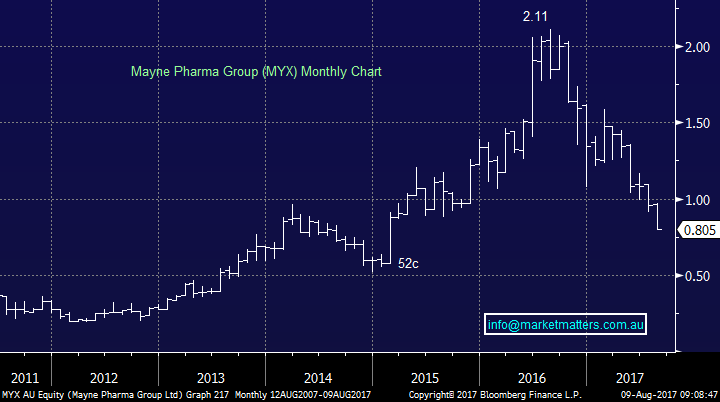

US Stocks

US equities were firm last night until Donald Trump told reporters North Korea "will be met with fire and fury like the world has never seen" if it threatened the United States again. This whole situation has a truly concerning feel that hopefully will eventually succumb to diplomacy and reason.

The S&P500 actually made fresh all-time highs before reversing, in a similar manner to us yesterday, and closing down 0.25%. There is no change to our current view that we believe a strong possibility exists for +5% correction by US stocks in the relative short-term.

An interesting occurrence which illustrates that our opinion that a short-term pullback, plus a much larger one probably in 2018 is far from unrealistic – China Evergrande shares have been the top performing stock in the MSCI All-Country World Index but have now dramatically fallen 20% to become one of the top decliners – all we are repeating is with the bull market for global stocks 8 ½ years old investors should remain open-minded and flexible.

US S&P500 Chart

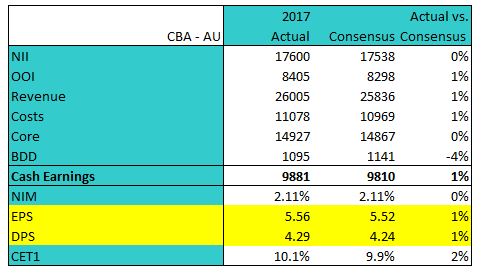

1 IOOF Holdings (IFL) $10.70

The diversified wealth management company IFL rallied 6.1% to its highest level since June 2015, as its net $$ inflows climbed by 156 per cent to $4.6 billion, as the market forgave its full-year profit falling 16 per cent. The gains were aided by its earnings of $169m slightly beating estimates of $160m but it’s the FUM (Funds under management) that caught investors’ attention. MM is bullish IFL targeting around $11.50, or ~7% higher.

IOOF Holdings (IFL) Monthly Chart

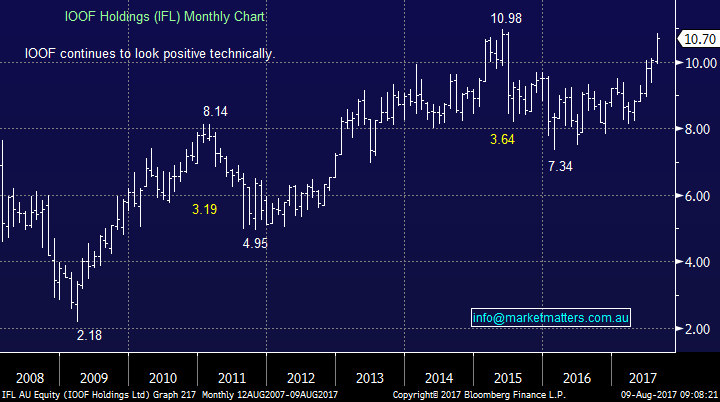

2 Mayne Pharma Group (MYX) 80.5c

The pharmaceutical company Mayne Pharma was the day's worst performer, plunging 9.6% on an earnings downgrade. The stock has now collapsed over 60% from its August 2016 high. MM regards MYX as extremely high risk and simply best avoided.

Mayne Pharma Group (MYX) Monthly Chart

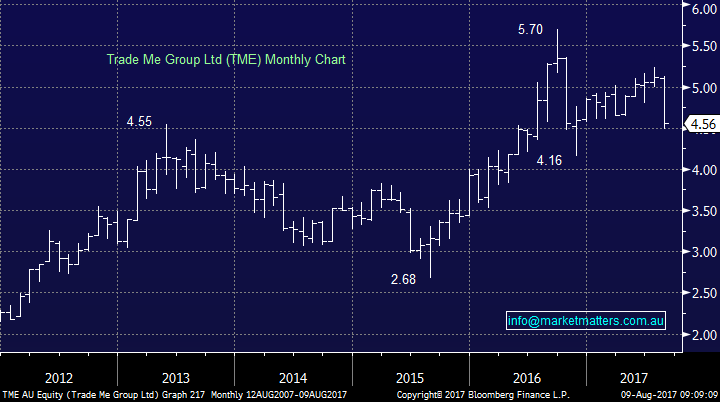

3 Trade Me Group Ltd (TME) $4.56

The New Zealanders equivalent of eBay, TME shares tumbled to a nine-month low after two major brokerages downgraded the stock. The shares closed down 6.6% following the changes in opinion to “sell” and “underperform” respectively. Amazon is the problem following its decision to settle in Melbourne with analysts believing it will damage TME’s competitiveness. MM is neutral TME and has no interest at current levels.

Trade Me Group Ltd (TME) Monthly Chart

4 James Hardie (JHX) $17.90

James Hardie shares were whacked 5.8% following a trading update which showed a fairly mixed outlook. JHX simply looks to be in wrong sector at the wrong time with sluggish wage growth in the US not feeling enough to offset potential higher interest rates moving forward. Technically a test below $15 would not surprise i.e. over 10% lower. MM has no interest in JHX given headwinds for the US building sector as interest rates rise and housing cools.

James Hardie (JHX) Monthly Chart

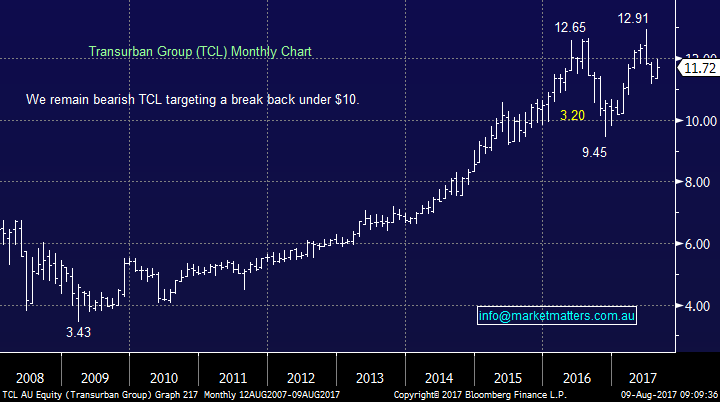

5 Transurban (TCL) $11.72

Transurban fell close to 2% as its yield-focused investors were disappointed with the company’s dividend guidance, expecting 56.7¢ rather than 56c, which followed a slight miss with its earnings estimate. The stock is on a yield of 4.7% unfranked in a rising interest rate environment which is not compelling. In comparative terms, that yield looked far better when Aussie 10-year bonds were yielding 1.8%, as opposed to around 2.62% tody - and that trend will continue as yields edge higher. MM remains bearish TCL, primarily due to the macro picture of higher interest rates.

Transurban (TCL) Monthly Chart

Conclusion (s)

Unfortunately, of the 5 stocks we considered this morning none are of interest except IFL but the risk / reward is not exciting above $10.50.

History tells us that patience will prove a virtue and we will get a good entry opportunity into a stock we like.

Overnight Market Matters Wrap

· A healthy retracement was seen in the US overnight, though the selloff in the afternoon was triggered following comments from US President, Trump noting that North Korea “will be met with fire and fury like the world has never seen” if it threatens the US again.

· Domestically, focus will be on the financials, with CBA reporting their earnings this morning with a beat from consensus. Investors will digest further whether there is downside risk from the recent anti-money laundering disaster AUSTRAC had found.

· The September SPI Futures is indicating the ASX 200 to open with little change around the 5745 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here