Financials soar but resources continue to lag

Compared to the bullish euphoria experienced by most global stock markets in 2017 it feels like the ASX200 is now being dragged higher kicking and screaming. Yesterday the heavyweight local banks surged a further 1.34%, taking their gains to the month to an impressive 5.4%. However the Healthcare, Retail and Gold sectors are struggling at present and this is reining in the overall index. Overnight Donald Trump and his administration delivered their initial attempt at the "biggest tax cut ever" outlining the goal of a top individual tax rate being cut from 39.6% to 35% and all corporations paying only 15% tax. The obvious question asked is how will these cuts be funded, perhaps simply by allowing the deficit to increase further. We have no doubt the new president will achieve lower taxes but probably with some reasonable compromises to this opening gambit – and maybe with a bit more detail than was provided in the 1 page release!

In the last 30-minutes of trade this morning US stocks pared their solid gains to actually close marginally in the red on rumours that the US is planning to break from NAFTA - North American Free Trade Agreement. So we have a "push-pull" effect slowly unfolding in equity markets, the bullish influence of economic stimulatory policies from Donald Trump versus the bearish pressure as free trade concerns slowly grow i.e. now NAFTA rumours following the tariffs slapped on Canadian lumber by Trump. With the 2 opposing forces at work it's easy to envisage the short-term 5% pullback we are targeting for US stocks in May / June.

As long-term subscribers know from experience with MM when we see pivot points / turns looming on the horizon, and hence portfolio activity, we focus the am reports very closely on the market at hand as opposed to exploring evolving future macro scenarios. Hopefully it is not boring but this degree of focus has enabled us to pinpoint both the major bottoms in October 2014 and early 2016.

Technically major overhead resistance is evolving just under the psychological 6000 area which is garnering plenty of press as stocks push higher. Our view remains that a "pop" over this month's high of 5950 will represent ideal / excellent selling on a risk / reward basis.

ASX200 Daily Chart

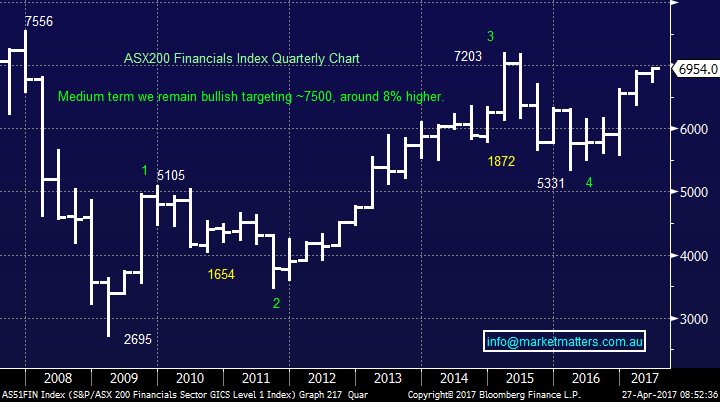

We have been heavily overweight the broad based Financials sector for a long time and are currently holding a significant 60.5% of the MM Portfolio in this outperforming group of stocks. Slowly but surely the financials have become the ‘in vogue’ place to be invested. This is a great example of how fickle markets can be after almost disowning the sector back in early 2016 - yet today we find it 30% higher with the index only 7% from our ultimate target area. However all good things do come to an end and we continue to target CBA and PTM as potential "sells" over coming days / weeks as a rest is becoming overdue.

ASX200 Financials Index Quarterly Chart

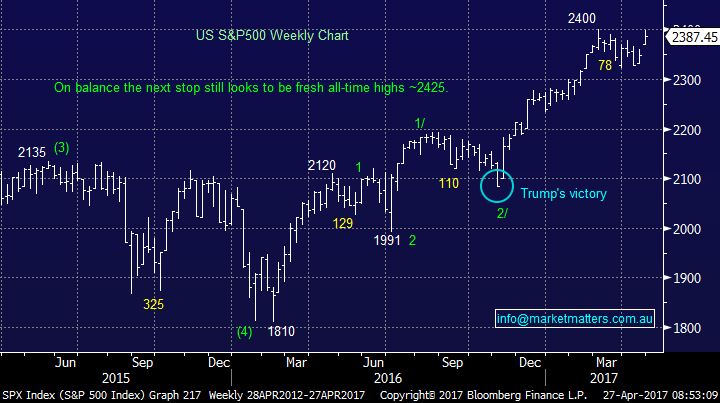

This morning US stocks traded within 0.1% of their all-time high before the NAFTA rumours led to a pullback. Importantly US equities are extremely close to our initial upside target and risk / reward no longer favours general buying:

1. US stocks look poised to only rally another 1-2% over next few days / weeks.

2. A 5% correction is now looming rapidly on the horizon, it now feels like we are heading towards a classic "sell in May and go away" scenario.

3. Assuming we get a 5% correction over May and June, similar to last year, we will be keen buyers into this weakness targeting further gains in 2017.

US S&P500 Weekly Chart

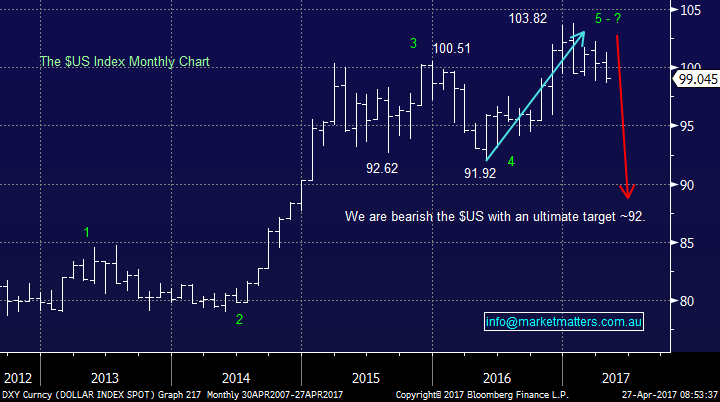

One of our favourite forecasts for 2017 was the decline of the $US, a very unpopular view when we came out on a limb in early January but here we are in late April and the $US Index is down 3% year to-date. We remain bearish the $US with an initial target ~7% lower.

We expected the recent pullback in US banks as the reflation trade needed a breather after surging since Donald Trump's election victory. Over the last 8-weeks we have seen our suggested pullback in bond yields and cyclical stocks. US Banks and commodity sectors have corrected strongly, whereas the defensives enjoyed a strong rebound. As subscribers know we now believe this sector rotation will reverse with a weaker $US likely to soon come to the aid of struggling resources stocks / commodity prices.

On a very short-term basis gold stocks remain overbought following their strong rally which commenced in December 2016. We continue to expect gold miners to correct a little lower as geo-political buying is unwound prior to commencing a new rally attempt into the Australian winter. We will look to buy RRL under $3.05.

The $US Index Monthly Chart

RIO which is one of our preferred stocks in the resources sector remains close to our buy zone after correcting 17.4% from its February high. The pullback in April / June was $11.84 and it took 10-weeks to reach the retracement low, so far this current pullback of $12.17 also took 10-weeks to touch its retracement low, lets watch this space to see if technical analysis has accurately pinpointed the time to buy - we hope so!

NB After yesterdays buying in OZL we now have 15% exposure in the MM portfolio to resource stocks via BHP, OZL and RIO - 5% each, that's enough we feel.

RIO Tinto (RIO) Weekly Chart

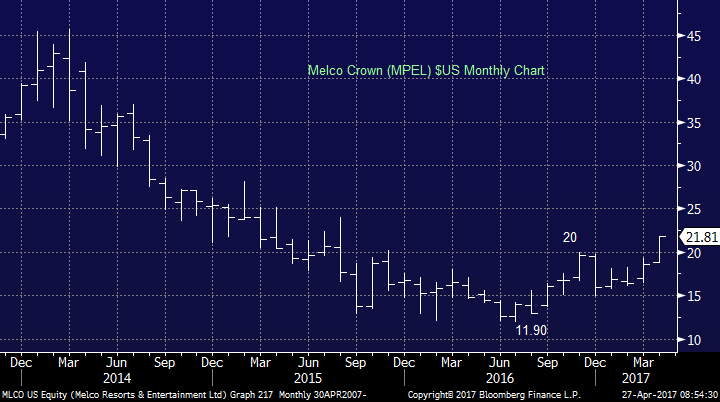

A few weeks ago we raised back our profit target for our Star City (SGR) holding which is showing around a 20% paper profit. The two reasons to hold the position longer were:

1. We were bullish the ASX200 and SGR was maintaining positive bullish momentum.

2. We were bullish the correlated US Melco Crown stock targeting a 20% rally at the time. The US stock has now rallied over 15% leaving the risk / reward far more evenly balanced.

We are now considering taking profit on our SGR position as the above 2 reasons to stay long have diminished.

US Melco Crown (MPEL) Monthly Chart

Below is an updated list of some potential stock rotation by MM over coming days / weeks, remembering we now only hold 10.5% in cash after purchasing OZL yesterday:

Sellers

Commonwealth Bank (CBA) into fresh highs for the ASX200 / US Banks / US bond yields, Ansell (ANN) over $24, SGR over $5.60 and ideally ~$5.70 and Platinum (PTM) "hopefully" over $5.

Buyers

Regis Resources (RRL) ~$3, Newcrest Mining (NCM) ~$21, Transurban (TCL) ~$11.00 and Telstra (TLS) ~$3.80.

Basically we will look to switch from stocks that benefit from higher yields to those that prefer lower ones when / if US bond yields make fresh 2017 highs in weeks / months to come plus also generally increasing our underlying cash position.

Conclusion

Stand out conclusions today:

1. We are bullish US bond yields over coming weeks looking for outperformance from financials / resources over gold and the "yield play".

2. Ideally we are looking for a short-term blow off top style rally into May prior to a classic "sell in May and go away" correction.

3. On balance we are wearing our "sellers hat" looking to increase cash holdings.

Overnight Market Matters Wrap

·A late selloff was experienced in the US overnight, wiping the day’s gains as investors took risk off the table.

·Our Aussie battler traded lower from this, now with a 74 handle, while Iron Ore closed 0.83% higher.

·A small gain is expected this morning in the ASX 200, towards the 5920 level as indicated by the June SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/04/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here