FANGS hammered, Bitcoin soars, banks rise, BREXIT’s unfolding – it’s all happening into Christmas! (FMG, NCM, TLS, NAN)

The ASX200 finally closed up +0.45% yesterday, only 40-points below the year’s high as the banks / financials basically carried the market higher. Following some wobbles overnight in the resources space (BHP is down 1%), the local index looks destined to open down around 10-points back around the psychological 6000 area, its 4th week of toying with this big level. We still anticipate a decent punch higher above 6000 with a Christmas / window dressing rally feeling the ideal timing, but as we have said previously MM is likely to increase cash levels if this unfolds.

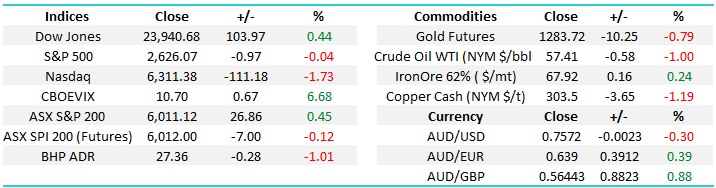

Overnight US stocks echoed our thoughts perfectly around investing into 2018, it’s all about sector rotation:

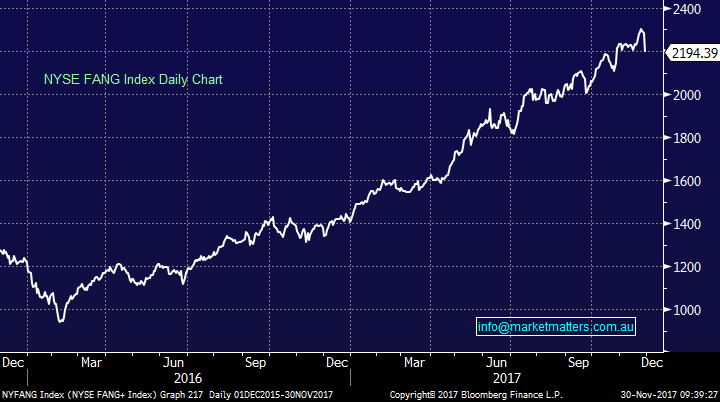

- The FANG’s were hammered ~4% as markets decided they were not the place to be invested for tax reform and higher interest rates – The FANG Index contains Facebook, APPLE, Amazon, Netflix and Google.

- US Financials gained another +1.7% while the “yield play” was generally lower i.e. markets continuing to align themselves for higher interest rates.

Today we are going to look at 5 key themes that are unfolding as both Christmas and 2018 approach.

ASX200 Monthly Chart

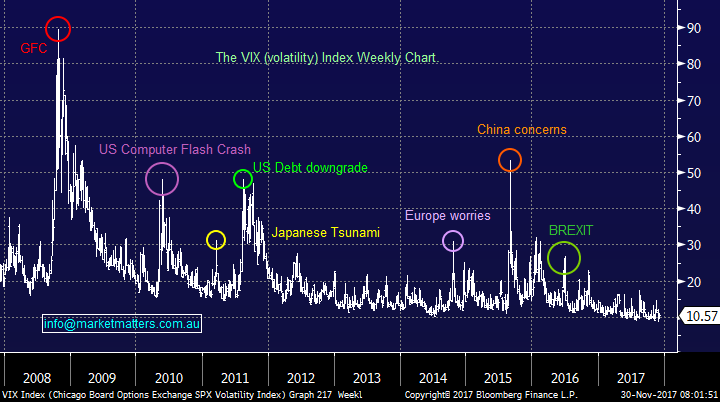

1 FANG’s show volatility maybe turning

Overnight the Dow rose 103-points, but with the FANG stocks dropping -4% and the broader NASDAQ down close to -2%, not surprisingly the volatility index (VIX) rallied over +5%. Last night’s $60bn wealth destruction in the FANG group was the largest in history, although this statistic is clearly helped by the recent run up in their valuations.

We feel the fall last night in the tech indices illustrates that the current complacency within stock markets with regard to any meaningful correction is way too low.

The FANG’s Index has more than doubled over the last 2-years, a 10-15% correction would almost be healthy.

US VIX (Fear gauge) Index Weekly Chart

US NYSE FANG Index Daily Chart

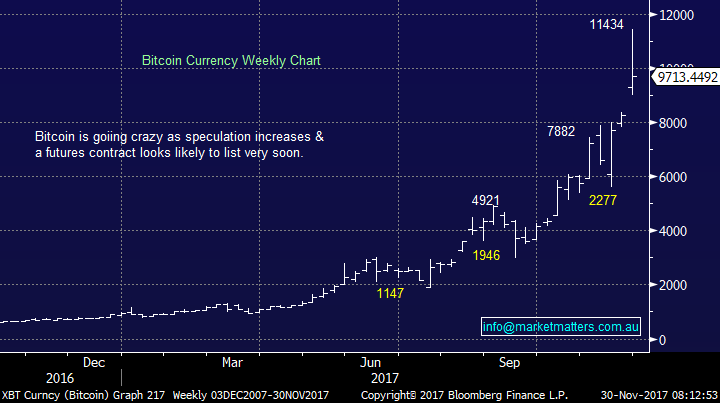

2 Bitcoin defines volatility!

Over the last 24-hours the press have been full of bitcoin surging over $US10,000, but this morning we wake up to see another ~20% fall in just a matter of hours, this is casino stuff! Hopefully people playing in this space have assessed all the risks / volatility because with the exception of the GFC, I have not seen a market move with such wild swings.

It’s interesting that we hear people now telling us they regard buying say Telstra (TLS) and Fortescue (FMG) after huge corrections as way to risky but they are considering bitcoin – investor psychology is an amazing thing.

- Watch out for our report “Bitcoin made easy” in the coming weeks.

Bitcoin Weekly Chart

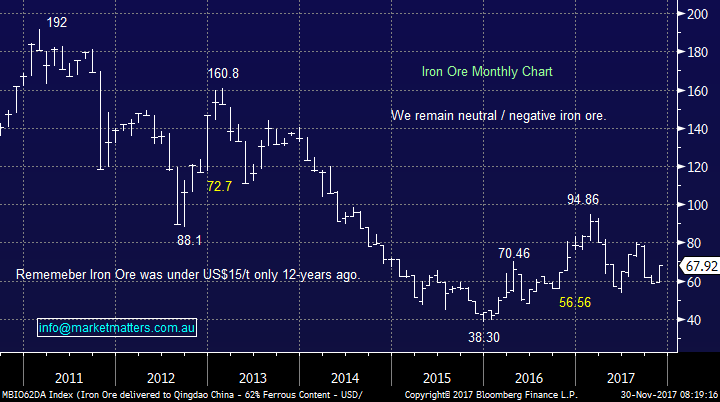

3 Goldman’s are bearish iron ore

Goldman Sachs have just come out with an iron ore forecast of $US50/tonne for one years’ time, primarily due to anticipated peak in Chinese usage coupled with increasing production. Our comment is good luck, nobody seems to regularly get this bulk commodity correct.

We have taken a small “high risk” position in Fortescue Metals (FMG) following its 37% fall this year, at current levels we see value, but time will tell if the market agrees.

- From 2015 – 2017, iron ore rallied 148% and FMG charged 505% as suddenly fund managers realised it would survive.

- In 2017 iron ore has fallen 44% and FMG 37%.

- Iron ore is 27% above the year’s low, but FMG is only up 2.4%, markets don’t believe iron ores rally.

Point 3 in particular, we believe shows the risk in FMG short-term is up as the stock has not rallied following the 27% bounce in iron ore.

Iron ore Monthly Chart

Fortescue Metals (FMG) Weekly Chart

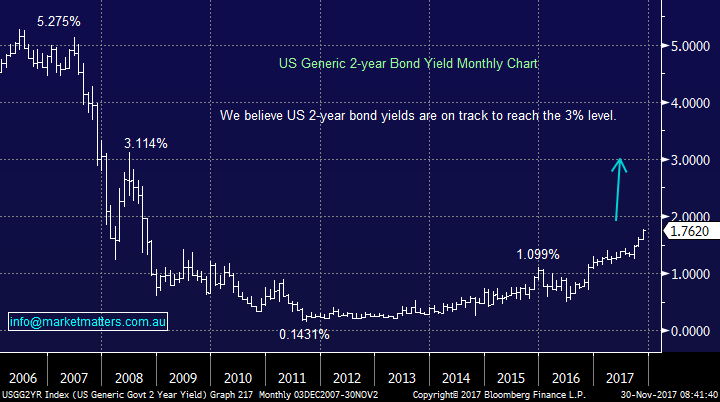

4 Markets are embracing higher interest rates

Overnight Janet Yellen, current Fed Chair, added fuel to the fire of higher interest rates, a thematic we are totally onboard with. US bond yields continued their charge higher helping the financials to gain +1.7%. We believe ultimately higher interest rates will stop this rampant asset bull market, as they usually do, but importantly for now we intend to avoid sectors / stocks that will be adversely impacted by rising interest rates.

Notably we have 3 stocks that fit into this danger group and they are not helping us i.e. Nanosonics (healthcare), Telstra (telco & “yield play”) and Newcrest (gold).

US 2-year bond yields Monthly Chart

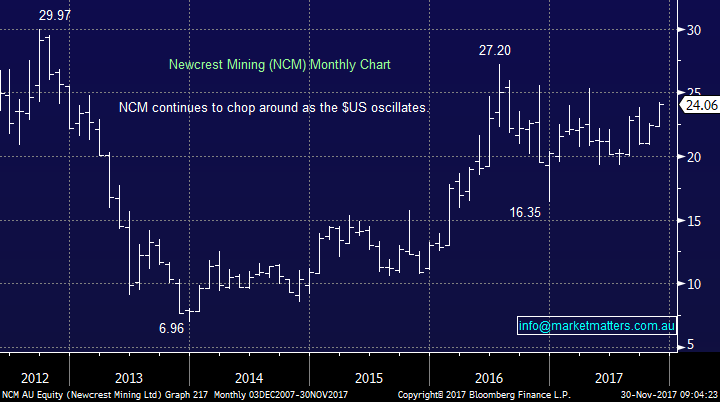

5 Is it time to cut our 3 positions exposed to higher rates NCM & main losers NAN and TLS?

We have 2 stocks in our MM Growth Portfolio that are causing us some $$ angst i.e. Nanasonics (NAN) -9.7% and Telstra (TLS) -4.3% plus Newcrest (NCM) is vulnerable to rising interest rates:

We simply hate losing money, especially in a rising market! Our plan on the 2 losing positions remains simple:

- Nanosonics (NAN) - we will exit the stock if it cannot hold above $2.60, it spiked there into the close yesterday and will get not get a second chance if it cannot rally today.

- Telstra (TLS) – while our paper loss is relatively small it’s still very annoying with TLS currently so out of favour it actually feels like a buy! However capital preservation is vital with investing and we will exit at least half of our position if TLS cannot close over $3.38, plus we are likely to exit 50% of our holding into any strength. TLS are now offering any customers who complain about their internet speed $20 off their next bill, we ponder if the NBN fiasco still got much further to unfold?

- Newcrest (NCM) – we have seen a 20% recovery from NCM over recent months and are simply pondering whether we should enjoy the reprieve however NCM does benefit from a falling $A, one of our long term views.

Newcrest Mining (NCM) Monthly Chart

Global markets

US Stocks

The US continues to make fresh all-time highs and although we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

1 - We remain bullish financials / banks but are already overweight the area.

2 – We like the risk / reward on FMG at current levels.

3 – We are not married to NAN, NCM or TLS and will exit / reduce if the appropriate signals are generated.

*watch for alerts.

Overnight Market Matters Wrap

· A mixed session was witnessed overnight in the US where investors rotated to stocks that is believed to benefit from the anticipated tax reform and better economic conditions.

· The Nasdaq 100 slumped 1.73%, while the Dow gained 0.44%, leaving the broader S&P 500 unchanged.

· Expect Macquarie group (MQG) to dominate today, following the outperformance of US financial stocks, while BHP is expected to underperform after ending its US session down 1.01% from Australia’s previous close to $27.36.

· Reports this morning of Aristocrat Leisure looking to acquire Big Fish Casino for US$1b. - AFR

· Locally investors wait for Aussie building approvals, where a consensus of -1% for the month is expected and China manufacturing PMI for November, expecting 51.4.

· The December SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6000 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/11/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here