EOFY shenanigans already raising its head (FMG, RHC, HVN, IGO, GXY, ORE, NAN)

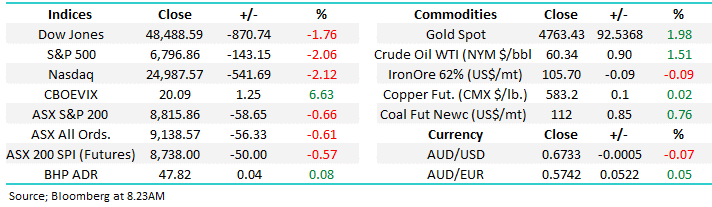

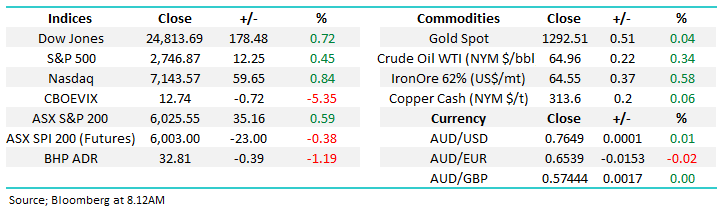

The ASX200 had a solid start to the week yesterday assisted by strong moves overseas on Friday night, news that CBA settled with AUSTRAC for $700m (hard to believe it was much less than expected) plus the futures markets pointing to a stronger night in Europe and the US. The banking sector finally closed in the green up over 1%, with only the healthcare sector catching our eye on the negative side. Without getting too micro if the ASX200 cannot hold onto the 6000 area today we will then expect another test down towards 5950.

Overnight global market followed the positive lead from the futures markets with the Dow +178-points and the EuroStoxx +0.5%. However the futures are unfortunately pointing to a weak open for the local market down ~20-points / 0.4% with BHP a likely major influence closing down 40c in the US as it followed the oil price and overseas energy stocks lower, Crude oil has now fallen well over 10% from its May highs following Saudi Arabia’s indication of a ramp up in production moving forward – at MM we remain bearish the local energy sector targeting up to 10% further weakness for the likes of Origin Energy (ORG).

Its undoubtedly disappointing for the bulls that the ASX200 is around 150-points / 2.5% below its 2018 high whereas the tech based US NASDAQ index closed this morning only 0.6% below both its 2018 and all-time high – as we often quote a market that cannot rally on positive influences is a weak market i.e. the ASX200 needs to get its “mojo” back and quickly!

- Medium term MM remains bullish targeting 6250 but the risk / reward is no longer compelling for the buyers. – we remain in “sell mode”.

Today’s report is going to look at some of the big movers yesterday who caught our eye potentially due to EOFY selling & / or squeezing of some shorts. At one stage in the morning 5 of the top 10 movers in the ASX200 were in the top 20 most shorted stocks – we believe such volatility within this group of stocks is likely to continue into EOFY. Also, stocks that have enjoyed a strong year which fund managers intend to hold may get a slight “push” over the coming weeks as it will reflect nicely in managers EOFY accounts i.e. a time of year when opportunities arise to both crystallise profits and accumulate bargains.

ASX200 Chart

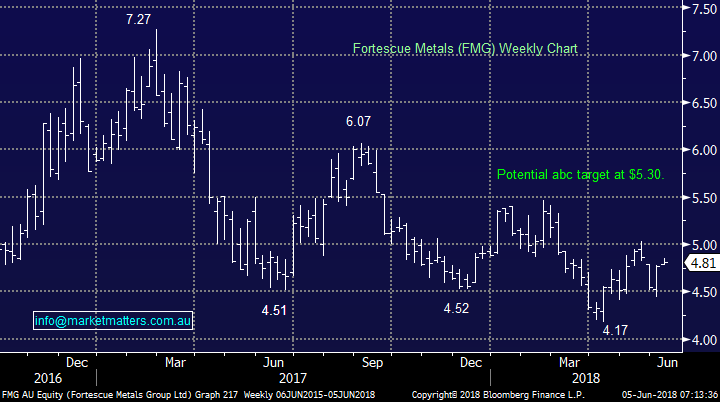

MM purchase of Fortescue Metals (FMG) $4.81

Yesterday MM followed our “trade of the week” and took an aggressive position in FMG at $4.83.

- MM remains bullish FMG targeting the $5.30 area with stops below $4.60.

NB The most common question we receive at MM is pertaining to the word “around”. We evaluate the situation at the time but the best general description would be we buy or sell within +/-1% of the outlined price.

Fortescue Metals (FMG) Chart

Moving onto 5 stocks that caught our eye yesterday for different reasons pertaining to EOFY, a style of report we anticipate will be repeated a few times over the next few weeks.

1 Ramsay Healthcare (RHC) $59.50

RHC fell 2.2% yesterday to its lowest level since February 2016 not a great performance by the largest hospital operator in Australia. The company clearly has tailwinds due to the countries ageing population so we question why the much loved stock finds itself down over 28% over the last 2-years. The rising cost of private health insurance is probably the largest single factor with the greatest volume of people ever leaving the private health system last year – as we’ve discussed the average Australian is carrying a large pile of debt and this is one way they can cut back. Other negative factors are also coming through competition from not-for-profit hospitals and general trust in the industry – will the press turn here next after the banking royal commission ends?

RHC is a prime target for EOFY selling and due to the above reasons we have no interest in the stock unless it falls another 8-10%. Ideally we will get some negative news / downgrades moving forward that explains this recent poor performance which may be the catalyst for a low risk / value entry.

We should remember rival Healthscope (HSO) is the target of a $4.1bn takeover with Australian Super part of the bidding consortium hence it seems the longer terms drivers for the sector remain attractive to some. Also, very importantly moving forward the government desperately wants people in the private system hence expect further policy incentives, pleasant or not, towards this end – positive for RHC.

- At MM we have been bearish RHC for well over a year targeting the $55 area which is now ~8% away – MM is a buyer of RHC around $55.

Ramsay Healthcare (RHC) Chart

2 Harvey Norman (HVN) $3.52

Harvey Norman (HVN) has been on our radar over the last quarter after it made fresh multi-year lows. HVN is now the 19th most shorted stock with 8.5% of the stock sold short – hedge funds / traders speculating the price will continue to fall.

HVN has recently been hurt on 2 fronts - news that its struggling in Ireland this year and Kogan (KGN) intends to enter the white goods market e.g. ovens, dryers and washing machines. This increased competition for HVN can only be bad news for Gerry Harvey & Co. at least until we have time to tell whether KGN can implement their plans successfully.

We have concerns for HVN on a number of fronts – a cooling housing market, increased on-line competition and the anti-franchise mood the markets currently maintaining. The large short position reflects the markets view on the stock but can also rapidly become a 2-edged sword if they change their minds.

The stock is now relatively cheap trading on a forward PE of 10.6x 2018 earnings while yielding 6.8% fully franked.

- We remain interested in HVN below $3.30, or 6% lower.

Harvey Norman (HVN) Chart

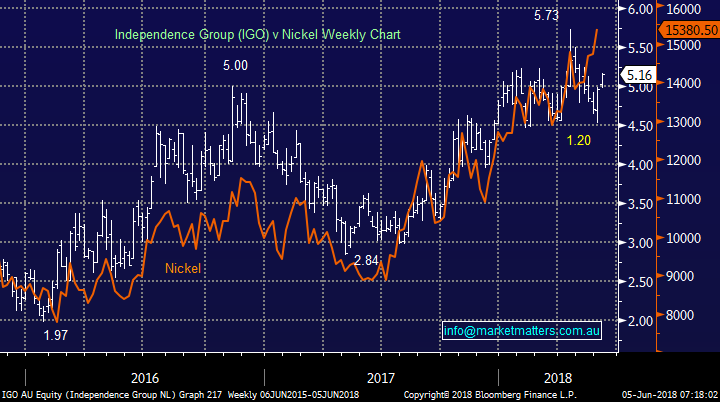

3 Independence Group (IGO) $5.16

Another stock we’ve recently both touched on and own is Independence Group (IGO), the nickel and gold producer. Yesterday the stock closed up almost 4% which would have hurt its large short position – IGO is the 13th most shorted stock on the ASX100 with 10.2% of its stock sold short.

We currently believe these traders are likely becoming uncomfortable as the nickel price continues to rise. The chart below illustrates how IGO is clearly / understandably very correlated to the nickel price which keeps rising, a “pop” well above $5.50 for IGO into EOFY feels like a strong possibility.

- MM remains comfortable with our IGO position but will consider taking profit if it “squeezes” higher into EOFY.

Independence Group (IGO) v Nickel Chart

4 Galaxy Resources (GXY) $3.59 & Orocobre (ORE) $5.75

Galaxy Resources (GXY) the lithium company is the 4th most shorted stock on the ASX100 with 14.5% of its stock sold short, followed not far behind by its sector friend Orocobre (ORE), which we own, at 11.7%.

Both stocks were strong yesterday, especially in the morning session, with GXY finally closing up +2.9% and Orocobre (ORE) +2.1%.

- Similar to IGO, we are currently comfortable with our ORE position but will consider taking profit into any EOFY squeeze.

Galaxy Resources (GXY) Chart

Orocobre (ORE) Chart

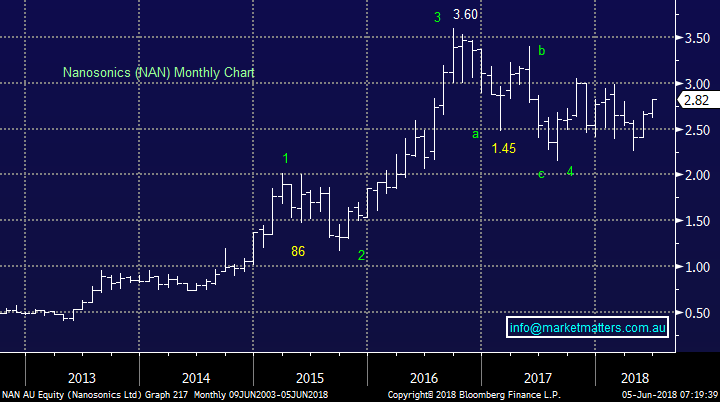

5 Nanosonics (NAN) $2.82

The life science company Nanosonics (NAN) has not been our favourite vehicle at MM over recent years but its again looking good having rallied almost 25% over the last 3-months. I was on Sky the one night last week with Andrew Page from the Motley Fool – who called it his No 1 pick right now!

NAN also carries a huge short position coming in number 6 on the register with 12.3% of the company sold short, a group of traders that would not have enjoyed yesterday’s +4.8% rally – a squeeze might be in the offing.

- We like NAN as a aggressive play / trade into EOFY with stops below $2.62 i.e. around 7% risk, targetting a ‘pop’ over $3

Nanosonics (NAN) Chart

Conclusion

We have the following 5 opinions / plans on the stocks mentioned into EOFY:

1. We are bearish RHC short-term but will have definite interest 8-10% lower.

2. Harvey Norman (HVN) may look interesting below $3.30, or 6% lower.

3. IGO looks positioned strongly for a squeeze above $5.50 into EOFY where we are likely to take profit.

4. Lithium stocks GXY and ORE have potential to squeeze higher into EOFY where we would probably take profit on our ORE holding.

5. Nanosonics (NAN) – we like NAN into EOFY with stops below $2.62.

Watch for alerts.

Overseas Indices

No change, we remain mildly bullish overseas indices targeting fresh 2018 highs for many, the US tech based NASDAQ looks likely to achieve this milestone this week.

US NASDAQ Chart

Overnight Market Matters Wrap

· The US started the week in positive territory, led by the tech heavy Nasdaq, hitting all-time highs as investors continued to take risk on following positive economic data last week.

· A packed day of economic data in our region today, with China May Caixin PMI (expecting 52.9), Australian Current Account Balance (expecting -$9.9b) and RBA meeting (expecting rates unchanged at 1.5%)

· The June SPI Futures is indicating the ASX 200 to open 26 points lower, testing the 6000 support level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/06/2018. 8.24AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here