Election fallout & subscribers questions (PCI, BSL)

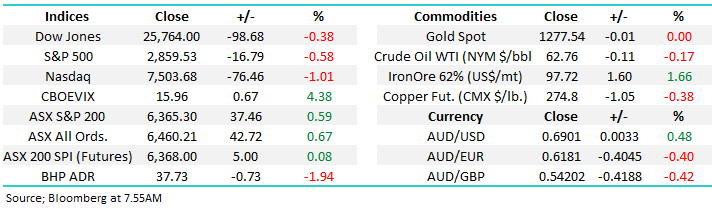

The SPI futures were calling the AX200 to open basically unchanged on Monday BUT that was before “ScoMo” pulled off the amazing election upset over the weekend – investors franking credits are safe and negative gearing around property will be left alone, that basically covers the vast majority of how Australians have invested for many, many years. Most importantly the uncertainty has all been removed from the financial landscape and I believe we will see a classic “Relief Rally” this morning which could easily take the ASX200 above the psychological 6400 resistance area – my best guess is we see a test of the 6425-50 area overhead resistance illustrated below.

On the election result the $A has rallied ~1% early this morning and the equivalent move by stocks would take the ASX200 up to 6430.

As subscribers know we do like our statistics at MM and following the last 6 elections won by the Liberal Coalition the ASX200 has rallied on average well over +4% through the next 3-months, this positive correlation is no major surprise considering the combination of the parties pro-business policies and the simple end to uncertainty. I’m not sure if we will see the local market soar over 6600 but it should not be discounted considering that we are also targeting the US S&P500 up to the 3000 area – remember one of the main drivers recently has appeared to be the distinct lack of selling, a phenomenon that may become even more prevalent following this election.

Before we move on I cannot resist putting the boot into the polling business, how can it now recover / maintain any degree of respectability following Donald Trump, BREXIT and now Scott Morrison (ScoMo), or perhaps it simply evolves like most businesses ultimately do - interestingly we read that Professor Bela Stantic from Griffith University forecasted all 3 outcomes accurately by analysing 2 million social media comments i.e. this clearly appears to be the future.

This morning we will look quickly at a few questions received during the week but today’s report is really all about MM’s concise opinion on how stocks will evolve under Scott Morrisons Coalition government, especially after they have traded for many months under the assumption of a Labor victory with its planned significant changes to our taxation system.

Thanks as always for the great questions, we’ve covered a couple today as the election result has been our main focus since late Saturday night.

ASX200 Index Chart

No major change on our interest rates projection is anticipated with 1-2 rate cuts still likely by the RBA over the next 12-months but the board members are likely to be happy with the election result as it should be far more supportive of the worrisome property market as the liberal Coalition are not planning on scraping negative gearing – a stable property market reduces the chances of rate cuts.

MM believes with no change to our taxation policies we should see investors slowly return to our struggling property market and 2019 may well be the year we bottom out as one major negative influence has clearly been removed. Importantly we still believe there is room for disappointment for investors expecting significantly lower rates as the RBA appears to be comfortable sitting on some ammunition to deal with an economic slowdown so if we do see property turn back up one cut may be all that investors enjoy.

Ironically an improving property market may remove the major tailwind for equities i.e. falling bond yields, something to be watched moving forward.

Australian 3-year bond yield v RBA targeted Cash Rate Chart

Winners & Losers of Saturdays Election.

Most importantly moving onto what sectors / stocks look set to be winners and losers following Saturdays surprise result which clearly has far reaching implications for a number of listed ASX companies:

1 – The banks have most to gain from a coalition win given that policies like capital gains tax reform, negative-gearing reform, and of course changes to franking credit legislation are now a distant memory. With their solid fully franked dividends plus the support for property certainly helping both in terms of a likely pickup in investment loans and a reduced risk to bad debts, banks could do well out of this outcome.

2 – Broadening this out, stocks paying sustainable fully franked dividends should perform solidly, we expect this to assist a diverse group of stocks from Telstra (TLS) to Alumina (AWC) but the major miners and banks dominate companies with available franking credits e.g. BHP, RIO, Westpac and CBA.

3 – Resources stocks look set to rally with lower required emission controls with coal producers leading the way, stocks likely to benefit include heavyweights BHP, Woodside (WPL) and Santos (STO).

4 – Conversely renewable energy business are likely to struggle with wind farm operator Infigen (IFN) one that comes to mind.

5 – Property stocks should receive a nice leg up with the removal of a major negative catalyst, the likes of Lend Lease (LLC), Mirvac (MGR) and REA Group (REA) are likely to start strongly this morning.

6 – Childcare stocks will not be receiving the promised subsidies from Labor, not good for G8 Education (GEM) for example.

7 – The result is great news for health insurance stocks as Labors 2% cap disappears, should be good news for our NIB (NHF) position.

8 – Lastly this defeat for Labor is likely to have seen the top from a regulatory perspective, this should help the likes of AMP, IOOF (IFL) and of course again the banks.

Conclusion

This is a very market friendly election result which should assist stocks at least in the short-term, the only tricky part is guessing how many people had positioned themselves for a Labor victory. Considering that the ASX200 made fresh decade highs on Friday we have to assume that the “scarred” positioning in anticipation of a Labor victory and its planned tax changes was relatively small but again general selling feels likely to be thin on the ground around current levels providing an underlying bullish backdrop for stocks.

Question 1

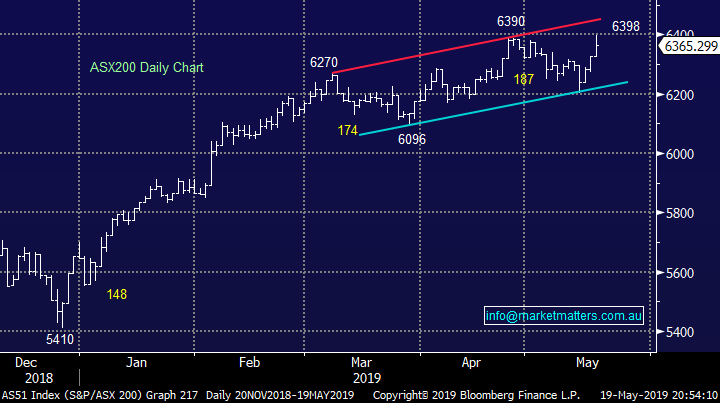

“Nice about-face on the AUD$ - I guess if you keep revising your opinion you can never be wrong! Consensus trade was right - and now you have jumped on-board that bandwagon. Please don't try to save face on this one by saying "our long term view.....". Because eventually it will get to $0.80 - EVENTUALLY!” Scott T.

Morning Scott,

Firstly I really appreciate your regular thoughts and questions to MM but on this one I believe your off the mark slightly.

We have been and remain bullish the $A looking for a major bottom, whether or not the final low is in place does not change this view. Most importantly we have not yet skewed our portfolio away from $US earners which we most certainly will do when we believe the $A has bottomed e.g. MM still holds both ResMed (RMD), Aristocrat (ALL) and Macquarie Group (MQG) in our Growth Portfolio. This is a classic case of be prepared as opposed to jump on board.

MM remains bullish the $A and are looking for a major inflection point in the months ahead.

Australian Dollar ($A) Chart

Question 2

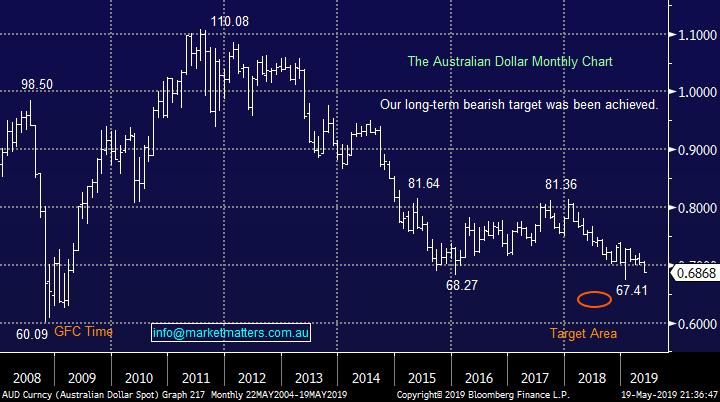

“G’day, earlier this month you wrote about an upcoming float – PCI Perpetual Credit Income Trust. They have commenced trading today. Is MM looking to add this to your Income Portfolio?” – Graeme D.

Morning Graeme,

We covered the investment before it listed in an income note back in March, concluding that given we had MXT and NBI in the portfolio, and PCI was essentially a cross between the two, we would not add it to the portfolio, preferring two independent strategies in those two types of credit. However if we did not have MXT and NBI in the portfolio, we would have added PCI. Here is what we wrote at the time - I did meet the managers and they should deliver what they say they will.

Perpetual launches new Income Trust (13th March 2019)

Another raising in the Income space with Perpetual launching the Perpetual Credit Income Trust that is to be listed on the ASX (subject to approval) under code PCI on the 14th May. While I haven’t met with the managers (I will) , the deal is lower risk than the MOT outlined above and a more traditional credit offering. As a consequence, the return targets / fee structure is aligned with that risk / return profile. The deal looks attractive. Our desk at Shaw can place bids for those with an account, or who wish to open one.

The trust will focus on investment grade assets in the high yield Australian corporate loan market and the global high yield bond market – it’s sort of a cross between MXT and NBI that we own in the MM Income Portfolio. MXT invests in corporate loans in Australia targeting a return of 4.75% while NBI is a global bond manager targeting a 5.25% return. PCI combines both sub asset classes into the one $400m listed investment vehicle.

The trust targets a return of the RBA cash rate plus 3.25%, which is the same target held by MXT, equating to 4.75% net of fees.

Distributions to be paid monthly and the fund should be a good diversifier for those looking for income that is not heavily aligned to equity markets.

They charge an annual management fee of 0.88% and no performance fee.

Perpetual Credit Income Trust (PCI) Chart

Question 3

Hi, I am wondering if your view expressed below on BSL has changed or is the risk/reward even better at BSL's current price levels?” - regards, Ian C.

Hi Ian,

BSL should benefit from the election result and the stock is certainly attractively priced trading on a Est P/E for 2019 of less than 7x although the stock does not have to benefit of paying an attractive yield.

MM likes BSL at current levels but would operate stops below $12.40

BlueScope Steel (BSL) Chart

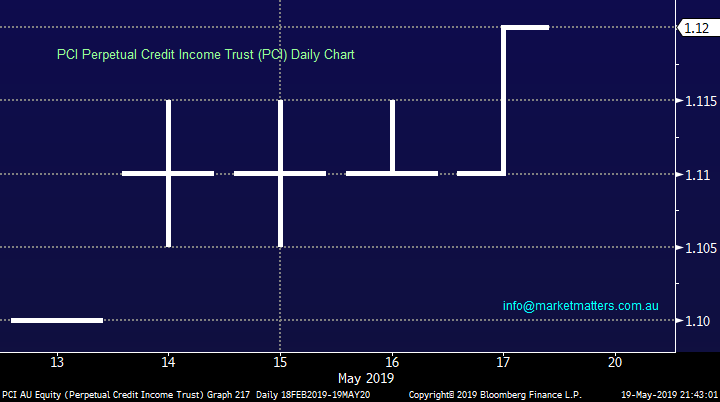

Overnight Market Matters Wrap

· The US lost some ground last Friday, as investors took risk off the table ahead of the weekend should there be any negative comments on the current US-China trade tension – the tech. heavy Nasdaq 100 underperformed against its peers, losing 1.01%.

· Metals on the LME were weak, in particular nickel which fell more than 1%, while iron ore continues to rally – expect the iron ore names to also have a good day today.

· The June SPI Futures is indicating the ASX 200 to open with little change, however we expect it to rally today, particularly in the banking sector following the election results over the weekend.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.