Don’t panic just yet!

Yesterday the ASX200 managed to close up 23-points after threatening to close the day in the red a number of times - a late rally did the trick. There was no standout winners or losers on the sector level, with the exception of insurance where a poor QBE result helped drag all 6 members down on the day. Volumes were low as nobody felt prepared to impose an opinion around the 5575 area with 25% of the days volume in the futures finally trading after 4pm, happily it was clearly driven by buying as the SPI rallied almost 50-points in the last hour of the day – usually a great short-term sign.

We continue to give the market the benefit of the doubt into Christmas assuming President Trump can control himself and that’s a big if! Last night he managed to wipe ~$100bn off the US share market following a public spat from the Oval Office with top Democrats over ‘the wall’ leading to doubt over the ability of Congress to function / compromise over the next 2-years if the President continues to act like a petulant child. Its not just our politicians that frustrate us all and we haven’t even mentioned the UK and BREXIT.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900 area – still feels a long way off.

Overnight the Dow finally closed down 53-points after gyrating in an almost 600-point range courtesy of the White House volatility, the market was trying so hard to rally and we still believe it will regain its mojo in the weeks ahead but investors should not be surprised by nervous “reactions” as we saw this morning AEST.

The SPI futures traded strongly overnight and although they failed to hold onto most of the rally, as US stocks surrendered their gains, they are still calling the ASX200 to open up around 25-points this morning – if we have started a Christmas rally this is likely to be a typical move in the coming weeks. Also, remember we said yesterday technically MM will become bullish on a close by the ASX200 above 5600, this will be confirmed by a break above 5625 – both could potentially be on the cards today.

Today’s report is going to follow on from Tuesday’s as we see that subscribers are becoming increasingly nervous from the questions that are dropping into our MM inbox.

More importantly we want to clarify how we see MM positioning our Portfolio (s) into 2019 /20 – the report is shorter than usual as I want to ensure the main points are clearly understood.

MM remains in “Sell Mode” but ideally at higher levels.

NB Yesterday we took a small profit on our 3% holding in Newcrest (ASX: NCM) because if the market does recover into 2019 its likely to lose its safety bid / appeal. We now have a short-term target for NCM down towards $20, or 5% lower.

ASX200 Chart

Yesterday we said:

“Overnight the US S&P500 made a fresh 10-month low before rallying strongly and amazingly generating a bullish technical signal by closing back above 2630.” – Tuesdays MM Morning Report.

The overnight move was looking excellent until Trumps outburst but the S&P500’s early strength still reaffirms our technical buy signal. Lets hope the President goes on a skiing holiday soon!

MM is targeting ~2800 for the US S&P500, around 6% higher in the short term.

US S&P500

A fascinating chart passed across my desk yesterday from Tom McClellan, a US analyst who was made famous by the McClellan Oscillator – a well-known technical indicator that I think was actually created by his parents. Anyway, I regularly read his insight simply because he has knack of creating “light bulb” moments while I’m looking at the ASX200 / local stocks.

The below chart shows the S&P500 under both US Presidents Clinton & Trump, while they are clearly very different leaders / people they both won without the majority of the popular vote and subsequently set about reorganizing a government to suit themselves. Similarly they both suffered scandals in their first 2-years in the White House and a share market which corrected aggressively before recovering solidly, plus just for good measure the Fed was raising interest rates. Uncanny?

He produced the below chart in late August this year and its following accuracy so far has been simply amazing, as you can see if the pattern continues stocks are about to rally / recover strongly.

The S&P500 1994 v 2008 Chart

How we will “play” these choppy markets.

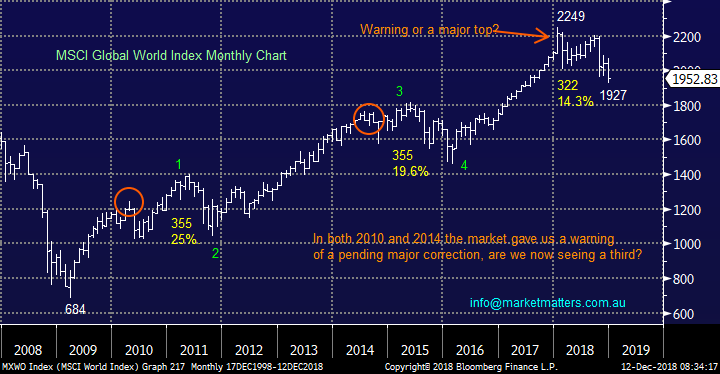

As subscribers know we can see the current post GFC bull market remaining “choppy” but following an appreciation of over 200% investors would be almost greedy not to expect some 10-20% corrections – its common market patterns.

MM is currently a touch 50-50 whether the latest correction is complete, or close, and hence whether we can see a strong rally from current levels as the 1994 overlay suggests. The average correction of the ASX200 over the last decade since the GFC is less than 14% and we have already fallen over 13% since August so statistically this is an ideal time to be buying – certainly has felt the hard option over recent weeks but it usually does when its correct!

However there are some standout views we have for the coming years:

1 – Market volatility will remain elevated hence investors should be prepared to sell strength and buy weakness – this would have certainly worked well in last few weeks.

2 – Boring more traditional “Blue Chip” stocks will outperform the high valuation / growth stocks over many quarters, unlike the last few years.

3 – A conservative style portfolio with sustainable solid yield should perform well and help investors sleep, especially when hedged at times.

The MSCI World Index Chart

Lets consider a basket of stocks like CBA, Telstra and even BHP, they will generate a yield of around 6% fully franked for an investor compared to say a term deposit paying 3% unfranked. However the clear risk is preservation of capital.

Firstly, as we showed in October use of protective ETF’s can add value to a portfolio. e.g. If an investor buys a bearish ETF for equal $$ value as the above portfolio, assuming the portfolio can track the ASX200, they should outperform cash by ~3% plus franking credits. Our point being, running to pure cash is not the obvious way ahead.

Secondly, with some opportune tweaks of a portfolio / hedge we believe investors can position themselves to significantly outperform cash and the market itself as long as we remain flexible – today is a classic example where MM does not want to hedge its portfolio because we expect the next few % for stocks is up.

We think it’s basically time to KISS (keep it simple stupid) with investments.

Conclusion

MM remains short-term bullish stocks but bearish medium-term.

We cannot stress enough how much we believe the investing landscape is evolving dramatically from the last decade. Our view is stock, sector and even market rotation will be required in the years ahead for optimum portfolio performance - it’s NOT time to buy and hold in our view.

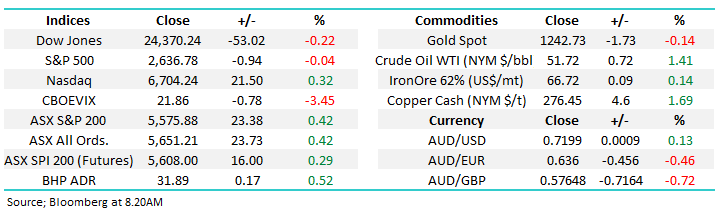

Overnight Market Matters Wrap

· Another roller coaster of a session overnight, oscillating in and out of positive territory. The Dow traded in a 570pt range from -200pts to +370pts before eventually steadying, closing a little changed.

· The markets hit their highs early after positive comments from President Trump around the progress of US-China trade and hit their lows after WSJ reports that the US would condemn China for hacking and economic espionage. The mood was also unsettled, after President Trump threatened to shut down the Government if he couldn’t get the funding for his Mexican wall in a televised angry standoff with the leaders of the Democrats.

· Earlier, European markets posted a solid recovery of between 1.3%-1.5% despite ongoing Brexit concerns, although the sterling sold off again to a new 20 month low against the US$.

· Commodities traded in a narrow band overnight with the oil price recovering some of the previous day’s losses as Crude climbed 1.41%, copper price 1.69% firmer, while gold and iron ore were slightly weaker.

· BHP is expected to outperform the broader market after ending its US session up and equivalent of 0.52% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 30 points higher, above the 5600 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.