Do we fade the crowds recent move?

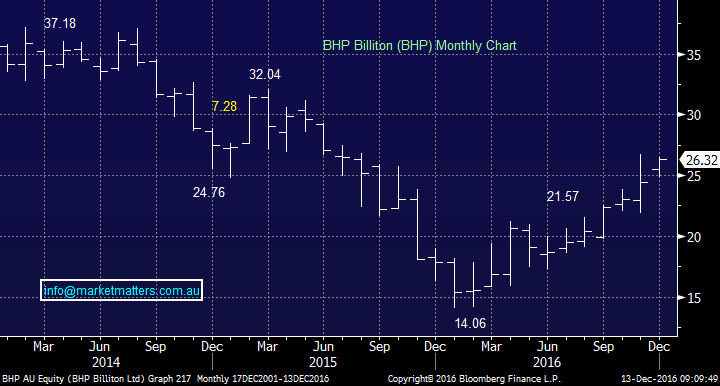

History tells us that fading the crowd often becomes an excellent investment thematic but as we all know it's about the timing. When we started 2016 the market simply hated resource stocks, led by BHP with the often called "Big Australian" making multi-year lows in January just above $14. Yet here we are approaching Christmas and BHP is up ~85% while the ASX200 is up only 5% - there are plenty of other stunning performances within the sector e.g. FMG +267%!

Overall we are happy with our calls around BHP but there were both some loses along the way and some profits left on the table.

- We called BHP a major sell in $30's targeting $20 which certainly led to lots of criticism as people do like BHP but it proved a great call which saved us lots of $$.

- We bought BHP too early around $20 leading to us being stopped out for a loss.

- We subsequently bought BHP, RIO and FMG a number of times in 2016 leading to some nice wins but we did unfortunately underestimate how far the sector would squeeze to the upside.

For the record we are now neutral the sector but the message we are looking to convey is don't be afraid to invest against the majority, they are very often wrong.

BHP Billiton (BHP) Monthly Chart

The two current market trends are to sell growth stocks that are trading on high valuations (P/E's) and to sell the "yield play". We believe interest rates are going higher hence we believe the second one has further to run but we are looking closely at the selling of the high P/E stocks.

Stocks are generally trading on high P/E's for two reasons, they are excellent companies that have constantly delivered, or they are companies where investors have become far too optimistic. There have certainly been some horrific stories within this growth sector of late with investors that sold early likely to feel vindicated but some excellent companies are being dragged down in the vortex, potentially presenting some opportunities.

1. Rerated stocks

The following are some of the stocks which the market has rerated during 2016 for a variety of different reasons. The common denominator of this long list are the stocks / sectors were market darlings at some stage and subsequently they traded on elevated valuations.

The China story - Blackmore's (BKL) -51% and Bellamy's (BAL) -60%.

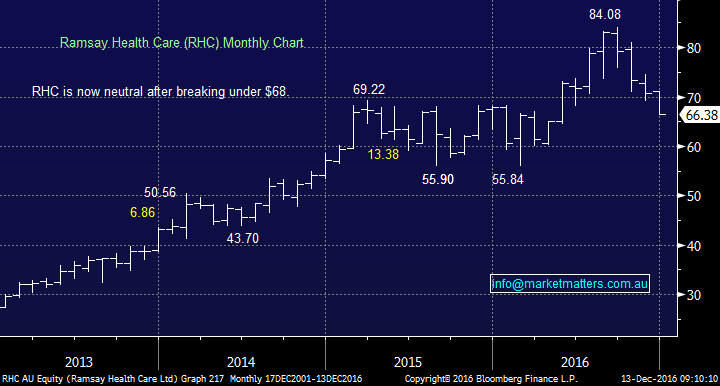

Healthcare -Cochlear (COH) -22%, Ramsay Healthcare (RHC) -21%, Sirttex (SRX) -60%, CSL Ltd (CSL) -24% and Healthscope (HSO) -27%.

Aged Care - Estia Health (EHE) -66%, Regis Healthcare (REG) -34% and Japara Healthcare (JHC) -34%.

Telco's - Vocus (VOC) -56%, TPG Telecom (TPM) -43% and Vita Group (VTG) -50%.

Others - REA Group (REA) -22% and Isentia (ISD) -46%.

Currently we own CSL Ltd, Vocus (VOC), Healthscope (HSO) and Vita Group, with good entry levels into weakness for the last two.

2. Potential opportunities looming

The carnage that has hit the high P/E stocks is still moving with some momentum as we literally saw yesterday with some of the worst performing stocks on the market in this currently unpopular group e.g. a2milk, Bega Cheese, Ramsay Healthcare, CSL and Webjet. Picking a bottom for a falling stock is very tricky as we experienced earlier in the year with BHP, a more prudent method is sometimes to scale in buying on the back foot - this avoids having to sell when your experience tells you that buying makes more sense.

As we have discussed over recent months we are buyers of HSO ~$2.10 and EHE ~$2. We are also considering adding to CSL but not just yet.

Our favourite 3 growth stocks on the radar at present are as follows, with simple buy levels stipulated.

1. Ramsay Healthcare $66.38.

We like the hospital operator but with even after its recent pullback the stock is trading on a P/E of 25.5x 2017 earnings. Hence we are keen buyers of RHC between $56 and $60.

Ramsay Healthcare Monthly Chart

2.REA Group (REA) $51

We like both REA's business model and dominant position in the market. However technically we can see a spike down towards the $40 region hence patience is required, plus the stock is still trading on a P/E of 27x estimated 2017 earnings, hence not cheap. We are keen buyers of REA around $40.

REA Group (REA) Monthly Chart

3. Isentia (ISD) $2.68

The media monitoring company ISD has endured a tough year falling by almost half but we believe the selling has been overdone and the stock is now trading on a P/E of 16x est. 2017 earnings - value emerging. We are currently keen buyers of ISD into fresh lows under $2.36.

Isentia (ISD) Daily Chart

Summary

- We are now looking very closely at the growth end of the market as the crowd continues dumping it aggressively. As we illustrated with the BHP example these trends often go further than expected so for now we are being patient with our entry levels although we bought Vita Group (VTG) last week. Our favourite 3 at present are:

- RHC under $60, REA ~$40 and ISD ~$2.30.

- Plus as we have discussed previously we like HSO ~$2.10 and EHE ~$2.

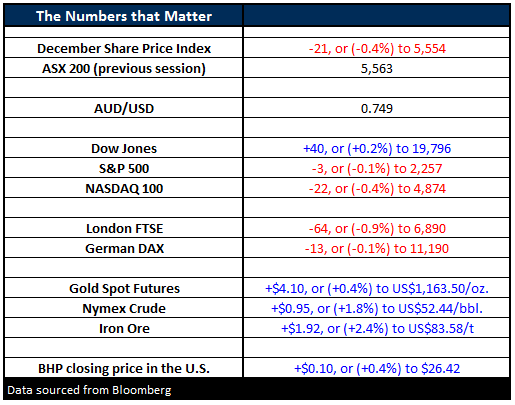

Overnight Market Matters Wrap

- A mixed session was experienced in the US overnight, with the Dow up 40 points (+0.2%) at 19,796, while the broader S&P 500 closed 3 points lower (-0.1%) at 2,257, after both hit all-time highs earlier in the day.

- The financials underperformed in the US as investors de-risk a portion of their portfolios ahead of the final US Fed meeting for the year, where we anticipate its first rate rise in many years.

- Iron Ore rallied 2.4% higher to US$83.58//t. while Crude Oil closed 2% higher to US$52.44/bbl.

- The December SPI Futures is indicating the ASX 200 to open 10 points lower, towards the 5,490 level this morning

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here