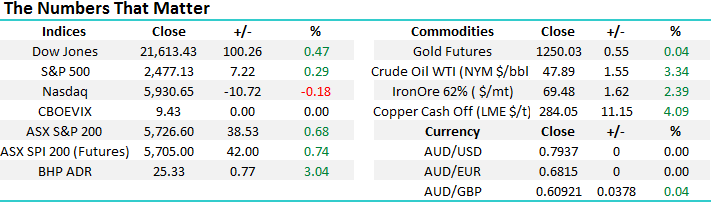

Could the retail selling have gone too far?

The ASX200 rallied strongly yesterday regaining all of Mondays losses plus a touch more for good measure. The market often likes to make you look “silly” and following our recent report outlining the negative statistical implications of the ASX200 breaking to fresh monthly lows the market has bounced strongly casting obvious doubt over our short-term negative outlook for Australian stocks. Our current view has not significantly changed but obviously it now looks likely that this July will now be the tightest range since mid-2014!

1. The ASX200 remains range bound between 5629-5655 support and 5836-5810 resistance.

2. Our preference is still for a further correction back towards 5500 in August / September and the more begrudging the pullback the keener MM will become to buy the retracement.

This morning local stocks look set to open up around 35-points led by the resources, following strong gains in iron ore, crude oil and copper e.g. BHP is set to open up 75c / 3% around $25.30.

ASX200 Daily Chart

US Stocks

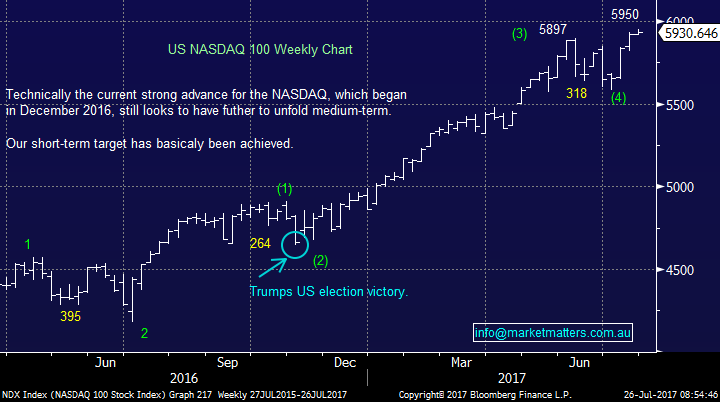

Last night US equities were mixed as reporting season unfolds, the broad S&P500 closed up 0.3% while the tech. NASDAQ fell 0.2% following a disappointing result from Google. The NASDAQ may now fall marginally short of our 6000-target area, it’s important to remember we are targeting a 6-7% correction from this hot sector in coming months.

However, importantly for local investors when the NASDAQ corrected sharply over 5% in June / July the ASX200 basically ignored the move. The broad S&P500 will need to correct before we are likely to take notice and we are only looking for a 4-5% correction here.

US NASDAQ Weekly Chart

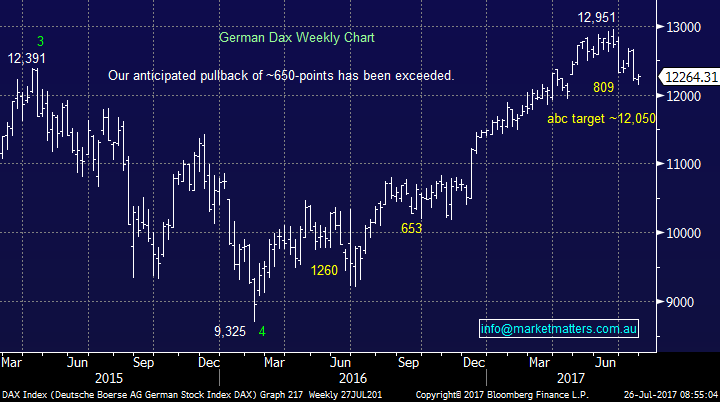

European Stocks

Europe has recently been tricky with the German DAX now approaching strong support in the 12,000-area following a 6.2% correction while the UK FTSE looks vulnerable to further declines, especially as investors understandably get increasing concerned around BREXIT.

German DAX Weekly Chart

We touched on yesterday our concerns around the local macroeconomic landscape moving forward i.e. household debt is at record levels, wage growth is almost low plus banks are pushing up interest rates out / ahead of the RBA cycle. However, the best opportunities can arise when everyone is negative and this certainly applies to the retail sector today which is being battered by the joint worries of our economy and the pending arrival of Amazon to Australia.

Remember we quoted a story from the AFR in yesterday’s afternoon report where Deutsche Bank said that companies who have been targeted by short sellers perform the best during reporting season, the below percentages of stock sold short clearly shows a large number of traders all positioned the same way i.e. very short retail:

Myer (MYR) 16%, JB Hi-Fi (JBH) 14.5%, Retail Food Group (RFG) 12.9%, Metcash (MTS) 12.3%, Ardent Leisure (AAD) 12%, Harvey Norman (HVN) 10.8% and Automotive Holdings (AHG) 8.6%.

Myer (MYR) Weekly Chart

Over the past few years some of our best market calls at MM have been by aided by insights from overseas markets as to the future direction for Australian stocks / sectors e.g. We said sell Woolworths ~$34, before its 40% fall courtesy of clues from Tesco / Sainsbury’s in the UK.

Today we have looked to Canada, a market not dissimilar to Australia, to search for clues as to Amazon's impact on our retail sector. Canada and Australia have a number of similarities including a strong resources presence, a weakening currency (arguably!) against the $US and large land masses with relatively small populations, dominated by a couple of large cities. Our key pick-ups from looking to Canada where Amazon has had a clear presence for around 6-years:

1. Surprisingly on-line shopping remains relatively low in Canada, like Australia, although it’s growing. Amazon's share of the on-line market is only 17% of its penetration in the US.

2. Retail assets have held up in Canada with shopping centre occupancy still high.

3. Supermarkets appear to have been impacted more by competition from the likes of ALDI than by Amazon.

4. Amazon does not offer its “Prime Now” service in Canada and its 2-3-day service is limited to certain areas, Australia may easily end up similar due to its geographical size.

So far Amazon does not appear to have decimated Canadian retail outlets / supermarkets. This should give investors some comfort for our retail sector with regards to Amazon.

When we look at store closures in Canada it gives some clear clues as to where the risks sit:

1. Many local brand stores have closed, especially in the clothing / fashion area, but many have been replaced by international brands e.g. Zara. Quality businesses moving with the times.

2. While department stores have struggled the closures are not huge with the exception of Target Canada i.e. discount retailer similar to that in Australia.

We have already witnessed these trends locally to a degree with Oroton Group (ORL) seeing its stock fall by almost 90%.

The question we ask ourselves is has the selling gone too far? When we look at the bare bone numbers there is clearly a lot of bad news built into these stock prices:

1. Myer trades on an est. P/E of 9.6x while paying a yield of ~8% fully franked.

2. JB Hi-Fi trades on an est. P/E of 13.6x while paying a yield of 6%.

3. Harvey Norman trades on an est. P/E of 11.7x while paying a yield of ~8%.

4. Automotive Holdings (AHG) trades on an est. P/E of 14x while yielding over 8%.

Conclusion (s)

We have been very anti-retail over recent years which has saved us considerable money but perhaps there now exists a few “cheeky but high-risk opportunities”, remember the embattled Metcash has rallied over 100% since mid-2015. Our revised feeling is the Amazon effect is now fully baked into the retail sector for the foreseeable future – and in any case, given depressed valuations, wouldn’t Amazon consider buying one of our well known retailers to gain properties & logistics networks?

1. Buy MYR under 75c but be prepared to cut losses if it cannot hold the 68c area.

2. Buy HVN if we get a pullback to fresh recent lows under $3.50.

3. Buy AHG if we get a correction back towards $3.50.

Keep an eye out for the Income Report later today as we continue to focus on the retail sector – it does offer amazing yield!

Overnight Market Matters Wrap

Corporate Earnings have dominated the US with another mixed session overnight. The Dow and S&P 500 rallied, led by strong results from McDonald and Caterpillar, while the heavy tech, NASDAQ 100 underperformed following disappointing results from Alphabet.

Tonight, the US Fed meet with expectations of its key interest rate to be unchanged at 1.25%, however investors more keen on seeing whether they may shed more light on when they will start unwinding their balance sheet.

Domestically we expect the CPI quarterly data to be released at 0.4% and the yearly CPI data at 2.2% this morning.

The June SPI Futures is indicating the ASX 200 to open 37 points higher this morning towards the 5765 area with the commodities sector expected to outperform.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here