Could Bitcoin disrupt gold as a safe haven asset?

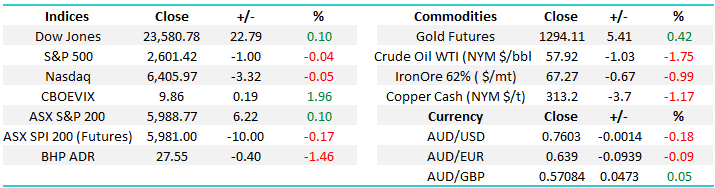

The ASX200 is currently treading water into December as investors / traders remain shy to chase local stocks over 6000 but there is also a lack of sellers into any weakness which makes sense as people start to consider when the Christmas / window dressing rally will commence – optimism is strong with nobody questioning if it will occur this year. The ideal scenario for MM would be a short-term correction back under 5900 before lift-off into 2018 i.e. only a ~2% pullback from yesterdays close.

This morning will provide a test for our market with resources lower e.g. BHP -1.2%, Telstra (TLS) hitting the headlines due to the NBN fiasco (although no real impact on earnings is expected) and the Nationals now getting the votes for yet another bank probe. This popularity quest to knock Australian banks is running very long in the tooth, it’s certainly not in the interest of voters who have huge chunks of their Super in bank shares!

Today we are going to look at the rise of Bitcoin and consider whether it could potentially replace gold as a safe haven asset.

ASX200 Daily Chart

Is gold a good investment?

Gold's history began in 3000 B.C, when the ancient Egyptians started making jewellery, it wasn't until 560 B.C. that gold started to act as a currency. At that time, merchants wanted to create a standardized and easily transferable form of money that would simplify trade – sounds like Bitcoin today! Moving rapidly forward to modern times The United States abandoned the gold standard in 1971 when the U.S. currency ceased to be backed by gold but the allure of the precious metal was not lost. It remains important in the global economy with gold sitting squarely on the balance sheets of central banks and other financial organizations e.g. The International Monetary Fund. Presently, such organizations are responsible for holding approximately one-fifth of the world's supply of mined gold.

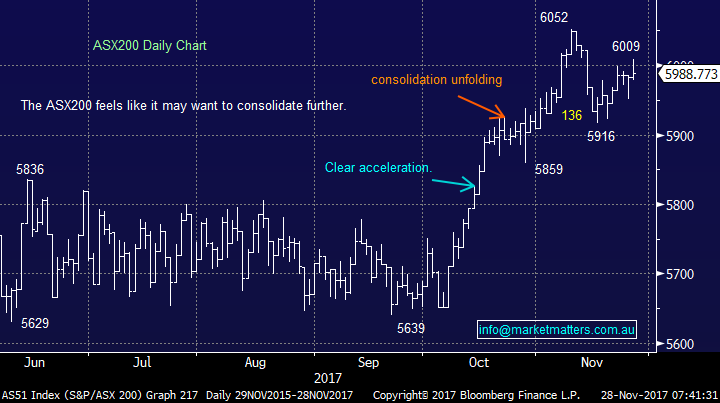

Gold is an investment that is regarded as a hedge against inflation + a falling $US, while many people also believe it’s a great safe haven through market volatility, although it must be said that these uncertain times can vanish as quickly as it arrived – many pundits were talking gold at $US5,000 during the GFC but it failed to break $US2,000 and now it sits ~30% lower today.

Over the last ~50-years gold has appreciated around 26x although investors have received no interest on their funds and will have needed to store it somewhere , potentially incurring costs – the power of compound interest is often underestimated.

At MM we believe gold, and more importantly Australian gold stocks, are trading vehicles that have their place in a portfolio on occasion but definitely not always. If we look at gold over the last 50-years there has only been around 15 good years, not a great strike rate.

Gold Quarterly Chart

Gold is a very unusual commodity that definitely does not follow usual supply and demand characteristics otherwise it would be significantly cheaper. "Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head." – Warren Buffett.

Conversely there are 2 very big supporters of gold for the foreseeable future, both China and India are the growth areas of the global economies and they simply love gold!

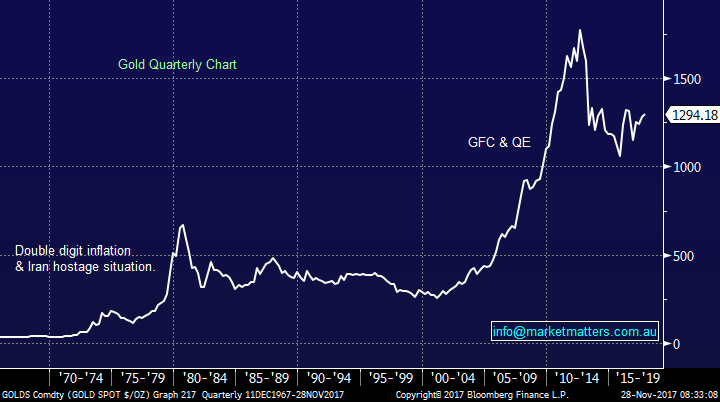

When we compare gold to US stocks over recent decades it’s been a huge win for the share market, even before considering dividends.

At MM we believe gold investing is very much around timing putting it in the aggressive investment / trading basket.

US S&P500 v Gold Quarterly Chart

Is Bitcoin a good investment?

The simple answer over the last 2-years is of course with the crypto currency up over 16x. While the volatility is not for the faint hearted there appears to be plenty of buying of weakness and importantly Bitcoin keeps rising in the face of potentially bad news which is a very bullish indicator.

- Over the last 6-months alone we have seen corrections of 38%, 39% and 29%.

We have seen many quality ASX300 stocks correct ~20% before solid buying remerges but with Bitcoin the rhythm is closer to 30%, from a technical perspective we would buy corrections of 30% using an additional say 15% for a stop – clearly very speculative / trading stuff.

We have seen prominent bankers and the Chinese government trying to suppress Bitcoin but to no avail – the simple growth stats are too hard to ignore!

- Bitcoin is slowly moving mainstream with Coinbase, a popular platform, adding 300,000 new users in a week!

- Coinbase now has 13.3 million users, tripling its customer base in one year – sounds like the evolution of the internet.

- A Bitcoin futures contract will be arriving soon giving the new asset validity.

- Dutch and Scandinavian countries are already experimenting with Bitcoin style / Blockchain products, as is the ASX locally.

Bitcoin currency Weekly Chart

At MM we feel there’s still plenty of $$ to be made in Bitcoin but also its casino like appreciation will inevitably lead to many investors losing large amounts of money. We will await further clarity on the space before considering investing but as always never say never.

We will write a simple explanation report on Bitcoin / Crypto currencies before Christmas as one if the toughest things around Bitcoin is understanding it!

Global markets

US Stocks

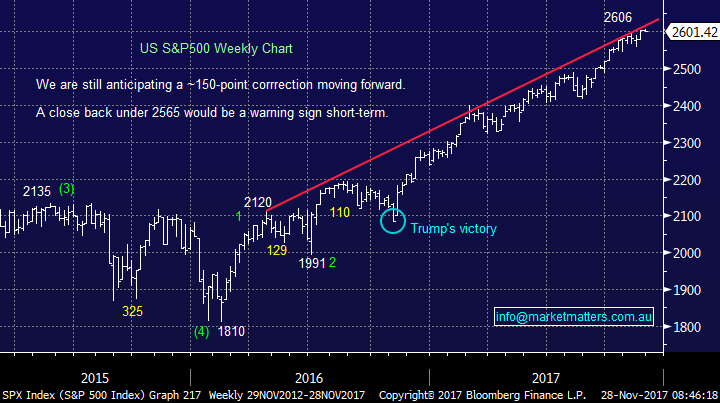

The US continues to oscillate around all-time highs and although we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date. The S&P500 has hit our target of 2600 and we now expect things to slow down into Christmas.

US equity ETF’s continued to attract money, even at these all-time highs, with investors adding $10.5bn last week on top of $7bn in the previous week alternatively last week other asset classes suffered minor outflows of $173m. Money pouring into US ETF’s is not particularly bullish when the S&P continues to hover around the 2600 level i.e. its finding some sellers for now.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

We do believe if Bitcoin / crypto currencies do continue to evolve in a positive manner it should challenge golds position as a safe haven but the likelihood is this will take years to evolve.

As always we believe gold is a primarily a trading vehicle and whether or not Bitcoin does become mainstream will not change this view.

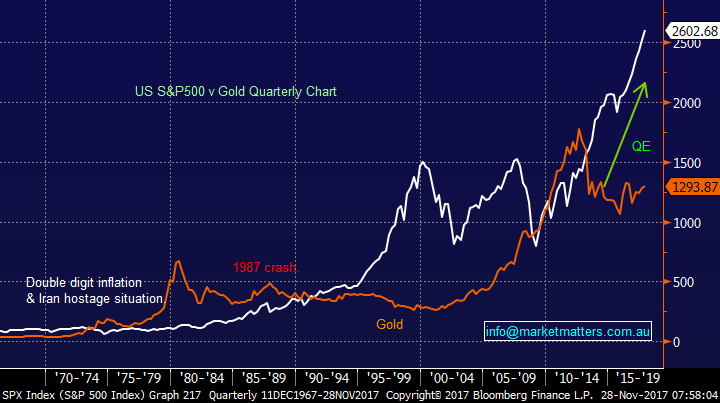

Overnight Market Matters Wrap

· The US ended their session little changed overnight, with the energy sector underperforming the broader market.

· Gold futures rose, while Dr. Copper (a leading indicator of economic growth) had retraced following a 7-day rally.

· BHP is likely to struggle against its ASX 200 peers today, following oil and iron ore down overnight and BHP ending its US session down an equivalent of $27.55, -1.46% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to follow the US and open with little change, down 10 points, testing the 5975 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/11/2017. 9.00am

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here