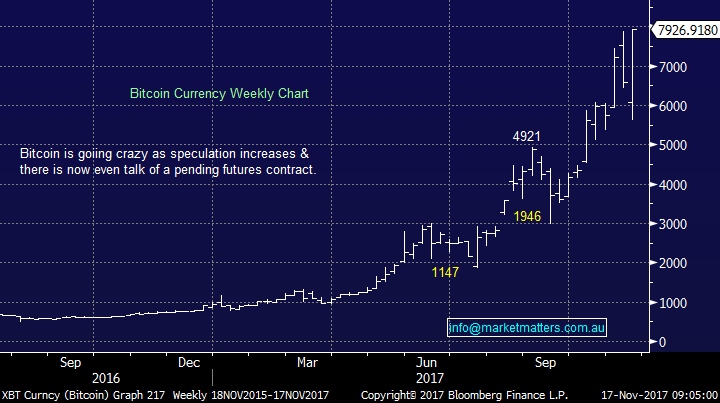

Considering “window dressing” into Christmas (A2M, ALL, CGF, IFL, TLS)

Happy Friday to all our subscribers as volatility continues to raise its head in stocks with the energy sector providing the majority of the local news this week. Yesterday the market managed to bounce with Santos (STO) leading the way following the $11bn takeover offer from US Big oil however the stock trading almost 7% below the reported price illustrates the markets lack of confidence in the eventual outcome.

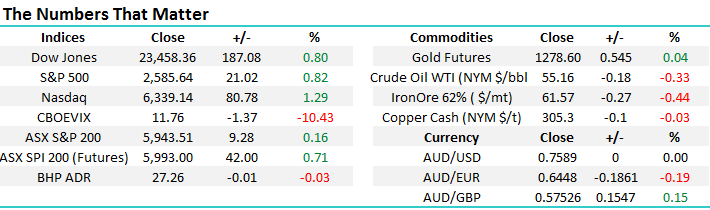

The ASX200 remains in a very negative period on a seasonal a basis where from a risk / reward perspective caution is warranted considering the average pullback during this period would actually take us closer to the 5750 area.

At MM we are simply sticking to our thoughts of recent weeks:

1. We are bullish the ASX200 targeting higher levels but the risk / reward is not currently compelling around today’s levels i.e. around 6000.

2. MM are likely to be active buyers if local stocks experience a decent correction over the next 1-2 weeks with the 5850 level our ideal target.

Amazingly the Christmas rally / window dressing period is only 3-4 weeks away where generally the year’s best performing stocks actually outperform again, hence there is no hurry to realise profits on big winners. Today we will focus on this concept within our portfolio.

ASX200 Daily Chart

We remind readers that while we anticipate a significant correction from stocks, which is likely to commence in 2018, there is no reason to jump off the equity train just yet. Many asset prices are still appreciating as most central banks continue to artificially “pump” money into the system, just ponder for a moment if you believe a pullback cannot unfold:

1. A painting, albeit a Da Vinci, is worth almost $600m?

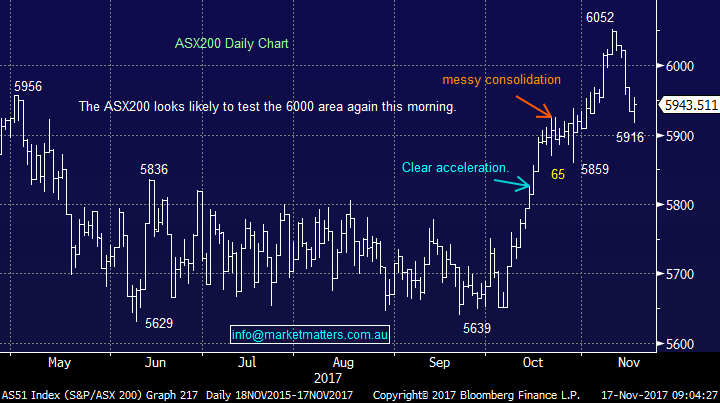

2. Bitcoin can appreciate exponentially in a year when fresh crypto currencies are hitting the market almost daily i.e. plenty of rival supply.

Bitcoin Weekly Chart

“Window dressing” and the MM Growth Portfolio

There are 2 factors we need to consider here:

1. What stocks do we hold that are showing big gains for 2017?

2. Is the money in our laggards better deployed elsewhere?

Let’s take a look at the Growth Portfolio, which is a more active, growth orientated portfolio.

Top Performers

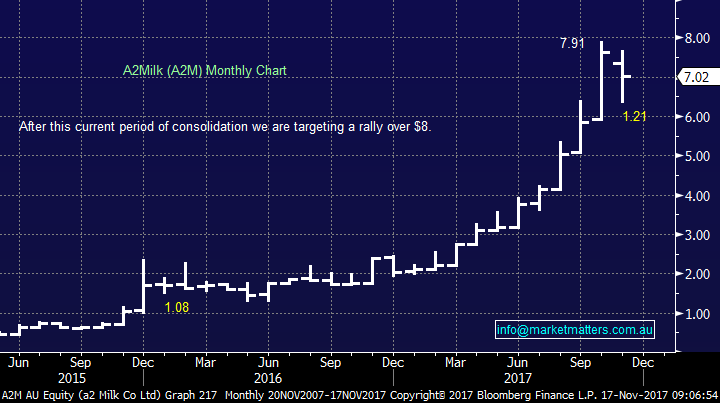

1. We jumped on the A2 Milk freight train fairly late in 2017 following its ~15% correction after the news that Colonial had reduced their stake – an act we felt made total sense considering the stocks advance.

We remain bullish and are targeting over $8 to take profit i.e. ~15% higher.

A2 Milk (A2M) Monthly Chart

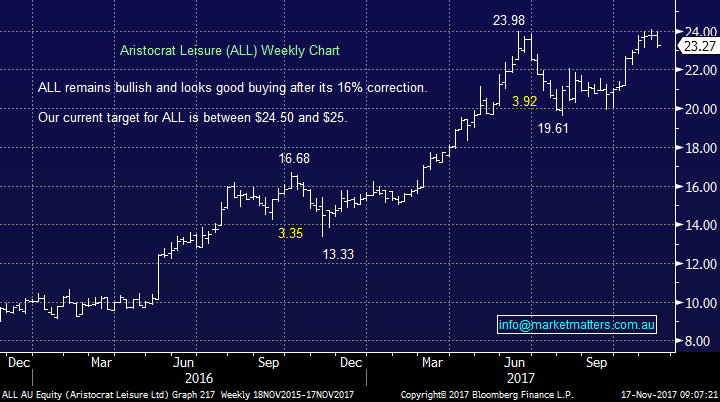

2. Aristocrat (ALL) has enjoyed an awesome 2017 to-date and our position has shown a good profit essentially since the purchase.

Our target remains around $25, or another 8% higher.

Aristocrat (ALL) Weekly Chart

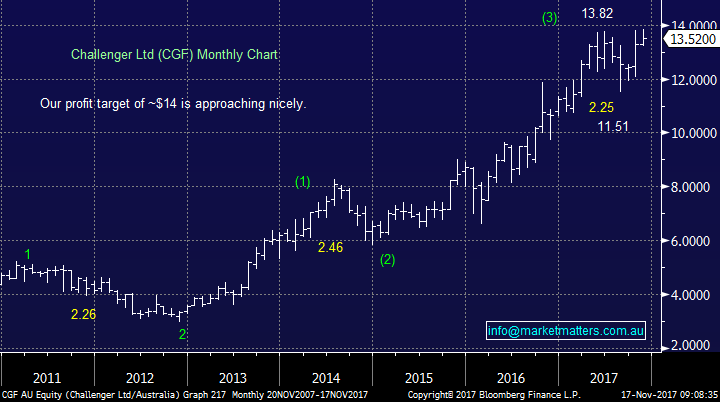

3. Challenger’s (CGF) year has been excellent although not in the league of A2M and ALL.

Our profit target remains over $14, or around 4% higher, it would not take much window dressing for this to be achieved.

Challenger (CGF) Monthly Chart

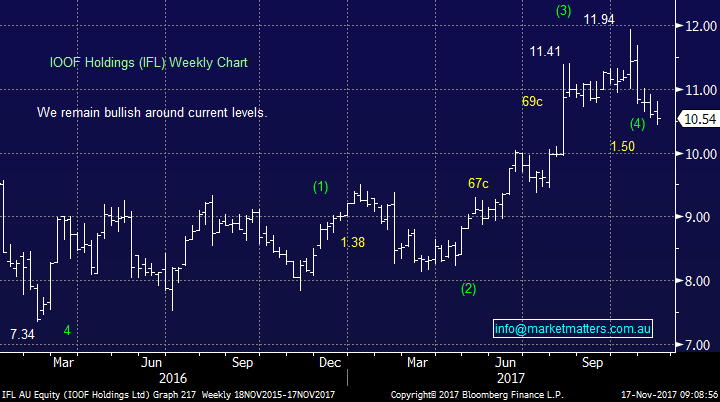

4. Although we are slightly behind with our purchase of IFL the stock has enjoyed a great 2017 and if anything, we are considering adding to our relatively small position.

IOOF Holdings (IFL) Weekly Chart

Laggards

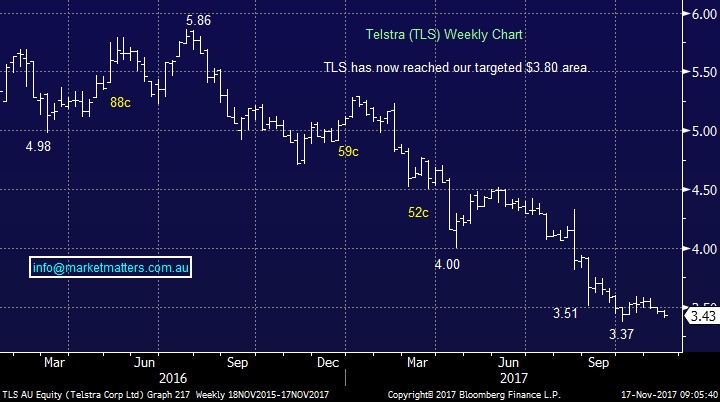

No surprises here with Telstra (TLS) top of the pops down over 30% in 2017 to-date and although our position is only slightly behind its unlikely to receive the usual market love around Christmas.

Our other holdings have generally enjoyed an average / solid 2017 highlighting our 10% in TLS as a strong candidate for switching to a better stock (s) over coming weeks.

Telstra (TLS) Weekly Chart

Global Indices

US Stocks

US equities rallied strongly overnight and now look poised to make fresh all-time highs into Thanksgiving (Thursday 23rd November) but from a trading perspective we would be happy to sell these new all-time highs.

Overall there is no change to our short-term outlook for US stocks, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

European Stocks

European indices bounced in line with Asia overnight but we still believe they are in for a few weeks consolidation / weakness.

Euro Stoxx 50 Weekly Chart

Conclusion (s)

We are considering switching out of our Telstra (TLS) holding over coming weeks for the Growth Portfolio.

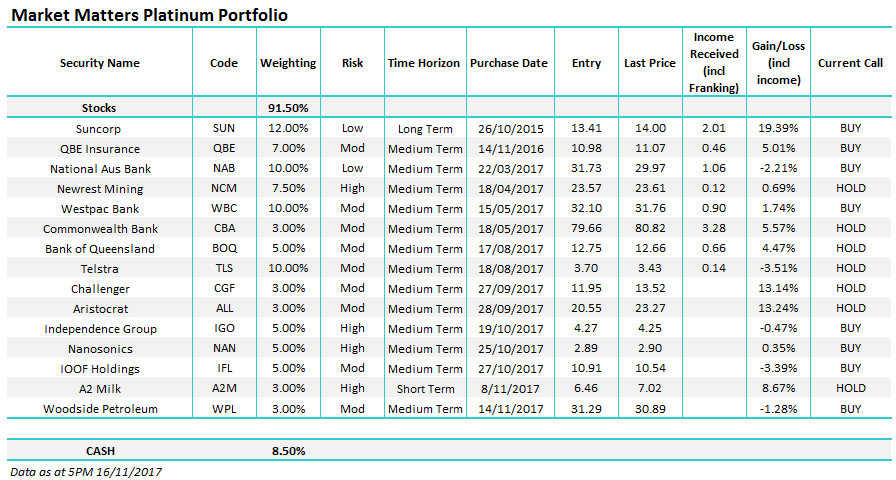

Overnight Market Matters Wrap

· The US equity markets rallied overnight, sparked by the US tax bill reform, again!

· The Norwegian wealth fund wants to reduce its exposure to energy shocks by selling large stakes it holds in Shell and Exxon. Oil stocks fell on the announcement.

· Metals on the LME were weaker, led by nickel which fell 3%. Oil and iron ore fell while gold is trading flat around $US1278/oz.

· The December SPI Futures is indicating the ASX 200 to open 42 points higher towards the 5985 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/11/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here