Comparing metals to interest rates in the bigger picture (BHP, RIO)

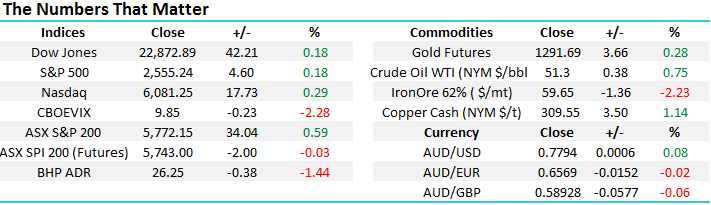

Local stocks have enjoyed an excellent bounce over the last 2-weeks, albeit within the context of a very quiet range bound market, and we again find ourselves in striking distance of the psychological 5800 resistance area. The internals of our market were fascinating yesterday when we look under the hood of the 34-point / 0.6% advance. We saw CBA unchanged plus the iron ore sector under pressure but the broad market was very healthy with buying basically across the board, historically the characteristics of a healthy market. It feels to us at MM that some fund managers are capitulating and putting some of their excess cash to work as US stocks continue to climb the wall of worry.

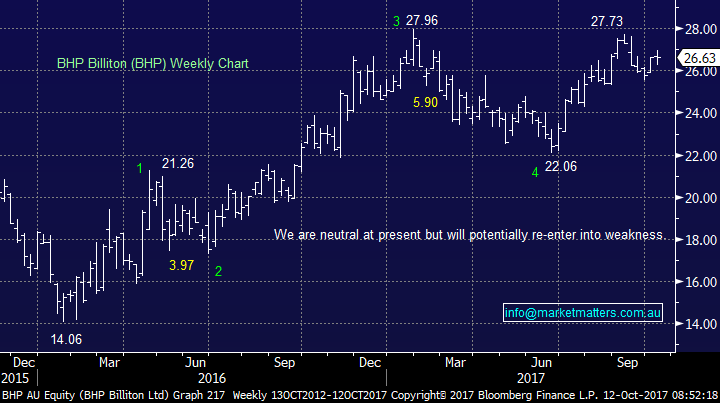

Today we are going to again touch on the striking sector rotation that’s been evolving within our market as we compare the long-term trends in 2 key areas for our market, just consider what’s evolved since we recently took profit on our BHP position:

- BHP has corrected ~5% since we sold out well over $27 with it due to open down 1.4% at $26.25 today.

- Over the last 3-months iron ore has fallen 25% and is now close to its 2017 lows, during this period Fortescue Metals (FMG) has tumbled over -18%.

- BHP topped out in first week of September amid the euphoria around its capital story and the potential to become a major yield play moving forward – as we said at the time chasing such optimism rarely pays off.

- Over this period the banks have rallied strongly e.g. NAB is up almost 6% and our recent purchase Aristocrat (ALL) is up almost 10%!

With the attractive dividends looming on the horizon in November from the likes of ANZ, NAB and WBC, even with the iron ore sector looking vulnerable, we can see a continuation of the ASX200 playing some catch up with its global peers and enjoying a rare period of outperformance.

As we said yesterday simply too many people are negative stocks and the bears need to be silenced before stocks will fall. For MM to get bearish and start significantly reducing our market exposure we want to see some euphoria / optimism out there and a rally by the ASSX200 to multi-year highs above the psychological 6000 area may be what the doctor ordered. At this point in time we are more confident in our forecast for the ASX200 of a break over 6000 in 2017/8 than our short-term feeling that a pullback towards 5500 was likely.

ASX200 Weekly Chart

Global Markets

US Stocks

Last night the broad based S&P500 again closed up 0.2% around its all-time high, we remain concerned around the current complacency within the US market but stress no sell signals have yet materialised.

There is no change to our short-term outlook for US stocks, ideally we are targeting / need a ~5% correction before the risk / reward will again favour buying this market.

US NASDAQ Weekly Chart

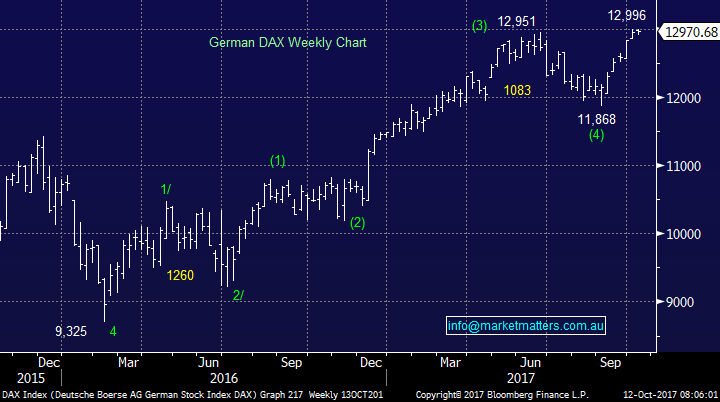

European Stocks

No change, European stocks look likely to make further fresh 2017 highs in the next few days but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Asian Stocks

The Hang Seng remains strong, especially after enjoying the 4.8% advance over the last 2-weeks but we continue to believe this 28,000 area will be a magnet for the market over coming few weeks at least

Hong Kong’s Hang Seng Weekly Chart

Metals and interest rates

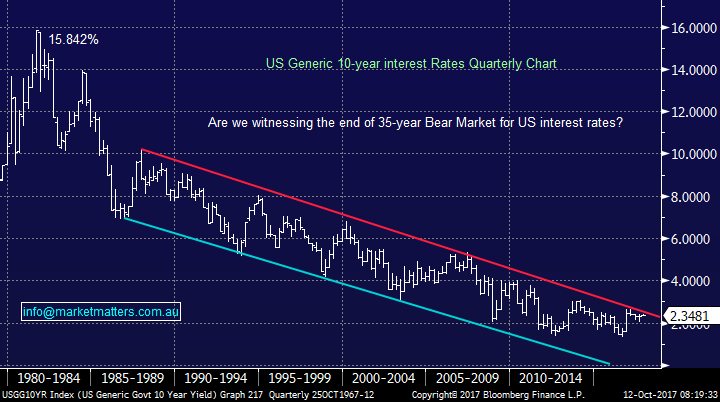

Not surprisingly there is a direct correlation between base metal prices and interest rates i.e. as global economies weaken so do base metals prices which generally leads to the lowering of interest rates by central banks in an attempt to stimulate economic recovery / growth - hence the phrase “Dr Copper” with the base metal being used by many to pick the trend of global growth. Simply as base metals fall in price usually so do interest rates.

Interest Rates

As I touched on in yesterday’s webinar US bond yields look close to ending a 35-year bear market and although we believe they eventually will pop higher they have threatened this previously on a few occasions.

The US stock market is currently agreeing with our view pushing US banks to decade highs over recent weeks – banks margins improve in a higher interest rate environment. We remain bullish US banks for now with a target around 5-6% higher. The MM Growth Portfolio has maintained a significantly overweight exposure to the banking sector in 2017 which has held us in good stead but we are not complacent with US banks close to our target area. Australian banks are now slightly ahead of their long-term valuation, following recent gains, on a relative index level and we have to ask ourselves if this is justified moving forward. We anticipate trimming this exposure in coming months with a preference for the out of favour insurance stocks at current levels who benefit even more from rising interest rates.

US 10-year bond yields quarterly Chart

US S&P500 banking sector weekly Chart

Base Metals

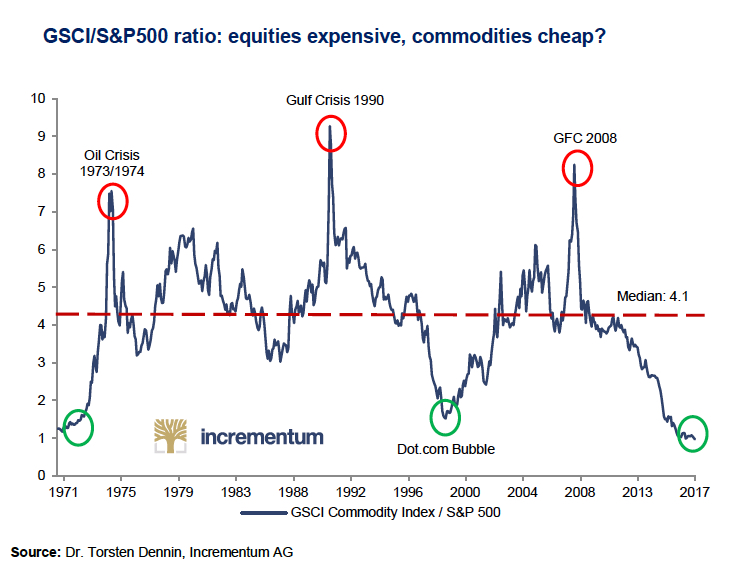

Unlike US bond yields base metals have broken their decade long down trend which ties in with our belief in the reflation trade – the base metals index comprises aluminium, copper, nickel and zinc.

Hence at MM we are buyers of the resources sector over the coming months with levels to push the buy button remaining they key.

Base Metals Index Monthly Chart

When we look at commodities versus the S&P500 it feels like something is going to break! As they say a picture tells a thousand tales.

At this stage our initial buy / accumulation levels are as below:

- BHP first level close to $25.

- RIO close to $65.

- Plus we are evaluating a few more base metal specific stocks to gain sector exposure.

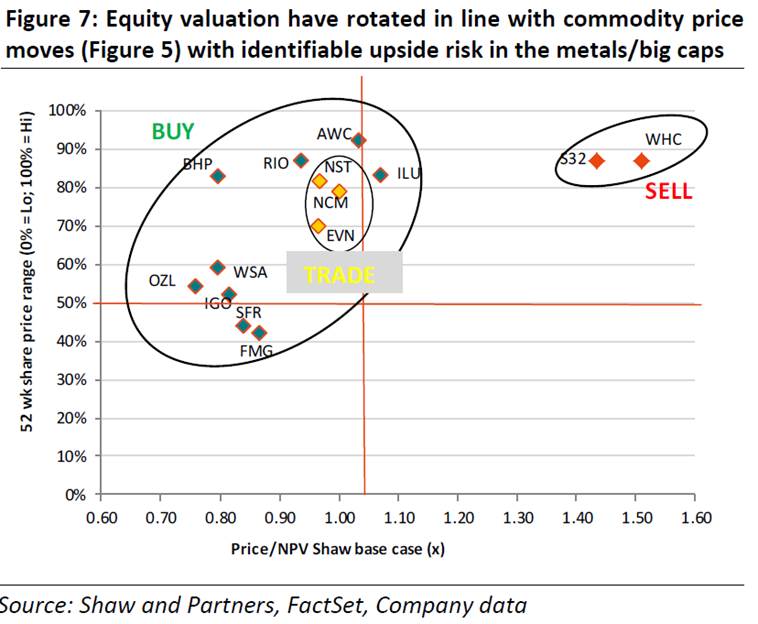

Remember the chart we often include from Shaw’s Resource Analyst Peter O’Connor who I also interviewed a few weeks ago.

BHP Billiton (BHP) Weekly Chart

RIO Tinto (RIO) Weekly Chart

Conclusion (s)

We remain happy to increase our market exposure as opportunities present themselves, and now have less conviction in our call for a decline to 5500 on the ASX 200 and more conviction that the market tracks to 6000 in the coming months

We are keen buyers of the resources if this current weakness unfolds further, as we expect.

Overnight Market Matters Wrap

· The US equity markets closed marginally higher overnight to further record highs, ahead of the beginning of September quarter reporting season, which kicks off tonight.

· Minutes of the last Federal Reserve meeting appeared to reaffirm that further interest rate hikes starting in December are on the cards, while the unwinding of the massive bond portfolio is due to begin later this month.

· Iron ore tumbled another 2% to under US$ 60/t on the back of falling china steel demand while copper, gold and oil once again firmed. BHP and RIO share prices went in opposite directions overnight with BHP -1.7% and RIO +0.4%.

· The A$ was little changed at around US 77.8c and the futures are pointing to a flat opening on the local exchange.

· The December SPI Futures is indicating the ASX 200 to open 10 points lower, testing the 5760 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here