China’s Population May Be About to Explode!

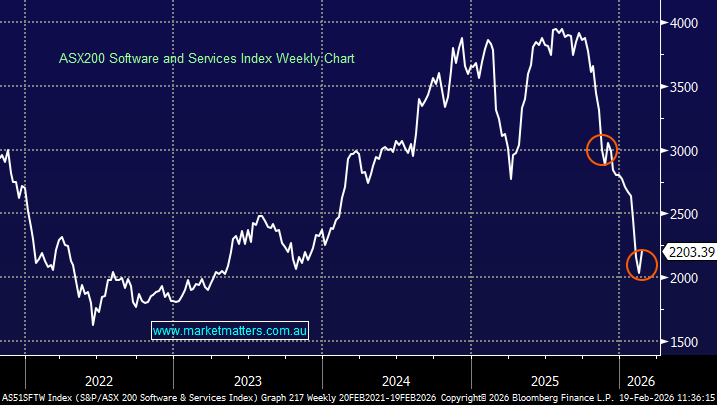

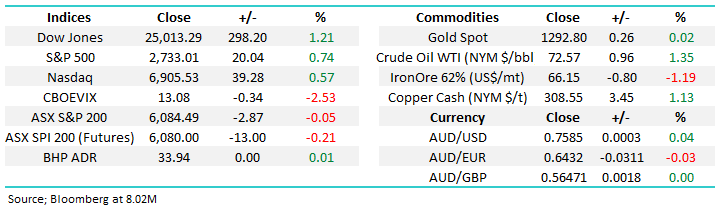

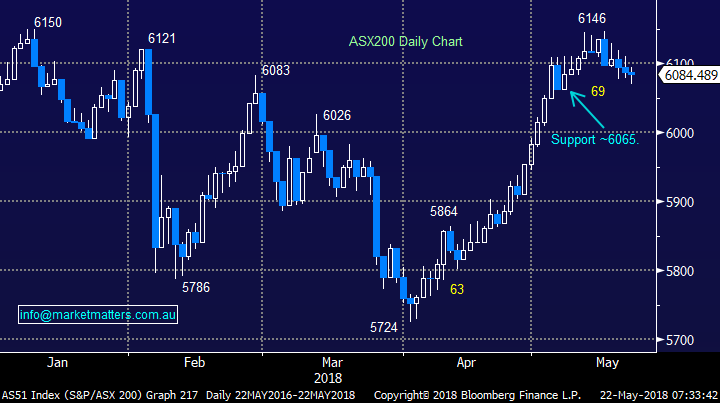

The ASX200 had another average session yesterday only slipping a few points lower, but ignoring the Dow futures that surged well over 200-points as they revelled in positive comments on US – China trade. Weakness is creeping into our market from a few different areas with iron ore catching our attention on Monday as the bulk commodity closed down -2.6% in China, dragging Fortescue (FMG) down 3.1% to its lowest level in over 2-weeks.

- Short-term we can easily see an extension of the current pullback towards ~6050, or another 0.6% lower for the ASX 200.

Overnight markets held onto their trade inspired gains with the Dow closing up almost 300-points, but the SPI futures are still targeting the ASX200 to open ~8-points lower. It feels like US stocks are playing catch up with other western indices as a number of European indices like ourselves ignored the US-China trade news and drifted into the red - remember the ASX200 is far more correlated to European stocks than the US.

- Medium term MM remains bullish targeting 6250 but the risk / reward is no longer compelling for the buyers.

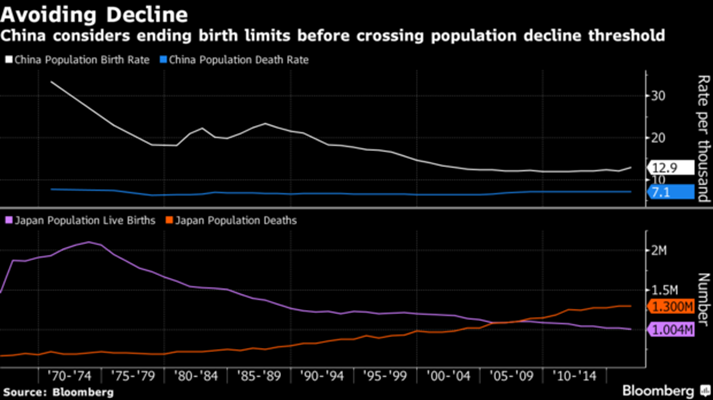

Today’s report is going to look at China who are said to be considering ending birth limits as soon as this year. I wrote 80% of this report late yesterday only to wake up and see Bloomberg leading with a similar topic, they must have read my mind! Fortunately they provided one informative chart I have used, and of course their article does not consider potential opportunities within the Australian stock market.

ASX200 Chart

What companies are set to benefit if / when China’s birth rate soars?

China is considering an imminent end to all birth limits as the country finds itself amazingly short of workers – the world’s second largest populations is ~1.4bn, already over 18% of the people on planet earth. The ramifications to the end of the 40-year old policy would potentially be huge as the government understandably wants to reduce the rate of its ageing population – we all know when China makes a decision it certainly follows through with actions, quickly and on a big scale!

Japan is usually regarded as the benchmark of an ageing population, a country where deaths have outnumbered births for more than a decade and sales of adult diapers is greater than those for babies – the economical strain to the “Land of the rising sun” is simply enormous.

The below chart shows that China is not yet experiencing a declining population but numbers suggest it may in the next decade without changes to its birth rate, a phenomenon that would certainly challenge the countries current economic miracle.

China & Japans population decline Chart

China’s 2-child policy is hard to comprehend for most of us, but it’s very real which can be illustrated by a country that now contains 30 million more men than women – some very clear humanitarian concerns at work as baby boys have been more desirable than girls for decades given their potential to earn $$ and support the family.

Worryingly for the Chinese government the birth rate actually fell over 3% last year undoing much of the work from previous policy relaxations. Simply President Xi Jinping needs to act fairly soon as the population is ageing fast which will create a huge burden on the economy moving forward, we believe it’s a matter of “when” they push the policy button with later in 2018 our best guess.

A baby boom in China of any magnitude should prove extremely lucrative for well positioned companies who cater to children’s needs in the world’s most populated country. Hence the question – “what local companies are well positioned to benefit from such a policy shift?” – one I reiterate that MM believes is inevitable.

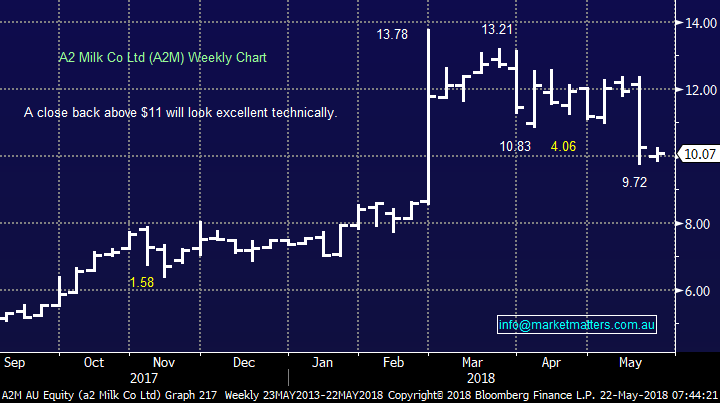

1 A2 Milk (A2M) $10.07

A2M is arguably the markets success story of recent years, even after their recent 29% correction it boasts a market cap. of over $7bn, larger than many household names like Seek (SEK), Flight Centre (FLT), Domino’s Pizza (DMP) and CSR Limited (CSR).

The shares of the NZ based business dived last week following their market update guiding that full year revenue would only increase by ~67% - a dream for almost every business but it was about 4% below analysts’ expectations and the stock had clearly been priced for “perfection”. The company has increased its marketing spend which surprised many analysts but we like the aggressive stance to capture market share early, especially as the population looks set to “pop” even higher and rivals like Nestle eye the profits being generated in the sector.

The business is not just the milk we see on the shelves in Woolworths (WOW), but a major player in the infant formula business, especially into China. Mos have probably read about the shelves being emptied in Australian supermarkets and the baby formula being shipped straight to China with a healthy mark-up for the initial purchaser – what a great indication of current demand.

MM likes A2M around the $10 area and expect a retest of $14 moving forward. However we do believe the almost vertical returns of previous years are behind us and a valuation of 40x earnings brings with it risks which were demonstrated last week – clearly any future bumps in the road are likely to be painful.

- We’re bullish A2M targeting $14, but a break back below $8 would concern us technically.

A2 Milk (A2M) Chart

2 Bellamy’s (BAL) $16.50

Bellamy’s organic infant formula appeals to the Chinese market especially because of the premium organic branding. The company currently has a market cap of ~1.9bn compared to $7bn for A2M, they have both certainly kicked major goals over the last 4-5 years, although BAL has had a few speed humps along the way.

BAL fell 15% last week following the relatively disappointing market update from A2M taking its correction to 28.5%, almost identical to that of A2M – they have been tracking each other like a 2-headed monster. Similar to A2M, we like BAL longer-term based on the likely demand from China, but similar to A2M any misses to market expectations will be dealt with harshly as the shares are currently trading on 38.5x earnings.

- We like BAL into current weakness but are unlikely to buy due to our A2M sector exposure.

Bellamy’s (BAL) Chart

3 Bubs Australia (BUB) 75c

Bubs Australia (BUB) produces organic baby food, goat milk formulas, cereals, and other nutritional products for children and has a comparatively small market cap of $290m. In April they signed a distribution agreement into the China market with QianJiaWanPu Co. Ltd. Importantly the Chinese firm is the fastest growing distributor of baby formula covering around 90% of all relevant stores in China.

China's goat milk infant formula segment was worth about $1 billion last year and it’s been quoted as currently growing at about 50% p.a. While “goat” is only 5% of the total infant formula market the growth and relatively lower competition bodes well for BUB. Goat’s milk is thought to be closer to ‘Mothers’ milk than more traditional cow’s milk and using demand in western counties as a guide, the trend has clearly caught on.

- MM likes BUB around 75c as a an aggressive play, but would leave “ammunition” to average around 60c in this volatile stock.

Bubs Australia (BUB) Chart

4 Wattle Health Australia (WHA) $1.71

WHA focuses on infant formula and dried dairy products and similar to BUB, has a market cap of $260m. Wattle Health Australia is another Australian player hoping to make its mark in China, but it’s very early days.

The company’s shares were in suspense for 6-weeks as they finalised a joint venture, the overall deal clearly did not go down well with the market where the shares were smashed almost 40% before recovering half of the losses.

We are concerned that WHA may have arrived late to the party and will find it extremely hard to gain traction against market heavyweights like A2M, BAL and Nestle.

- MM is currently neutral WHA.

Wattle Health Australia (WHA) Chart

Conclusion

1 MM likes A2M and BAL but are unlikely to add to our sector exposure.

2 We also like BUB for a more aggressive play into the “goat” milk sector where the competition is likely to be less fierce moving forward.

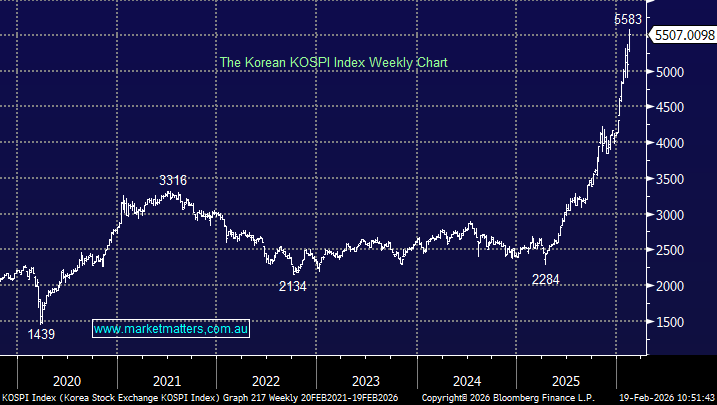

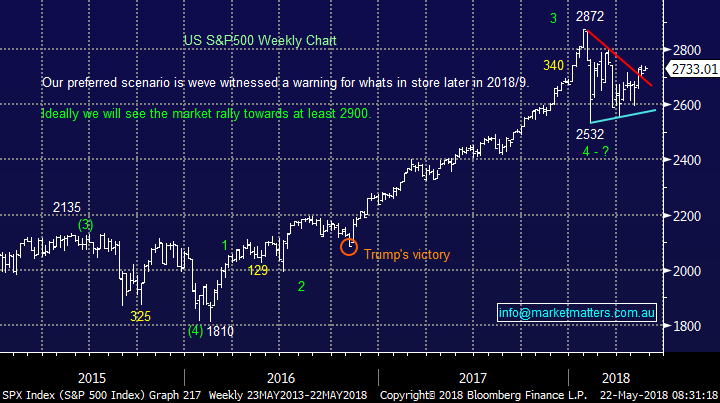

Overseas Indices

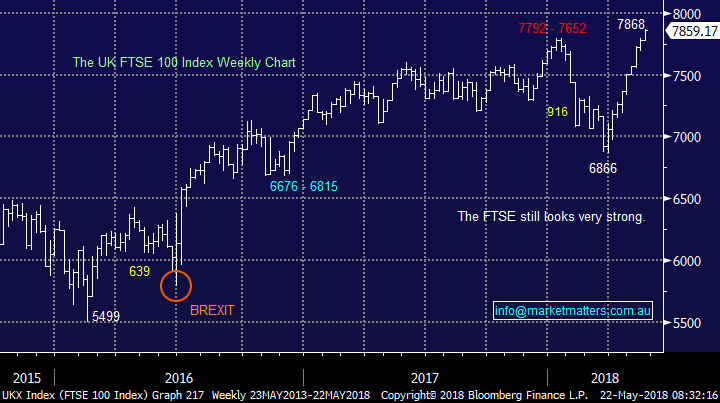

We remain bullish overseas indices, targeting fresh 2018 highs for many indices, but we are mindful that we in May and the UK FTSE has already reached MM’s new all-time high target.

US S&P500 Chart

UK FTSE Chart

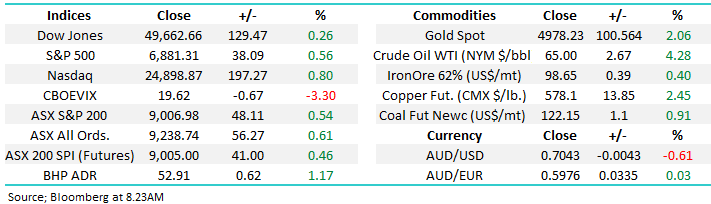

Overnight Market Matters Wrap

· US investors welcomed reports that threated China-US tariffs had been placed on hold, with the Industrial sector outperforming the broader market – Expect the likes of the earthmoving equipment such as Seven Group (SVW) to outperform the broader local market.

· On the commodities front, Crude Oil rallied towards US$72.57/bbl. while Iron Ore continues its recent descent, off over 1% overnight.

· The June SPI Futures is indicating the ASX 200 to open 8 points lower towards the 6075 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/05/2018. 8.31AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here