Buy now pay later stocks surge (TWE, PPS)

WHAT MATTERED TODAY

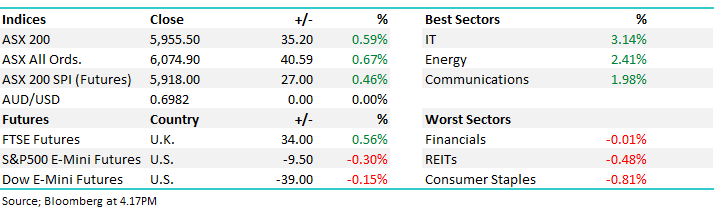

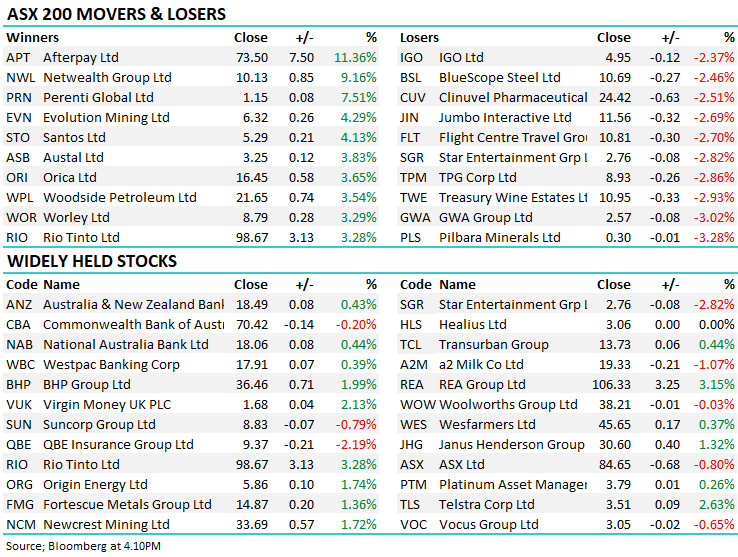

The Aussie market bounce back today after yesterday’s weakness with the market up +35pts led by some fairly spectacular gains in the buy now pay later space, two companies we’ve spoken about recently did well with Z1P rallying by more than 10% while Openpay (OPY) put on more than 20%, clearly a hot sector on the market today as Afterpay (APT) crushed through its raise price of $66 to close up 11% at $73.50. I had lunch today with an older broker who is retiring, and the conversation was around tech stocks, there remains so much scepticism in the space that it seems the only direction is up – in my view. Stay open minded here, the growth in the sector is clearly phenomenal.

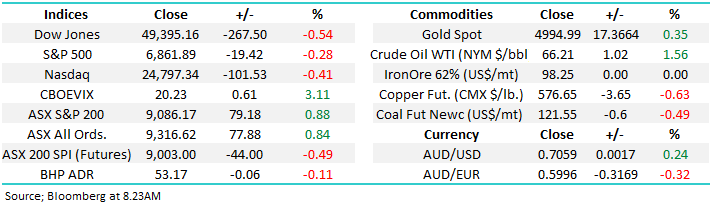

At a sector level today, IT stocks were strong followed closely by energy while the defensive names clearly lagged, Consumer Staples and REITs the obvious drags.

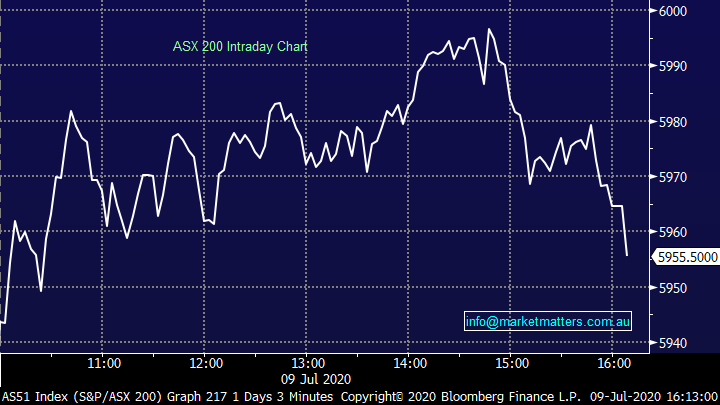

Overall, the ASX 200 added +35pts / +0.59% to close at 5955. Dow Futures are trading down -45pts / -0.18%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

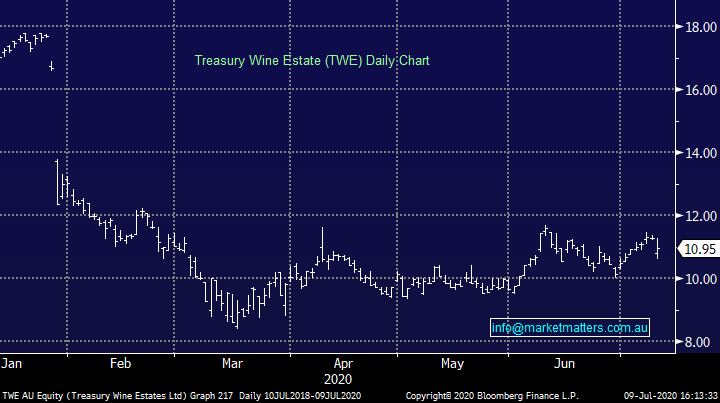

Treasury Wines (TWE) -2.93%: The wine company downgraded guidance this morning saying EBIT would be $530-$540m versus the $574m expected by the market which is a 6% downgrade to expectations, however there were a few offsets that meant the share price held up better. They have a new CEO so the downgrade was not unexpected plus they spoke more favourably about trends in China and the US, at least in terms of volume rather than price. We wrote about this in the weekend report and while todays update implied weakness near term, the actual trends seem to be turning for the better. Down but not out by any stretch.

Treasury Wines (TWE) Chart

Platforms: Praemium (PPS) launched a bid for rival platform Powerwrap (PWL) today, a deal that has been rumoured for some time. The offer of 7cps and 1 PPS per 2 PWL shares, representing more than a 50% premium to the last close price. Praemium already holds around 15% of PWL shares while the price represents just 1.4x EV/Sales valuation. The combined group will have FUA of over $27b with scale key for the independent platforms. Shares in both names were higher today, PPS up 22.97%, and PWL 65.71%. We use Praemium and while we’ve had our challenges in the past, its improving and the Powerwrap acquisition is a good one.

Praemium (PPS) Chart – I think this is a buy!

Netwealth (NWL) was also better today guiding EBTDA for FY20 to $58-62m, around in line with consensus at $61m. Importantly it saw inflows return after the tumultuous markets in March with FUA up 35% for the year to $31.5b. NWL jumped 9.16%.

BROKER MOVES:

· WiseTech Cut to Lighten at Ord Minnett; PT A$19.60

· Saracen Mineral Cut to Underperform at Macquarie; PT A$5.40

· Telstra Raised to Buy at HSBC; PT A$4.40

· Pacific Smiles Raised to Buy at Bell Potter; PT A$1.75

· Afterpay Raised to Overweight at Morgan Stanley; PT A$101

· Select Harvests Cut to Hold at Bell Potter; PT A$6.10

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.