BHP has reported and CBA goes ex-dividend.

By the end of the week well over 90% of the local market will have reported and it will be back to business as normal. Over coming days / weeks some healthy dividends will be returned to investors from our relatively high yielding Australian market, these include Wesfarmers last Monday and Suncorp yesterday, plus the biggest of all Commonwealth Bank which pays a very attractive $1.99 (fully franked) to the faithful today. As mentioned previously with our market paying out the equivalent to around 50-points in dividends this quarter it remains a big ask for the ASX200 to follow current overseas markets strength and surge over the 5800 area quickly but further gains do feel likely in 2017. Hence as we continue to say "Buy weakness and sell strength until further notice".

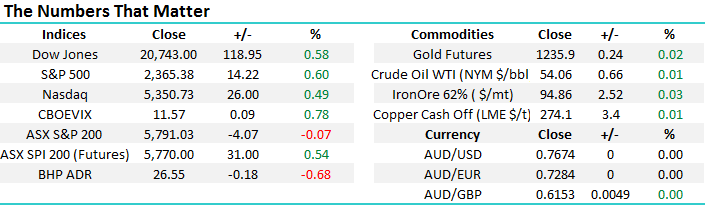

Overnight US stocks yet again made fresh all-time highs led by the recently out of favour "yield play" stocks, with the market predicting the Fed will not raise interest rates in March - currently priced at a 36% possibility. Our view remains intact that the US share market will continue to rally in step like fashion prior to forming a major top later in the year, while a 4-5% correction is looming on the horizon how far the current positive momentum will take the market first is hard to forecast - the best risk / reward will come from buying this pullback when it unfolds.

Today we will look at BHP's result that came in yesterday evening plus Altium's (ALU) yesterday. Also, we are going to consider a potential, switch after CBA trades ex-dividend today.

US S&P500 Weekly Chart

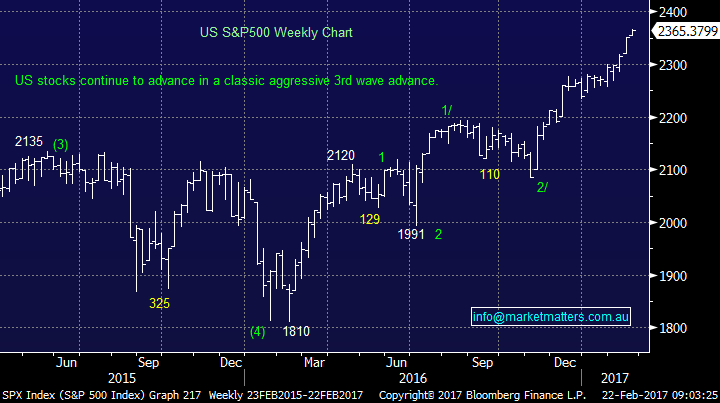

BHP Billiton (BHP) $26.73

After our market closed yesterday BHP presented the market with some excellent results but this would be expected after we have witnessed rallies in commodities like iron ore and crude oil. Some quick take outs on the result:

- BHP delivered a good set of numbers beating market expectations across nearly all areas, headlining with Net Profit after Tax of $3.2bn.

- BHP announced a 40c fully franked dividend, a payout ratio of ~65% and above the markets expectations by around 18%

- Their comments around "additional dividends and buybacks" implies strongly to us that a buyback (s) are not far away.

However moving onto the market reaction which has been initially very muted - overnight the Dow is up 118-points, both iron ore and crude oil are up but BHP is set to open down ~20c. We believe the rally in BHP that has seen the stock essentially double since its panic lows in 2016 has further to run targeting at least $30 but we are currently 50-50 whether the stock can trade under $25 first.

Hence we are looking to buy BHP but it's all about entry and over coming days we will observe closely.

BHP Billiton (BHP) Weekly Chart

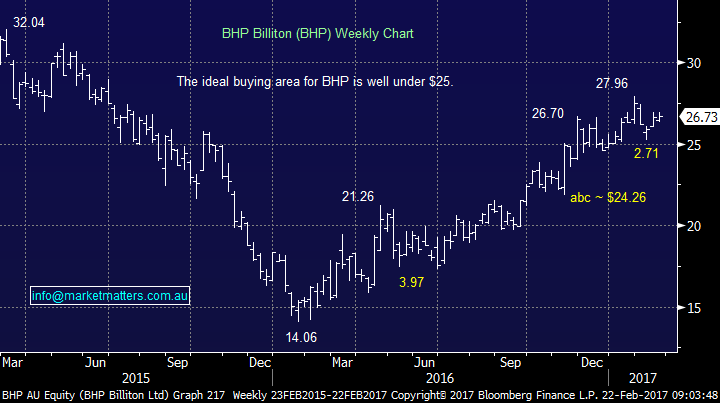

"Which Bank" to hold from here?

The MM portfolio currently holds 8.5% in CBA which trades ex-dividend today, 5% in ANZ Bank and 4% in Macquarie (MQG) - the question we ask ourselves today is this the correct mix after CBA trades ex-dividend today? Firstly let's consider some numbers / thoughts around both ANZ and CBA:

ANZ Bank:

(1) Technically targets the $40 area if the recent bull advance for banks continues i.e. ~30% higher.

(2) Trades on an Est. P/E of 12.8x for 2017.

(3) Yields 7.5% grossed up, next dividend in May.

Commonwealth Bank:

(1) Technically targets the $100 area if the current advance for banks continues i.e. 18% higher.

(2) Trades on an Est. P/E of 15.25x for 2017.

(3) Yields 7% grossed up. It pays $1.99 fully franked today.

As can be seen from the comparison graph the two banks are very correlated with ANZ having slightly more exaggerated swings.

When we take the above 3 simple points into account we are considering switching part of our CBA holding that was purchased at much lower levels into ANZ - if investors only hold CBA from our recent date of purchase they will lose franking credits if the stock is sold today. Please check this carefully and consult a financial advisor if possible.

We will switch ~35% of our CBA holding into ANZ if banks open in-line with yesterday's closing prices, obviously taking CBA's dividend into account, hence we will be holding 5.5% of our portfolio in CBA and 8% in ANZ.

** Watch for trading alert**

CBA v ANZ Monthly Chart

Altium (ALU) $8.01

Yesterday ALU reported and the stock dropped sharply on the open by well over 10%, however it recovered pretty quickly to be down -4.98% by the end of the day to $8.01. There were no surprises in the result, the clear issue was around the level of growth in a business that is priced on 30x - there are clearly big expectations built into this stock. The underlying result was pretty much in line with expectations, and there was no surprise in terms of guidance, however it may have been more subdued than the market had priced.

The rejection from the sub $7.50 is very encouraging for the stock and we would not be surprised to see ~8% upside from current levels. We will not increase our holding given liquidity but remain comfortable with our 4% portfolio exposure to the stock. We own ALU from around $7.95

Altium (ALU) Daily Chart

Conclusion

Three simple conclusions for today:

1. We are looking to buy BHP but optimum entry is not yet clear.

2. We are currently comfortable with our ALU holding.

3. We are looking to switch ~35% of our CBA holding into ANZ, taking our portfolio weighting to 8% ANZ and 5.5% CBA - a slight "tweak".

Vocus Communications (VOC) is just out with their 1H result and they have reconfirmed guidance for earnings of $430-$450m for the full year. Other metrics were a tad weak, but that shouldn’t be a major issue. Focus would also on the 1st/2nd half skew for earnings (whether or not they are relying too much on the second half) and this looks OK. We’ll put a note out on VOC after the company briefing at 9.30am.

Overnight Market Matters Wrap

- Another record high was reached intraday in the US indices overnight, with both the S&P 500 and Dow settling up ~0.60%.

- Despite Iron Ore being higher overnight, BHP is expected to open lower this morning, with the US equivalent down 0.7% from Australia’s previous close.

- Major stocks trading ex-dividend à AMP ($0.14) & CBA ($1.99). Companies reporting today à Blackmores (BKL), Woolworths (WOW), Fortescue Metals (FMG) & Westfield (WFD) & numerous others

- The March SPI Futures is indicating the ASX 200 to open 15 points higher this morning, testing the 5,810 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here