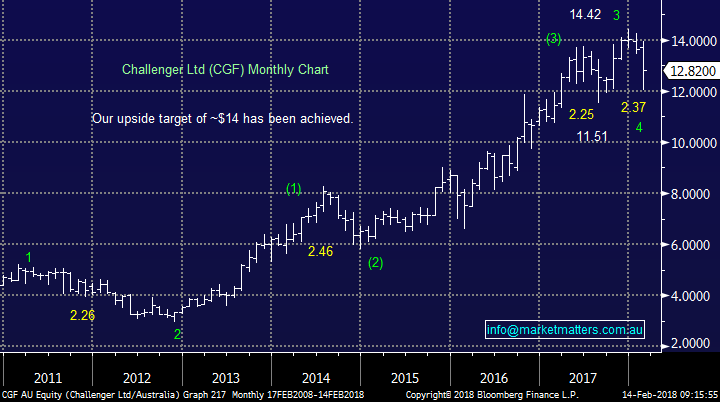

Beware of crowded trades (RIO, ORE, CGF, COH)

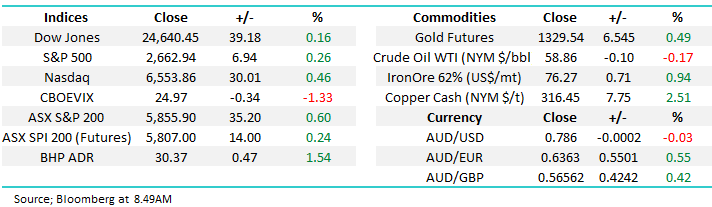

A degree of stability has returned to global stocks over the last few days with the Dow trading ~1300-points above last week’s low and the ASX200 set to open this morning almost 100-points above its equivalent milestone. However, the recovery is likely to be significantly influenced by tonight’s inflation data in the US, a number that will guide the market to how fast the Fed are likely to raise interest rates – our “Gut Feel” is the current relative calm will continue.

The resources look very good this morning with BHP set to open around $30.40, up over 1.5% but remember CBA is ex-dividend $2 which will take a few points off an otherwise likely positive start by the ASX200 early on in the session.

ASX200 Weekly Chart

Arguably there were 3 very crowded trades into the recent volatility and 2 have already been smacked!

1. Short volatility – whack, we’ve just witnessed the largest 1-day spike in history with the VIX soaring from sub 9 in January to over 50 in early February.

2. Long US Tech stocks – whack, it seemed everyone wanted to own the “FANGS” but suddenly the NASDAQ corrected over 12% in a couple of weeks.

3. Short the $US Dollar – so far so good but we believe this will crack relatively soon.

There has been a lot written in a short space of time around the recent aggressive correction in stocks but at M we believe the below 3-points cover most of the reasoning behind the short, sharp plunge:

1. Points 1 & 2 above unwound very quickly with the market net short volatility and net long stocks leaving no room to sell / buy the panic moves as investors and “hot money” were already full to the gills.

2. The usual support for US stocks from the huge stock buybacks that have regularly supported the market since the GFC were not present simply because many companies are in reporting season prohibiting the purchase of stock. Under SEC rules, companies can't buy back any of their shares during the roughly five-week period which ends two days after the company's results are released.

3. A tick up in US Wages Growth suddenly got investors scarred about inflation / rising interest rates – amazing to us as this has been bubbling away for a while – and importantly, wages growth is unlikely to filter directly into rising inflation in such a short period of time (it will – but unlikely yet)

Last night I found 4 major local stocks that look well placed to make / test fresh highs for 2018 in coming months – I can assure you my life is not that boring but these markets need full attention! Picking the market is like doing a jigsaw but you have to make an informed decision / opinion before all the pieces are in place or it’s too late– at this stage MM remains’ bullish short-term after buying last week’s panic.

Today we will look at 6 markets that leave us currently comfortable with our view including one very crowded trade.

1 Global Indices

MM has been targeting a “warning correction” for stocks in early 2018 prior to one final high to complete this 9-year bull market. So far so good and we will be watching the likes of the Dow and German DAX for clues to when it’s time to get off the stock market train and buy some negative facing ETF’s.

US Dow Jones Weekly Chart

2 The $US Dollar

We have been discussing the $US at nauseam since late 2017 but its inverse correlation to stocks is as good as it gets! We are targeting one final low, probably under 88, around 3% lower, for the $US before we are looking for a major trend reversal.

We will be moving to cash aggressively and / or putting in more bearish skews across the portfolio if / when this move unfolds for the $US.

$US Index Daily Chart

3 RIO Tinto (RIO) $78.87

We bought RIO into the recent panic selling just under $75 – the position is currently showing a healthy 5.3% paper profit.

The stock looks on track for our ~$84 target area where we will have no hesitation taking profit.

RIO Tinto (RIO) Weekly Chart

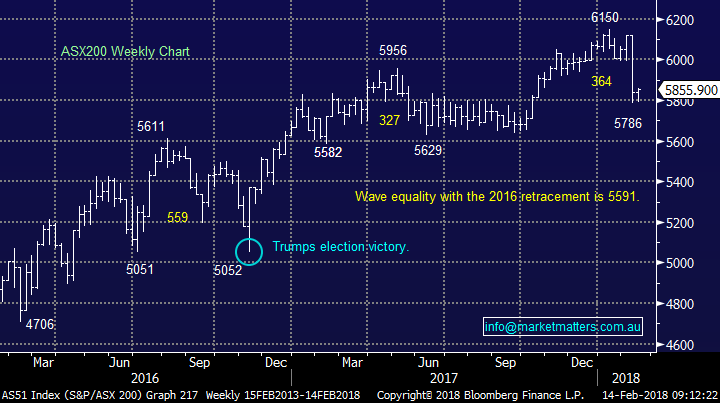

4 Orocobre (ORE) $6.80

ORE has been one of our favourite stocks this year and we would have bought back into the stock following its spike down towards $6, if it was not for our holding in Kidman Resources (KDR) - just because we like a story i.e. lithium does not mean we will put all our eggs in one basket.

ORE looks on track to test the $8 area which hopefully will also see KDR get close to the $2.30-40 region.

Orocobre (ORE) Monthly Chart

5 Cochlear (COH) $171.74

Cochlear recovered extremely well yesterday after early weakness following its half year results .

COH now looks nicely on track to make fresh recent highs up towards $190.

Cochlear (COH) Weekly Chart

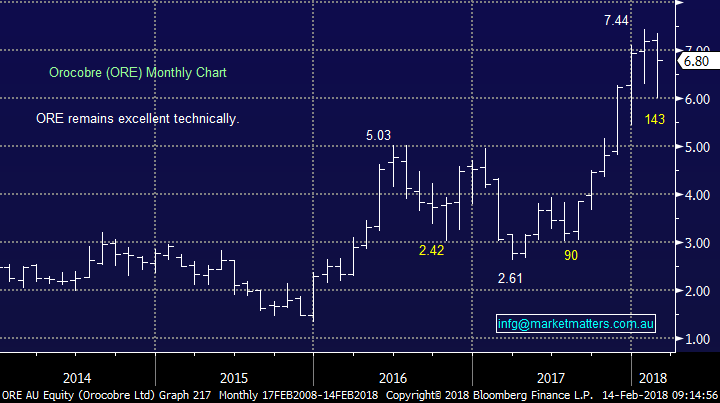

6 Challenger (CGF) $12.82

Similarly, to Cochlear, CGF sold off pretty hard after its company report only to recover basically all of its losses. The result was good, simply the market was long this stock and consensus was already at the top of their guided range.

Yesterday afternoon I suggested $11.50 as a downside technical target, however on reflection overnight and looking at coverage this am, we now think CGF looks very well placed to challenge the $14 area, minimum,

Challenger (CGF) Monthly Chart

Conclusion (s)

No major change, at this stage we are comfortable with our short-term bullish call targeting new all-time highs from a number of global indices in the next few months, encouragingly a number of local stocks have at this stage turned nicely bullish.

Global Indices

US Stocks

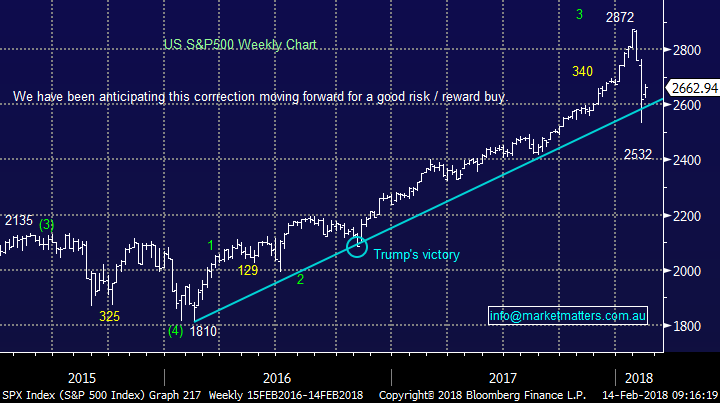

Our target area for the recent gut-wrenching weakness in US stocks was reached and to-date has been rejected. Assuming this week the S&P500 can trade around current levels in a calmer fashion a test of all-time highs looks a strong possibility.

US S&P500 Weekly Chart

European Stocks

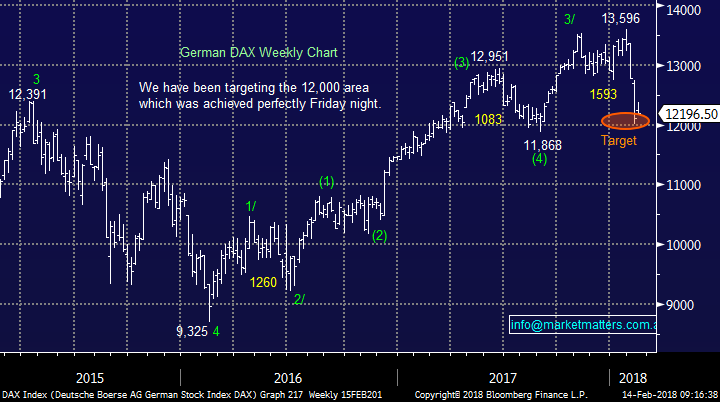

No major change with our call for the German DAX to correct back towards the 12,000-area for excellent risk/reward buying looking good at present.

German DAX Weekly Chart

Asian Stocks

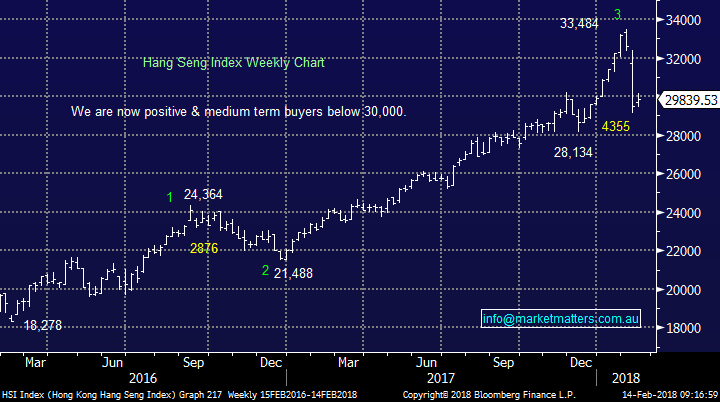

Similarly, to western global indices the Hang Seng has corrected over 10% and is looking good from a risk / reward perspective under 30,000.

Hang Seng Weekly Chart

Overnight Market Matters Wrap

· A less volatile session in the US equity markets overnight, witnessing a tighter range, ahead of the US CPI number for January tonight which is expected to be around 1.9% annualised. All 3 key indices heading into the close slightly firmer, with the NASDAQ 100 leading the way, up 0.46% above the 6550 region again.

· Commodities were also stronger, with copper in particular leading the recovery up 2.5% at us$3.16/lb, iron ore +1.5% at over us$77/t., while oil arrested its recent decline firming about 0.5% with the benchmark Brent price just under US$63/bbl. US ten year bonds were slightly improved at 2.83%.

· BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 1.56% from Australia’s previous close, towards $30.37.

· The March SPI Futures indicating the ASX 200 to open with little change this morning, above the 5850 region with CBA trading ex-dividend today.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/02/2018. 8.49AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here