Bank of Queensland sets the bar for the banks. (CBA, BOQ)

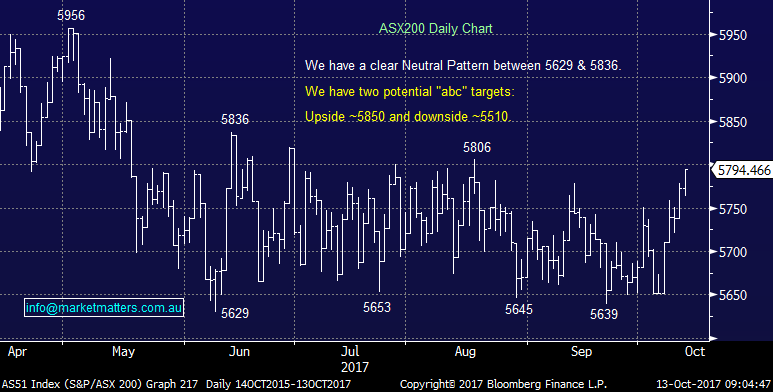

What a difference a few days makes, only 5-days ago we were testing the 5600-major support area and yesterday we knocked back on the door of the 5800-major resistance area as the ASX200 maintains its tight 21-week trading range. In the absence of the recent aggressive SPI futures selling, fund managers appear to be scouring the landscape for any stocks that are reasonably cheap – certainly not too many bargains out there at these levels!

As we discussed earlier in the week the broad market is feeling strong which is generally a very healthy sign for a stock market. The internals of yesterday’s 0.4% rally were excellent with all sectors of the ASX200 closing in the black, even as iron ore stocks continued with their recent slump e.g. BHP -1.6%, Fortescue -1.8% and RIO -1.4%.

As we’ve touched on recently MM would love to go “limit long” around the 5500-area but its feeling more and more like we will need some major Trump style bad news to give us this 5% pull back. Conversely, we are becoming increasingly confident that the ASX200 will break over 6000 in 2017 / early 2018.

ASX200 Daily Chart

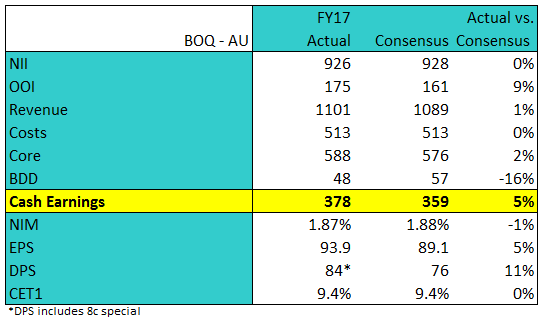

Bank of Queensland (BOQ) Yesterday led the reporting season for the Australian market’s most important sector and it was a solid start with the stock gaining 1.2%, after at one stage rallying ~3.5%. Overall their FY17 result surprised on the upside, beating consensus by around 5% on earnings per share, driven by low bad debts.

The long-term frustrated scare mongers in the press forecasting doom and gloom in our property market are finally getting a glimmer of hope with a recent report showing some parts of Sydney have experienced a 6% fall, potentially ending its 5-year boom. However, this is just a blip on the radar and it’s a sharp rise in interest rates that would likely be required to cause the large falls that may lead to an increase in bad debts for our banks – this feels miles away economically and importantly our banks benefit from any orderly rise in interest rates – and that is our expectation.

We read a very interesting article yesterday in Livewire by Charlie Aitken who I’ll get on for another video before Christmas (last one can be found here) , its focus was the future efficiency improvements for banks from technology. The piece titled “Can banks become tech stocks” made some fascinating points around digital transformation within Europe e.g.

1. ING has 8 million customers in Germany and zero branches, think of the cost savings!

2. In Spain ING covers 80% of the population with only 28 branches.

3. Local Spanish bank BBVA saw mobile customers rise over 40% to 14.5 million in just 6-months.

Obviously, there are 2-sides to the coin with easier potential competition to banks from an increasingly tech savvy world but if our banks can get ahead of the curve and leverage their existing customer base it’s up to potential disruptors to do things better and cheaper to dislodge what’s clearly a very sticky clientele - perhaps our long-term target for CBA over $100 is not madness like some feel!

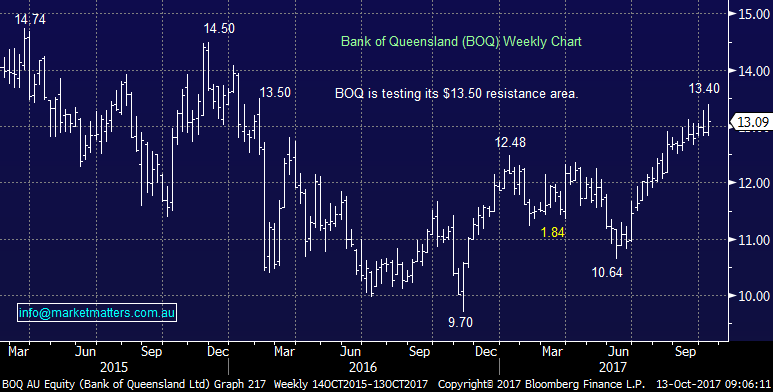

Coming back to BOQ after a good result we remain comfortable with our 5% holding in our Growth Portfolio and look forward to our 46c fully franked dividend with the stock going ex-dividend on the 2nd November, which includes a 8c special dividend. Ignoring the special dividend BOQ is paying a healthy 5.81% fully franked yield however after an uninterrupted rally from around $11 we can see the stock consolidating in this $13 region for a while.

Bank of Queensland (BOQ) Weekly Chart

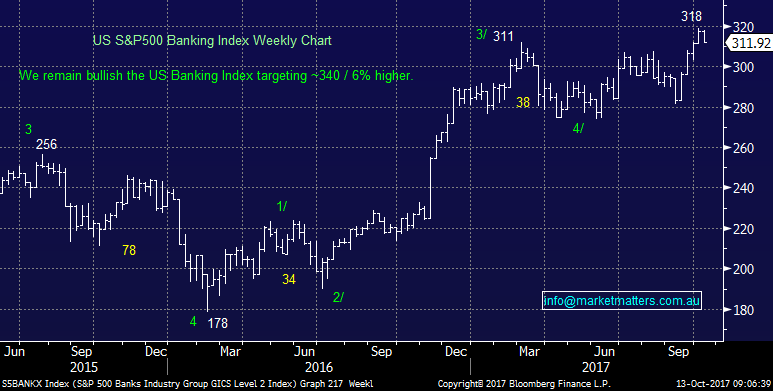

However, we also want to add a word of caution from the US banking sector which has made fresh decade highs this month. While we are still targeting ~6% higher prices we also see a 10% correction not too far away. This needs to be balanced with our seasonally strong period for Australian banks as investors get long ahead of the November dividend bonanza.

US S&P500 Banking Index Weekly Chart

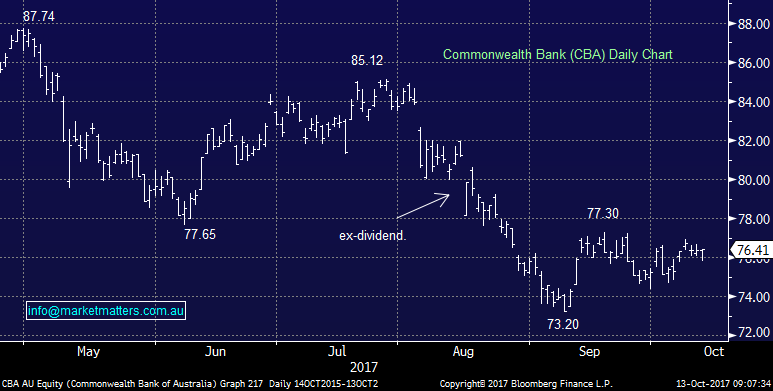

Moving onto CBA the underperformer of the last month e.g. NAB is up +4.4% while CBA is down -0.2%. If this continues as investors hunt for short-term dividends we can see ourselves potentially switching from say a Westpac or NAB, probably in November, into CBA whose next dividend is in 2018.

Commonwealth Bank (CBA) Daily Chart

A Portfolio sale that is close at hand.

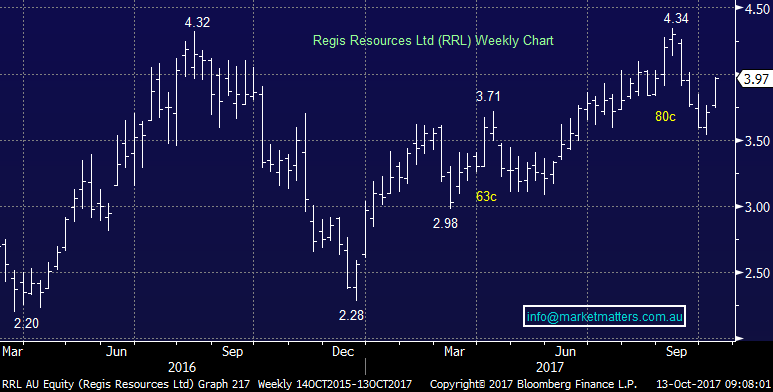

We purchased Regis Resources (RRL) for our MM Growth Portfolio only 9-days ago at $3.66 as a short-term investment targeting a ~10% rally over $4. The stock closed strongly yesterday at $3.97. We intend to stick to our plan and will take profit on RRL if it rallies over $4 in the coming few days.

Regis Resources (RRL) Weekly Chart

Global Indices

US Stocks

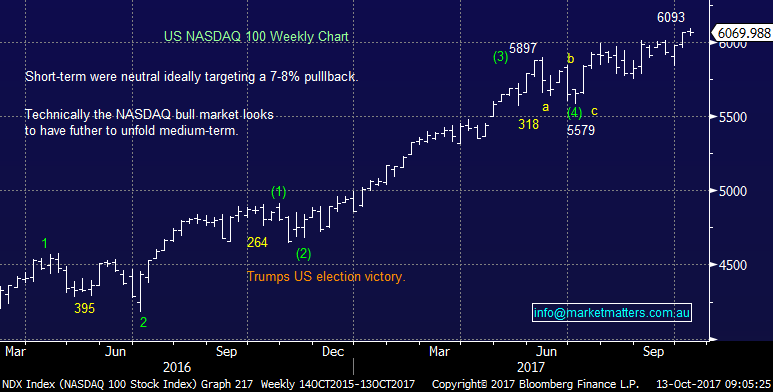

US equities were marginally lower last night, while there are definitely no sell signals emerging we would not advocate chasing stocks at current levels.

Overall there is no change to our short-term outlook for US stocks, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US NASDAQ Weekly Chart

European Markets

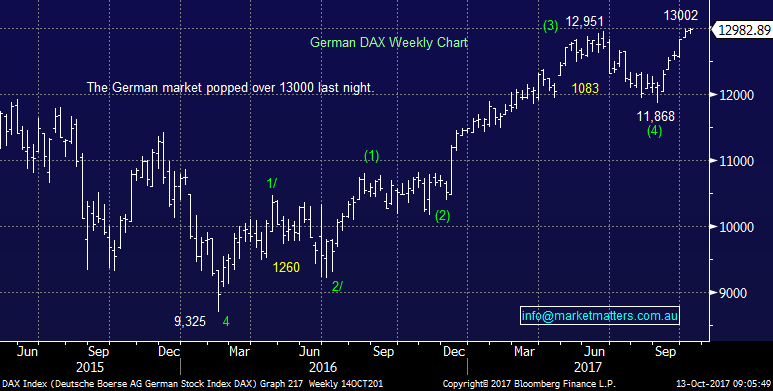

No change, the German DAX made fresh 2017 last night but we can see this move failing and a decent correction again unfolding, potentially back under the psychological 12,000-area.

However overall on balance we have to remain neutral just for now.

German DAX Weekly Chart

Conclusion (s)

No major change, remain flexible and be prepared to “tweak” portfolios when appropriate and this may well become one of the most exciting periods from investing we’ve ever witnessed.

We are comfortable with our overweight bank position at present but are definitely not “married” to the view.

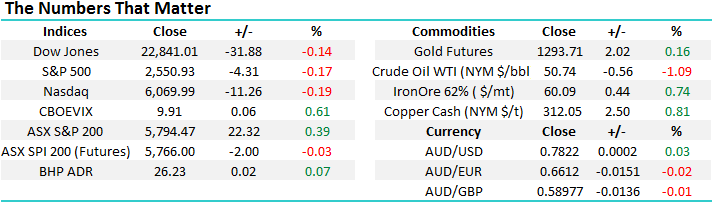

Overnight Market Matters Wrap

· The US equity markets closed marginally lower as the third quarter earnings season started with a lackluster result from 3 of the top US banks - Citigroup, JP Morgan and Chase.

· Oil prices also slid following a report by the IEA suggesting a global glut in stockpiles will persist into 2018 as US shale production counters continuing OPEC cuts.

· Metal prices however firmed, with iron ore back above us$60/t and copper continuing its recent rally to US$3.12/lb.

· Other global markets were more promising than Wall St with the German DAX index hitting a record 13,000 overnight and Japan's Nikkei index at near 2 decade highs of 21,000. Local futures are pointing to a flat opening while the A$ has rallied back above US78c.

· The December SPI Futures is indicating the ASX 200 to open 10 points lower, towards the 5785 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here