Assessing the Trump damage

Donald Trump's immigration actions over the weekend appear at least in the short-term to have put the brakes on US stocks as the Dow plunged over 200-points at one stage in its overnight session. The market has been totally in the "glass half full" camp since his election victory last November but we feel the growth euphoria is ready to evaporate as concerns are likely to grow around potential trade wars.

The new US President, unlike many politicians, is simply implementing his election promises but these also included huge tariffs to be levied against China. If we see the outbreak of a global trade war the world's economy could easily slip back into the recession it is struggling to leave behind after the GFC. We now believe this potential outcome will be enough to see US stocks correct ~4%.

US Dow Jones Daily Chart

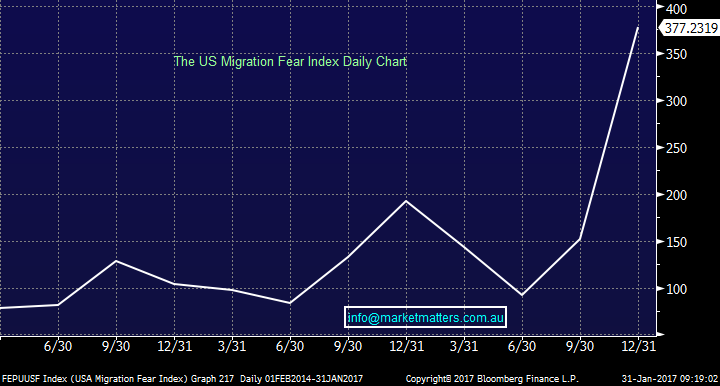

One tangible way of measuring the effect that Donald Trump is having on people is via the "Migration Fear Index" which has hit a record high - this index basically counts certain words in news stories around migration / immigration. These worries confirms to us that this year will be a choppy one at best for equities with emotional swings extremely prevalent. That sort of trade is very typical of a market top – emotional swings, choppy price action and a very convenient reason to justify it!

The US Migration Fear Index Daily Chart

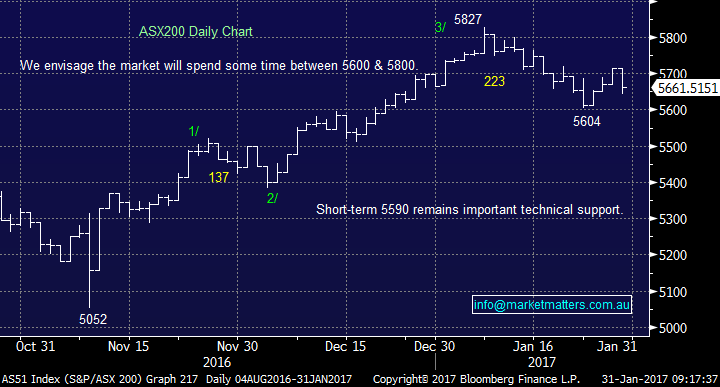

While the local market held the 5600 support last week our preferred scenario after both yesterday’s weakness and our view for US stocks is we are likely to see a test under this level. Assuming the market does not accelerate below 5600 we will maintain our "buy weakness, sell strength" mantra.

ASX200 Daily Chart

Yesterday we unfortunately saw another local stock trading on a high p/e smashed when its earnings numbers disappointed - Aconex (ACX) closed down a massive 44%. As we mentioned in yesterday afternoons report we are giving ACX a wide berth but it does illustrate perfectly that old fashioned valuations should not be ignored because the market can, and often does, re- focus on the them very quickly. The concept of having a ‘margin of safety’ in stocks is important as left field events regularly crop up. Who would have thought that ACX would be impacted by BREXIT & Trump, but they were and when growth fails to materialise in a stock on 84 times earnings, the outcome is very harsh.

Another important point of note is that local stocks that have been hit hard due to excessively optimistic valuations are not recovering quickly following a downgrade hence investors can and should be patient.

Simple valuation comparisons is one of the reasons we like currently out of favour Henderson (HGG), we are looking to add to our position in HGG under $3.60.

Aconex Ltd (ACX) Daily Chart

We continue to want to buy pullbacks in the resource sector with the belief that the sector is likely to see further gains in 2017 but we are being fussy on entry after the strong gains since 2016. Our preferred stocks are currently a touch boring but its where we see the best risk reward - RIO, BHP and OZ Minerals.

Summary

We remain sellers of strength and buyers of weakness which is currently unfolding nicely as anticipated.

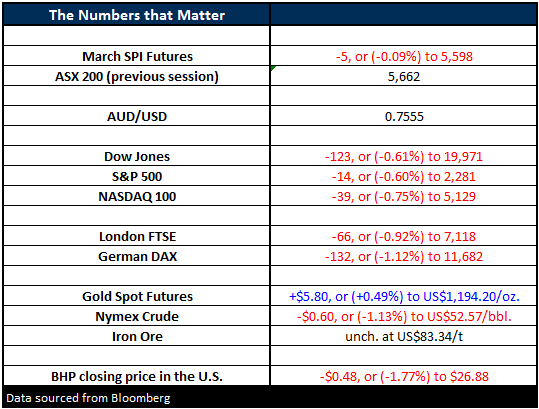

Overnight Market Matters Wrap

- Worst equity market drop since the election. DJIA loses 0.8%, S&P 500 down 0.86% and the NASDAQ off by 1%.

- All S&P sectors down with Energy the worst at minus 2.2% and Materials off by 1.25%. Consumer Staples the best at down 0.1%.

- Technology stocks weak on immigration concerns with Alphabet losing 2.3% and Facebook 1.2%.

- The ASX 200 is expected to continue the current weakness and open towards the 5,,650 level as indicated by the March SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here