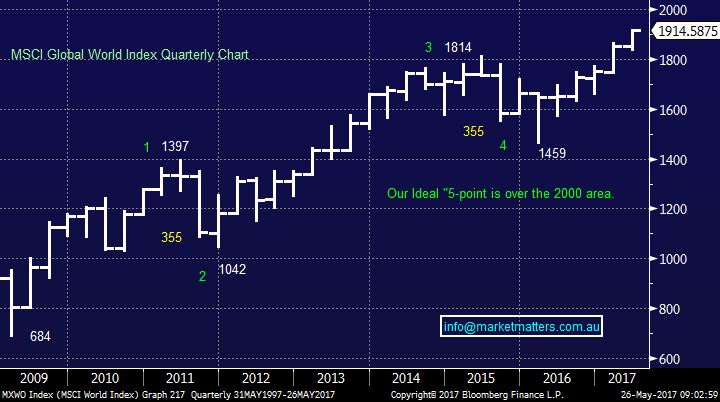

Asian Stocks Surge even after Moody’s Downgrade China

Yesterday the ASX200 rallied strongly after an early sell-off, when fund managers appeared to sell stocks to help fund their allocations of the ~$600m sell down of BT Investment. The solid recovery felt assisted by fresh all-time highs in the US and further strong gains in Asia, led by China which rallied +1.43% - government intervention perhaps after the Moody’s action? Slowly but surely the local market is recovering its early May losses and it now sits down only -2.3% for May while over the same period the US S&P500 is up +0.8%, the German DAX +1.5%, Japan’s Nikkei +3.2% and even the NZ market is +0.6%.

Global equities clearly remain very buoyant, but we are sticking to our belief that the bull market which has seen the broad US stock market more than triple in 8-years, is slowly reaching maturity. After many years of asset appreciation with equities and property at the forefront some interesting cracks are slowly, and we stress slowly, emerging in the slightly more obscure landscape:

1. The sale of Italian sports cars has stagnated at best with the sell through rate down 5% – even a Ferrari owned by Donald Trump recently failed to sell at auction.

2. The fine wine index fell 0.5% in April following 16 straight months of gains.

3. The cost of renting an apartment in Manhattan with a doorman has actually now fallen for 7 consecutive months, property can fall!

4. The price of luxury rentals near Donald Trump in NY fell close to 7% over 4 months from December 2016.

5. Art sales tumbled 14% last year dragging the luxury investment index to its weakest performance since 2009, just when the equity bull market commenced.

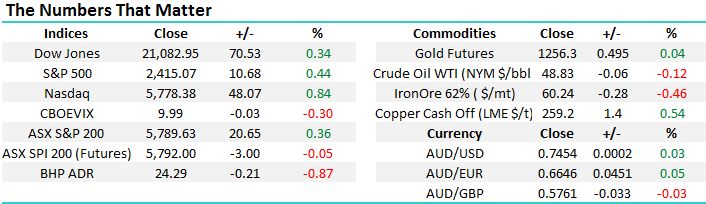

On an index level, we will persist with our view that the local market is suffering its “sell in May and go away” correction with a close over 5830 required by the ASX200 to switch us back to a neutral stance i.e. now only 0.7% higher. Perhaps this year the normal Australian market weakness over May-June will only materialise in the form of significant underperformance compared to its global peers, as we always say - remain open-minded.

Importantly at this stage, we still believe any weakness over this May-June period is an opportunity to buy, not panic sell.

ASX200 Weekly Chart

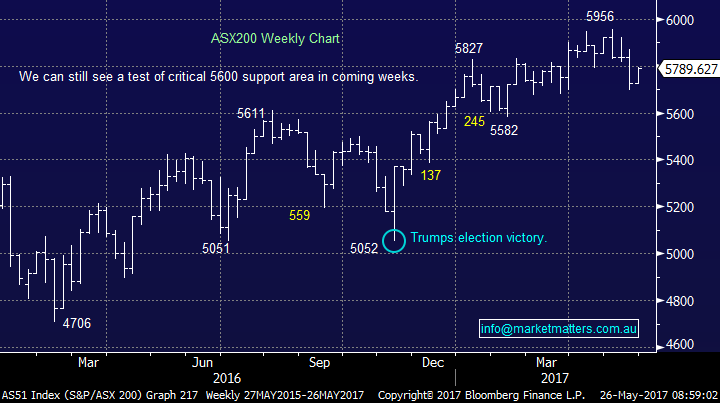

US markets rallied yet again last night with the S&P500 closing up 0.34% at another all-time high. We remain short-term cautious / bearish, but very aware of the strength of this underlying bull market, the path of least resistance clearly remains up. Traders who are looking to sell this current advance are likely to now use a close below 2400 as a trigger for entry i.e. 0.6% below last night’s close.

US S&P500 Weekly Chart

In the short-term the Dow remains bullish, targeting the 21,500 area / 2% higher. Considering the poor market news it has shrugged off recently, this has now become our favoured scenario into June before a likely decent pullback.

US Dow Jones Daily Chart

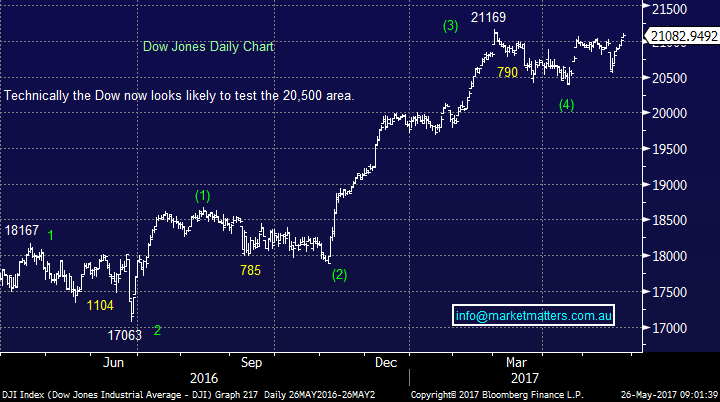

The global world equity market continues to follow our forecasted path with our initial psychological 2000 target area now less than 5% away. At MM we like to follow the charts which are clear to us and ignore those which resemble a spider walking across the page after first swimming in black ink, technically we like the long-term Global World Index for 2 reasons:

1. The Index had 2 perfectly symmetrical pullbacks of 355-points since it commenced the current bullish advance in March 2009.

2. The Elliott wave count is almost perfect targeting a significant high in the coming year. The retracement target is under 1500 i.e. +20% lower.

Ideally in the short-term we will eventually see a ~90-points / 5% correction which should present a good buying opportunity as this impressive bull market slowly matures like a good red wine.

MSCI Global World Index Quarterly Chart

As we mentioned in today’s title Asian indices are enjoying some strong gains with the Japanese Nikkei remaining firmly on track for our target ~22,000, or 10% higher. Asian markets, similar to the Emerging Markets Index, have a strong correlation to our resources sector where we currently have a historically high exposure within the MM portfolio. A quick snapshot on our holdings and current view:

1. BHP Billiton (BHP) $24.50 – BHP has bounced nicely over recent weeks but not with the same momentum of our other 2 holdings, probably due to its oil exposure. We remain bullish but think the stock may struggle over $25.50 short-term.

2. OZ Minerals (OZL) $7.32 – OZL has been the volatile part of our holdings which in hindsight we entered too early but finally its rallied 16% in the last few weeks. We remain bullish.

3. RIO Tinto (RIO) $64.80 – RIO has enjoyed a great 14% rally from its May lows, we remain bullish targeting prices over $70 overall however some consolidation at current levels would not surprise.

Japanese Nikkei Monthly Chart

Conclusion (s)

We remain pretty quiet at present looking to buy weakness and sell strength – sounds almost textbook stuff!

We remain comfortable with our resources exposure.

Overnight Market Matters Wrap

· The US markets set record highs again overnight - ahead of a long weekend - following stronger than expected sales numbers from key retailers, which boosted confidence that consumer spending will help bolster the broader economy.

· The S&P 500 and the tech heavy Nasdaq 100 both set new records at 2415 and 6205 respectively. The Dow was within a whisker of its March high, just hovering under 21,100.

· Oil prices ran out of steam, slumping 5% with the key US benchmark, WTI, back below US$50 again, after the OPEC meeting decision met expectations to extend cuts until March 2018 but did not increase the cuts as some hoped, in the face of rising US production.

· The June SPI Futures is indicating the ASX 200 to open with little change towards the 5,790 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here