Asia almost panics but Europe / America remain calm (CGF, A2M, DMP)

The ASX200 gave back almost all of Tuesdays gains yesterday, slipping over 1%, courtesy of the news that Donald Trump’s economic advisor Gary Cohn had resigned following the tariff debate. Concerns grew rapidly during our time zone that a global trade war was looming on the horizon with both the Japanese and Hong Kong’s indices also falling over -1%. Market concerns about a global trade war are currently turning on and off like a tap!

Overnight US markets have recovered very well from an initial panic sell off with the broad S&P500 down only -0.15% at 7.30am AEST. Comments from the US Treasury Secretary were far more measured and basically sensible than what many players fear / expect from President Trump e.g. “Our objective is not to create a trade war. Our objective is to make sure U.S. companies and workers are treated fairly.” We have already seen over last 24-hours major US partners Canada and Mexico being named as exempt from the steel and aluminium tariffs, essentially we all know this is about China and he’s got a point there - it’s currently not a level playing field between these 2 largest global economic powerhouses, or anyone else for that matter.

The ASX200 is set to open up ~25-points today, regaining around half of yesterday’s losses on the open – note BHP trades ex-dividend ~73c fully franked this morning so expect the big Australian to be down at least this morning.

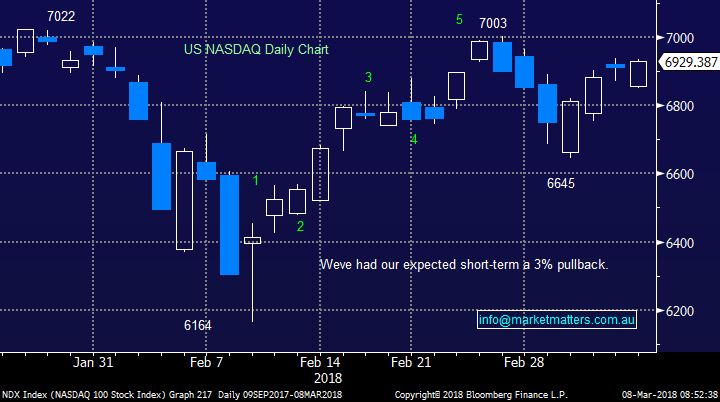

MM remains bullish the ASX200 through March and April targeting the 6250 area, or around 6% higher – the underlying feeling is equities still want to rally and they are regularly doing a pretty good job of shaking off some potentially very bad news. Overnight the high flying NASDAQ, which at MM we believe usually leads global indices, is now only 1.3% below its all-time high after rallying +0.24% in the face of adversity last night, remember one of our favourite quotes:

- “A market that rallies in the face of bad news is a very strong market” – Market Matters.

NB Also, the US NASDAQ made fresh highs for March last night, a statistically very bullish indicator.

Today’s report is going to focus on 3 stocks that have dropped into “interesting areas” but should we restrain ourselves due to cash levels / our medium-term outlook for stocks?

ASX200 Chart

US NASDAQ Chart

1 Challenger Ltd (CGF) $12.03

Challenger (CGF) is Australia’s leading annuity provider which has performed extremely well since the GFC which also enabled us to make a good return prior to selling our position on the 28th November for more than ~15% profit at $13.80 – we became concerned with CGF’s valuation plus how crowded the trade had become i.e. everyone was bullish and long = dangerous.

Challenger depends on asset prices growth for it to outperform the returns it is offering on its annuities. Importantly if it doesn’t outperform then it is ‘losing’ money over the long run. Given we’re fairly confident asset prices will grow over the long-term, but we believe there’s potential trouble ahead in the short-term as the bear market for interest rates ends.

Long-term there is going to be an increasing number of people reaching retirement age who want / need a secure place for their money. We are clearly an ageing population: The number of people over the age of 65 is expected to grow by 75% during the next 20 years.

Hence we like the business model moving forward, the question is do we buy it now following its 17% correction.

- We believe CGF is fair short-term value under $12 but if / when we see global equities end the current second longest bull market in history CGF is likely to underperform hence we will keep our powder dry for now. Our view is be patient and CGF will offer great value when the next decent correction is complete.

Challenger Ltd (CGF) Chart

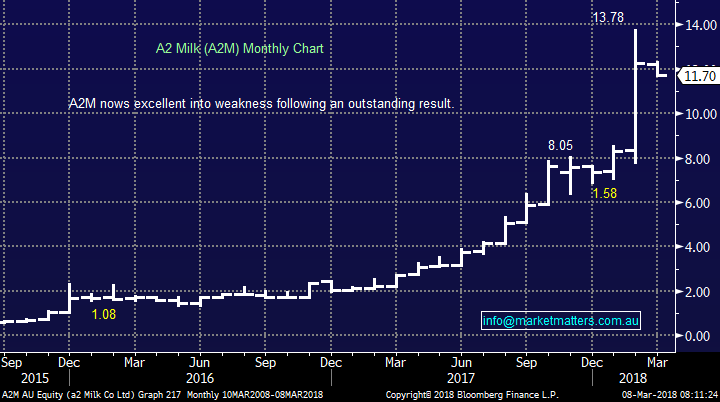

2 A2 Milk Co. Ltd (A2M) $11.70

A2M has had an amazing rally since early 2017 and the obvious question is what is a good area to buy A2M on a risk / reward basis? A2M is trading on very high valuation and has already corrected 15% from last month’s high so it’s far from risk free.

In late February the stock soared after releasing an exceptional result, smashing market expectations and announcing a good deal with Fonterra. As we said at the time, it was the ‘result of the season’ which is obviously frustrating after we were only recently out of the stock. The result was boosted by strong demand for its infant formula products both locally and in China while it continues to strengthen its market share and improve margins. It’s certainly in our fridge and I’m not even sure why, that’s good marketing!

We are concerned around its high valuation in a rising interest rate environment, far from ideal, but we like the companies insulation from tough economic times. We recently made a nice profit from A2M but as we often preach MM is happy to buy a share at a higher price than we sold it if the “goalposts have moved” and that feels the case with A2M following its latest result.

- We like A2M and are happy to accumulate into weakness between $11. and $11.50.

A2 Milk Co. Ltd (A2M) Chart

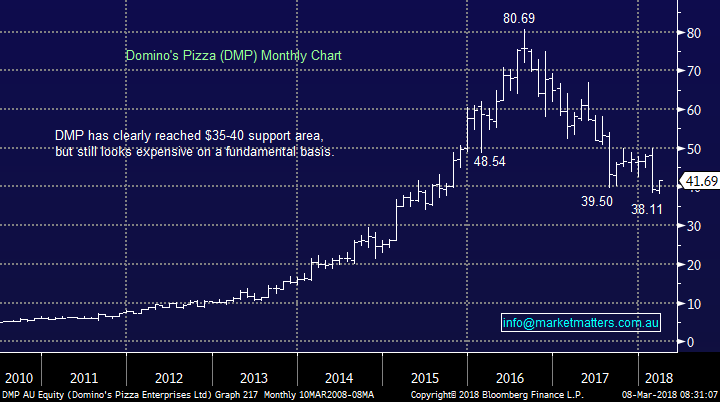

3 Domino’s Pizza $41.69

DMP is a clear warning for investors piling into growth stocks, including ourselves when we look at A2M. We remain committed to our view that the next few years will be tough for high P/E growth stocks, especially compared to the last 2-3 years. Hence if we were to buy A2M, or other high valuation stocks, it will be in a relatively conservative manner.

DMP has tumbled over 50% from its 2016 highs when investors became too optimistic and the extremely high valuation was not sustainable. DMP is still trading on a valuation of 26.6x est. 2018 earnings, and there is a big ?? over whether or not they’ll meet guidance. They have fallen almost 10% following its poor result in February – companies trading on high valuations need to hit a home run each time they report!

The company has undoubtedly been impressive one but there clearly still is a lot baked into the share price, and several risks, such as the franchise model, are not accounted for at all – think retail food group. We have not touched on all the rumours around directors having borrowed against their shareholdings because without facts we are reticent to comment.

- Technically we like DMP for a bounce up towards the high $40 region, say 15%. However we are not long-term investors at these valuations / prices.

Domino's Pizza (DMP) Chart

Conclusion

- We remain bullish stocks into April / May and intend to increase our cash levels fairly aggressively moving forward.

- We like A2M below $11.50, have no interest in Challenger / Domino’s except for a “trading bounce”.

Global markets

US Indices

No major change, overall we believe US stocks have formed a low and they will be higher in 1-2 months’ time.

- While we expect US stocks to rally to fresh highs the likely manner of the advance is far more choppy / indecisive than the almost exponential gains we have witnessed from late 2016 – feels accurate at the moment.

US Dow Jones Chart

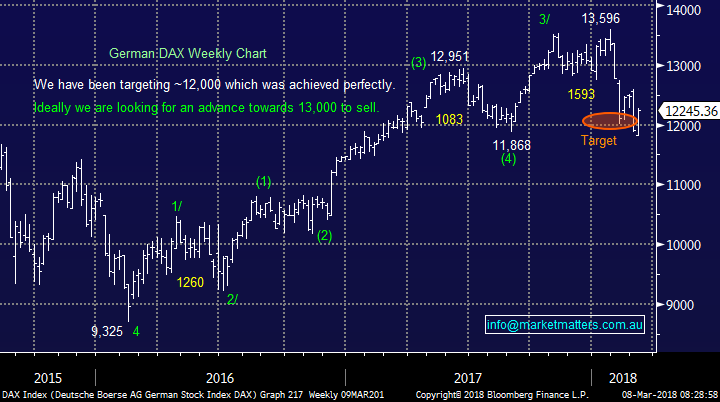

European Stocks

European indices have been lagging since late January but picked up over the last 48-hours, potentially we’ve seen their low for a few months.

German DAX Chart

Asian Stocks / Emerging Markets

We remain bullish the Hang Seng at current levels ideally targeting fresh 2018 highs in the next ~4-6 weeks – also this adds weight to our preferred scenario that the $US can see one final low in the coming weeks.

Hang Seng Chart

Overnight Market Matters Wrap

· The prospect of President Trump’s tariff proposal being signed this week pushed markets lower on Wednesday. The Dow and S&P 500 In particular were on the decline as a snow storm on the east coast of the USA kept some traders away and volumes lighter than usual.

· The widely rumoured resignation of Trump’s senior economic adviser Gary Cohn spooked investors around the globe, with the registered Democrat seen as a voice of reason within the often volatile White House.

· Concerns of a broader trade war are causing disparities between the indices in recent days. The Dow Jones, comprising big multinationals that will likely be impacted was down 0.8%, whilst domestic based tech stocks on the Nasdaq were unchanged.

· Iron ore dipped slightly, down 0.3%, whilst oil dived nearly 3%. These movements saw both BHP and RIO give up more than 1.5% in US trading. BHP also announced it expects to attract up to 50 potential bidders for their US shale portfolio. The 10 year bond rate is slightly easier at 2.86%. In spite of the negative sentiment, the SPI is pointing to a 6 point rise on the open at 5903, whilst the $A was 0.4% lower at 78.25c

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/03/2018. 9.34am

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here