Are we too heavily exposed to insurance stocks?

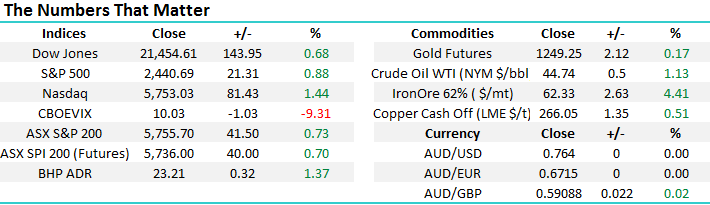

A strong night for US stocks with the Dow Jones putting on +143pts while the S&P 500 added +0.88% however it was the Nasdaq that shone brightest with the Tech stocks adding +1.44%, recouping the majority of the losses from the prior session. Locally, our market is tipped to rally by around +30pts. US interest rates were higher again with the 10 year yield ticking up another 2bp to settle at 2.23% as Central Bankers around the globe try to condition investors for higher interest rates.

It’s a topic we often cover at MM, and we spoke about it with Charlie Aitken yesterday - available here for those that missed it. Clearly interest rates at current levels globally are unsustainable and will move higher over time, however it’s the timing and trajectory of rate hikes that see’s the big divide between what central banks are saying and how the market is positioning. Overnight we had the Bank of England Governor Mark Carney saying the time was near for an increase in rates. His U.S counterpart Janet Yellen said on Tuesday night her policy tightening was on track, Mario Draghi in Europe was also attempting to guide in a similar direction, even the Canadian’s are considering a rate hike. Interest rates are clearly going higher.

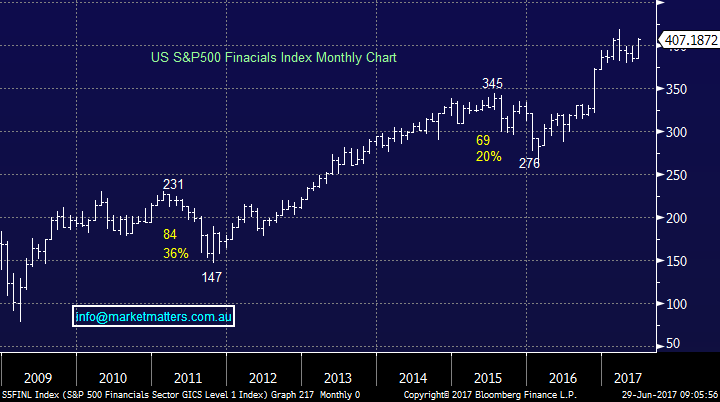

Financials were once again the strongest sector in the US overnight, adding 1.58% as the market slowly but surely starts to re-position for higher rates.

US Financial Sector – Daily Chart

Yesterday, the ASX 200 had a very strong session opening firm but seeing sustained buying throughout the day closing up by 0.73%. The sectors we’re heavy in for the Market Matters portfolio did well, particularly the insurance stocks and the miners, which represent around 40% of our holdings. We’ve been targeting a buy of Westpac below $30 and it briefly traded there however has now bounced. We continue to think Banks will be strong in July and will look to increase our holding by +2.5% – watch for alerts.

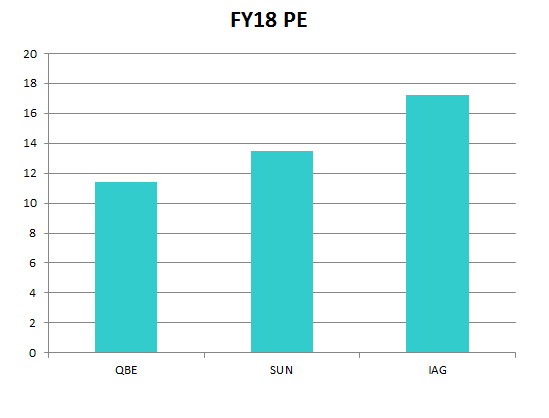

Insurance sector PE’s

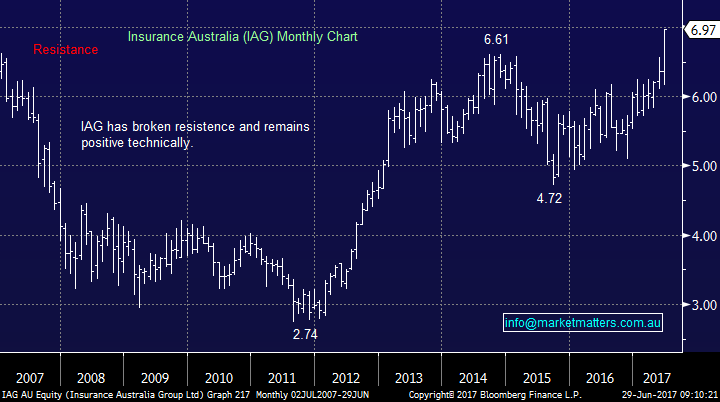

Insurance Australia Group (IAG) $6.97

IAG put a rocket in the insurance space yesterday by announcing they expect reserve releases of at least 5% for FY17 – up from previous guidance of 2%. To give some context here, general insurance stocks put aside money (and invest it) to make good on the policies they write. When doing this, they make some assumptions around inflation, wage growth and other things – basically the likely costs of fulfilling the cover if they are called upon to do so. If their assumptions are too high, as was the case with IAG yesterday they can then release some of the reserves through their P & L – and this obviously boosts earnings. IAG did this yesterday and the stock traded up to match its all-time highs of $6.97. We are bullish the insurance space however view IAG as expensive relative to peers. IAG has had a great year up around 30% in FY17.

IAG Monthly Chart

Suncorp (SUN) $15.11

The announcement clearly has positive read throughs for Suncorp, given the basis for the bigger than expected reserve release was low inflation – something that will also impact the other insurers. Suncorp already had excess capital on their balance sheet and these positive trends around further releases is another boon for the insurer – bigger profits, excess capital probably means special dividends for SUN shareholders! SUN is Market Matters largest holding with a 12% weighting in the portfolio.

We remain bullish Suncorp with our long held target of $16.00 now clearly in play. We may look to take profits on a portion of our holding ~$15.50 if the opportunity arises. Suncorp has had a great year up around 30% in FY17

Suncorp Monthly Chart

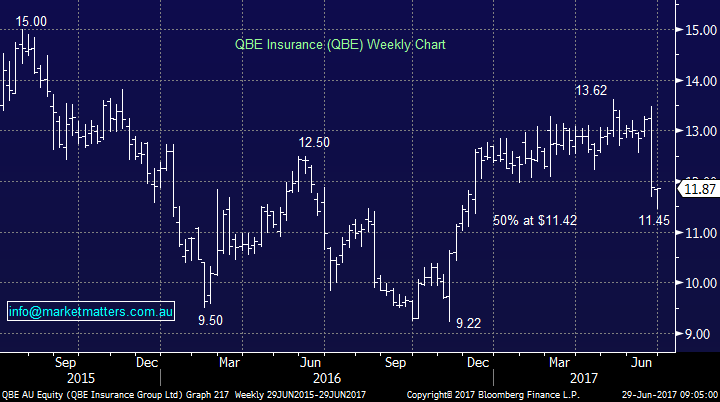

QBE Insurance (QBE) $11.87

QBE has had a volatile time in recent weeks with a downgrade to earnings (~6%) following some problems in their emerging markets business. We own QBE and added to the position on Tuesday ~$11.60. QBE is a different story to IAG and Suncorp given more of its earnings are concentrated overseas. It’s a bigger global player and a lot more complicated in its structure / exposures – which have clearly played against the insurer in recent years. They won’t benefit as much from the news yesterday, however it is a positive non-the-less. QBE have also said they see positive releases from their North American business which is helpful. Insurance stocks have tailwinds at the moment from different areas. QBE’s tailwinds are more macro (higher US rates, lower Aussie Dollar) and we continue to like it for exposure to those themes, plus we think the earnings ‘blip’ last week will prove to be just that. We now have a 7% holding in QBE from lower levels and remain bullish on the stock.

QBE Weekly Chart

Conclusion (s)

We remain bullish the insurance sector given positive tailwinds to earnings.

We have a large portfolio weighting in this sector of 19%, which is clearly high conviction - typical of our approach

We will look to reduce our big overweight position into further strength – remember, BUY weakness, SELL strength is our mantra for 2017

Overnight Market Matters Wrap

· The US clawed back most of its recent losses in the equities markets, with the NASDAQ outperforming the other indices.

· The US Financials continue to dominate the broader S&P 500, with Bank of America, JPMorgan, Morgan Stanley and Citigroup plans a buyback and lifts its dividend. Expect Macquarie Group (MQG) to follow in the same path and outperform the broader market today.

· Elsewhere, another strong rally was witnessed in the iron ore space, with BHP also expected to outperform the broader market today, after ending its US session up an equivalent of 1.37% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 30 points higher, towards the 5790 level this morning. Note it is June Equity Index Expiry this afternoon.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here