Are we being too patient on resources?

Firstly, the US Fed left interest rates unchanged as anticipated last night with policy makers still targeting 3 rate hikes throughout 2017. The Feds opinion varies, like most peoples, on the extent to which Donald Trump will boost growth by cutting taxes, lifting regulation and simply spending - it definitely feels like 2017 will be a Trump dominated year.

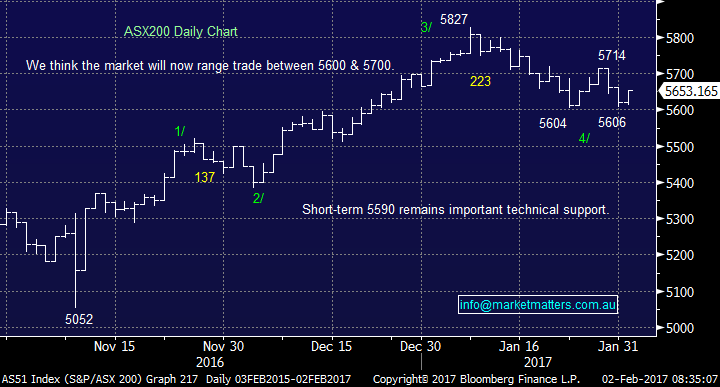

The local market is gaining excellent support from the 5600 area and assuming any declines from the US are not too aggressive we think February will start slowly with stocks trading between 5600 and 5800 with the local market likely to outperform globally. Clearly the other wild card is company reporting season and we've seen some horror stories recently with Oz Forex (OFX) joining the list yesterday falling 24% - see Wednesday Market Matters morning report.

ASX200 Daily Chart

US stocks continue to drift lower and our view remains that the current pullback will eventually be around 4%, with the Dow targeting the 19,400 area.

US Dow Jones Daily Chart

We have been looking to buy resource stocks for a while now but they seem extremely well supported, actually rallying over recent weeks while the ASX200 has fallen almost 4%. This is clearly a bullish sign overall but not one to lead us down the FOMO / "Fear of missing out" path that has led many to the poor house. We continue to believe 2017 will be a volatile one with coming weeks likely to see some movement from growth stocks to defensives as the US market drifts lower.

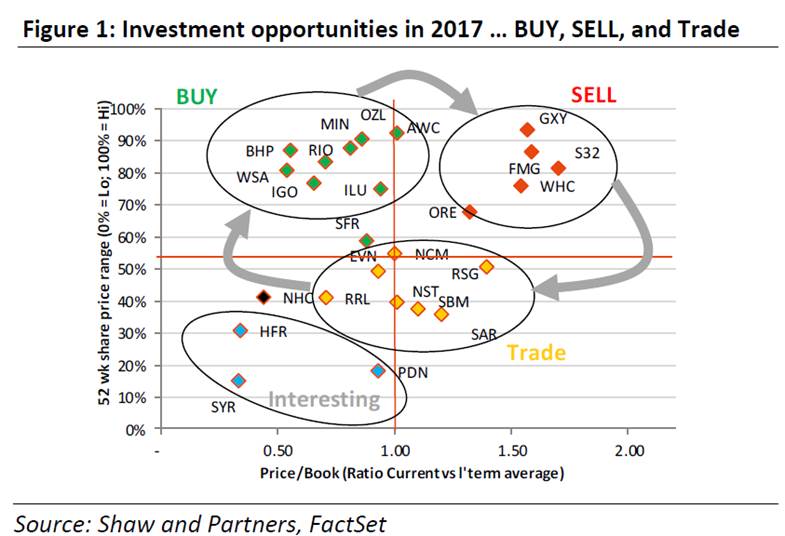

Importantly our view that inflation is set to rise is a bullish backdrop for the resources sector. That said, not all resource plays can be lobbed into the one basket given the varying dynamics of underlying commodity prices, and the big moves we saw last year. Shaw and Partners put out an interesting chart recently highlighting the different ‘buckets’ that commodity stocks fall into given current pricing, and we tend to agree with the logic. The bulk commodity plays had a huge 2016 with the likes of S32 and Fortescue benefitting from a surge in their underlying commodities. In terms of S32 for instance, their underlying basket of commodities rallied ~180% driving big gains in the share price, however commodities are cyclical and big price gains one year generally doesn’t last as more production comes on line to take advantage of the higher prices. At this stage, it’s the base metals and diversified’s that are still offering reasonable value relative to the rest, while the Golds should be more actively traded.

The table plots key mining stocks in terms of their current price to book / their long term average. For instance, FMG is trading around 1.5 times their historical price to book while RIO is trading at 0.75 of their long term average. Newcrest if about average as is Northern Star, while Regis is on the cheaper side in the Gold space. The Y axis highlights where the stock sits in terms of their 52 week range. OZL, BHP, RIO etc are near the top of their yearly range while the golds are about mid-range.

Let’s update our view on 4 sector heavyweights.

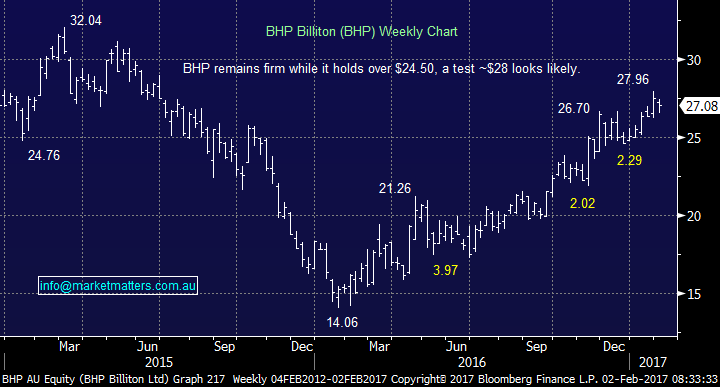

1. BHP Billiton (BHP) $27.08

BHP has reached our $28 target area and has doubled since its panic lows of 2016. While we are bullish BHP for 2017 our buying level is under $25.

BHP Billiton (BHP) Weekly Chart

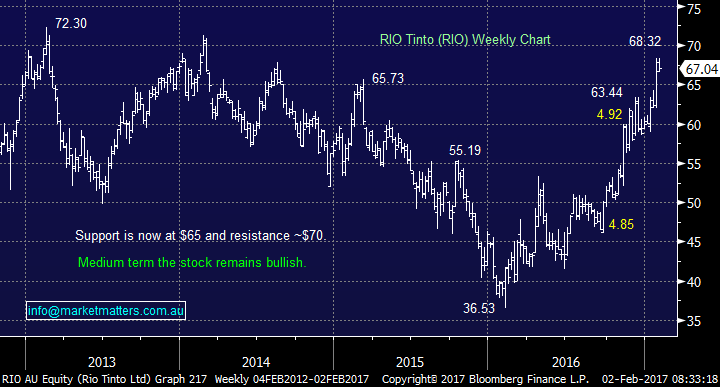

2. RIO Tinto (RIO) $67.04

RIO has performed exceptionally well as both a company and in terms of stock price, outperforming BHP since the dark days of early 2016. Our buying level for RIO is now up to the $63.50 area.

RIO Tinto (RIO) Weekly Chart

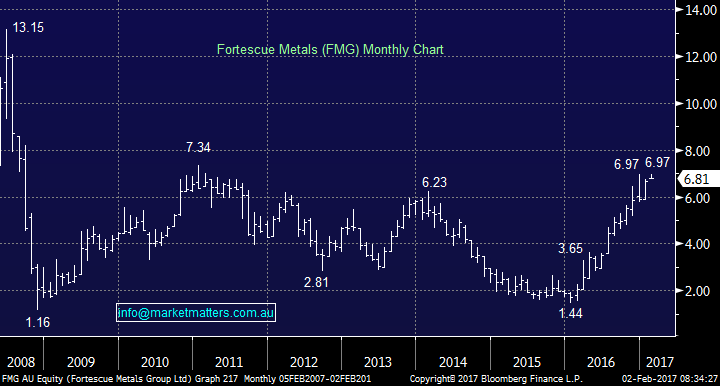

3. Fortescue Metals (FMG) $6.81

FMG has again tested the $7 area after, like RIO, performing exceptionally well operationally, with the surge in the Iron Ore price giving them room to address their big pile of debt, however we believe much of the good news is baked into the share price at current levels, even Nev Power, CEO of FMG believes the iron Ore price should be ~40% lower, illustrating the vulnerability of FMG close to $7.

That said, mining CEO’s do not typically have a good handle on underlying commodity prices. We sat through a meeting with Andrew McKenzie of BHP when Iron Ore was trading nearer to ~$30, where he outlined how BHP would operate as prices stayed lower for longer – which was their view at the time. Iron Ore is now above ~US$80! We are not buyers of Fortescue at this juncture

Fortescue Metals (FMG) Monthly Chart

4. Oz Minerals (OZL) $9.13

We are buyers of OZL around the $8 region.

Oz Minerals (OZL) Daily Chart

Summary

- Resource companies have had a great 12 months, obviously on the back of strong commodity prices but that benefit has been amplified by the fact they hadn’t expected them to be so strong. Resource companies had ripped out costs, streamlined operations and prepared for an extended period of low prices. That didn’t materialised and therefore they were more leveraged to the upside than in previous cycles.

- We remain buyers of resources stocks but only into weakness

Overnight Market Matters Wrap

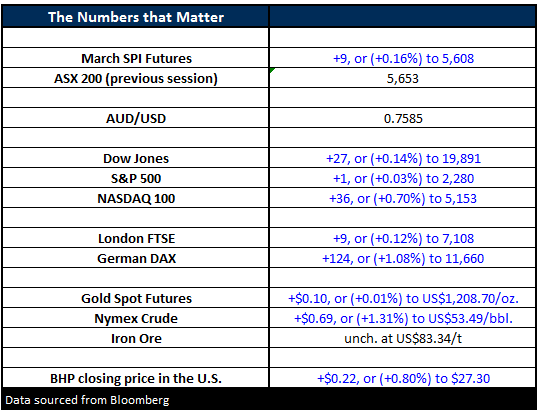

- US equities edged higher, late in the session with the NASDAQ 100 outperforming the other indices, after Apple’s earning’s beat.

- The Dow closed 27 points higher (+0.14%) at 19,891, the S&P 500 flat at 2,280, while the NASDAQ 100 rallied 36 points (+0.7%) to 5,153.

- The US Fed has made no change to rates at its first meeting for 2017 and little indication was given on the timing of the next move. We anticipate at least 2 rate rises in 2017.

- The ASX 200 is expected to open marginally higher this morning, above the 5,660 level as indicated by the March SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here