Are there any clues from Caterpillar Inc. (US)? (OZL, BHP, ALL)

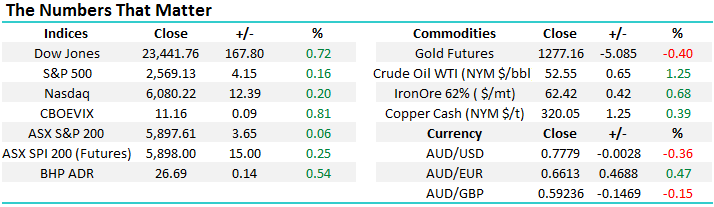

The ASX200 continues to market time around the 5900-area, following its impressive 275-point advance with our opinion on the overall market remaining intact. We continue to believe that US stocks are likely to commence a ~5% correction relatively soon to provide an excellent buying opportunity for yet another exciting Christmas rally. Our call for a small US retracement may sound like a broken record to a few subscribers, but Bank of America’s October Fund Managers’ survey supports our view i.e. the average cash holding of US money managers has now declined to 4.7%, the lowest in 2 ½ years. Simply, the reduced cash holdings of US Fund Managers equates to diminished buying support as these previous bears have been forced to buy stocks i.e. the likely buying capitulation we flagged ~6-months ago.

Our feeling is that local stocks will outperform most of their global counterparts. If this correction does unfold, the below levels should remain important over coming days / weeks:

- We should see a test of last Friday’s 5870 low in the next few days which is likely to offer some initial support.

- We see a worst case scenario of a pullback to the 5825 area which we would regard as an optimum buying area.

- A break back under the psychological 5800 area would negate our current bullish outlook for stocks into 2018.

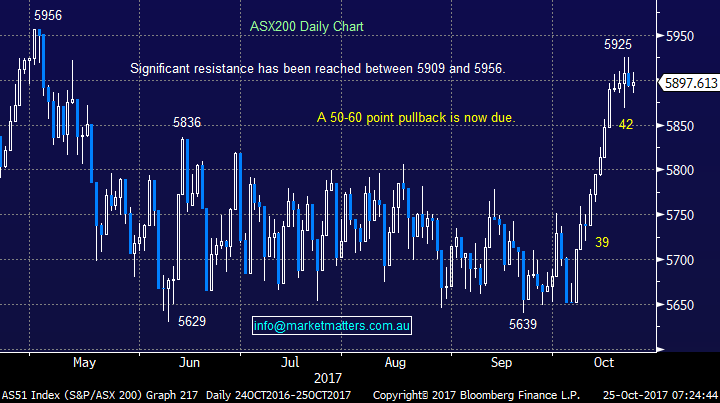

Last night Caterpillar Inc (US) which manufactures mining equipment had a great result and rallied ~5%, today we are going to look at whether this stock has been a leading indicator for our resources sector in the past.

The MM Growth Portfolio is now sitting on a fairly hefty 20% cash position, but volatility feels to be slowly on the rise so we remain confident of finding some good buying opportunities in the days / weeks ahead – we remain in the market to allocate 3% of the portfolios into Oz Minerals (OZL) under $8.25 which was frustratingly very close yesterday.

*Watch for further alerts.

ASX200 Daily Chart

Caterpillar Inc (US) & our resource stocks

On both the fundamental and technical level, Caterpillar looks great as the stock makes fresh all-time highs, dragging the Dow with it. This implies to us that global mining companies are going to continue with their Capex (Capital Expenditure) as the sector continues to recover from its doom and gloom back in late 2015 / early 2016. This coincides nicely with our bullish resources sector view moving forward – MM are firm believers in the “Reflation trade”.

Caterpillar Inc (US) Quarterly Chart

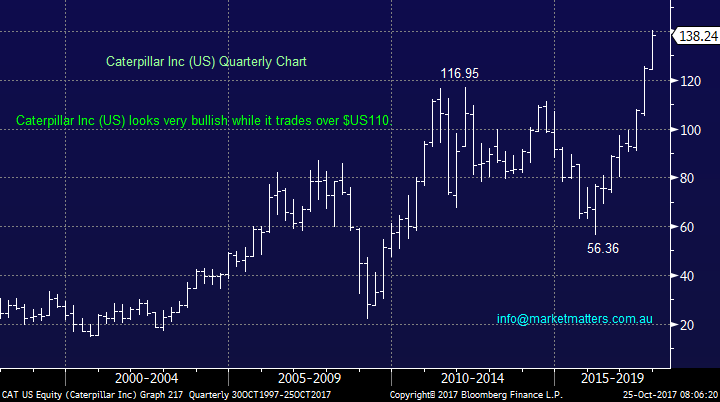

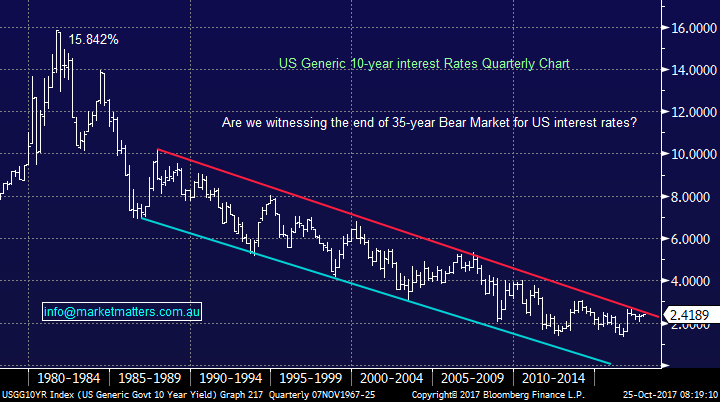

Just quickly on the reflation theme, US 10-year bond yields traded back to their May highs last night as they continue to challenge the long-term, 35-year bear market. The theoretical winners and losers when and if this occurs, assuming it’s an orderly rise in interest rates:

Winners – Banks / Financials and reflation facing companies.

Losers – “yield play” and healthcare stocks.

Not surprisingly, the MM Growth Portfolio currently holds no “yield play” or healthcare stocks.

US 10-year bond yields Weekly Chart

US 10-year bond yields Quarterly Chart

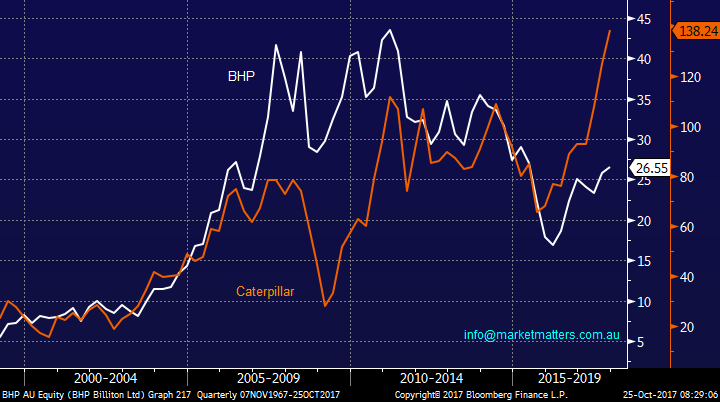

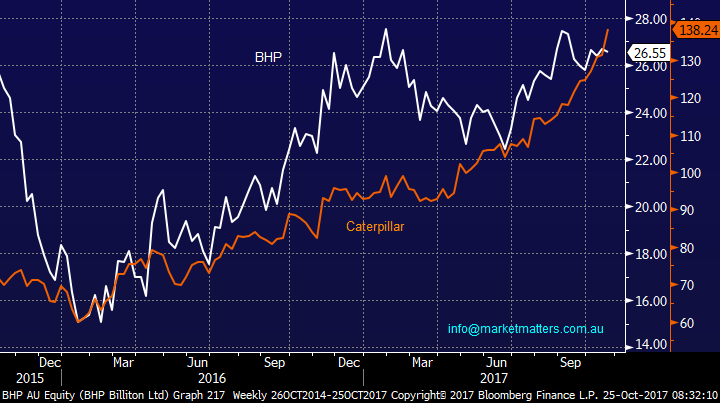

Moving onto any correlations between Caterpillar Inc (US) and our resource stocks, we will use BHP as the benchmark for this quick investigation. When we compare the 2 stocks over both the last 2-years and 2-decades our conclusions are simple but unfortunately not as exciting as we hoped:

1. As you would expect, Caterpillar and BHP have a strong correlation to each other on all time-frames.

2. The stocks generally turn together as opposed one leading the other.

Hence looking at Caterpillar has just reaffirmed our positive outlook for Australian resources moving forward but has unfortunately not assisted with any timing of future purchases.

BHP v Caterpillar Inc (US) Quarterly Chart

BHP v Caterpillar Inc (US) Weekly Chart

Potential activity for the MM Growth Portfolio

We remain in the market looking to commence accumulating OZL below $8.25, hopefully yesterday morning’s quick spike down to $8.26 does not become a missed opportunity.

Oz Minerals (OZL) Daily Chart

2 Sell Aristocrat (ALL)

This feels like a premature entry to our potential activity list, but since we purchased ALL at $20.55 the stock has soared with our position already showing 14% paper profit. We continue to be sellers around the $25 region i.e. another ~7% higher.

Aristocrat (ALL) Monthly Chart

Global Markets today

US Stocks

Last night the broad based S&P500 closed up 0.16% and remains close it’s to all-time high. However, we feel it’s important that the tech NASDAQ, which often leads the US indices, is slowly becoming the relative underperformer.

There remains no change to our short-term outlook for US stocks, ideally we are targeting / need a ~5% correction before the risk / reward will again favour buying this market.

US NASDAQ Weekly Chart

European Stocks

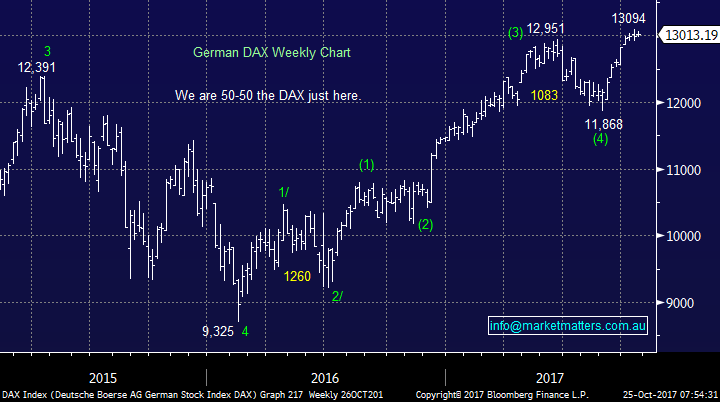

Yet again no change, European stocks have now made the fresh highs we anticipated but MM would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Conclusion (s)

Stocks look close to a reasonable correction, but this remains likely to be another good buying opportunity, although perhaps the last one for a while.

Hence looking at Caterpillar has just reaffirmed our bullish outlook for Australian resources moving forward, but has unfortunately not assisted with any timing of purchases.

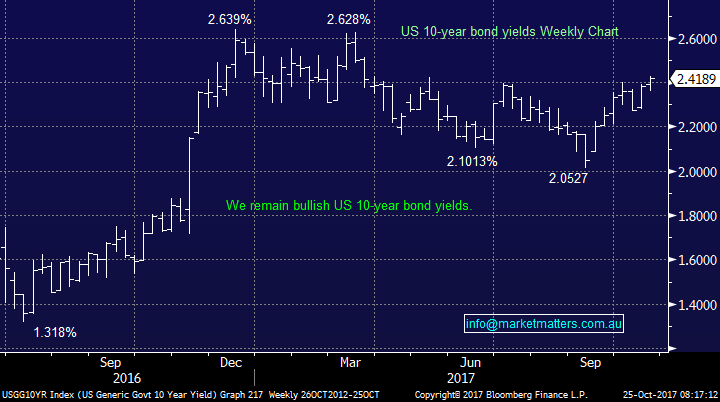

Overnight Market Matters Wrap

· The US markets soldiered on to further record highs overnight, after Monday’s breather, driven by strong earnings numbers from a number of bell weather industrial stocks including Caterpillar and 3M.

· Treasuries were once again under pressure, with US 10 year bonds falling to 2.4%, as the earnings trends continue to highlight the underlying strength of the US economy.

· The positive mood also helped boost commodities with oil once again rallying and base metals firmer. Both BHP and RIO traded stronger in overnight trading. A stronger US$ however saw the A$ rate back below 78c.

· The December SPI Futures is indicating the ASX 200 to open 20 points higher towards the 5920 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here