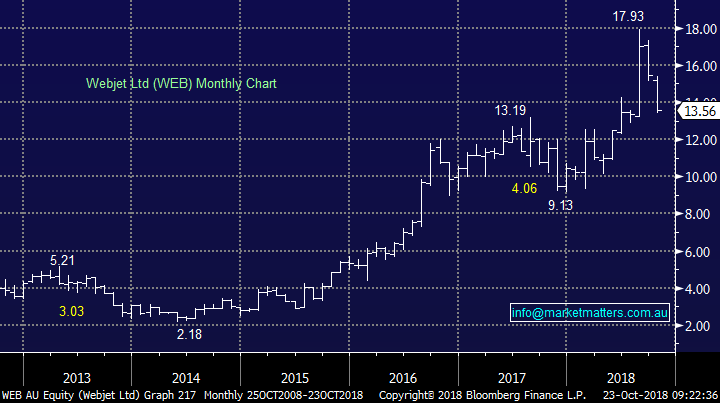

Are the high growth / valuation stocks destined to correct significantly more? (WEB, HSO, RHC, CSL, COH)

The ASX200 recovered reasonably well after lunch courtesy of a strong tailwind created by a surging Chinese share-market e.g. RIO bounced almost 3% from its intraday low to close up over 1%, with similar stories across most of the resources sector. The Healthcare Sector caught our eye on the negative side of the ledger with the once extremely popular group closing down almost 2%.

China closed up over 4% on the day following pledges of support from influential officials and as we discussed in the Weekend Report swimming against the tide of any Chinese Government decision is fraught with danger, let alone one that essentially states - we will stop our share market falling any further.

When the Chinese government supported the Hang Seng back in 1998 the index almost tripled in less than 2-years, squeezing any shorts in its path, unfortunately over the same period the ASX200 gains were comparatively muted.

Hong Kong’s Hang Seng Index Chart

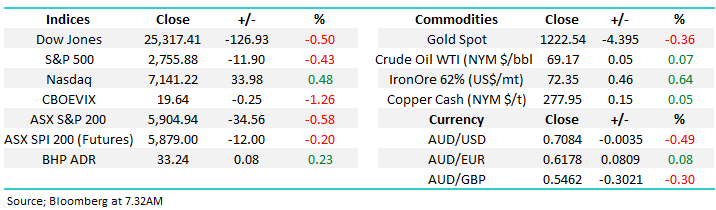

No change in our overall outlook for the ASX200 which is no great surprise considering the lack of movement by our index over the last 4 trading sessions. On balance in our opinion the negative news which greeted local stocks on Monday morning was handled pretty well by the market, especially certain sectors, it’s slowly starting to feel like a market which is priming itself for a rally – the question is, from what level will the rally start?

MM remains mildly negative the ASX200 short-term expecting at least a second attempt at the 5800 area.

Overnight stocks were again weaker with the US S&P500 closing down -0.4% while the FANG’s added some much needed backbone as the NASDAQ managed to actually advance +0.5%.

The SPI futures are calling the ASX200 to open down ~10-points with BHP trading basically unchanged in the US.

ASX200 Chart

Today’s report is going to again look at the high growth / valuation end of town for 2 reasons:

1 – They continue to underperform e.g. yesterday while the ASX200 fell -0.58% we saw Wistech Global (WTC) -5%, Appen Ltd (APX) -4.1% plus Flight Centre (FLT) & Webjet (WEB) all clobbered.

Over the last month while the ASX200 has fallen -4.7% the growth end of town has seen serious underperformance e.g. A2 Milk (A2M) -16.4%, Webjet (WEB) -17.6%, Afterpay Touch (APT) -18.8%, Altium (ALU) -16.8% and Xero (XRO) -15.9%.

2 – We recently bought CSL Ltd (CSL) and Cochlear (COH), both in the healthcare sector and they are still slipping lower, even while the index has bounced – they are being tarred with the same high growth / valuation brush.

Hence we ponder “should we cut one / both of these early and switch all / some of the funds into the resources sector which we’ve been patiently looking to buy but may now be supported by China”.

Our 4 positions in the healthcare sector have struggled even when 3 of them were purchased into recent strong weakness i.e. over the last month CSL Ltd (CSL) -10.8%, Cochlear (COH) -10.8%, Healthscope (HSO) -13.8% and Ramsay Healthcare (RHC) -1.6%. Certainly not as bad as some of the previously more in vogue growth names but still on the wrong side of the ledger.

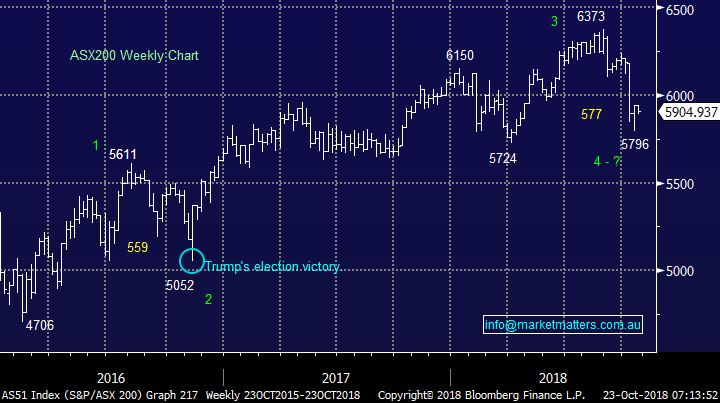

If we stand back and look at the MSCI growth and value indices over the last few years the disconnect has been pronounced but it looks to be reverting in a hurry, importantly its only half way which implies there’s no hurry to buy the growth end of town.

MM remains mildly negative the high growth / value stocks until further notice.

MSCI Value v Growth Index Chart

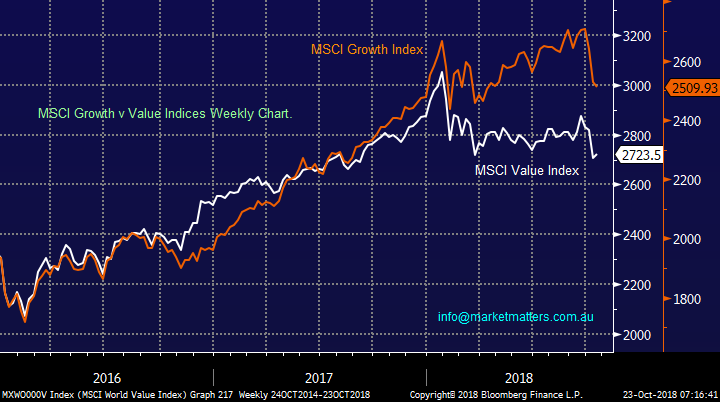

Yesterday Flight Centre (FLT) provided guidance that was below the market’s expectations leading to a sharp 10% decline in the stock. The current market will not tolerate any misses on growth whether your stock is trading on a high, or average valuation. Throughout yesterday we also witnessed a ripple effect from FLT to rival Webjet (WEB) which fell almost 4%.

We took an almost 40% profit from a WEB position back in June only to see the stock surge in August – frustrating! However, we still can see the online travel agent correcting back towards $10, just from a higher level than we thought in June.

Webjet’s currently trading on a Est P/E of almost 22x 2019 earnings but if they fail to deliver next year as we saw with FLT our $10 target area may easily come into play.

Webjet (WEB) Chart

Today we are going to quickly consider our 4 holdings in the healthcare space as we contemplate switching at least part of the exposure to the resources sector.

Private hospital providers Healthscope (HSO) and Ramsay Healthcare (RHC) are trading cheap relative to history as a number of headwinds hit the stocks e.g. Australians reducing their private health insurance and many private procedures being undertaken in public hospitals. We have no doubt that in the bigger picture private hospitals will again develop into a necessity in our country as the public system becomes congested and the government struggles for funding.

1 Healthscope (HSO) $1.78

HSO is trading on an Est P/E for 2019 of 19x having been battered this month as the 2 rejected takeover offers only a few months ago become a distant memory, with the stock now over 30% below May’s high I wonder how the board feel today.

HSO is very cheap compared to its historical valuation but it’s certainly in the sin bin today, we must consider whether it will remain out of favour into 2019 and hence the funds could be better deployed elsewhere.

We are reticent to sell such a cheap stock but it does feel likely to fall further over the short-term without some positive external news

Healthscope Valuation relative to history

2 Ramsay Healthcare (RHC) $53.93

RHC is also trading on an Est P/E for 2019 of 19x but its been a strong performer over the last month only slipping -1.6% as its European acquisition became clarified – we think it has merit.

RHC is also cheap compared to its historical valuation and importantly it’s not providing us with the same degree of concern as HSO.

We remain comfortable with our targeted profit area for RHC between $58 and $60.

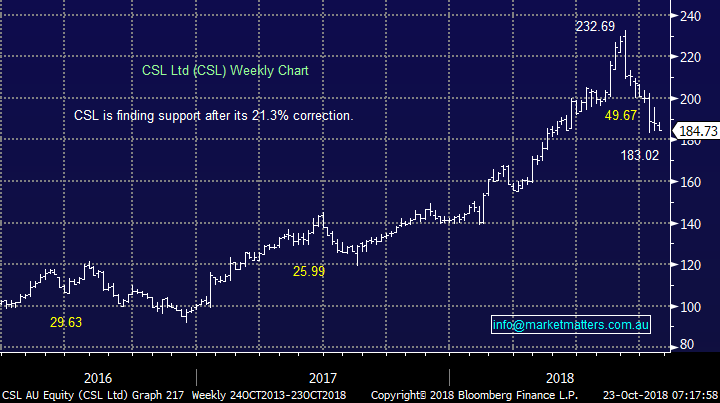

3 CSL Ltd (CSL) $184.73

CSL is less than 2% below our entry level but its inability to bounce with the market is a concern, at least short-term.

Unlike both private hospital operators HSO and RHC, even after its 21% correction CSL is still trading above its long term average valuation and we are concerned that the washout of complacently long investors in this top performer may not have started.

CSL is undoubtedly a great business but if the growth versus value rerating has got further to go CSL may continue to struggle and other stocks / sectors may offer better value.

CSL Ltd (CSL) Chart

4 Cochlear (COH) $179.14

COH closed yesterday 5.6% below our entry as the stock made a fresh 6-month low.

Technically we expected COH to hold the $180 area and so far it basically has but it is “feeling wrong” at present.

COH is also a undoubtedly a great business but again if the growth versus value rerating has got much further to go COH may continue to struggle and other stocks / sectors may offer better value.

Cochlear (COH) Chart

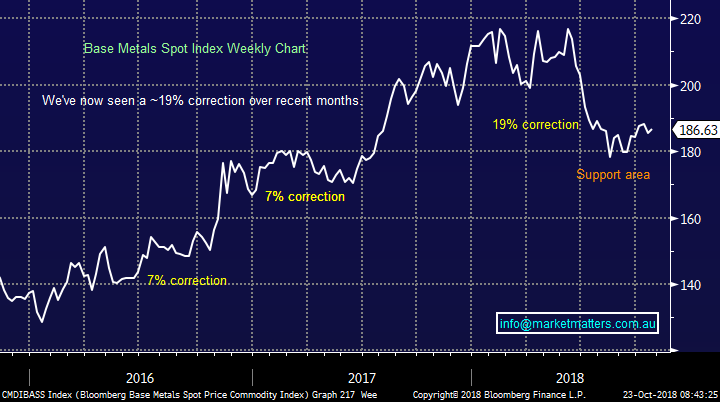

Base metals have corrected almost 20% in just a few months unsurprisingly dragging a number of our quality resource stocks lower. Our Growth Portfolio currently holds 11% exposure to the sector via RIO Tinto (RIO), Mineral Resources (MIN) and Newcrest Mining (NCM).

As subscribers know we are looking to increase this with likely targets Fortescue Metals (FMG), Western Areas (WSA), OZ Minerals (OZL) and BHP itself.

Ideally we will see a final dip lower by all / some of these names to present optimum buying levels but China’s intervention in its equity market is likely to support the sector, hence should we buy some now?

Bloomberg Base Metals Index Chart

Conclusion

MM is considering switching part of our healthcare exposure into resources earlier than we anticipated as anything labelled “ high value growth” remains under pressure.

At this stage FMG is the most likely purchase while the funder is likely to be 1 or 2 of HSO, CSL and / or COH.

Watch for alerts.

Overseas Indices

The US Russell 2000 continues to follow our path and again closed lower last night, testing multi- months lows.

We remain bearish US stocks.

US Russell 2000 Chart

European indices failed to hold onto early gains last night and look destined to test our long term target now only a few percent lower – then what is the million dollar question.

UK FTSE Chart

Overnight Market Matters Wrap

· The broader US equity markets followed Australia’s lead and failed to follow the strength in Asia yesterday, with the financials and commodities sectors hit the most.

· Fears remain high on global tensions, despite a broad positive quarterly earnings being reported.

· Locally today, Oil Search (OSH) is due to release its 3Q output numbers, while BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.23% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 8 points lower, testing the 5900 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.