Are ETF’s scary, or an opportunity?

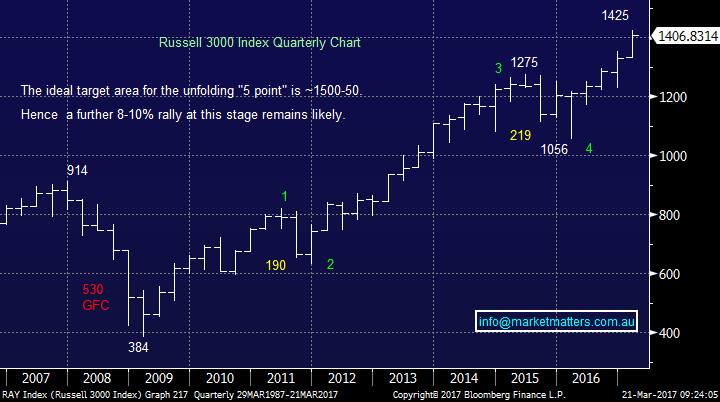

Major overseas stock markets continue to tread water while sector rotation continues, last night the Dow finished down 8-points while financials fell 0.8% but resources gained 0.6%. The Emerging Markets (EEM) continued with their recent surge rallying another 1.3%, making fresh highs since mid-2015, unfortunately the local market will struggle to maintain its strong positive correlation with the EEM's until global financials can end this current period of weakness. The $US also remains under pressure as it struggles to hold the psychological 100 area on the Dollar Index.

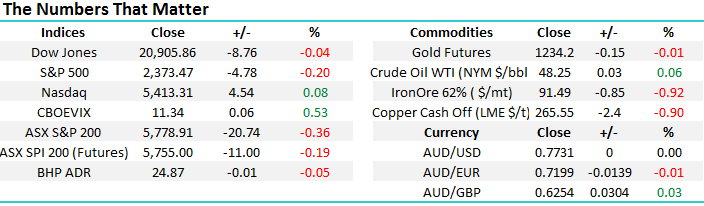

The ASX200 was weak yesterday in an extremely lacklustre day, assisted by a Japanese holiday. The retailers received some special attention from the sellers with the Retail Index falling 2.8% led by Harvey Norman (HVN) -8.2% and Super Retail Group -3.5%. HVN earned the standout attention following the news that 2 senior executives, including the MD, sold a combination of over $2.5m worth of their stock - recent performance from stocks following directors selling has been simply awful. To counteract that Gerry Harvey did step up and buy 2m shares yesterday probably more to make a statement than anything else!

The big picture million dollar question remains the same, how large will the impact be of this year's arrival of Amazon in Australia on our traditional retailers profitability? We have no definitive answer but the obvious conclusion is trading conditions are likely to be significantly tougher, but it's likely to take a few years for clarity to return to the Australian retail landscape. Our conclusion is simple: "From an investing perspective avoid the Australian Retail sector until further notice" - Market Matters.

This is a great example of why at MM we do not believe in "classic portfolio theory" which believes in maintaining an investment finger in all pies. We say why be in a sector if you believe it will struggle at best.

ASX200 Retail Index Monthly Chart

We had already decided to write about ETF's this morning before the Australian Financial Review (AFR) ran an on-line article last night postulating that "ETF's could spark the next major sell off", this leads perfectly into the discussion we were planning to address. The question is, is this headline accurate or one which is ran to sell newspapers? Firstly let’s look at the numbers which the AFR quoted from the Financial Times to perhaps scare local investors:

1. Global investors sunk a significant $US131bn into ETF's in the first 2 months of this year i.e. $US65.5bn per month.

2. In 2016 a record $US390bn was invested into ETF's i.e. $US32.5bn per month.

Clearly on the surface money flowing into ETF's is slowly accelerating leading the AFR to throw out the in vogue word "bubble". The arrival of ETF's in a big way cannot be disputed with ETF's now accounting for over 25% of turnover in the US. As expected this has led to the increased correlation of sectors compared to individual stocks. Recently inflows have been into Materials (resources) and Financials ETF's with outflows from Utilities.

Now let's look at the whole picture, not just ETF's, for the flow of money into / out of US stocks in 2016:

Money flowing into the US market - Company buybacks $584bn, Net demand $209bn and ETF's $188bn.

Money flowing out of the US market - Pension Funds $130bn, Mutual Funds $117bn, Foreign Investment $109bn and Households $39bn.

MM believes we are simply witnessing an evolution / or fad by investors who are primarily switching from Mutual Funds into ETF's. At MM we have four simple views surrounding ETF's:

1. ETF's are not a causing a bubble in stocks, money is just going into stocks via a different vehicle. Company buybacks are clearly the current main driver of this mature bull market for US stocks.

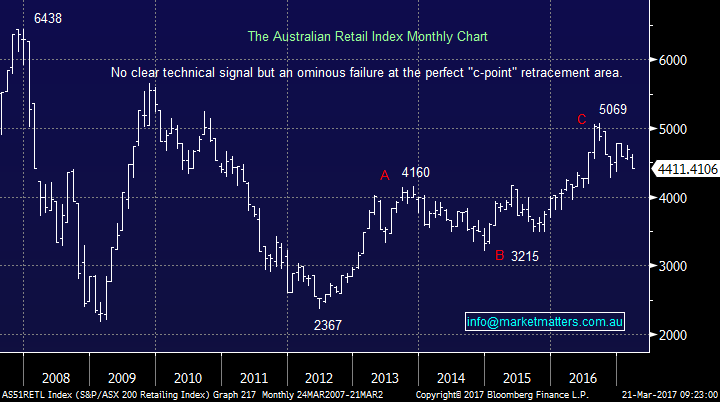

2. ETF's create increased volatility within stocks of specific sectors during different periods, or in other words, prevailing movements in stocks / sectors are amplified by the amount of money sitting in ETFs. For example, when the gold ETF's recently corrected almost 18% the ETF managers would have needed to sell a basket of gold stocks to satisfy the money flow out of their ETF. This led to an almost indiscriminate selling of gold stocks, relative to their weighting in the ETF, as most ETF's usually holding stock weighting's around market capitalization, not on their view of individual stocks. Hence some individual stocks experience waves of selling that would not have materialised under previous market conditions – this clearly creates opportunity!

3. We believe for the informed investing individual shares will provide superior returns over comparative ETF's, however it requires some activity and thought.

4. Lastly ETF's provide an excellent vehicle for going short stock markets, something we believe at MM will be very useful over the coming few years.

Market Vectors Gold ETF Daily Chart

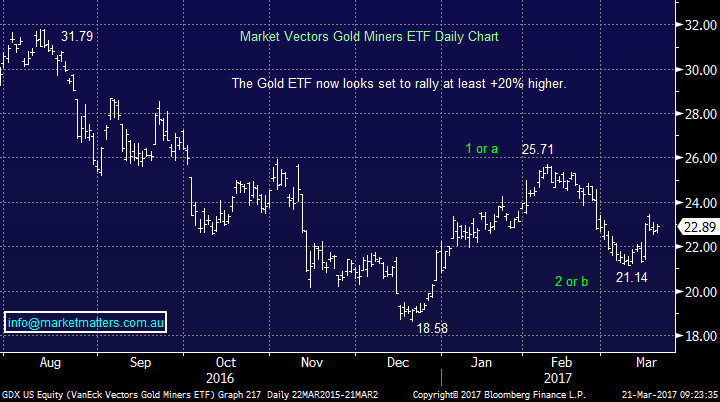

This again brings us to the question what may cause the ~25% correction in equities that we are targeting over the next few years. Short positions have clearly been squeezed since Donald Trump's victory in November but a catalyst still feels required to tip stocks lower. Our best guess is that corporate buybacks will vanish far faster than many analysts are predicting as interest rates rise i.e. borrowing money to buy back your own stock is clearly less attractive as rates rise.

We can imagine corporate America scrambling to buy their own stock over say the next 6-months as the market perception is clearly US interest rates have bottomed, this action will potentially leave a void of buying after one too many rate rises down the track.

Last year US earnings actually fell but the Fed commenced their long awaited normalization of interest rates i.e. raising interest rates. Interestingly similar circumstances unfolded in both the mid 1980's and late 1990's, both times the blend of rising rates and falling earnings led to a 25% correction in US stocks.

Russel 3000 Quarterly Chart

Conclusion

1. We do not believe ETF's are creating a bubble but they will increase volatility within individual sectors

2. Interest rates may still be the undoing of US stocks when / if corporate buybacks are switched off.

3. We remain committed to our view that US stocks will correct 25% over the next 1-2 years.

Overnight Market Matters Wrap

- Another session of a day with pretty much no change in the US major indices overnight, while all action was seen in the treasuries, with the US 10-year bonds rallying overnight.

- Iron Ore fell 0.92%, however it feels that Asia-pacific led this yesterday, with BHP in the US closing pretty much unchanged, to an equivalent -0.05% overnight from Australia’s previous close.

- Oil sold off 1.25% overnight, its ninth decline in eleven days, while Gold reached its 2-week highs.

- The June SPI Futures is indicating the ASX 200 to open 8 points lower, towards the 5,770 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/03/2017. 9.24AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here