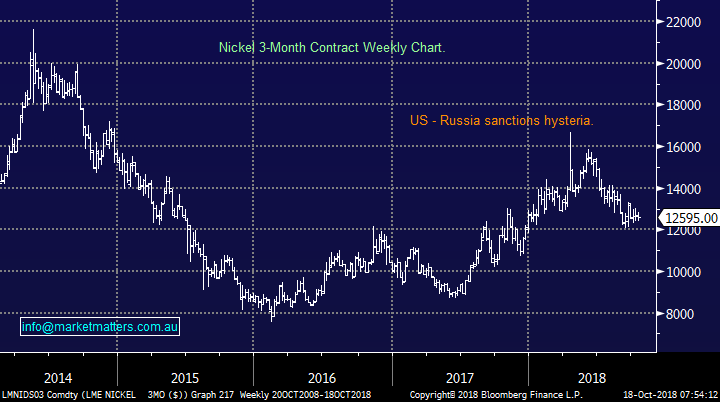

Any value in the 5 stocks down 30%, or more, over the last 3-months? (APT, WSA, EHE, PGH, SDA, SYR)

Local stocks enjoyed a corking Wednesday rallying almost +1.2% strongly supported by the banks and healthcare stocks while only the resources sector closed in the red with BHP -0.7% and South32 -0.78%. Noticeably most of the best performers yesterday were from the battered-up names of the last few weeks such as A2 Milk (A2M), Appen Ltd (APX) and Webjet (WEB). We appear to be leading / in sync with the US at present where overnight the only 2 sectors who closed up more than +0.5% were the financials and healthcare while their materials / resources struggled.

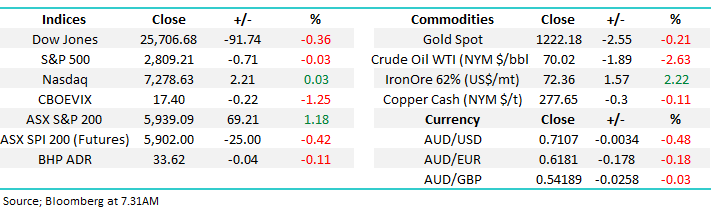

The ASX200 has traded slightly better than our expected short term range of 5775 – 5900 for the week and it will be interesting to see if the market jitters return over the coming days - we continue to anticipate tweaking of our MM Growth Portfolio over the coming weeks with the old cliché “buy strength & sell weakness” remaining our broad brush plan – yesterday we sold 4% of our Suncorp position following its almost 6% recovery.

MM remains mildly negative the ASX200 short-term expecting at least a second attempt at the 5800 area.

Overnight stocks were quiet by the close of the day with the US recovering pretty well from an aggressive sell off in their morning. The SPI futures are pointing to an open down around 20-points.

Today’s report is going to look at the 5 worst stocks on the ASX200 over the last 3-months all of which have fallen by 30%, or more, while the ASX200 itself has declined less than 5%.

ASX200 Chart

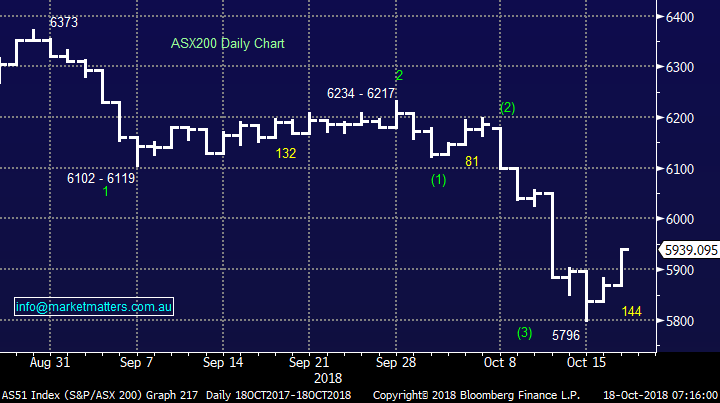

The main talking point of yesterday was Afterpay Touch (APT) which tumbled 25% in an hour following an aggressively titled story in the Sydney Morning Herald:

"Afterpay, payday lenders and 'debt vultures' to face Senate inquiry" - SMH

Unfortunately, it makes sense to us, just imagine the uproar if the “big 4” banks came out with similar products (s) to encourage debt in the primarily younger demographic. We’ve consistently been of the opinion that tighter regulation on this sector would eventuate, and that now seems more likely . While we’ve missed upside in the stock / sector, it simply felt wrong.

Afterpay Ltd (APT) Chart

Yesterday was a classic example that buying “battered stocks” at the correct time can lead to outperformance, at least for the short-term. However, it’s important to remember why the stocks have been sold so aggressively and hence if / when you buy them what’s the reason i.e. is it simply for a strong bounce or is there a longer term re-direction opportunity for the business.

1 Western Areas (WSA) $2.40

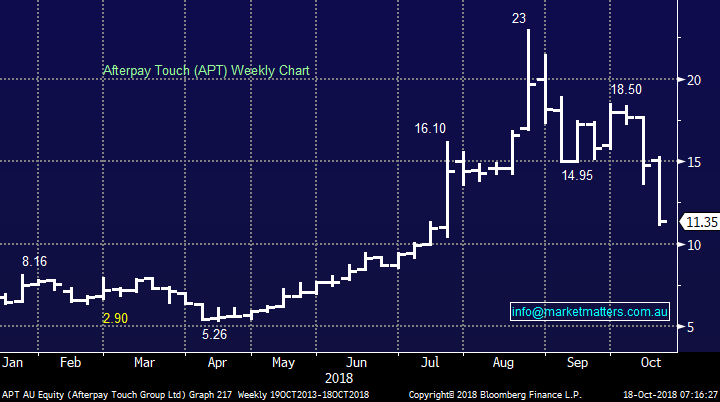

Nickel producer WSA has been on our radar for many weeks and its currently down 30% over the last 3 months and a total of 40% from its 2018 high. The stock has been tracking the nickel price fairly closely throughout 2018 but in an exaggerated manner.

The nickel price has retreated 24% from its panic high in April when US – Russia sanction concerns hit fever pitch sending the metal to a 4-year high. The relative pullback in WSA is starting to feel overdone, when nickel was at today’s price back in December 2017 WSA was trading over 30% higher.

WSA has a strong balance sheet holding over $150m in cash plus its return to profitability even resulted in the company reinitiating a dividend. MM likes WSA into further weakness as the elastic band of negativity around nickel / WSA is becoming too stretched.

MM is a buyer of WSA into fresh 2018 lows, ideally below $2.20.

Also remember MM is keen to increase its resources exposure into this late cycle market.

Western Areas (WSA) Chart

Nickel Price Chart

2 Pact Group (PGH) $3.51

The packaging business PGH is down 30.7% over the last 3 months and over 50% since its 2017 high.

The business has been coping it from all directions with higher input, restructuring and one-off costs leading to its profit coming in this August down close to 20% at $74m with adjusted profit only down 5% to $95m – bad but not as bad as the share price which implies the company has lost investors’ confidence. The shares are now trading on a very conservative estimated P/E for 2019 of 11.6x while yielding 6.55% part franked.

My initial thought is this feels like a potential turnaround story, especially with a reasonable amount of bad news apparently built into the stock.

The stock’s only carrying a 2.73% short position but we notice this is rising slowly, rarely a good sign.

On balance I feel the momentum still feels a little wrong making this a watch and see at this stage for us.

Pact Group (PGH) Chart

3 Estia Health (EHE) $2.22

Estia Health is down 31% over the last 3-months and far worse since its 2015 high. EHE is one of the country’s leading residential aged care companies currently operating 68 aged care homes across the country. A definite tailwind for the business is our ageing population although this is not a new thematic.

The business appears to be moving in the correct direction on some levels having opened 2 new homes last year with more in the offing while existing homes are being improved on a steady basis to improve is competitive position. Debt levels are now less of a burden having been reduced to under $65m and the stock looks cheap trading on an attractive Est P/E for 2019 of 12.9x while yielding ~7% fully franked – although that dividend may not be sustainable.

All sounds okay for a speculative buy but the government’s recent decision for a royal commission into aged care is a scary proposition.

MM believes a good buying opportunity is looming as the stock gets sold too aggressively leading into any enquiry.

MM is watching EHE carefully and does believe it will outperform over the coming years.

Estia Health (EHE) Chart

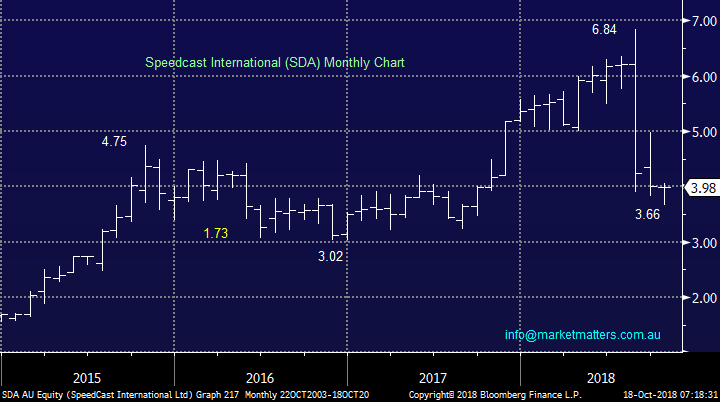

4 Speedcast International (SDA) $3.98

Satellite based communication business SDA is down 34.2% over the last 3-months having been smacked in August following the release of its half-year results which weren’t too bad but the company’s guidance was weak - down around 10% from what it delivered just in May.

This is clearly a company that has now lost the markets confidence and a few months further down the track it’s not particularly improved, we feel at least one more set of numbers is required before many reconsider the stock.

MM is neutral SDA around the $4 area.

Speedcast International (SDA) Chart

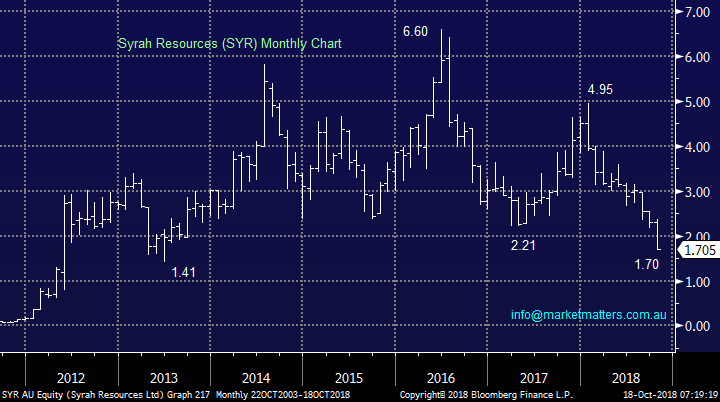

5 Syrah Resources (SYR) $1.70

Industrial minerals business SYR is down 40.3% over the last 3-months and interestingly its large short position of 16% is slowly ticking lower i.e. the hedge funds are taking their profits – SYR is currently the 4th most shorted stock on the ASX.

The company most certainly doesn’t have the markets confidence and regularly missing production targets doesn’t help matters.

SYR will undoubtedly bounce one day but it’s not a stock we are likely to consider anytime soon.

Syrah Resources (SYR) Chart

Conclusion

We aren’t too excited by any of the 5 stocks at today’s prices / time but we do like WSA around / under $2.20 near term.

EHE and PGH are the two we are watching most closely moving forward.

Overseas Indices

No change we are still targeting lower prices for the US market and now last night’s low needs to be broken to see a potential cascade effect unfold.

US S&P500 Chart

European indices remain tricky, looking ok in the short-term but a worry in the longer term.

German DAX Chart

Overnight Market Matters Wrap

- The US equities market recovered most of its losses overnight, ending marginally mixed as investors looked passed the Fed minutes and focused back on quarterly earnings.

- Earlier in the session the US Fed released its minutes with officials mixed with regards to the current pace of rate hikes, leading a jump in current US government bond yields.

- Earnings and quarterly updates were clearly the focus, and domestically we expect the following to be expected – API, GXY, STO, S32, TWE and WPL.

- The December SPI Futures is indicating the ASX 200 to open 21 points lower towards the 5915 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.