A time to tweak portfolios but NOT dump stocks

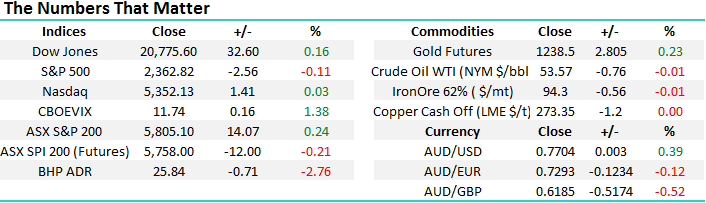

The ASX200 continues to toy with the psychological 5800 area, dragged higher by strong overseas indices but contained by the distribution of dividends. While our preferred scenario is the local market breaks over 6000 in 2017, before alarmbells start ringing, short-term we are now leaning towards the neutral / bearish camp looking for a reasonable pullback in the shorter term. The two main thoughts behind this are our negative view on resource stocks from current levels and the feeling that local banks are at least due for a rest, both of these are covered with some interesting insights later in this report.

Yesterday’s reporting provided some clues into what's currently driving some stocks:

Winners : Vocus (VOC) +9.3%, Healthscope (HSO) +5.8%, McMillan Shakespeare (MMS) +8.4% and Woolworths (WOW) +4.4%.

Losers : Isentia Group (ISD) -35.4%, Blackmore's (BKL) -10.3%, Independence Group (IGO) -3.3% and Fortescue Metals (FMG) -2.6%.

Firstly, of the 4 stocks we have highlighted as "winners" from yesterday, while they did provide solid / better than expected results, the share price reaction was more about how the market was positioned leading into the result. The current short positions in 3 of the stocks is significant with VOC 11.35%, HSO 8% and WOW 5.2% which is highly likely to have assisted their rallies yesterday, and possibly moving forward. However, it should always be remembered that the "shorters" are professional investors who generally get it right more than wrong and they did enjoy a good day with 3 positions - IGO 6.9%, BKL 4.9% and especially ISD 7.7% - ISD is a stock we feel very happy to have avoided.

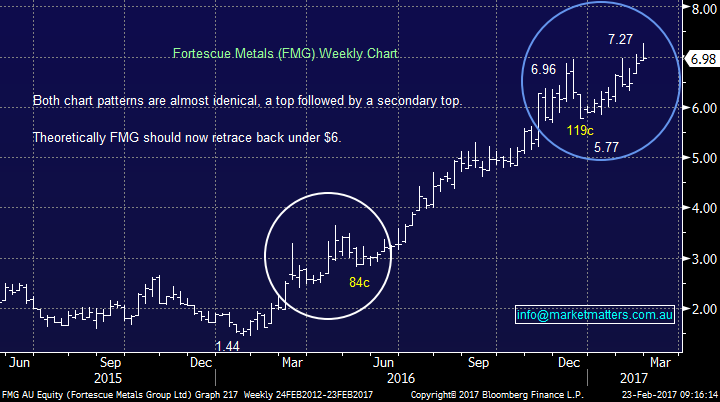

Secondly, the stock we noticed the most, with a smile slowly forming, was Fortescue Metals (FMG) where we hold a short position. FMG reported an excellent report which was better than market expectations, which cynically is likely to explain the strong rally on Tuesday into the report. However, in classic "buy on rumour sell on fact" style the stock initially popped up to $7.27 before being smacked over 4% to close under $7. It now feels like the market is ready to take some profits on stocks that have run hard since the US election.

ASX200 Weekly Chart

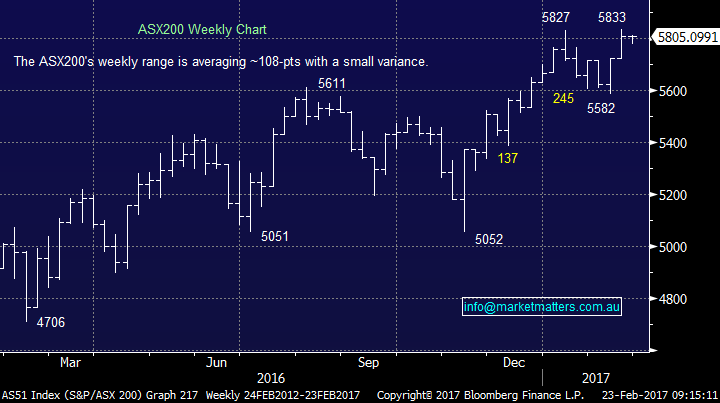

The recent advance by US stocks is / was (depending on which index you follow) the longest rally since September 2013. There are two important points we want to highlight to subscribers:

1. Over the last 30-years US stocks have enjoyed 29 rallies of 7-days or more but only twice did this create a major top i.e. under 7% of the time. This statistic concurs with our view that the rally for US stocks is likely to extend another ~7% into later 2017 at the earliest, before the major top we are still targeting.

2. Hence while US stocks are overdue a correction short-term this pullback remains one to buy.

US S&P500 Weekly Chart

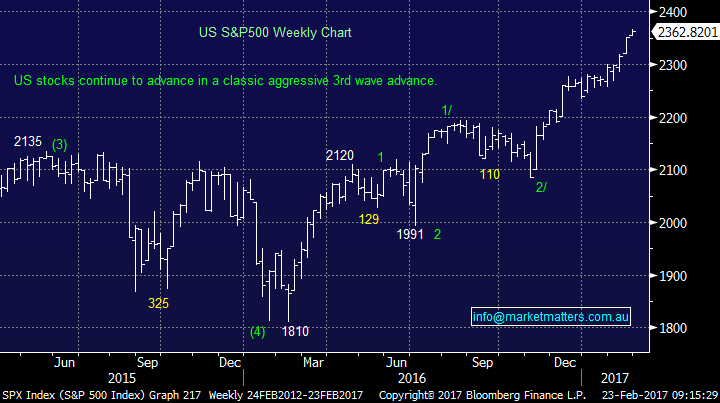

Banking sector

The local market is dominated by our banking / financial sector to the degree that we are often heard to say in the office "it cannot get up without the banks" - the big 4 banks make up around 26% of the ASX200. Lets compare 2017 so far to an average year for our banking sector on a seasonal basis:

1. The January fall and rally into the end of February fits into normal seasonal patterns, albeit in a relatively extreme manner this year.

2. There is often a 1-2 week pullback in banks around now before rallying nicely through to late March.

3. Historically good buying in the 1st week of April and a significant sell at the end of the month.

Hence, unlike the resources we are not negative our banks at current levels but we do think logic dictates being patient with further buying for now. Yesterday we simply tweaked our exposure to the sector, rather than adding to it, by reducing CBA (ex-dividend) by 3% and adding those funds into ANZ

Australian Banks Seasonal Performance

Resources

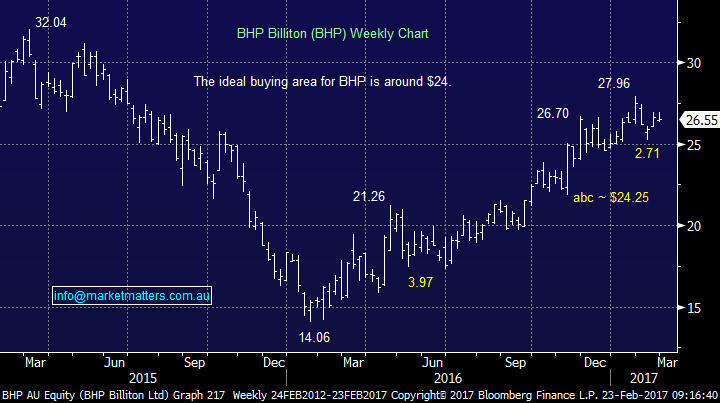

After last night's trading in the US, BHP is looking to open down ~70c (2.7%) at $25.83 which is a large fall with no significant moves in commodities, or US stocks. As we mentioned earlier the market feels very ready to take profits on stocks which have run hard since the US election. Putting this in perspective for coming weeks:

1. We are targeting a pullback in BHP to challenge the $24 area i.e. almost 10% below yesterdays $26.55 close. We are likely buyers of BHP under $24.50.

2. We remain short FMG targeting a move to at least $6, well over 10% lower. We are likely buyers of FMG under $6.

If these 2 corrections unfold in these large big cap resource stocks it's hard to imagine the ASX200 powering over 5800 in the short-term.

BHP Billiton Weekly (BHP) Chart

Fortescue Metals (FMG) Weekly Chart

Lastly, taking a quick look at our VOC position which has caused us the most discomfort since our inception. After yesterday's report and more importantly upbeat guidance moving forward we can see the current huge short position being trimmed back. While we have not hidden our desire to exit this position it's all about the optimum level, we can easily see a rally towards the $6 area where we are likely to reduce / sell our position. Obviously this level may be tweaked over coming days / weeks. For a run down of yesterday’s result, see our report yesterday afternoon.

Vocus (VOC) Weekly Chart

Conclusion

Three simple messages:

1. We are neutral banks at current levels.

2. We remain negative resources targeting a correction of around 10% before we become buyers.

3. We will look to reduce / sell our VOC position close to the $6 level.

Overnight Market Matters Wrap

- The US share indices closed mixed with marginal change, with the Dow hitting another all-time high.

- All eyes were on the US Fed officials’ comments, mentioning that they are likely to raise interest rates fairly soon, but are confident that any rate rises will be gradual.

- Companies reporting today include Crown Resort (CWN), Ardent Leisure (AAD), Qantas (QAN) and Platinum Asset Management (PTM).

- The ASX 200 is expected open 15 points lower, towards the 5,790 area as indicated by the March SPI Futures this morning. Note it is February Equity expiry this afternoon.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here