5 trades / plays we like for March & April (BHP, NAB, ORE, CBA, TPM, MQG)

The ASX200 looks set to open up around 10-points this morning following a solid performance by Wall St, although resources are likely to struggle following a slightly concerning bounce by the $US e.g. BHP is trading -0.5% in the US.

Overall markets are following our anticipated path for March / April after the first 10-days i.e. we have been looking for choppy advance to fresh 2018 highs for global stocks before MM expects to significantly increase our cash position within both of our portfolios.

- Over the last 10-years the All Ords has gained an average +3% in March / April before tumbling -4.7% in May / June.

Hence at this point in time we are sticking with our short-term bullish outlook for global stocks while remaining very mindful of our medium-term view which is for a +20% correction commencing this year.

MM’s action plan moving forward has remained the same for the last few weeks following our aggressive buying exactly one month ago. Refer to Wednesday’s report covering the MM Growth Portfolio – click here

Hence today’s report focuses on 5 opportunities that subscribers may want to consider to add value “around the edges” as we intend to sit on our hands, from an investment perspective, for a few more weeks at least – MM is currently holding a 9% cash weighting in our Growth Portfolio.

In our view, investors / traders may not actually need to play in the more speculative areas of the market and get hurt by unscrupulous promoters such as those from GetSwift (GSW) or Big Un (BIG) - some great alpha (performance) to a portfolio can be regularly attained from the major ASX200 stocks.

Active investing / trading is simply about sensible and evaluated risk / reward.

ASX200 Chart

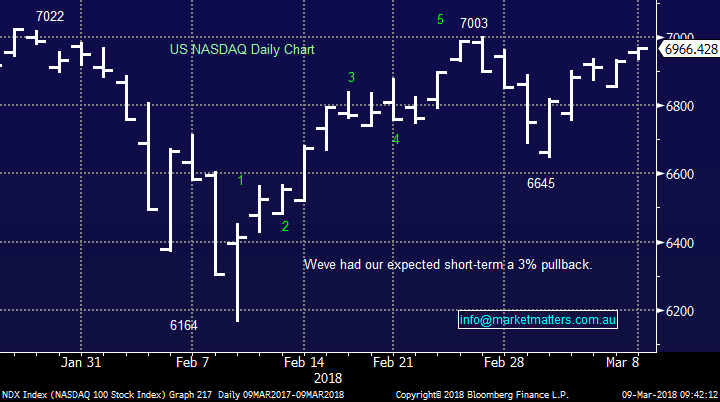

Interestingly last night the tech-based US NASDAQ, in our view market leading index, again made fresh highs for the month and traded within 0.7% of its all-time high – a clearly positive sign.

US NASDAQ Chart

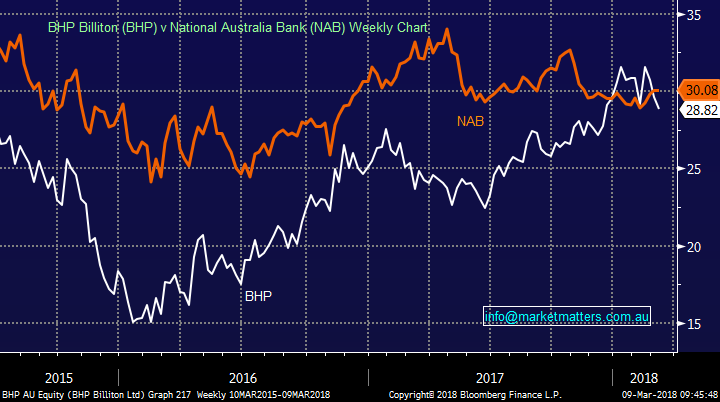

1 Buy NAB $30.08 and sell BHP $28.82

Firstly, looking at our live “trading idea’ which we outlined in the Weekend Report on the 25th of February (click here), since then NAB has rallied 30c while BHP has fallen just over $1.10 after taking into account its US55c dividend paid yesterday.

- We still believe this position has further to unfold and would be sitting back and holding for now – we expect another $1 relative performance change at least from +BHP / -NAB.

BHP v NAB Chart

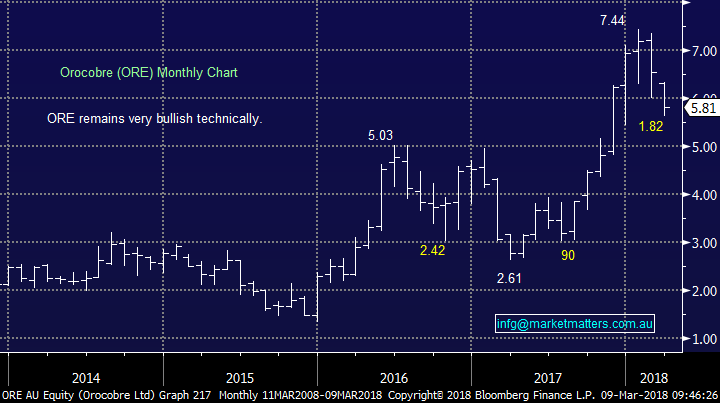

2 Lithium giant Orocobre (ORE) $5.81

ORE has been on our radar over recent weeks since we realized an excellent profit back on the 29th of January, at around $7.30. The subsequent pullback has been deeper than we expected but its providing an excellent opportunity with the lithium producer – a sector we like moving forward.

- Buy ORE around $5.80 target above $7 with stops below $5.40 – a healthy 3:1 risk / reward profile.

Orocobre (ORE) Chart

3 Buy Commonwealth Bank (CBA) $76.17 – boring but looks great!

CBA is likely to make fresh highs for the month today, above $76.39 a very bullish sign statistically in the most seasonally bullish period for our banking sector.

- Over the last 10-years CBA has gained +6.77% during March / April which targets $81.56.

The Australian banks have been out of favour recently as many pundits predict our property markets imminent demise but its treading water and we can see some of the weak bears falling on their swords in the coming few weeks if we see more of solid auction results.

- Buy CBA this morning targeting over $80 with stops below $74.80 – another healthy 3:1 risk / reward profile.

NB Stops are simply placed where you are wrong, not about how much $$ you are prepared to lose, in this case if CBA makes fresh lows for March.

Commonwealth Bank (CBA) Chart

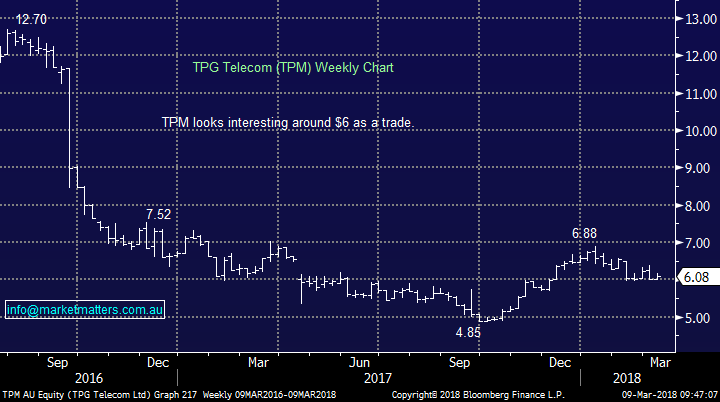

4 TPG Telecom (TPM) $6.08

In our opinion this is undoubtedly the riskiest of our 5 calls today, although because its fallen so far often the one investors find the easiest to follow.

We like the telco sector moving forward on a relative basis - being with the crowd may feel comfortable but it’s not often good for the bottom line.

- Buy TPM around $6 targeting $7 with stops below $5.80 good 4:1 risk / reward but it should be to take on such a counter trend position.

TPG Telecom (TPM) Chart

5 Macquarie Group (MQG) $104.02

We believe MQG will make fresh all-time highs in the very near future – we’re long and happy! Its strong correlation to US indices which are again looking excellent adds weight to this opinion.

- Buy MQG below $104.50 targeting over $110 with stops below $101.60 – note only ok risk / reward but the bullish trend is very strong.

Also, once / if MQG breaks above $105.60 technically stops could be raised to $103.80 making the risk / reward more attractive!

Macquarie Group (MQG) Chart

Conclusion (s)

Considering our bearish medium-term outlook for stocks we need some enticing risk / reward to take on new short-term longs at this point in time, todays 5 examples satisfy the criteria for aggressive shorter term players.

*Watch for alerts.

Global Indices

US Stocks

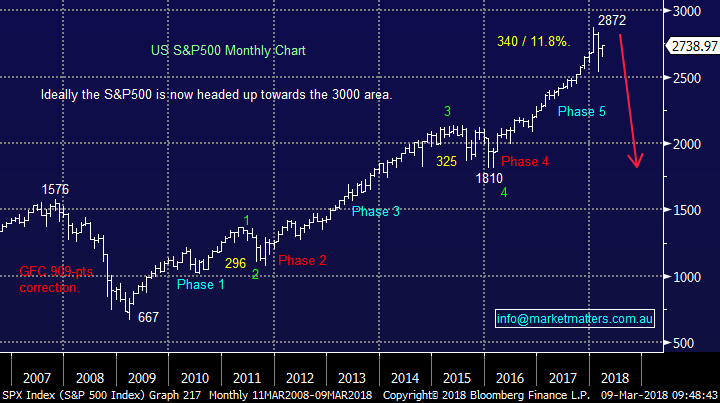

The US market is currently dancing to our tune and we believe it will rally another +8% from current levels duringr March / April.

US Dow Chart

US S&P500 Chart

European Stocks

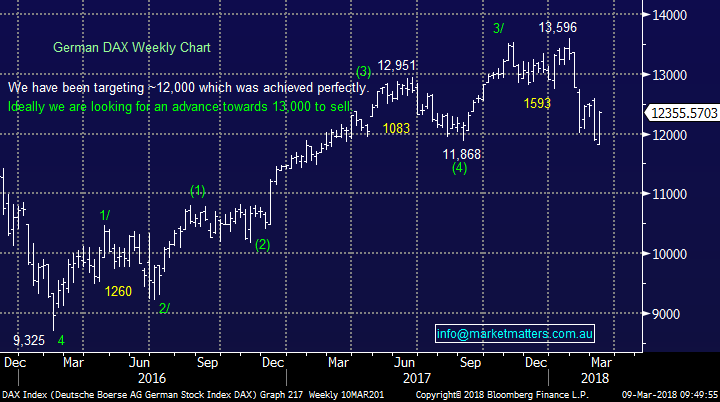

No major change we are now targeting around the 14,000-area for the German DAX before we will turn bearish.

German DAX Chart

Asian Stocks

Similarly, to western global indices the Hang Seng corrected over 10% and looks good from a risk / reward perspective around 30,500.

The more time the market can spend around 31,000 the stronger it will look technically.

Hang Seng Chart

Overnight Market Matters Wrap

· The US equity markets rallied late in the session following President Trump’s comments of its imposed aluminium and steel import tariffs, however has excluded its allies such as Australia.

· Commodities suffered overnight on concerns the tariffs will lead to tit-for-tat responses from the ECB and China leading to an escalating trade war. Gold, oil, copper and iron ore prices continued their pullback, with iron ore in particular under pressure, falling over 3% to US$73.2/t.

· Not surprisingly both BHP and RIO weakened in the wake of the falls with RIO down over 2% in US trading. BHP in the US closed an equivalent of -0.45% to $28.69 from Australia’s previous close, however we anticipate BHP to perform better locally.

· The March SPI Futures indicating the ASX 200 to open 11 points higher this morning towards the 5955 area.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/03/2018. 9.30AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here