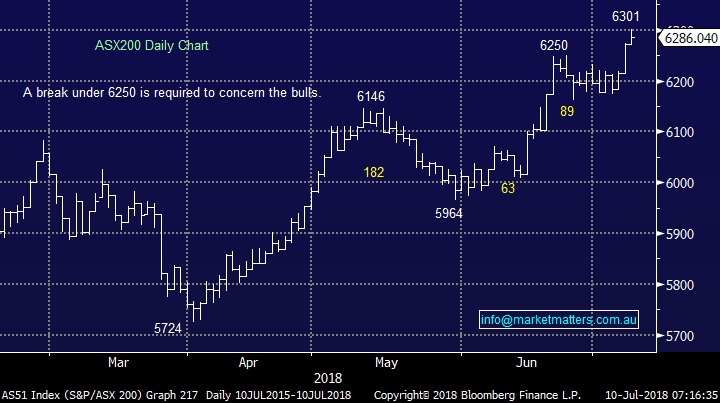

5 Stocks that may Rally Strongly into a “FOMO” Blow-Off Top for Stocks (CGF, OZL, VOC, CCL, TWE)

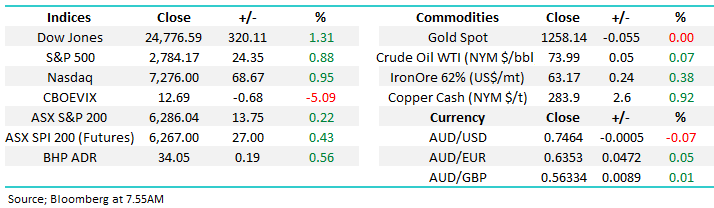

The ASX200 had an ok session to kick off the week, gaining +0.2%, again closing at fresh decade highs, although the day felt pretty insipid considering global markets were both strong on Friday night and in the futures markets during our time zone e.g. the Dow futures were up ~125-points when we closed. Volumes were light as expected with school holidays having their usual impact which probably explains a large part of the lacklustre feel.

We should never underestimate markets especially when they are breaking out from a prolonged trading range, let’s consider the below simple numbers for 2018:

- The average monthly range so far in 2018 is 249-points, with the lowest being January at 159-points.

- So far, the seasonally bullish July has rallied only 127-points from a low of 6174.

- Hence assuming 6174 remains the low for July the high is likely to be closer to 6400 than yesterday’s 6301 high.

At MM we have been expecting a major top in 2018 / 2019, but we must never underestimate markets including how far stocks can “blow off” if the “Fear of Missing Out” (FOMO) kicks in, especially for underweight fund managers who are gauged by how they perform against the benchmark index.

- Short-term MM is positive the ASX200 with a close below 6250 required to switch us to neutral / bearish, however we remain in net “sell but very patient mode”.

Overnight, stocks followed through on their strong futures lead during our time zone with the broad based US S&P500 gaining +0.88%, led by the financials which gained over 2% while the interest rate sensitive utilities fell over 3% i.e. markets remain optimistic around global growth as the US earnings season approaches.

Today’s report is going to look at 5 stocks that MM believes could pop higher if we see panic style buying of stocks (FOMO) over the next 1-2 months – we hold a fairly large cash position in our Growth Portfolio plus small negative facing ETF positions, hence we are not afraid of picking up 1, or 2, stocks for potential quick gains if the risk / reward profile look attractive. We have also deliberately looked for stocks with a relatively low market correlation, or Beta.

N.B. We often discuss the elastic band effect on markets caused by extreme “optimism & pessimism” how about this example I saw today – before the football World Cup they had to cut the price of Category 1 tickets for the final to $US550 due to the general lack of interest, but today even though Russia are out with “euphoric” England in the semi finals, the same tickets are now closer to $US5000!

ASX200 Chart

1 Challenger (CGF) $12.02

CGF is Australia’s annuity provider i.e. it turns a retiree’s capital into a guaranteed source of income. The long-term future looks good with the number of retirees projected to increase by ~75% over the next 20-years. However if / when stocks become volatile / correct, Challenger is likely to struggle given the mis of assets it holds to underpin it's future liability.

So far 2018 has been pretty tough for CGF, even in a rising market, with the stock down over 14% since the end of last December. The stocks trading on a P/E of 17.8x estimated earnings, while yielding almost 3% fully franked – nothing too scary there. From current levels we believe CGF could offer a good proxy for a quick pop higher in stocks.

- We like CGF around $12 with stops below $11.60 – excellent risk / reward.

Challenger (CGF) Chart

2 OZ Minerals (OZL) $9.25

The bullish resources cycle has been in full swing for 31-months now and we believe its heading into its final stages, but it doesn’t feel dead just yet. The headlines around M&A remain bullish although this is usually the case as this very cyclical sector matures.

M&A activity remains on the rise – typically better for targets than acquirers and there is serious talk that goliath RIO is searching -“RIO would be willing to fork out a large premium over market value (i.e. to pay 30-40% premium over any prime target’s mkt value) to secure a prime asset as it tries to reduce its reliance on iron ore,” - we know it’s a big call BUT perhaps copper play OZL is one of those companies under the microscope, its large enough to make a difference to RIO.

At MM we’ve been looking to buy OZL below $9, unfortunately it spent less than 10-minutes there last week after correcting 16% following the copper price lower. However, the stock remains attractive to MM at current levels if we maintain entry flexibility.

- We like OZL at current levels if we leave enough ammunition to average if the opportunity presents itself around $8.80.

OZ Minerals (OZL) Chart

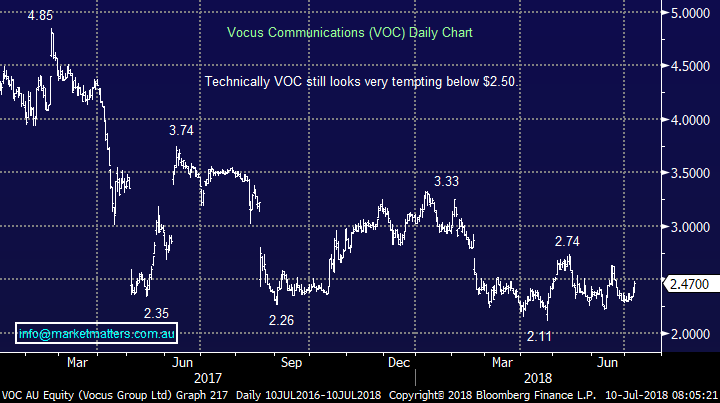

3 Vocus (VOC) $2.47

As many subscribers know, Vocus has not been our most successful vehicle at MM, but it looks very attractive on a risk / reward basis at current levels. Undoubtedly VOC has struggled badly over the last few years, but its ~12% short position and potentially cheap status may be catching a few fund managers eye:

- We like VOC as an aggressive play around $2.50 with stops below $2.35 i.e. excellent risk / reward.

Vocus (VOC) Chart

4 Coca-Cola Amatil (CCL) $9.73

At MM we have disliked CCL for most of the last 5-years which has proved a successful call, but today the stock is generating excellent buy signals targeting a test of $11, over 10% higher. While the fundamentals do not excite us at MM primarily with sugar issues set to linger investors should never ignore what the market is telling us.

- We like CCL technically with stops below $9.35 i.e. excellent risk / reward.

Coca Cola Amatil (CCL) Chart

5 Treasury Wines (TWE) $18

TWE has had a volatile year in a similar manner to A2 Milk i.e. successful companies cannot soar forever, in this case the concern was around a supply glut of wine in China caused by TWE itself. However the stock has shrugged off the bad news and looks capable of making fresh highs above $20.50.

- We like TWE as an aggressive play around $18 with stops below $16.90 i.e. solid risk / reward.

Treasury Wines (TWE) Chart

Conclusion

We like the 5 stocks outlined above especially because they largely have a low correlation to the ASX200 i.e. they run their own race.

Our order of preference is : OZL, CGF / VOC, CCL and TWE.

*Watch out for MM alerts.

Overseas Indices

The tech-based NASDAQ is trading very close to its all-time high while the Europe although less certain feels close to regaining its positive stance.

The S&P500 is rallying the main question to MM is does it break 2872 before failure, now less than 4% away.

US S&P500 Chart

The German DAX is very close to generating an excellent buy signal potentially targeting ~14,000 i.e. significantly higher. Even the UK rallied +0.9% last night shaking off more damaging news around BREXIT.

- Europe looks set to play catch up with the US in the coming weeks.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets hit a three-week high as investors focused on the coming earnings season. Treasuries however fell, with 10-year yields rising four basis points to 2.86% while the dollar index bounced slightly from intraday lows.

· Oil and gold both advanced, while base metals were stronger, with copper rebounding nearly 2% for the first time since the recent selloff. BHP is expected to outperform the broader market again after ending its US session up an equivalent of 0.58% from Australia’s previous close.

· On the domestic financial front, Macquarie Group (MQG) has joined the ranks of lenders, lifting their variable mortgage rates and turning the spotlight to the big four banks and how they may manoeuvre to protect profit margins.

· The September SPI Futures is indicating the ASX 200 to hit fresh decade highs yet again, up 35 points towards the 6320 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here