5 stocks on our radar to buy into weakness (ILU, OZL, BHP, A2M, FMG)

The ASX200 has struggled over the last 2-days declining 1.6% from its weekly high with the “yield play” and high valuation stocks leading the decline. Basically, it feels like the local market has lost its recent “mojo” for now. This morning US stocks are again up nicely to fresh all-time highs, BHP is trading up ~60c in the US but our futures imply the local market will open unchanged. While it’s hard to see the recent weakness continuing today, the Australian market is certainly embracing any bad news with open arms.

Perhaps overseas investors are taking advantage of the bounce in the $A (almost 79c) to sell local stocks as they remain concerned as to the implications of a widening yield differential between Australia and the US in 2018 i.e, US rates going higher / faster than rates locally.

The ideal technical area for us to step up and start putting our large cash position to work for the Growth Portfolio would be in the 5900-5950 region, or 1.5-2% lower.

ASX200 Daily Chart

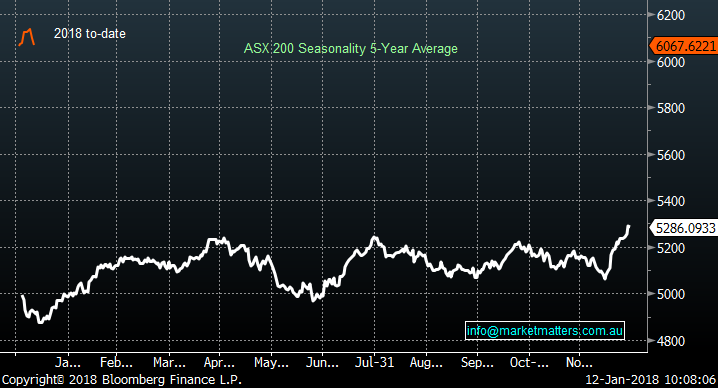

The below seasonality chart illustrates how it’s actually common for the local market to struggle into the end of January before advancing into the classically weak April / May period. This adds comfort to our planned purchase of a pullback over the coming 1-2 weeks.

ASX200 December Seasonality Chart

5 stocks on our radar to buy

1 Iluka Resources (ILU) $9.85

ILU is a mineral sands company which we have not covered for a while but after the last 2-weeks 6% decline it has popped back up on our radar.

We are keen buyers of ILU in the $9 region, almost 9% lower but its important to be prepared.

Iluka (ILU) Weekly Chart

2 OZ Minerals (OZL) $8.87

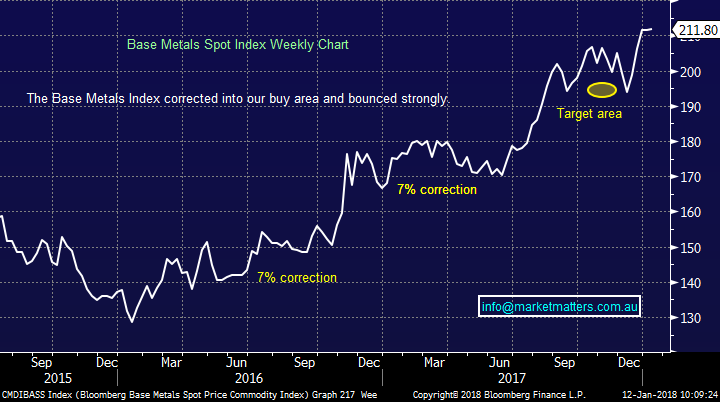

The copper focused Australian miner OZL is a very tricky stock to identify perfect entry levels but its volatility does offer some excellent opportunities on a regular basis. Yesterday OZL closed 2.5% below where we took profit on our most recent position exited in late December. The question is where to buy and considering we can easily see a 5% correction in base metals at this stage we will be fussy.

We are looking to buy OZL around $8 and $7.50 i.e. looking to average into weakness.

OZ Minerals (OZL) Daily Chart

Bloomberg Base Metals Weekly Chart

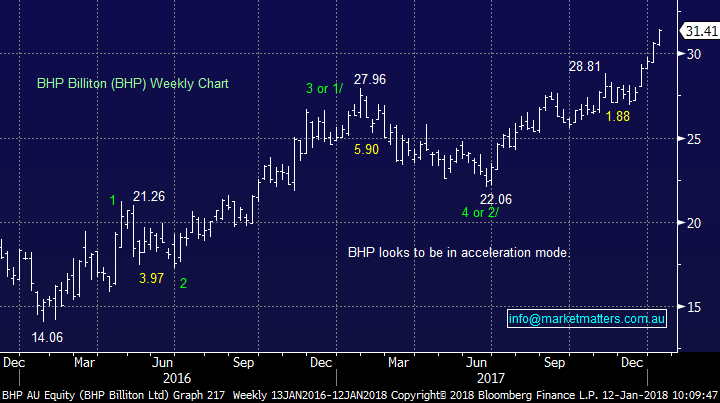

3 BHP Billiton (BHP) $30.84

We’ve discussed BHP a few times recently but the fact remains we are looking to buy the stock.

At this stage we are considering two approaches but considering our view around base metals a little patience will be maintained for now.

- Buy around $30 with a view to adding at $29.

- For the more sophisticated trader a buy / write at market may be the play e.g. buy BHP and sell the March 33.01 calls (European).

BHP Billiton (BHP) Weekly Chart

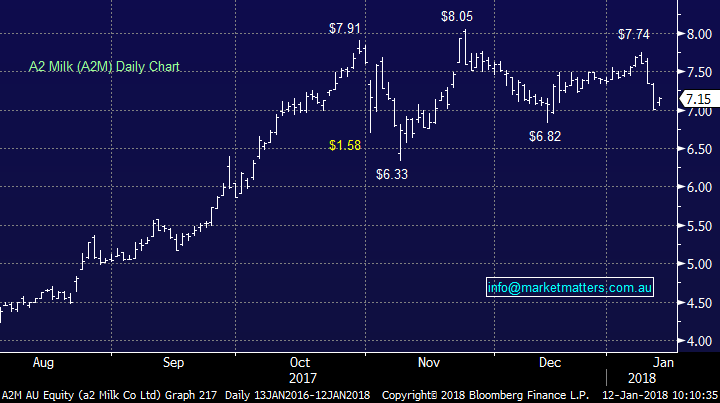

4 A2 Milk (A2M) $7.01

A2M is another stock we have discussed recently and as we outlined in yesterday’s afternoon report we are buyers of A2M around the $6.50 area.

A2 Milk (A2M) Daily Chart

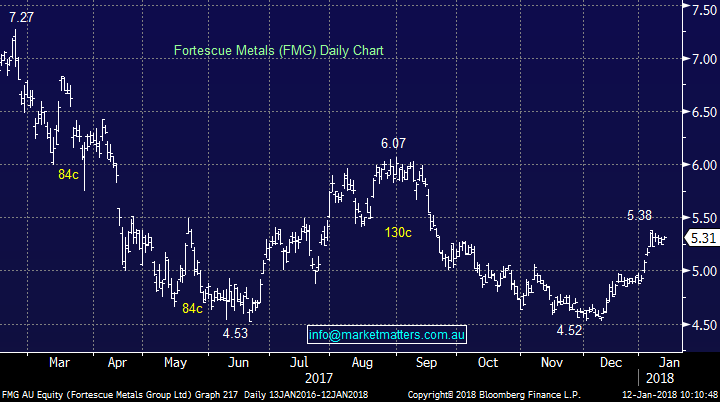

5 Fortescue Metals (FMG) $5.25

We took a relatively small ~8% profit in FMG close to $5 in late December on an active position, this has now proved to be premature. However, we are not too proud at MM to admit when we get something wrong and potentially buy a stock at a higher level than we previously sold – it’s all about making money not ego!

We believe FMG now looks set to reach at least $5.50 with a nice fully franked dividend looming in early March. Aggressive traders may buy FMG under $5.20 via stock, or options targeting a quick rally.

Fortescue Metals (FMG) Daily Chart

Global Indices

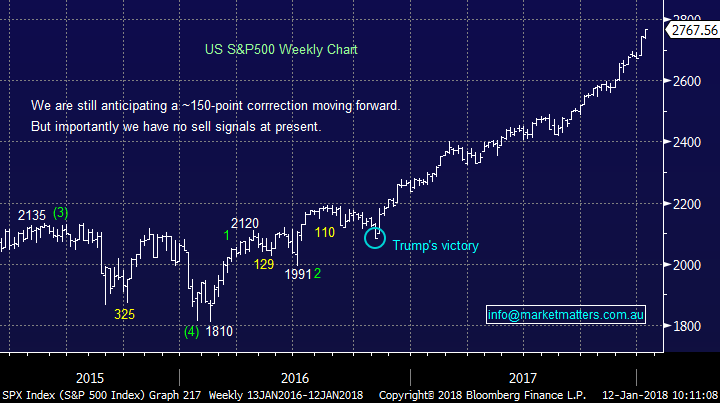

US Stocks

US equities continue to rally higher with no sell signals being generated and potentially bad news being ignored. It feels like we are seeing some rotation out of bonds into stocks creating strong underlying demand.

Overall there is no change to our short-term outlook for the US market, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

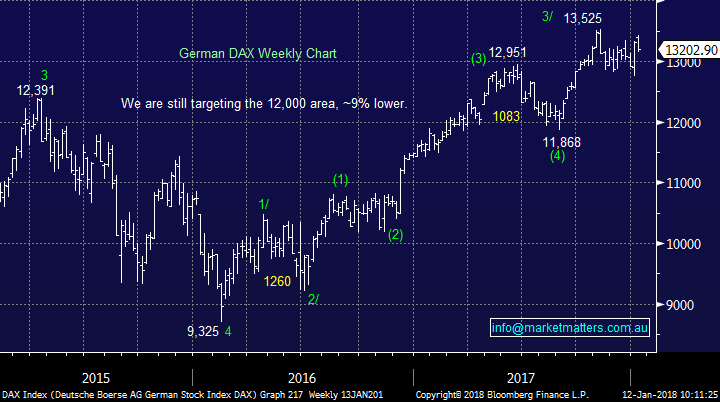

European Stocks

No major change with our preferred scenario for the German DAX a 9% correction back towards the 12,000 area for excellent risk/reward buying – a pop over 2017 highs first still feels likely.

German DAX Weekly Chart

Conclusion (s)

We are potential buyers of ILU, OZL, BHP, A2M and FMG as outlined above.

Overnight Market Matters Wrap

· The US equity markets resumed their recent ascend, where reaching an all-time high is a norm to investors as of late.

· The energy sector roared, as we experienced oil futures climbing ever so higher, while the volatility (fear) index remains far below complacency.

· Our little Aussie battler, AUD remains to test the US80c handle as we continue to be surprised with better than expected Aussie economic data as of late.

· The March SPI Futures is indicating the ASX 200 to open 14 points higher towards the 6080 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here