5 stocks adding weight to our bullish Christmas picture (ANZ, CSL, COH, A2M, XRO)

The ASX200 soared higher yesterday finally closing up 77-points / 1.4% with strength across the board but from a points perspective gains were headed by our largest company CBA which advanced $1.65 / 2.4%. In fact the only noticeable weakness on the day was from the safe haven of the gold sector which gave the thumbs up to our exit from Newcrest Mining (ASX: NCM), at least for one day!

Finally stocks have taken the positive side of the news flow focusing on improving US – China trade relations while Theresa May won a no confidence vote smack on 8am our time which corresponded with the US close of trade. Interestingly, the market largely ignored President Trumps former lawyer and “fixer” being jailed for 3-years, obviously the New York property mogul may have problems in the years ahead but it’s not particularly worrying stocks today.

As the market ground higher throughout the day it had that bullish inevitability feel about it as sellers looked to have taken an early Christmas vacation. Putting things in perspective we have only enjoyed a 104-point bounce from the 12.6% savage 824-point decline from the highs of August but we’ll take “any port in a storm” at the moment. We continue to feel the ASX200 has finished its 5-month leg lower and a decent bounce is due and probably underway – interestingly, a classic 50% bounce takes us to the 5960 area.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900 area – still feels a long way off.

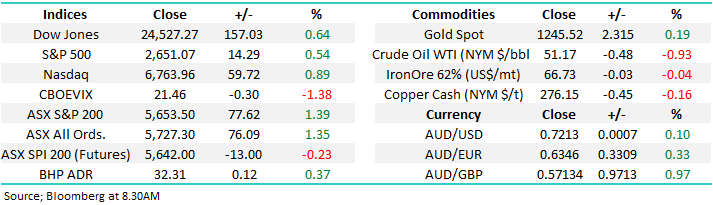

Overnight the Dow finally closed up 157-points surrendering 300-points of earlier gains. The SPI futures are actually calling the ASX200 down 10-points following the late selling in the US while BHP closed mildly positive on the US ADR’s.

Today’s report is going to look at 5 stocks which are adding weight to our short-term bullish outlook.

MM is in “sell mode” but we’re still anticipating higher levels.

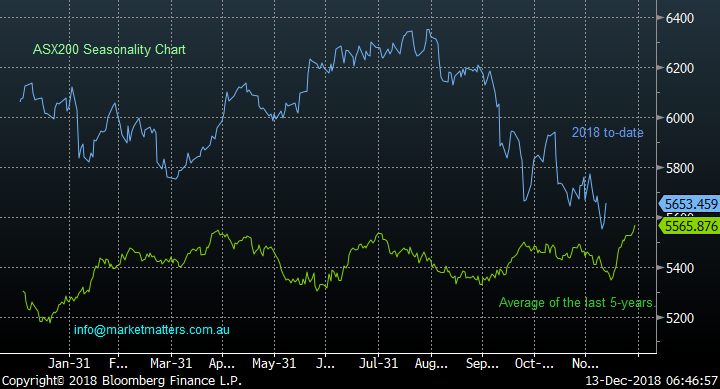

ASX200 Chart

The ASX200 kicked higher yesterday smack on cue with its usual seasonal timing, the important point to keep remembering is the index usually tops out in the last 48-hours of December but not all stocks move exactly in line with the overall market.

ASX200 Seasonality Chart

Following on from yesterday’s look at the comparison with 2018 and 1994, which pointed to a strong stock market recovery commencing this week, we’ve added a simple statistic to the bullish mix: The US S&P 500 Index fell over 4% early this month, when this occurs its usually a great time to buy. In fact 90% of the time around 3-weeks later the markets usually regained almost all of these losses – this should add solid support to local stocks.

However, as we saw last night markets remain nervous / skittish hence any recovery is likely to be choppy in nature – an important consideration when making short term buy / sell decisions.

The S&P500 Chart

5 stocks that look bullish today

We have deliberately looked at some market heavyweights that have been very influential during the local markets recent aggressive decline.

We did notice that the resources still don’t look particularly exciting.

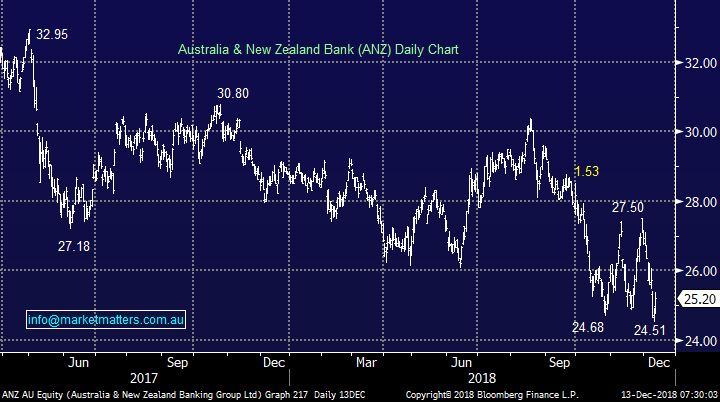

1 The Banks

The banking sector is the most dominant part of our index with the “Big Four” making up almost 22% of the ASX200.

Recently we’ve seen some large financial institutions becoming more positive the sector, one calling it 30% undervalued, and some even calling the Australian housing market worries overblown – we believe fund mangers are underweight the sector and a squeeze higher is easy to imagine e.g. CBA yesterday on the expectation that could launch a reasonable share buy-back, a topic we’ll cover at some point soon.

MM has not been shy with our outperform call on the banks and their sustainable yield into 2019 - following the recent panic lows the technical picture is now looking good.

We are bullish ANZ targeting ~$27, around 7% higher.

ANZ Bank (ASX: ANZ) Chart

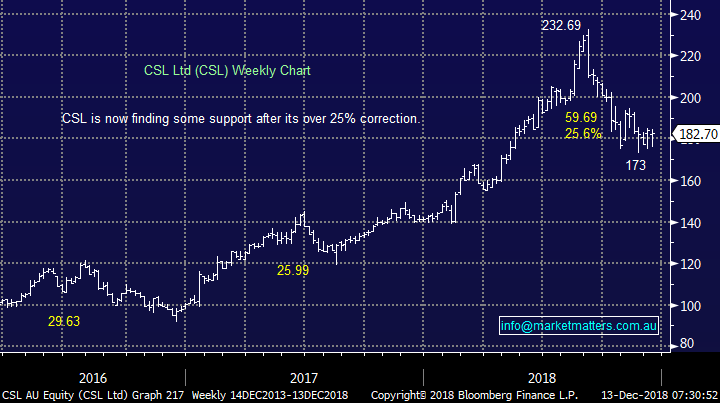

2 CSL Ltd (ASX: CSL) $182.70

Heavyweight CSL is now the 4th largest stock in Australia making up almost 5% of the ASX200.

Nobody questions the companies quality but like anything, valuation is the clear variable. While we clearly bought CSL too early in its decline we now like the picture.

MM is bullish CSL, looking for a move above $190, around 5% higher in the short term.

CSL Ltd (ASX: CSL) Chart

3 Cochlear (ASX: COH) $170.44

COH is a similar story for MM with us having caught this falling knife too early. Another quality business that was too expensive but we believe the elastic band has now stretched too far on the downside.

Technically COH looks bullish targeting ~$185.

MM is bullish COH short-term, looking to cut our position around $185, or 8% higher.

Cochlear (ASX: COH) Chart

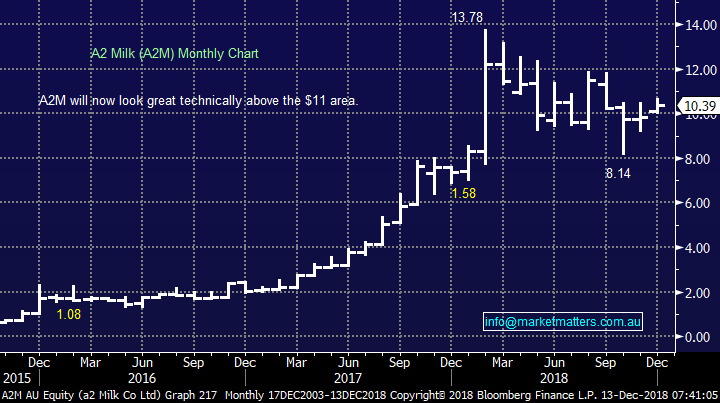

4 A2 Milk (ASX: A2M) $10.39

A2M has been a glamour stock of the last few years and its slowly regaining its lustre. Another growth stock which looks set to regain a significant portion of its 2018 weakness.

MM is bullish A2M targeting at least $12, well over 10% higher.

NB This bullish picture will be negated by a break back below $10 – i.e. good risk / reward for the traders.

A2 Milk (ASX: A2M) Chart

5 Xero (ASX: XRO) $39.30

Lastly XRO which MM owns from lower levels and its looking excellent targeting the $43 to $45 area – yet another growth stock slowly coming back into favour.

We are bullish XRO targeting $43 minimum, or 9% higher.

Xero (ASX: XRO) Chart

Conclusion

MM is bullish the ASX200 into January with the growth, healthcare and banking stocks looking especially bullish.

Overnight Market Matters Wrap

· The US rallied higher overnight, following a WSJ report that the US and China were making progress towards resolving their ongoing trade dispute, only to lose some steam towards the end of its session following Britain’s Prime Minister, May voted in for confidence, where traders believe that Brexit will ultimately happen.

· On the commodities front, crude oil lost 0.93%, while gold gained little. We expect BHP to outperform the broader market, after ending its US session up an equivalent of 0.3% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 14 points lower towards the 5640 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.