3 stocks who enjoy a rising $A (NCM, JBH, HVN, WES)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Yesterday we saw results from CIP & COF which were out a day early, while today we have NCK & MGR.

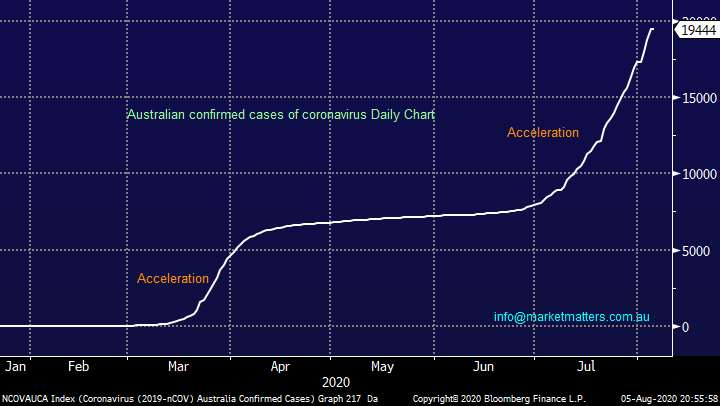

The ASX200 slipped back to the 6000 area on Wednesday with 60% of the index closing down on the day. The Resources Sector was the only shining light under the hood with strength in most pockets although gold was the standout top performer. Conversely healthcare was the weakest sector courtesy of a -1.8% decline by heavyweight CSL Ltd (CSL) plus the likes of Cochlear (COH), Ramsay Healthcare (RHC), ResMed (RMD) and Healius Ltd (HLS) all fell by over -2%.

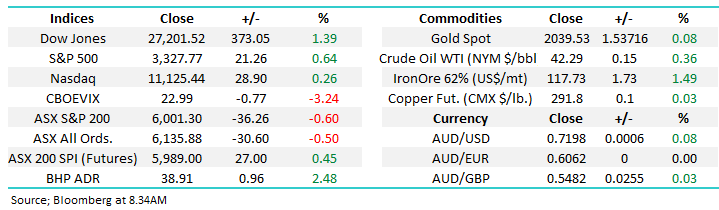

Discussing the virus is becoming increasingly repetitive but while its dominating Australians way of life, most conversations and the underlying market confidence it obviously requires a mention. The chart below illustrates how bad the 2nd wave has become with Victoria the major contributor – our number of cases has already more than tripled since July and yesterday saw another record number for Victoria, while we know the “Stage 4” lockdown in Melbourne should start to help the statistics later next week the peak may still be a few days away.

Globally things remain dire with over 18.6m reported cases of which more than 25% are in the US, also the total number of global deaths has now exceeded 700,000, significantly worse than many of us anticipated a few months ago. As this highly contagious disease continues to wreak havoc on the worlds social fabric I was intrigued to hear a number of news services discussing the possibility that a vaccine may never be found i.e. pessimism is on the increase, or perhaps just realism, time will tell.

MM believes Australia can again flatten the curve by September, but the disturbing question is then what?

We keep saying “never say never” in 2020 and the coronavirus has shown us how things can change in a heartbeat but on a fun note today it snowed in Launceston overnight for the first time in 100-years! We have a few clients in Launceston, so I hope you’re enjoying the historical event.

Australian confirmed cases of COVID-19 Chart

This morning should see the local market regain most of Wednesdays losses with BHP and the Energy Sector likely to add a major tailwind following oils rally back above $US43/barrel in the US – BHP is set to open around $39 this morning, up ~2.7%. The ASX200 may remain glued to the 6000 area but an improving situation in Victoria might just be the required news to provide the impetus for stocks to enjoy a breakout to fresh 5-month highs, assuming of course NSW & QLD keep on top of things. We remain neutral short-term at MM until an obvious catalyst to adjust the current comfortable state of equilibrium unfolds.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

All the ducks have aligned for gold with central banks pumping liquidity into circulation, interest rates at their lowest levels in history plus COVID-19 has created enormous uncertainty across the world, hence gold has rallied ~70% since mid-2018. However as is always the case not all stocks enjoy the full benefits of a significant positive macro backdrop usually due to operational issues, hedging production and the like, the obvious Australian gold company being heavyweight Newcrest Mining (NCM) which remains below its 2019 high even as gold has appreciated ~40% over the same period.

We often say that a market that doesn’t rally on good news is a weak market but there becomes a time when things go too far and MM now believes NCM is the best value stock in the sector. However even as gold surged above $US2050/oz gold stocks in North American struggled to remain positive as the “crowded trade” we’ve been concerned around still feels in play, we were too pedantic ~$32 I feel now is definitely not the time to be chasing the stock / sector due to the “Fear of missing out” (FOMO).

MM remains bullish NCM looking for ideal risk / reward entry.

Newcrest Mining v Gold ($US/oz) Chart

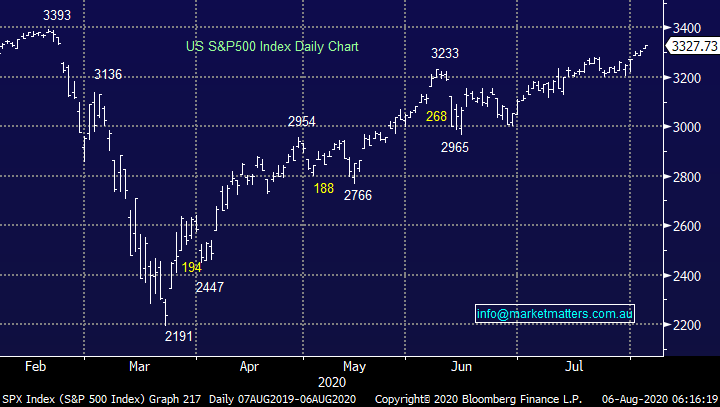

Overseas Indices & markets

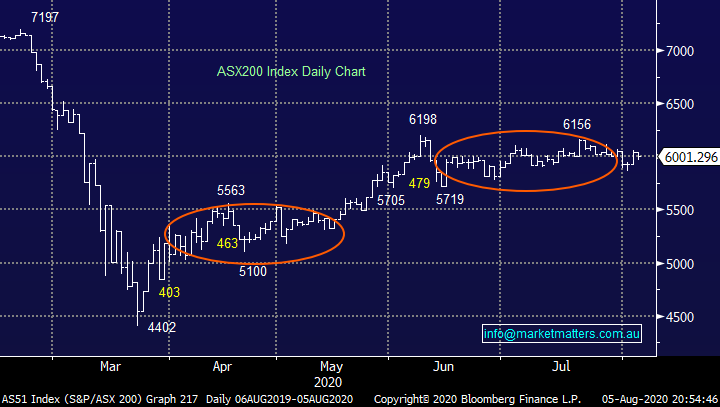

US stocks enjoyed another strong night on Wall Street with the S&P500 now only 2% below its all-time high, what virus! I’m just glad the US (according to President Trump) is doing better than the world in terms of deaths!!

The small cap Russell 2000 was the outperforming index rallying almost 2% to heights not scaled since March, this catch up implies to us that investors continue to struggle to find areas to invest their large cash levels i.e. its hard for a market to fall when the majority are overweight cash looking to buy bargains at lower levels.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

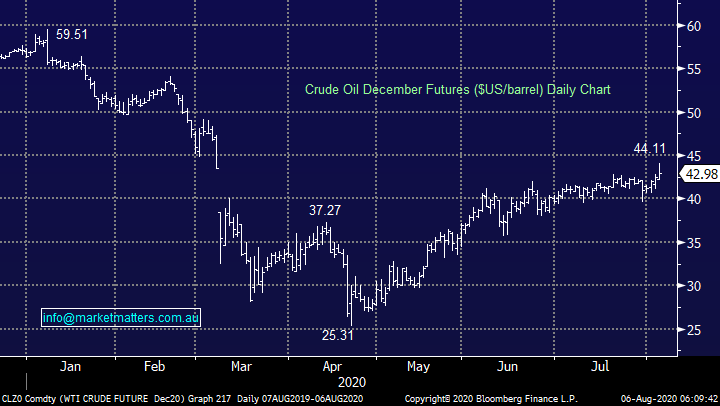

Overnight crude oil popped to fresh post-March highs defying the struggling economic back drop, interestingly the local Energy Sector has not been a true believer with most stocks still trading ~10% below their June high, fingers crossed we see some catch up as MM has reasonable exposure to a few of these names and it’s become a little frustrating of late!

MM remains bullish commodities & the “reflation trade”.

Crude Oil December Futures ($US/barrel) Chart.

3 stocks who benefit from a rising $A.

Overnight we saw another strong session for the $A and around midnight it posted a fresh 19-month high at 72.41c. We maintain our bullish stance towards the $A although after surging over 30% since March a period of consolidation feels a strong possibility. A large number of ASX big names have enjoyed the decade long tailwind of a declining $A but as the “little Aussie battler” is showing increasing signs of following our bullish view this tailwind is becoming a headwind for a number of large $US earners such as market heavyweight CSL Ltd (CSL). Other big names like BHP and RIO are hindered by a rising $A but the appreciating commodity market which is by definition supporting the local currency is more than offsetting the FX move.

Today we’ve put on our positive hat and looked at 3 stocks that benefit from an appreciating $A. It’s a simple equation, the obvious beneficiaries buy products & services that are denominated in $US before selling on in the local market in $A. Ironically it would usually help the tourism sector and local airlines but they’re on hold as we all know.

MM remains bullish and long the $A

Australian Dollar ($A) Chart

Its refreshing in todays troubled and uncertain times to be looking at markets with a “glass half full” attitude, I’ll be making an effort to maintain the bias!

1 JB Hi-Fi (JBH) $44.79.

Major music and electronics retailer JBH have performed admirably in 2020 with their excellent on-line offering, which we use regularly at MM, clearly a big help in these challenging times. We like JBH as a business and it’s a clear winner from an appreciating $A as the vast majority of its inventory are manufactured o/s. Also, for good measure is the not irrelevant fully franked yield which looks attractive compared to term deposits for the foreseeable future. However with government stimulus likely to taper off discretionary spending might follow suit, especially as most home offices have now been set up, we like JBH but a pullback towards $40 would not surprise hence the risk / reward is not exciting ~$45.

MM is bullish JBH from lower levels.

JB Hi-Fi (JBH) Chart

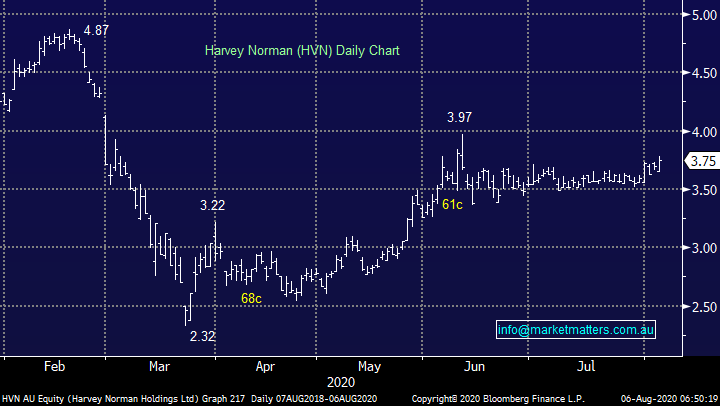

2 Harvey Norman (HVN) $3.75

Another retailer whose benefited from the establishment of the massive new trend of “working from home (WFM)” is HVN although their share price appreciation has not been as impressive as JBH. This discretionary retailer looks on track to break above $4 in the coming months, but I’m not convinced it will be a sustainable rally with discretionary spending in question post stimulus plus the company maintains a large footprint outside of electronics. Just look at the rise of Temple and Webster (TPW) as the pin up for online furniture and homeware sales, a clear threat to the HVN model.

MM is short-term bullish HVN.

Harvey Norman (HVN) Chart

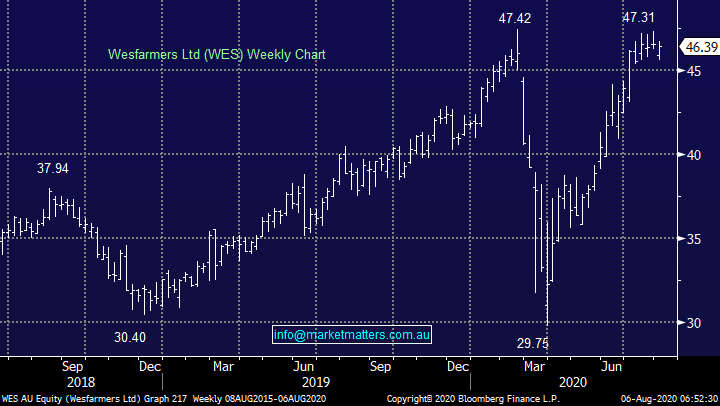

3 Wesfarmers (WES) $46.39.

Bunnings obviously have a huge number of products which are made overseas hence a strong $A helps their margins. The major retailer is trading around its all-time high showing it’s a clear beneficiary of the new coronavirus environment plus appreciating $A. We continue to believe that the WES war chest puts them in a very good position to take advantage of any Coronavirus led opportunities.

We like WES as a yield play believing any surprises to its anticipated 3.30% fully franked dividend are likely on the upside but from a growth risk / reward perspective we need lower entry levels to become very attracted.

MM remains bullish WES.

NB MM remains long and comfortable in our Income Portfolio: https://www.marketmatters.com.au/new-income-portfolio-csv/

Wesfarmers (WES) Chart

Conclusion

We like the 3 stock touched on today who benefit from a strong $A with our order of preference WES, JBH and HVN – at this stage I don’t envisage any fresh transactions in the 3.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.