3 Stocks We Like if Tax Loss Selling Kicks In!

The ASX200 again found some love yesterday following a soft open, with the market rallying 50-points from its early low to close in the black, led by the banking sector. Tax loss selling is rapidly growing in real estate, as viewed in the financial pages. Just like the end of financial year, adverts are slowly emerging in the various media outlets. Tax loss selling creates opportunities every year, the key is - use the phenomenon to achieve good entry into stocks you are looking to buy anyway and importantly, don’t just buy the stocks that had an awful year, most of them are best left alone!

After yesterday’s lacklustre list, today we have delved a little deeper into potential stocks that are down for the year as we search for potential candidates to buy if seasonal selling weakness unfolds. We have identified 3 stocks that are down for the year which we may consider buying, for very different reasons. If they sell-off over the next 1-2 weeks, they may reach our optimum entry levels i.e. let’s lay some traps and fingers crossed at least one of the stocks falls in.

The ASX200 has now corrected 327-points (5.5%) from its 2017 high on the 1st of May. We feel there is now a strong possibility the ASX200 can now recover back towards the psychological 5800 area, if we weren’t concerned about the short-term position of global markets, we would actually be ringing the bullish bell with some fervour.

ASX200 Daily Chart

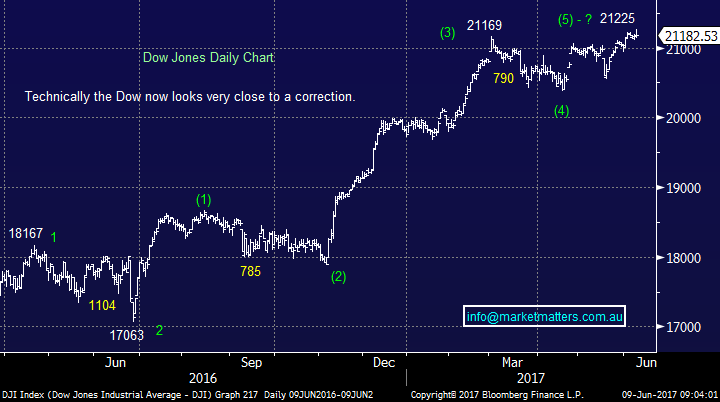

US stocks closed basically unchanged last night, which is an impressive result considering the 2 pieces of negative which are unfolding:

1. The ugly “lie accusing” of Donald Trump by James Comey at a US Senate Intelligence Committee.

2. It appears the UK may be heading towards a hung parliament following its general election, although some mixed messages now unfolding – big volatility playing out in the currency.

US Dow Jones Daily Chart

1 Orocobre (ORE) $3.82

ORE is a mineral exploration company with the prime objective to develop lithium-potassium brine projects with its flagship project in Argentina. ORE has fallen over 20% this calendar year, taking the company’s market cap. back towards $800m. This not the usual style of company that MM invests in, but the current risk / reward is looking very good if we see a pullback towards $3.30, over 10% lower.

We will consider buying ORE under $3.40 if the stock falls over the next 1-2 weeks.

Orocobre (ORE) Daily Chart

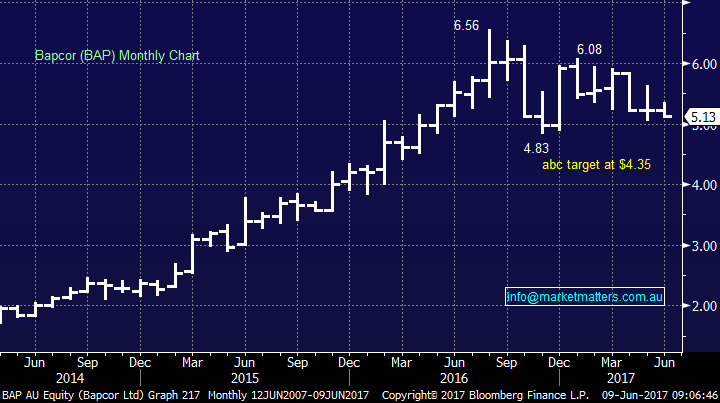

2 Bapcor (BAP) $5.13.

BAP is a Victorian based company which retails automotive parts, it has a market cap. of 1,429m. The stock is down under 5% for the year but being involved in retail may lead to it being a candidate for tax loss selling.

We will consider buying BAP under $4.50 in the next 1-2 weeks, over 12% lower.

Bapcor (BAP) Monthly Chart

3 Myer Holdings (MYR) 85c.

Myer is potentially the “basket case” stock of the 3, but it’s certainly in the headlines on a regular basis. The stock is down, close to 25% for the financial year and today is challenging its 82c all-time low, you only have to walk through one of its store to realise this is a company in trouble, it’s almost spot the customer! However, there is potential sugar coating with MYR in the form a takeover, potential from Premier Investments (Solomon Lew).

Back in March, Premier invested $101m into the structurally challenged department store, sending the stock up a few % over $1.20, here we are a few months later, a painful 29% lower. We believe there is a strong possibility of a takeover offer in 2017.

We will consider buying MYR under 80c in the next 1-2 weeks – this is a particularly aggressive play.

Myer Holdings (MYR) Weekly Chart

Conclusion (s)

Three candidates we found for tax loss selling and hence potential value buying in the next 1-2 weeks are:

1. Orocobre (ORE) under $3.40.

2. Bapcor (BAP) under $4.50.

3. Myer (MYR) under 80c.

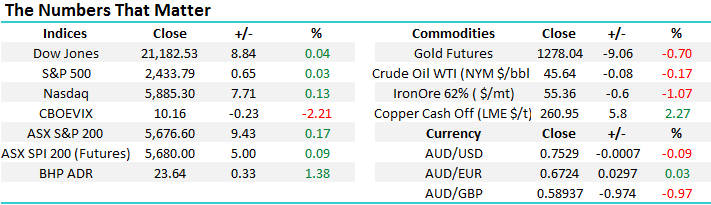

Overnight Market Matters Wrap

- Three big events overnight appeared to have little effect on global markets, with the US indices ending its session with little change, despite the former FBI Director James Comey's controversial testimony to a senate committee in which was at odds with President Trump over the reasons for his dismissal, painting the White House version as "lies".

- In the U.K. the markets closed slightly lower ahead of polls closing with expectations that the Prime Minister Theresa May's Conservatives will be re-elected, albeit an exit BBC poll was indicating she may be short of a majority. We should have an indication of the outcome by early afternoon.

- And in Europe, The ECB president Mario Draghi maintained stimulus measures in the face of slightly weaker inflation expectations albeit indicating growth outlook was balanced,

- Oil and gold prices eased back further while treasuries lost a little ground. BHP and RIO both traded firmly (+2%) in US trading after a solid rally in the copper price (+2.5%). While ASX futures are indicating a flat opening, the local market’s moves today will be impacted by the news on the UK election as the results come through during our day.

- The ASX is likely to follow the overseas trend this morning and open with little change as indicated by the June SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here