3 stocks we are considering into weakness

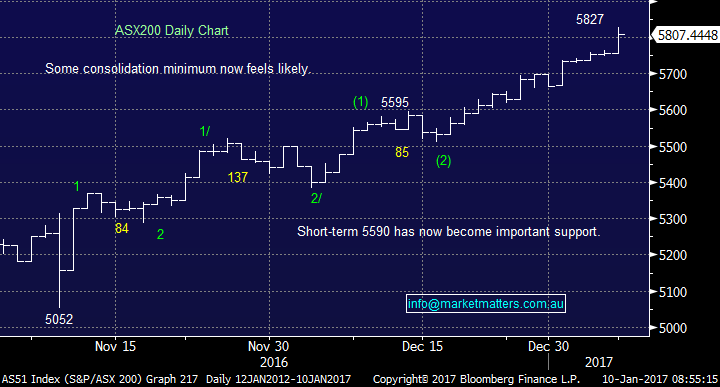

Yesterday’s intra-day strength in the local market surprised many investors including ourselves . The simple explanation for the ASX to gain over 70-points by lunchtime is money flowing into equities, which we believe is for two primary reasons - importantly not perceived value in the market. The almost impossible task is gauging how much and how far the effect will be on stocks.

- Local investors are increasing their superannuation investments prior to legislation changes in June with some of this money ending in equities.

- As the world prepares for higher interest rates fund managers are reducing their huge holdings in bonds (which depreciate when interest rates rise) with some of this money finding its way into stocks.

To estimate how far the market may advance this month we should refer to simple statistics that have served us so well in December. Since the start of 2016:

- The average monthly range was 345-points.

- The smallest monthly range was 199-points which interestingly was when the market topped for 2016 at 5611.

Hence if 5667 remains the low for the month we are highly likely to see a test of 5900 before we welcome in February.

ASX200 Daily Chart

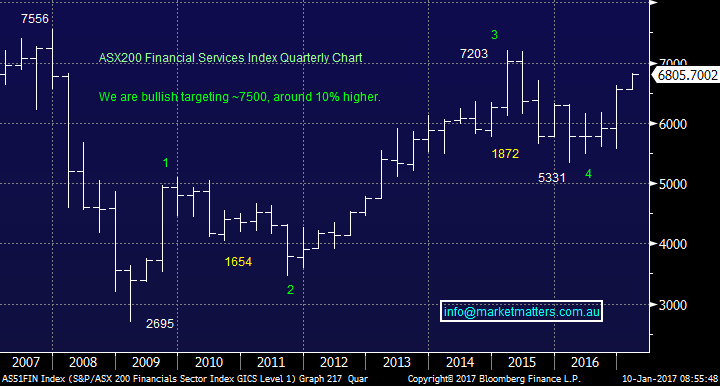

After recent profit taking we are now sitting on 36% cash and are short-term buyers of weakness / sellers of strength. Our favourite sector at present is the Financials where we already have some exposure through CBA, Macquarie, QBE and Suncorp. However we would rather be heavily overweight a sector we are bullish than spread across areas where we have little faith, plus it helps that a higher interest rate environment is positive many financials. Below we cover a couple of Fund Managers who are benefiting from inflows and an uptick in funds under management courtesy of a strong market. In most analyst models, they assume the market increases by 6.5% annually which impacts total funds under management. When we see markets do better obviously upgrades often happen.

ASX200 Financials Index Quarterly Chart

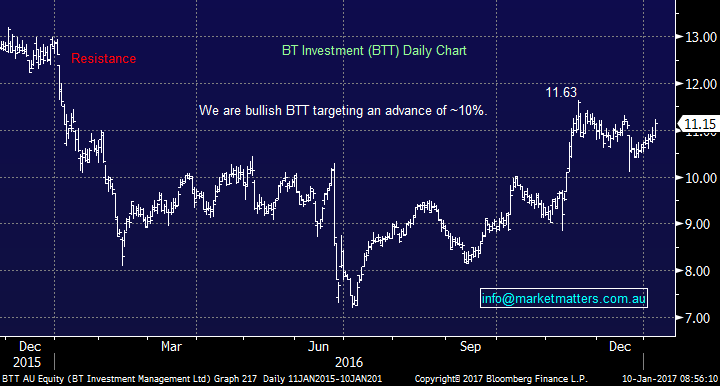

1a. BT Investment (BTT) $11.15

Fund Manager BT has recovered well since the BREXIT scare, technically the stock looks excellent targeting at least a further 10% advance.

Ideal buying of BTT is under $11 with stops under $10, only average risk / return but the degree of confidence we have in the position tips the scales.

BT Investment (BTT) Daily Chart

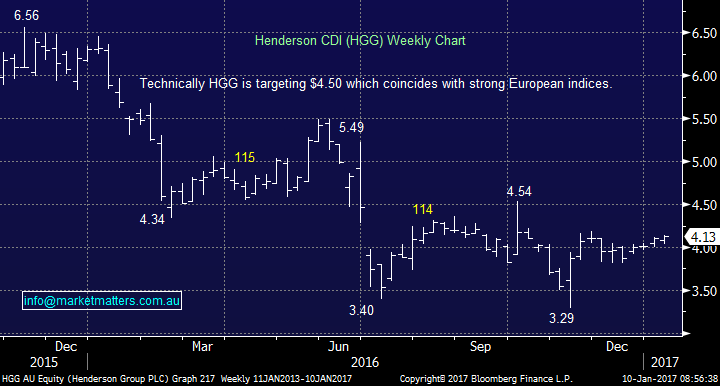

1b. Henderson (HGG) $4.13

HGG is a similar play to BTT and its very unlikely we would purchase both stocks, hence 1a and 1b. We like HGG for a rally towards $4.50.

Ideally we are buyers of HGG under $4 with stops under $3.70.

Note both these plays are relatively aggressive as they are very susceptible to any bad news from Europe e.g. BREXIT's unfolding, Italian banks and looming elections.

Henderson (HGG) Weekly Chart

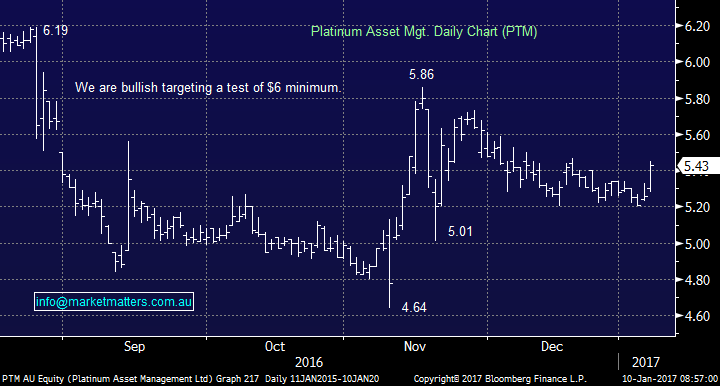

2 Platinum Asset Mgt. (PTM) $5.43

PTM has been a horrible sector underperformer given key personnel changes but as investors search for value in this rich market its looking excellent on a risk / reward basis.

We are buyers of PTM around $5.40 with stops under $5.20.

Platinum Asset Mgt. Daily Chart

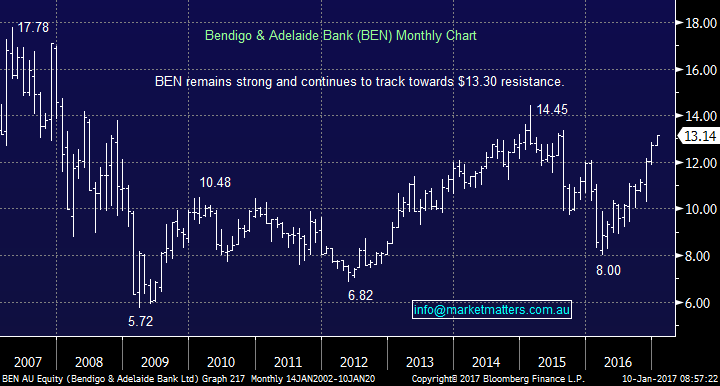

3 Bendigo Bank (BEN) $13.14

We like BEN as our banking exposure is now light after taking profit on Westpac, which currently feels a touch premature, and BEN pays a healthy fully franked dividend in mid-February.

The current ideal buying of BEN is ~$12.75 with stops under $12.40.

Bendigo Bank (BEN) Monthly Chart

Summary

While we remain buyers of weakness it is likely that a large degree of our focus will remain in the financial sector with BTT. HGG, PTM and BEN on the radar as outlined above.

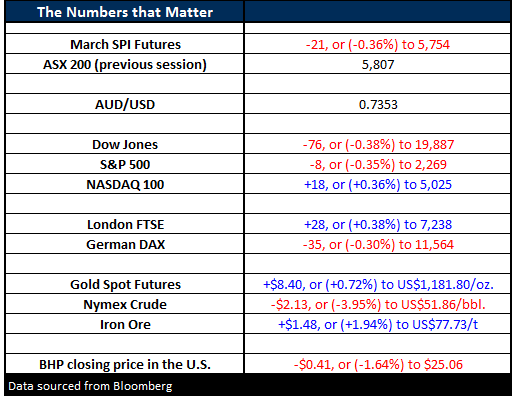

Overnight Market Matters Wrap

- A change in tune was experienced in the US markets overnight, with stocks falling

- The Dow lost 76 points (-0.38%) to 19,887.38, while the broader S&P 500 closed 8 points lower (-0.35%) at 2,269. The NASDAQ 100 however gained 18 points (+0.36%) to 5,025.

- Oil slid 3.94% overnight to US$51.86/bbl as concerns returned back to investors’ minds with the rise in Iraqi and US exports providing some risk of a deal to limit output from major producers.

- Iron Ore gained some it recent losses overnight, rallying 1.94% higher to US$77.73/t, this will however not help BHP today due to its exposure in the energy space. BHP is expected to underperform the broader market again, after closing in the US to an equivalent of$25.06, down 1.64% from the previous close in Australia’s trade.

- The March SPI Futures is indicating the ASX 200 to open above the 5,800 level, however the banks will need to do the heavy lifting again if the broader market wants to close in positive territory.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/01/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here