3 stocks that are close to being oversold

As the US sits back and enjoys their Thanksgiving the short-term bullish trend for the ASX200 has clearly been established. Even with no major leads from overseas markets the futures are pointing to a 25-point higher opening, well over 5500. We remain bullish with a break back over 5600 a very strong possibility for 2016, we will be watching both the seasonal and technical paths closely over coming weeks, for the traders we anticipate the below:

- A few days consolidation around the 5500 area before another push higher.

- The "Trump rally" should consolidate / pullback around 80-100 points in early December.

- The "Christmas rally" will then follow over 5600, sending the market to fresh 2016 highs.

NB Surprises happen in the direction of the trend which is up hence the best risk / reward will come from buying pullbacks as opposed to selling strength.

At MM we are almost fully committed to the market at present looking for levels to take some profits on the stocks in our portfolio. However there are some stocks that have not enjoyed the recent strength and may become oversold in coming weeks creating buying opportunities into 2017 - we have covered 3 we like, and are watching this morning.

ASX200 Daily Chart

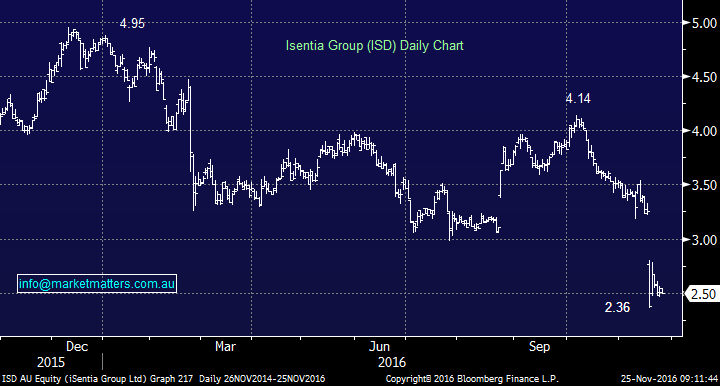

1. Isentia Group (ISD) $2.50

Isentia (ISD) has experienced an awful year with its shares trading down almost 50% from their highs of 2015. The stock recently plunged 25% after they downgraded guidance at their AGM to ‘high single digit’ earnings growth, largely a result of weakness in their content Marketing division – although that division only accounts for around ~9% of earnings and the rest of the business is performing well – which is the more important aspect. However as we’ve seen in recent times, stocks on high multiples that disappoint get savaged. – and that has clearly occurred with Isentia.

Technically ISD looks likely to test the $2.30 area prior to a 20% rally. We will consider buying this move if it occurs as a trade but do not see decent risk / reward at current levels.

Isentia Group (ISD) Daily Chart

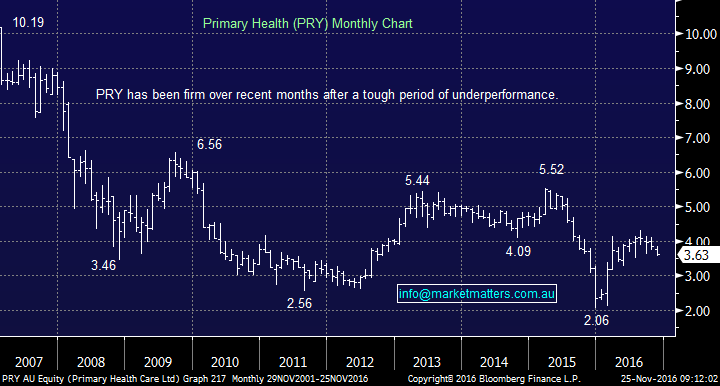

2. Primary Health $3.63

PRY has had a poor month falling 8.6%, within a Healthcare Sector that is down 2.5%, while the ASX200 has rallied. We believe the overall sector will regain some love shortly and potentially be the main benefactor of a "Christmas rally".

We like PRY under $3.50 with stops under $3.20.

Primary Health (PRY) Monthly Chart

3. Healthscope (HSO) $2.29

We have discussed HSO numerous times over recent weeks and it remains very firmly on our radar. We have a position in HSO currently.

We will look to add to that position ~$2.10.

Healthscope (HSO) Weekly Chart

Summary

We are long TPG Telecom as a trade at present, targeting the $8 region. We like the following stocks for a rally into Christmas if the buying opportunity arises:

ISD ~$2.30, HSO ~$2.10 and PRY ~$3.45.

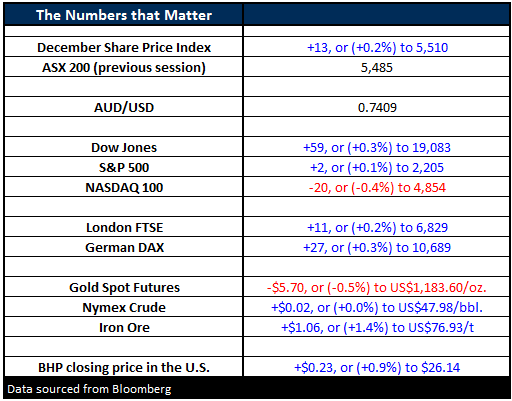

Overnight Market Matters Wrap

- The European share markets edged higher on a quiet session overnight, with the US closed for Thanks Giving.

- The EuroStoxx closed 0.3% higher at 3,040, while London’s FTSE closed 0.2% higher at 6,829.

- Iron Ore managed to climb 1.4% higher overnight to US$76.93/t.

- A quiet day is expected in the ASX 200 with the December SPI Futures indicating the index to open above the 5,500 level this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/11/2016. 9.15AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here