3 opportunities looming on the horizon

Global markets are now treading water after pricing in some major positives since Donald Trump's election victory, investors simply want to see some justification for the rerating stocks have enjoyed. This is normal trading activity after a 15.3% rally in the ASX200, in this case since the US election. It's easy to understand the psychological dynamic, nobody wants too much market exposure before a weekend when "Tweets" will be flying but conversely nobody is keen to liquidate large stock holdings with clearly strengthening US and global economies.

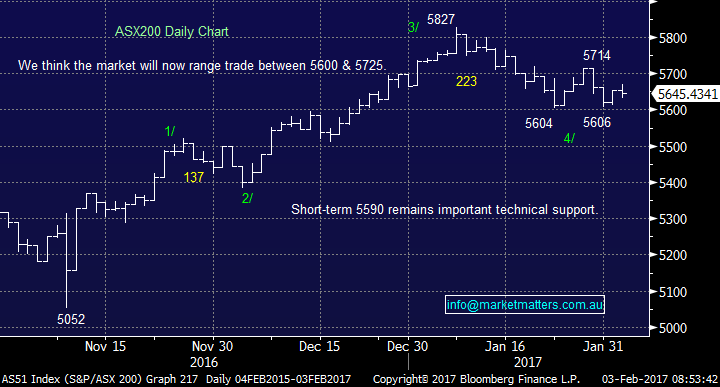

In the short-term we expect a fairly boring local market that will rotate between 5600 and 5725, a clear break over 5725 will again turn us bullish local stocks while a break under 5590 will question our medium term bullish view.

ASX200 Daily Chart

No change to our thoughts around US stocks, they continue to drift lower, with our target for the Dow 19,400 area, around 2.5% lower.

US Dow Jones Daily Chart

The current pullback and rotation in stocks is throwing up some attractive opportunities for investors, especially if they followed our lead and became cashed up into the recent strength - after recently topping up our Henderson holding into current weakness we hold 27% in cash. However, importantly we are not looking to fire all our bullets in this choppy market unless we get favourable entry levels into the resources sector. How we look to deploy our money is a very fluid process in this volatile time for individual sectors and stocks.

3 investment decisions looming in the short-term are outlined below, one is a potential sell and two are buys:

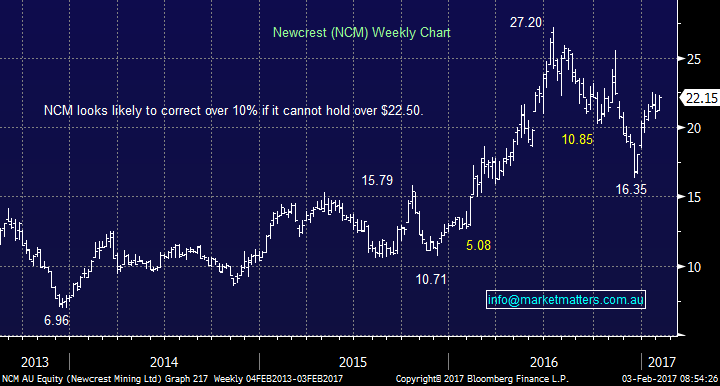

1. Newcrest Mining (NCM) $22.15

We continue to believe that 2017 will be an excellent year to be active in the gold sector with the $US pushing and pulling in both directions as sentiment oscillates around the speed that the US will raise interest rates. We are long NCM from ~$21, if the stock cannot sustain a break over $22.50 we will look to take a 7-8% profit and target a re-entry into the sector around 10% lower, again we reiterate that we treat gold stocks as short-term vehicles, not long-term investments.

Newcrest Mining (NCM) Weekly Chart

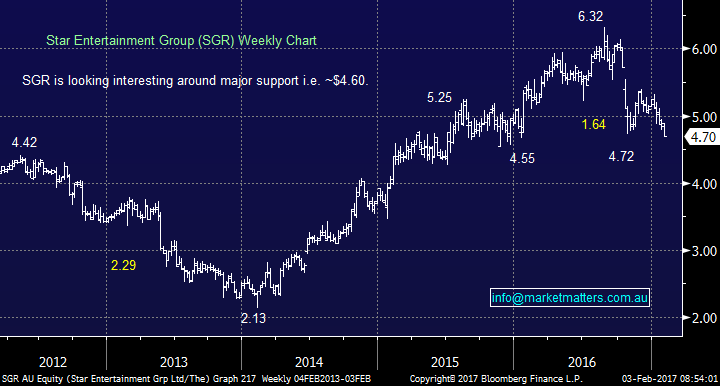

2. Star Entertainment (SGR) $4.70

We have been stalking SGR for a few months and it is finally slipping into our targeted buy zone, under $4.72. We remain keen to hold exposure to Australian tourism and the US president is currently aiding this belief, our last foray into the space via Mantra was disappointing but with the stock falling ~10% after our exit selling was appropriate.

The risk / reward with SGR is attractive, buy under $4.70 targeting at least a 12% rally while a break under $4.30 would imply we are wrong, a 6% fall.

We are buyers of SGR, into current weakness, under $4.72, a healthy 25% correction from its 2016 highs.

Star Entertainment (SGR) Weekly Chart

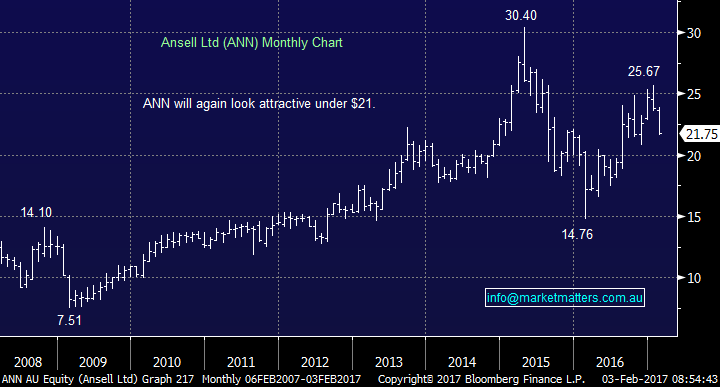

3. Ansell Ltd (ANN) $21.75

ANN was a solid success for MM in 2016 when we bought the stock ~$22 and sold over $25. Due to some broker downgrades, who were late to the selling party ANN has fallen ~$4 sharply over the last few days, we still like the stock but at the correct price and will look to re-enter ANN under $21.

Ansell Ltd (ANN) Monthly Chart

Summary

We are buyers of SGR under $4.70 and ANN under $21, while we will be watching NCM carefully around the $22.50 area.

Overnight Market Matters Wrap

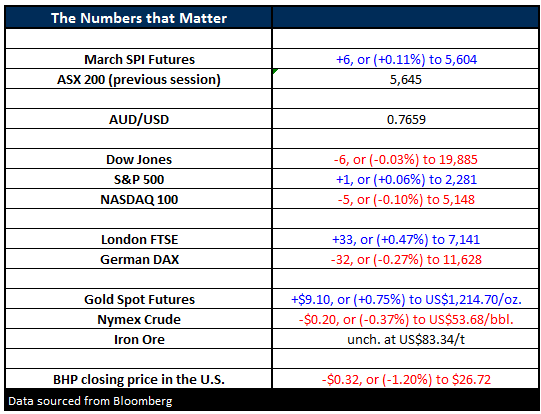

- The US markets closed with little change overnight as investors look to shy away from risk following comments from President Trump.

- Oil has slipped 0.32% lower to US$53.71/bbl. after reaching a one month high overnight while Gold has traded higher to hitting 6-week highs

- The March SPI Futures is indicating the ASX 200 to test the 5,660 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here