3 more Healthcare stocks under the microscope

A change from our usual Monday morning questions format as we want to be totally prepared for any opportunities in the coming days /weeks. Over recent reports, we have made no secret of our likely intention to switch some of our overweight banking positions into the healthcare space. In last Thursday mornings report we covered Ansell, Cochlear, and Healthscope and after some short-term poor news for Healthscope, we purchased the stock on Friday under $2.40. Note Ansell is approaching our buy zone under $22 and ideally close to $21.50.

Ideally we see another ~2% upside from the banking sector in October and with NAB the first big bank to report this Thursday some volatility within the sector is likely, remember ANZ, NAB, and WBC all report soon and pay "fat fully franked" dividends in November - of these 3 we currently hold ANZ and WBC. The main focus for NAB, and the reason why we don’t own it is their dividend payout ratio of 85% which is unsustainable. NAB reckon they can grow into that dividend without the need for cutting it – we’re not so sure. As we covered in the Weekend Report the Healthcare sector usually outperforms in November / December with an average of return ~4.5% hence our current close focus on the sector. We tend to look more closely at sector rotation when markets overall are fairly muted. A more active approach is required over the next 6 months in our view, so we, therefore, need to be very conscious of seasonality amongst sectors

The US Healthcare Index fell ~0.9% on Friday night and our ideal short-term target is another 2-3% lower before resuming its long-term uptrend, also suggesting a good buying opportunity is close at hand.

US S&P500 Health Care Index Quarterly Chart

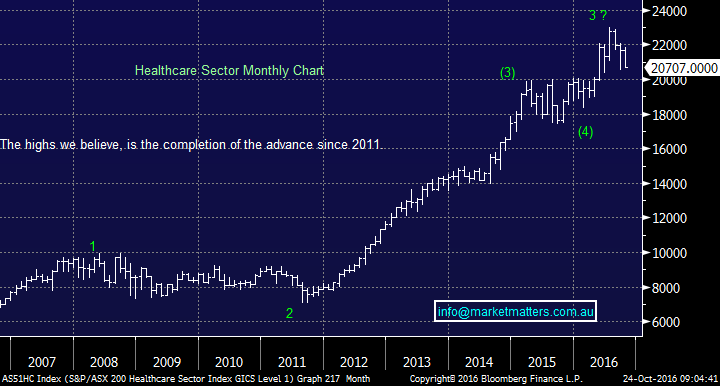

The local Healthcare Index actually looks to have completed a huge bullish advance since 2011 which makes sense as we are increasingly seeing stocks on high valuations getting whacked on the slightest whiff of disappointment - the Healthcare Index trades on P/E valuation over double that of the banking Index. Hence this rotation into the healthcare sector for our portfolio is likely to only be for 2-3 months.

Australian Health Index Monthly Chart

Today we are going to cast an eye over 3 more stocks within the sector.

1. Primary Healthcare (PRY) $3.95

PRY is the old bulk billing company which recently received some average press for charging patients up to $100 to see a GP - clearly a large psychological number. This would mean patients paying $63 and Medicare $37, this increased cost to patients is notably a total contradiction to Malcolm Turnbull's election promise. The shift away from bulk-billing by PRY, who own 71 clinics, maybe a little rocky until 2020 when the government's freeze on Medicare rebates expires. However PRY will benefit from a steadily aging population that needs more medical care, hence the longer-term thematic remains supportive.

The stock was hit hard in 2015 and remains 70% below its GFC levels as opposed to most stocks within the sector that are nearer their highs. Clearly, this is a result of changing Government policy which continues to present a risk to the company. Another key issue for PRY remains debt levels and although they have made substantial progress in recent times, they still have some way to go in terms of balance sheet repair.

The stock is currently trading on an estimated P/E valuation for 2017 of 18.5x which is not scary within the healthcare space but not as cheap as earlier in the year – and we doubt that the stock justifies it’s 15% premium to the market.

Technically PRY is ultimately targeting the $5 region but a pullback to towards $3.50 would not surprise short-term. The stock's underlying quality would make it more of a trade as opposed to investment to us. Better opportunities elsewhere at this stage.

Primary Health (PRY) Monthly Chart

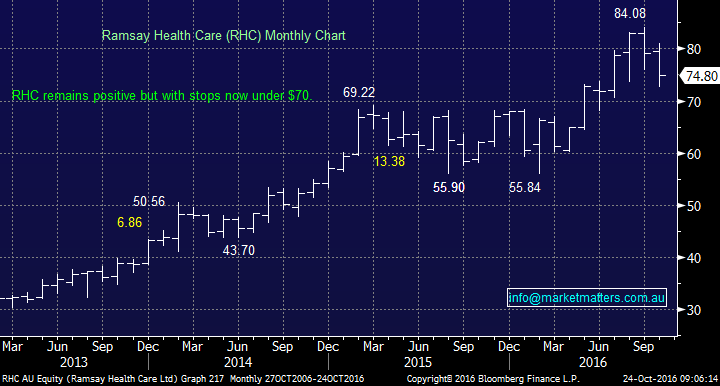

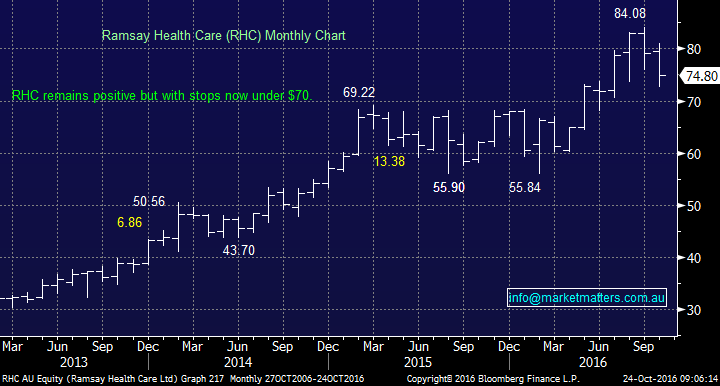

2. Ramsay Healthcare (RHC) $74.80

RHC is one of the top private hospitals globally and has been one of the top performers within the ASX200 since the GFC. Its most recent report implied further growth resulting in the stock making all-time highs over $84. The company has successfully expanded into France, the UK and Asia reducing its footprint risk in Australia.

We like RHC as a company and we were very tempted to purchase the stock on Friday ahead of Healthscope given it fell in sympathy, however, the ~20% plunge in HSO tipped our hand. It would be an aggressive decision for us to justify buying both HSO and RHC considering their similar exposures but it's not out of the question.

Technically the stock looks bullish while it holds over $70.

Ramsay Healthcare (RHC) Monthly Chart

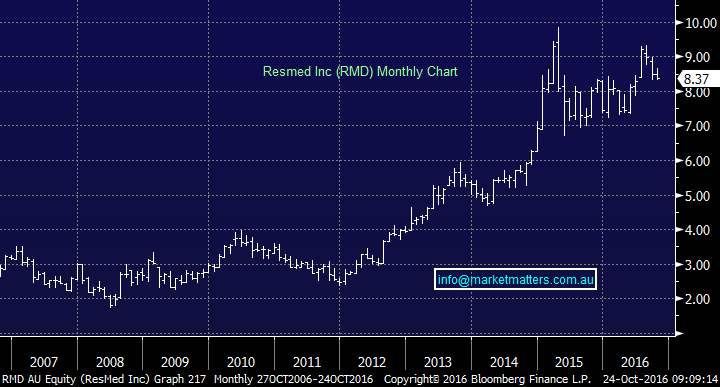

3. Resmed (RMD) $8.37

ResMed is a company whose products deal with sleeping disorders. This is a company we like and its recent 4Q16 report was solid driving its shares over $9, however, the stock has recently drifted lower with the sector potentially creating an opportunity. RMD's recent purchase of cloud-based health solutions provider, Brightree, looks likely to produce an even stronger earnings outlook moving forward.

While there is some pressure building around prices, RMD has continued to book good margins by managing costs extremely well. We believe RMD offers excellent risk / reward at current levels.

Technically we are buyers of RMD under $8.30 with stops under $7.90.

Resmed (RMD) Monthly Chart

Summary

Of the 3 stocks covered today below is our 3 simple conclusions:

- We could buy PRY ~$3.50 but as a short term opportunity only

- We like RHC at current levels with stops under $70, however, we now have exposure to HSO

- We like RMD under $8.30 with stops under $7.90 – this is our preference

*Watch for alerts*

Overnight Market Matters Wrap

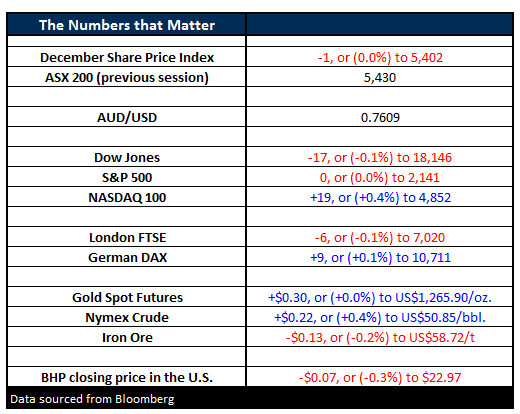

- Stocks in the US closed virtually breakeven on Friday with the Dow down just 17 to 18,146 whilst the S&P500 closed down only 0.18 points to 2,141. For the week it was much better with the Dow finishing up just 7 points and the S&P500, better in percentage terms, up 8 points.

- Oil finished the week with its fifth weekly gain after Russia made bullish comments, reiterating its commitment to cut the global glut, against another week of rising number of oil rigs, with another eleven rigs starting up last week. Crude finished up 22c (+0.4%) to US$50.85/bbl.

- The ASX 200 is expected to open flat this morning, around the 5,427 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here