3 major sectors catching our attention at MM (WPL,CBA, CYB, SYD, TCL)

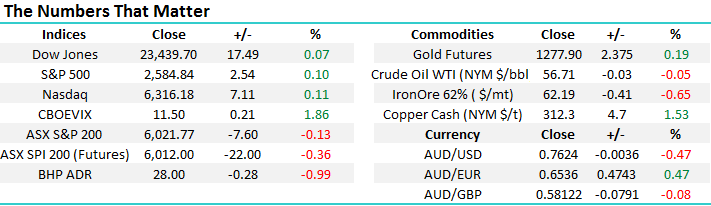

The local market feels ready for a period of consolidation and this morning our SPI futures market are calling a test of the psychological 6000 area, around 20-points lower. We remain vigilant of the seasonally vulnerable mid-November period, as identified previously the average pullback since the GFC around this time of year is over 5% for the ASX200 and over 6% for market heavyweight CBA, however there certainly have been no signs of any major weakness in our market to-date.

Following the ASX200’s +7% advance since early October we remain bullish the local market for now and would be keen to allocate our 11.5% cash position into appropriate stocks if / when we get a decent pullback by local / global equities. Overall no change to our current view:

- We remain bullish the ASX200 into 2018 targeting a solid break over this 6000 area.

- We would need a break back under 5825 to lose this short-term bullish outlook.

Today we are going to concentrate on 3 very important sectors of our market, which we regularly mention, but are currently generating very different thoughts / signals:

- Energy Sector – following Shell's $2.7bn sale of its Woodside (WPL) stake overnight at $31.10, around 3.5% below yesterday close, will opportunities arise in the sector?

- The “yield play” which we are very bearish slipped yesterday as bond yields continue to advance.

- Australian banks remain very strong and perhaps 2017 will break the rule of weakness from the sector, obviously after dividends.

ASX200 Daily Chart

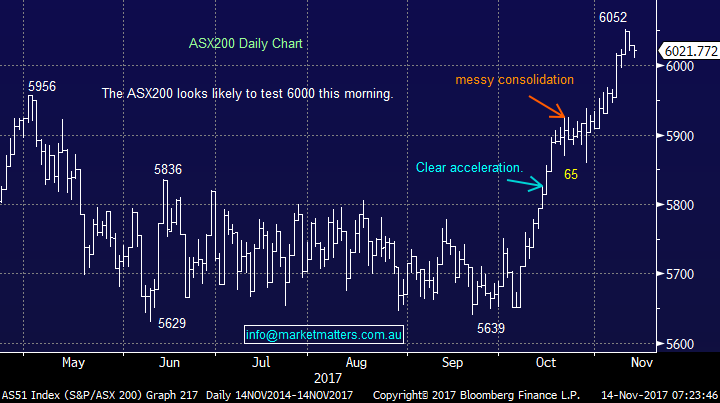

1 The Energy Sector.

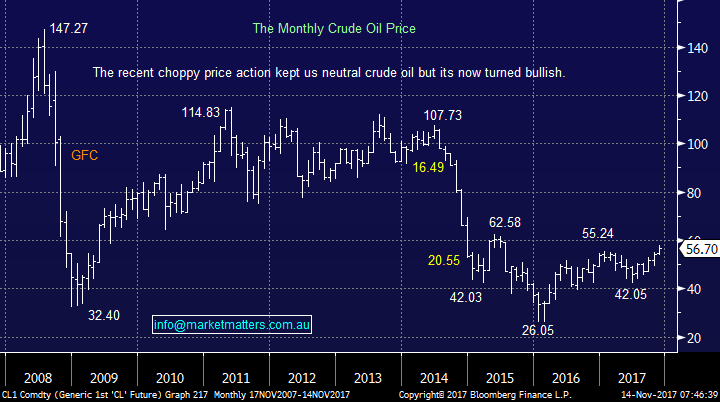

Overnight Shell has sold its entire stake in Woodside (WPL) for $2.7bn at $31.10. Our 2 initial takeout’s on this action:

- Shell initially only tried to sell part of its stake in WPL last night but due to huge demand they finally sold all of it, a clearly positive sign.

- The huge overhang over the WPL share price of the Shell stake has now been removed.

Importantly Shell are on a 3-year $30bn asset sales program which included its WPL stake following its acquisition of the BG Group 2 years ago. Hence there are no sinister reasons behind the sale, Shell are simply following a well laid out plan. We are medium-term bullish crude oil with a potential target of ~$US70/barrel, or over 20% higher.

Crude Oil Monthly Chart

WPL has been a poor performer since the GFC still trading down over 50% from its pre-GFC highs. However following the removal of the Shell stake, clearly huge demand for the stock near $31 and our positive outlook for crude oil in coming months we like WPL down close to its overnight placement price of $31.10.

MM is considering buying WPL this morning around $31, with a 3% weighting, should it trade that low. Importantly, we will not chase to higher levels given that 111m shares are now in the hands of institutions and that will naturally reduce on market demand for the stock.

From a more trading perspective Santos (STO) is very tempting around $4.30 – weakness in the whole sector is likely early today as fund managers rebalance their portfolios following the purchase of WPL.

*Watch for alerts*

Woodside Petroleum (WPL) Monthly Chart

Santos (STO) Daily Chart

2 The “yield play”.

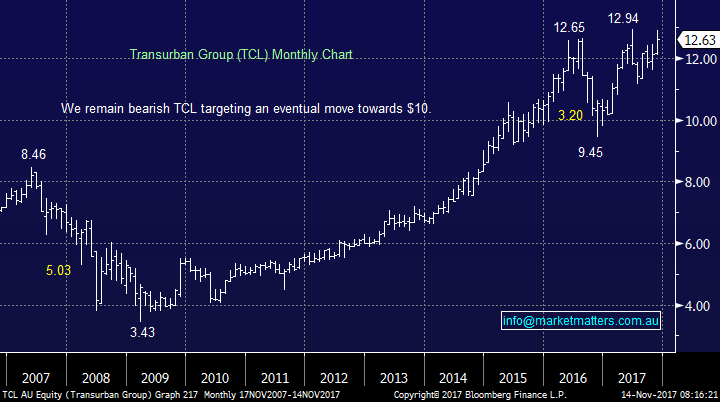

We’ve repeatedly discussed our current dislike of the “yield play” stocks like Transurban (TCL) and Sydney Airports (SYD), not because we feel they are bad businesses but simply as they are commonly regarded as a “quasi-bonds” hence as interest rate rise they should fall in price. In 2016 we witnessed TCL plunge 25% in just 4-months as markets decided interest rates would rise, so clearly it can happen again. Although TCL has recovered strongly we believe as interest rates rise they will again fall back towards $10.

However we’ve been relaying this message for months so the obvious question is why again this morning?

Transurban (TCL) Monthly Chart

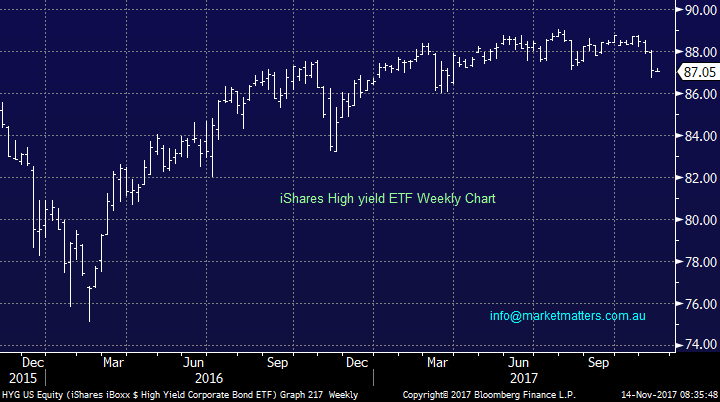

The answer is the “noises” coming from the US junk bond markets – higher risk corporate bonds. Recently we’ve seen some significant jitters within the US junk bond market which could signal the end to both cheap credit for American businesses and investors insatiable and almost indiscriminate chase for yield.

Last week the iShares Junk Bond ETF fell to its lowest level since late March, at this point in time it’s just a warning fall but we believe the risks are building for a sharp decline which will likely hammer the “yield play” as we know it. Outright ‘yield’ is an area to avoid and unfortunately, Australian investors are very long yield. It’s one of the key challenges facing the Income Portfolio, however we recognise this, and have positioned accordingly.

iShares High Yield (Junk bond) ETF Weekly Chart

3 The Australian Banks.

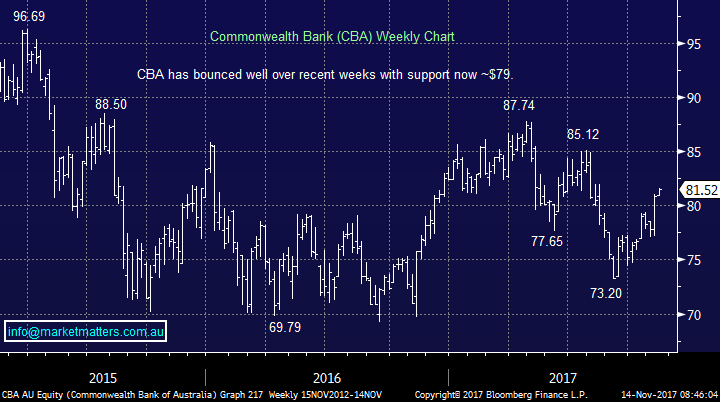

We recently took some profit on our Commonwealth Bank (CBA) position reducing the holding back to 3% and our banking exposure to 28% in the Growth Portfolio, still slightly overweight but not to the degree we were previously (please note, we maintained our 7.5% weighting in the Income Portfolio). As you know seasonally we are in the middle of a usually weak period for local stocks and especially banks, but it’s clearly not manifesting itself at present – CBA is up +5.3% over the last week including over 2% since we sold part of our holding. Three important thoughts at this point:

- We do intend to increase our banking exposure over coming weeks / months.

- At this stage we are comfortable being patient with purchases due to the position of the market and banks seasonality.

- Our likely purchases are CYB and CBA with the potential to also switch part of our Bank of Queensland (BOQ)

Commonwealth Bank (CBA) Weekly Chart

CYBG Plc (CYB) Weekly Chart

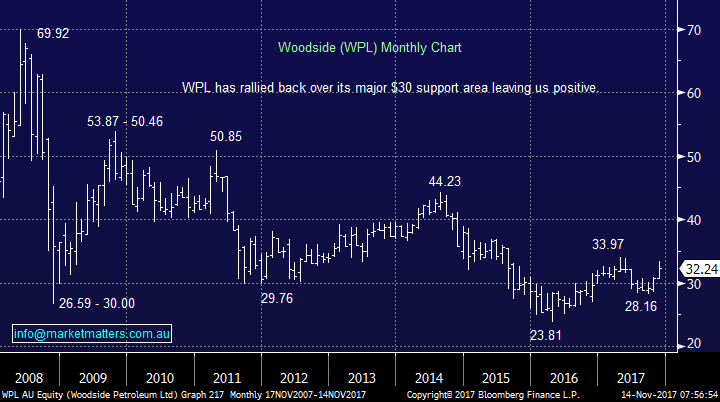

Global markets

US Stocks

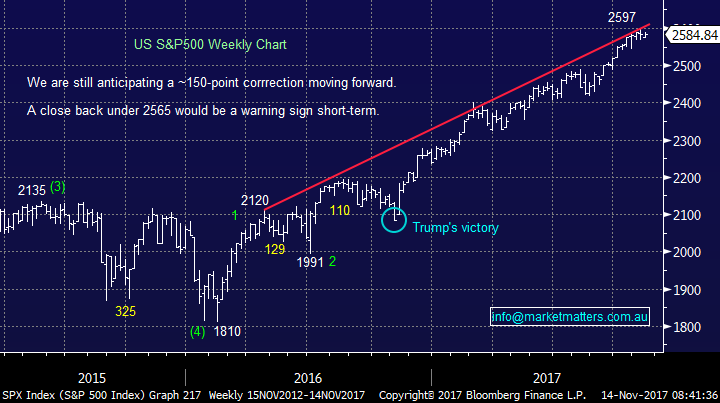

The US continues to oscillate around all-time highs and although we need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

US S&P500 Index Weekly Chart

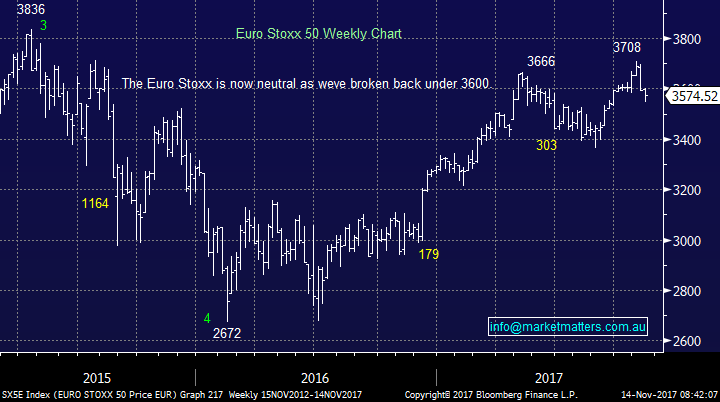

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative the Euro Stoxx technically following the break back under 3600. Notably at this point in time the fall has not been confirmed by the German DAX Index.

Euro Stoxx 50 Weekly Chart

Conclusion (s)

We are considering buying WPL this morning.

Overnight Market Matters Wrap

· The US share markets bounced back from earlier losses to return back to positive territory as the monthly US Fed budget deficit reported more than anticipated.

· The Euro Zone area continues to underperform against its global peers, with the EuroStoxx down 0.54% and the German Dax off 0.4% overnight.

· The December SPI Futures is indicating the ASX 200 to open 20 points lower, testing the 6,000 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/11/2017. 8.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here