3 Income Opportunities

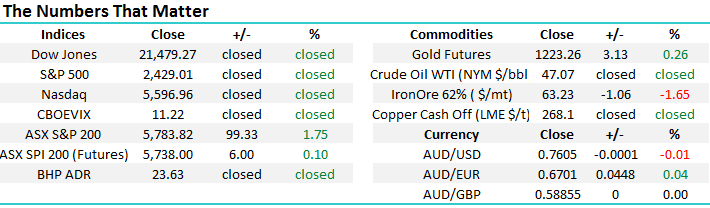

An extremely bullish session on the Australian market yesterday with a very broad based rally playing out that saw the ASX 200 up by +1.75%, led the Financials which added +2.20%. The big 4 banks accounted for 1/3rd of the move as interest rates globally continue to rise and perhaps the banks have an ally in the South Australian Liberals, who will oppose the state based bank tax.

The US Market was closed overnight for Independence Day - the anniversary of the publication of the declaration of independence from Great Britain all the way back in 1776. Interestingly, it’s the ‘publication’ of the declaration, not the declaration itself which was secretly voted on in Congress two days prior. It’s a national holiday around the States and they do patriotic things like hotdog and watermelon eating competitions!

In Europe, markets were a touch weaker with the FTSE down -0.30% however our local Futures are higher by +6pts. After yesterday’s move which punched through key resistance, the 5820 level becomes the next obvious target in the short term, however the positive seasonality that often plays out in July points to a target around 5950 on the ASX 200, which in another ~3% higher.

ASX 200 Seasonality

Income Opportunities

Later today Market Matters will launch a weekly income report with an associated income portfolio as a value add to existing subscribers. More information about the report to flow later in the day, however lets cover 3 income opportunities this morning.

1. AP Eagers $8.20 FY17 P/E of 15.7x Yield of 4.7% FF

A rough 12 months for the Nick Politis backed national car dealer which has traded from a 12 month high of $12.50 to a low of $7.25 before closing yesterday at $8.20. APE own the 12 top selling car brands in Australia with a huge dealer network that it predominately on the East Coast. One of the interesting aspects of APE is their property ownership. They own around 65% of the land the dealers sit on making them not only a ‘car’ play but one that’s backed by real assets. In May they provided earnings guidance which was below market expectations and the stock was sold off. Market conditions remain challenging, which is clearly the case across most retailers in Australia however they’ve been through this before, have a very experienced management team with a lot of skin in the game. The dividend is likely to stay around 35cps for the next few years putting it on a yield of 4.7% fully franked, while importantly, this represents a 70% payout of earnings – so not stretched. We are keen on APE around $8.00 as an income play.

AP Eagers (APE) Weekly Chart

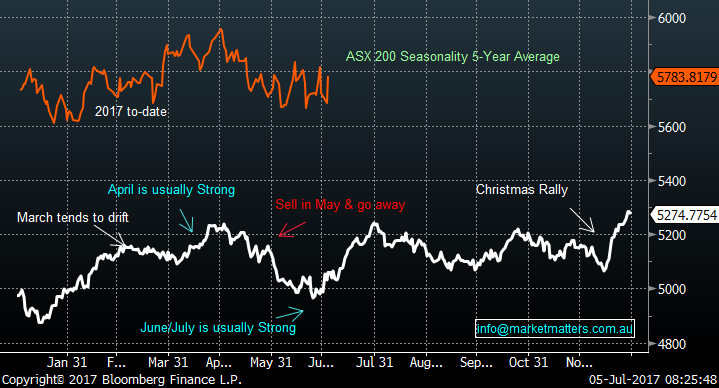

2. Centuria Capital $1.20 FY17 P/E of 10.1x (underlying) - Yield of 6.6% (40 % franked)

CNI is a listed funds manager that does a variety of different things such as property funds management, insurance, investment bonds, reverse mortgages and the like. For those that attended Market Matters Live in Sydney we had the Executive Director Jason Huljich present on the night. The funds management business is growing and they now have around $3.6bn under management with the bulk of this (around $3bn) in property. A large proportion of their revenue is now re-occurring (around 77%) and they have increased their scale following a large acquisition earlier in the year. They have a strong balance sheet, low gearing, on a reasonable multiple with a good yield that represents a payout of around 75% of earnings. A lack of meaningful liquidity is a negative however we think this is in the price. We are keen on CNI around $1.20 as an income play.

Centuria Capital (CNI) Weekly Chart

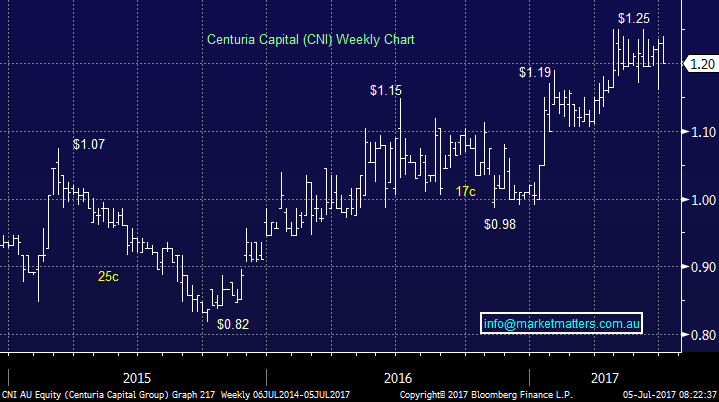

3. Hybrids – some interesting themes

Hybrids are a listed security that combine some elements of debt and some of equity. If managed properly, Hybrids within a portfolio can increase yield and also increase capital stability (or reduce overall portfolio volatility). A lot pay quarterly dividends (of distributions for some) and they are generally lower risk than equities. That said, they’re not a replacement for cash and are higher risk than a Bond or Subordinated Note. Hybrids will feature within the new Market Matters Income Portfolio and we will write about them weekly, giving investors a better understanding of the vagaries of the instrument and the opportunities in the market, in terms of existing listed securities and any new offers that come up.

On the ASX, there are around 36 Bank Tier 1 Hybrids, which make up the bulk of the Hybrid market, around 7 Bank Tier 2 securities which are Subordinated Notes or Bonds and around 15 Corporate Issues of various structures , from companies like Crown, Ramsay Healthcare and the like. It’s a reasonably small market however with some active management, Hybrids can be a worthwhile proposition.

At this juncture, most relative value is obvious in the Tier 1 Bank Hybrids over and above the corporates, and over and above Tier 2 notes. Most Hybrids have rallied in price recently making them less compelling however there are still some opportunities about.

The CBAPF is a Tier 1 Hybrid with 4.7 years to first call date. Based on a trading price of $101.70, this has a yield to call of 6.10% pa, which for its duration and credit quality of the underlying issuer, look reasonable value.

CBAPF – Weekly Chart

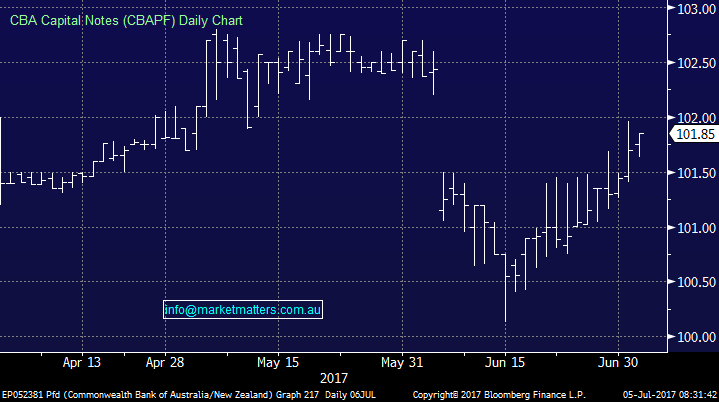

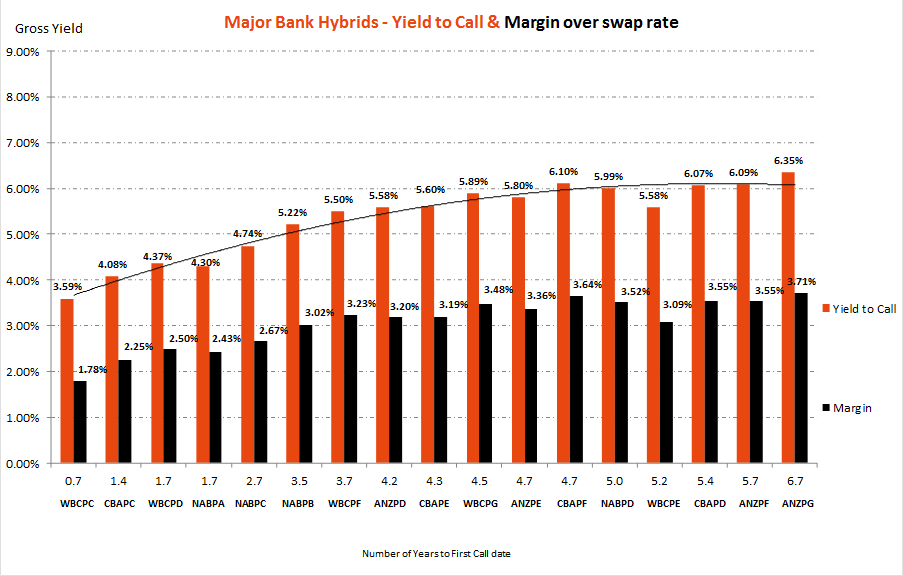

For a broader look at the Major Bank Hybrids below is a chart courtesy of the Hybrids desk at Shaw and Partners. The x axis looks at years to first call date, (the shorter the date to maturity the lower the risk all things being equal), the black column looks at the margin the security pays over its benchmark (such as the 90 day bank bill rate) and the orange bar looks at total yield to call (inclusive of any franking).

Source; Shaw and Partners

Overnight Market Matters Wrap

· With Wall St closed for the July 4th Independence Day holiday, European markets eased lower and gold edged higher on the news that North Korea had successfully tested a long range intercontinental ballistic missile.

· The positive mood on global growth, which helped the Australian market rally 1.7% yesterday, was dampened by this further threat created by the continuing North Korean weapons development.

· Gold regained some lost ground, up +0.26% to US$1223.26/oz, but most commodities were easier, notably iron ore down 1.7%. the Aussie Battler slipped back to US76c, following the rba dovish talk on rate outlook following yesterday's board meeting which kept rates on hold at 1.5%.

· Overnight, the world’s biggest LNG exporter, Qatar announced it would look to increase LNG production by 30% over the next 7 years to 100mt, (about 40 % of last year’s global demand), which will create fears of continuing oversupply for Australia's LNG exporters.

· The June SPI Futures is indicating the ASX 200 to open with little change this morning, near the 5790 area, with Asia likely to direct us later in the morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here