3 ‘Cheap’ Income Stocks

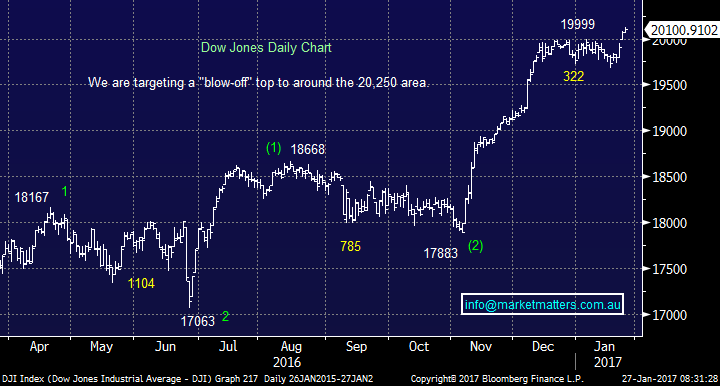

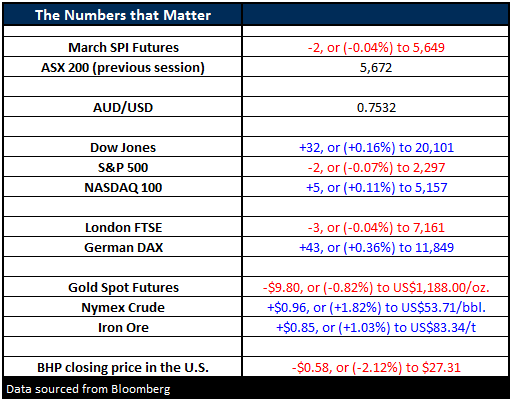

Two sessions of trade overseas, while we enjoyed the Australia Day break yesterday and no doubt many will be taking today off to make it a four day weekend! On Wednesday night the Dow Jones pushed through the 20,000 level for the first time in history, with a strong +150pt rally followed up overnight by a mixed session. Locally the SPI Futures are trading at 5649, up from the close on Wednesday of 5610, implying a ~40pt move higher in our market since we last traded. Obviously 20,000 is a ‘catchy’ number however it means very little other than providing a good headline for media reports. We’ve seen many ‘physiologically important’ numbers come and go over the years and it’s simply another one of those.

Importantly for us though, the move means the US market has now traded to new all time highs as we’ve been predicting and our preferred scenario now is for a ‘false break’ to play out before the US market retraces ~4%.

US Dow Jones Daily Chart

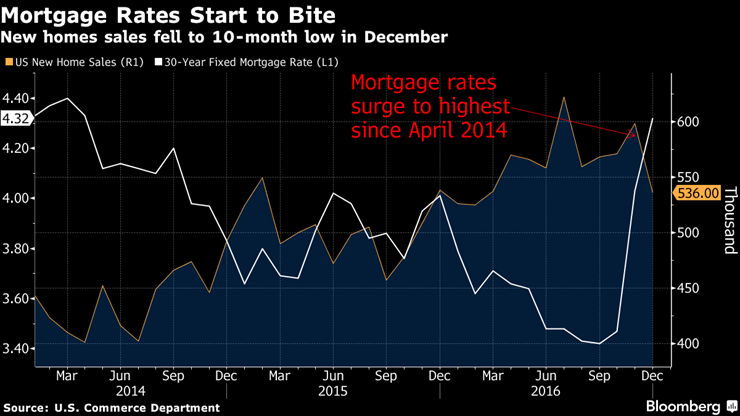

Earlier this week we said that there is ‘enough good news baked into current stock valuations that they will not follow through with this current rally’ which remains our view. Overnight in the US there was New Home Sales data released for December and it highlights one of the key risks racing the US economy – that rising interest rates will start to impact US economic momentum. Purchases of new home sales hit a 10 month low, however the interesting aspect of the chart below is the big uptick in the 30 year fixed mortgage rate which has gone from 3.54% just before the election to 4.32% overnight. A theme we’ve spoken of regularly however one that we think will dominate our thinking over the next few years.

We’ve written that the ‘yield trade’ will struggle in 2017 and we still think that will be case, however sentiment will ebb and flow and we need to be looking in places that might not have been on the radar in the last few years, and are therefore still reasonably cheap. Income is still very important for many investors and simply, there’s not many places to get it. Buying a stock for yield in an environment of rising interest rates has risk, but so too does buying a ‘growth stock’ on a high multiple in that sort of environment.

Here’s 3 ‘cheap’ income stocks that we like the look of for the longer term;

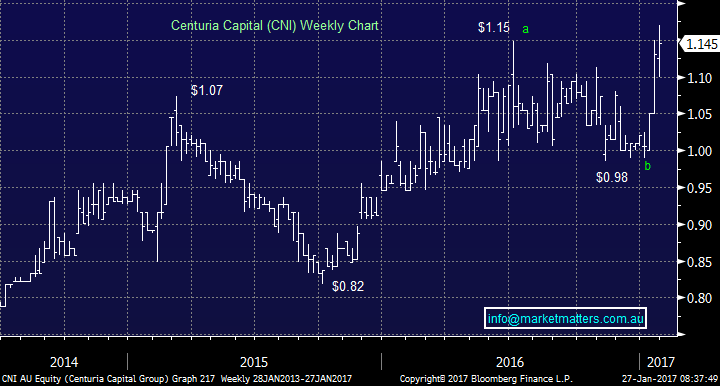

1. Centuria Capital (CNI) $1.15

Est P/E; 10

Est Yield FY17; 7.4% (100% franked)

This is a funds management business but not your typical operation - they do property funds management, investment bonds, reverse mortgages and some insurance and they just recently bought 360 Capital – another funds management business to give them more than $3.5bn in assets. They are big in property funds management and obviously property has been through a very strong period, however the 360 Capital deal is a positive one for earnings and it will give the stock a lot more liquidity and eventual inclusion in the ASX 300 we think. Cheap, high yield, low debt and a reasonable pathway to grow earnings over the next few years.

Centuria Capital (CNI) Weekly Chart

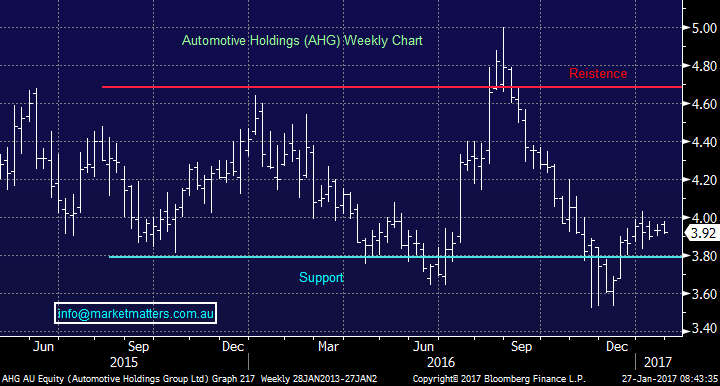

2. Automotive Holdings Group (AHG) $3.92

Est PE; 13.2

Est Yield FY17; 5.8% (100% franked)

AHG is Australia’s largest car retailer with around 6% market share, and it’s also Australia’s largest refrigerated food transport and warehousing provider. This is a company with a long history that’s had a tough time in the last six months, which is the reason why it now offers good value and a decent yield. The car retailing side of the business has been going very well, however the logistics side has been a major drag. At their last update towards the end of 2016 they outlined a big cost reduction plan in their cold logistics business which should significantly improve earning there however ultimately, a sale of that division at a reasonable price could be the trigger for this stock to move higher. A turnaround play.

Automotive Holdings Group (AHG) Weekly Chart

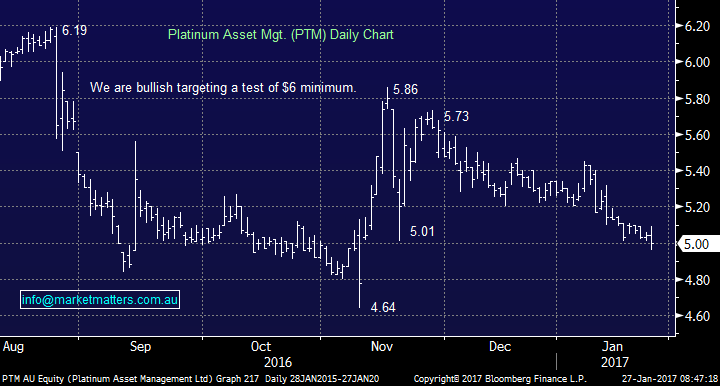

3. Platinum Asset Management (PTM) $5.00

Est PE; 14.60

Est Yield FY 17; 6.0% (100% franked)

One of Australia’s most well known fund managers that specialises in investing in international equities. They manage around $23bn now but that number has come down over the past 12 months or so, largely a result of weak performance in their major funds. PTM is an active manager and active managers struggled last year. The rise of cheaper, passive funds is a headwind but at the end of the day performance is the key, and it is starting to improve. This is stemming the slow of redemptions that are still happening, but at a slower rate. This is a contrarian play but cheap relative to peers and it’s cheap relative to it’s historical PE which for the last five years sits around 17.5x.

We have a position in PTM in the MM Portfolio and are looking to ad to it on a move below $5.00 – watch for alerts

Platinum Asset Management Daily Chart

Summary

- While we think that having a more active bias this year will deliver better results, some ‘yield stocks’ that are cheap, and have a catalyst to turnaround are worth considering

- We like CNI and AHG however liquidity is reasonably low

- We are looking to add to our existing position in PTM on a move below $5.00

Overnight Market Matters Wrap

- DJIA holds above 20,000 for a 0.16% advance, S&P 500 and NASDAQ flat.

- Just 4 sectors positive with Consumer Discretionary the best at up 0.26% and Health Care down 0.57%.

- Gold has traded off 0.7% to $US1192 and NYMEX WTI is up 1.4% at US53.78.

- Markets in China, South Korea, Taiwan and Vietnam closed today and China closed through to next Thursday for the Lunar New Year holiday.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here