2 stocks that are in our “Buy” cross-hairs

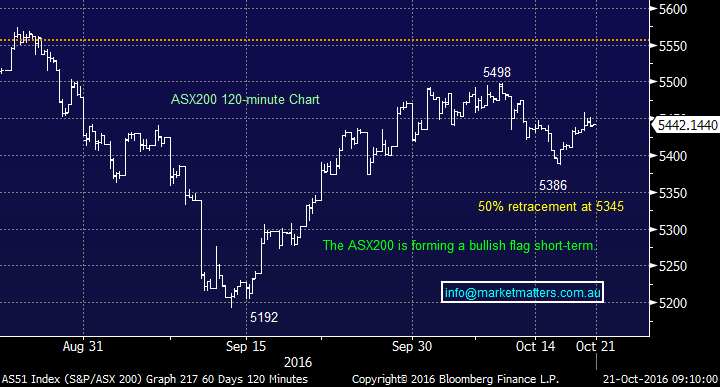

Happy Friday everybody, Sydney is delivering us a beautiful 27 degrees today as summer continues to raise its head. As we have mentioned recently global stocks have been quiet for the last 4-weeks and it feels they are likely to attempt a move in the not too distant future - the obvious question is in which direction! We are watching two important points carefully on the ASX200:

1. The ASX200 is forming a "Bullish Flag" pattern while it can hold above 5345.

2. Octobers range has been extremely tight, which is not unexpected into a US Election - November 8th. A break of 5498 level, or 5386, is likely to see decent follow through.

We recently increased our cash position to 14% by taking profit from our Bendigo Bank (BEN) position plus as you know we are looking to further reduce our bank holdings this month, with one eye watching the healthcare sector closely. However there are also 3 other stocks which are very close , or even at, our buy levels.

ASX200 120-mins Chart

Recently we enjoyed a successful trade in RIO options by taking advantage of the same "Bullish Flag" pattern. RIO formed this pattern after driving up from $41.51 to $51.04 and then consolidating this $9.53 (23%) advance above its 50% point ~$46. After a few weeks consolidation the stock rallied another $7 quickly although this rally has recently run out of steam. If a stock / market does break out of a bullish flag, like RIO, it should not then break back into the flag to remain bullish e.g. RIO will become neutral technically under $50.20.

RIO Tinto (RIO) Daily Chart

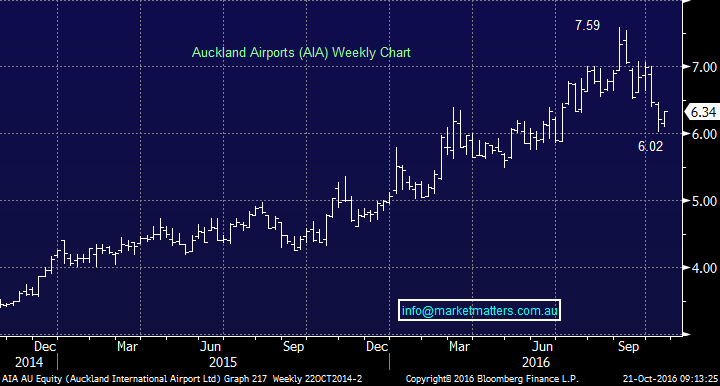

1. Auckland Airports (AIA) $6.34

The "yield play" stocks like Sydney Airports (SYD) have been under pressure recently with SYD correcting 16.4% at one stage this month. SYD is undoubtedly an excellent company but when investors are all long anticipating global interest rates around zero indefinitely the risks can clearly build. We went bearish SYD well over $7 but after its recent large correction we have switched to a neutral stance. Often when we have large sector moves some stocks get caught up in the excitement leading to opportunities. AIA has corrected over 20% underperforming its Sydney counterpart during recent weakness. Interestingly the long term picture for AIA remains bullish so perhaps our positive view on tourism will be on the money or the recent sell off in stocks related to rising rates will become just a warning for the future, as opposed to the actual economic shift.

The numbers for AIA are solid - during the last financial year total passenger numbers were up 9%, with 8 new airlines announcing services and 2 more saying they plan to. We reiterate that we like tourism over the coming years with the growth of the middle class in China. Technically AIA looks excellent and can bought at current levels with stops under $6, or ~5% risk.

Auckland Airports (AIA) Weekly Chart

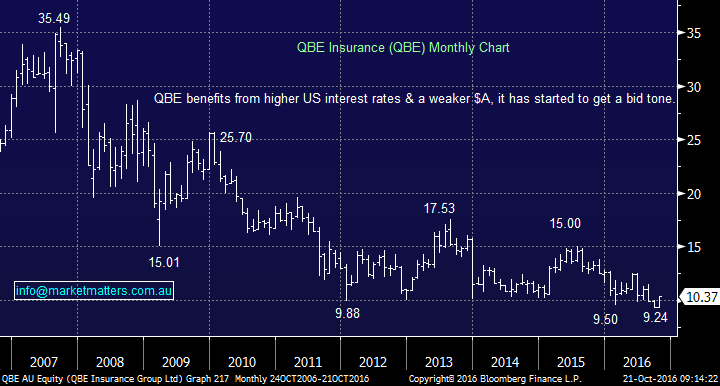

2. QBE Insurance (QBE) $10.37

We have been discussing QBE for a number of weeks and currently wish we had pulled the trigger! QBE has been a shocking performer over recent years hence ok news on the corporate front will be taken positively. QBE benefits from rising interest rates and a lower $A, hence a great exposure to one theme that hurts much of our local market i.e. rising US rates. As with all insurance stocks, earnings are generated by managing claims effectively and investing the float – both of which QBE has struggled with in recent times. The ‘float’ will start to generate better returns if interest rates rise however claims management will be down to QBE to execute on. Technically QBE looks excellent targeting at least $12 and probably $15 with stops under $9.50, or even under $9.90 for the more active.

QBE Insurance (QBE) Monthly Chart

Summary

Of the 3 stocks covered today below is our 3 simple conclusions:

1. AIA looks a BUY at current prices with stops under $6.

2. QBE looks a BUY at current prices with stops under $9.50, or $9.90.

*Watch for alerts*

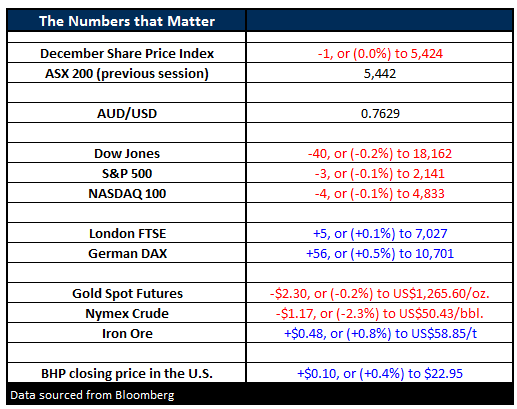

Overnight Market Matters Wrap

- Stocks in the US closed weaker last night in a complete reverse from yesterday, wherein the oil price was a catalyst for the strength yesterday, but dragged the market lower last night. The Dow finished down 40 points (-2%) to 18,162.35, whilst the S&P500 finished down just shy of 3 points to 2,141.34.

- Oil fell from its 15 month high on strength in the US$ and profit taking. The US$ Index (which is a comparison of the US$ against six foreign currencies) has now hit seven month highs, helped in part by Europe keeping interest rates on hold. Crude finished down US $1.17 (-2.3%) to US$50.43/bbl.

- Iron Ore managed to keep in the black, rising 48c (+0.8%) to US$58.85/t.

- BHP however was flat in London and New York ~$22.95.

- The ASX 200 is expected to marginally higher this morning, around the 5,448 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here