2 potential moves by us today / over next week (NAB, CYB, STO)

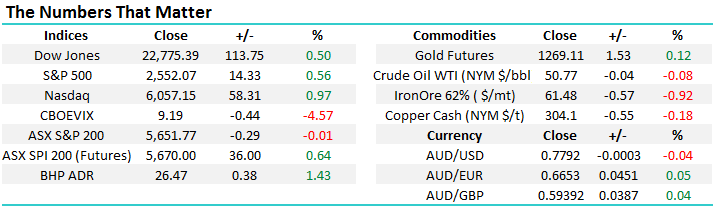

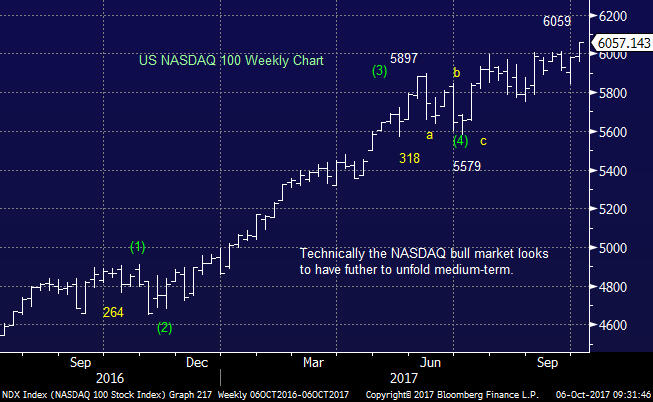

The Australian market continues to struggle compared to its international rivals from a pure index perspective e.g. since the start of September the ASX200 has fallen -1.1% while the Dow has gained +3.8%. The American market has received some strong economic data this week fuelling optimism around the US economy whereas Australia was hit with horrible retail sales numbers yesterday, hence the current relative market performance is easy to comprehend.

We can feel the complacency towards US stocks growing even in our office as the day often starts with “how much was the Dow up last night”? Two interesting statistics have caught our eye recently:

1. The retail buying of gold coins is on track for its worst year in a decade as investors look towards the stock market for better returns.

2. More margin loans are operational in the US than during the tech boom / crash around the year 2000.

As we know warning signs can be around for many months prior to any justification but we stick with our current opinion that global stocks are in the maturing phase of a bull market and hence any buying should be well considered before pulling the trigger as risks are slowly increasing.

The local market is set to open up ~35-points / 0.6% today as the recent support around 5600 yet again holds, at least for now. We still see a test of ~5500 in coming weeks.

ASX200 Daily Chart

Global Indices

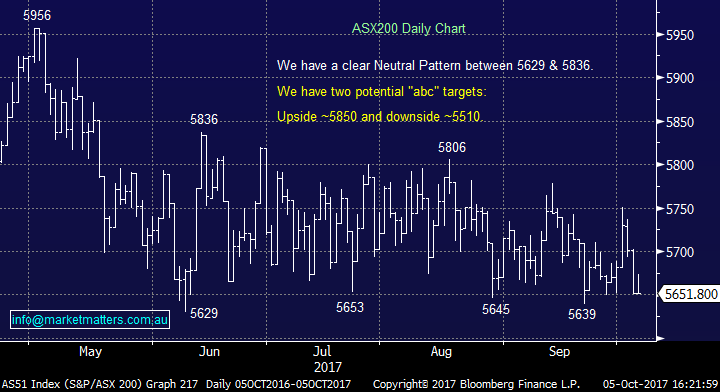

Global stock markets are trading at all-time highs having rallied almost 40% since we turned very bullish back in early 2016. We reiterate we have not yet turned bearish but our ideal target is now only ~7% away.

MSCI Global World Index Quarterly Chart

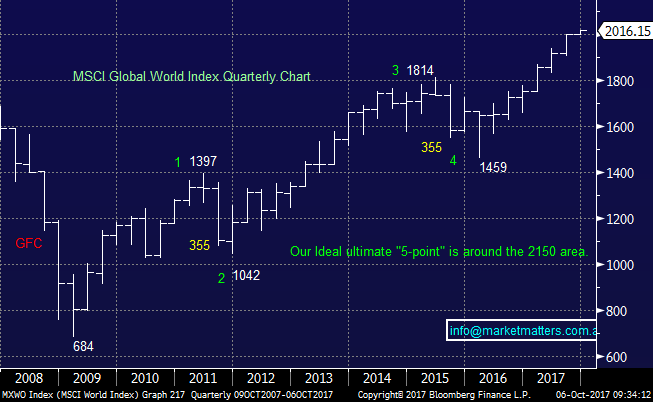

US Stocks

US equities were strong last night following positive reads on the US economy, while there are definitely no sell signals emerging we would not advocate chasing stocks at current levels.

Overall there is no change to our short-term outlook for US stocks where we are still targeting a ~5% correction to provide a reasonable risk / reward buying opportunity.

US NASDAQ Weekly Chart

European Markets

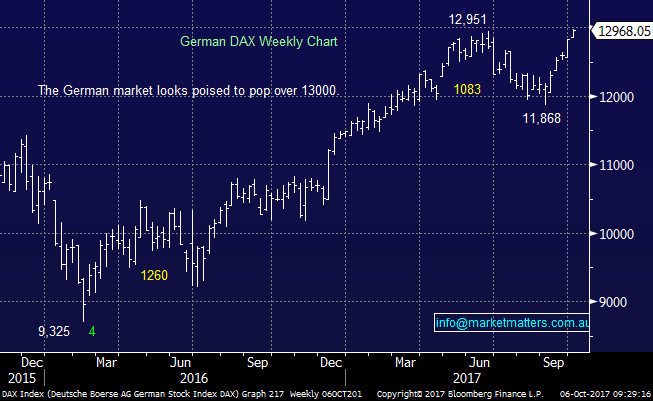

The German DAX looks positioned perfectly to make both fresh 2017 and all-time highs in coming days but we can see this move failing and a decent correction again unfolding.

However overall just here we have to be neutral.

German DAX Weekly Chart

2 Portfolio moves MM is considering.

We find ourselves tweaking our Growth Portfolio more often than many investors / subscribers are used to but the reason is simple – this is a mature bull market where sector rotation is far more prevalent than overall buying / selling of the index.

Just consider these 4 favourite stocks if you have generally been a buy and hold style investor over the years:

1. BHP is down 44% over the last 6-years and 9-years respectively.

2. CBA is down over 21% over the last 2 ½ years.

3. Telstra (TLS) is down 50% over the last 2 ½ years.

4. Ramsay Healthcare (RHC) is down 26% over the last year.

These are huge moves when the RBA cash rate is only 1.5% and the ASX200 is basically unchanged for a decade.

While MM definitely does not advocate “trading” we believe strongly that investors looking for optimal returns must be more active than in the past e.g. be prepared to both hold large cash positions and switch stocks when appropriate.

We are comfortable with the balance that some stocks have been in our portfolio for 2-years whereas some may only last 2-weeks!

1 Switch CYB to NAB.

Last night US banking stocks rallied another 1.3% to again make fresh highs for 2017, we have been bullish the sector but remind subscribers that following the recent strong advance our ideal target is now only ~7% higher.

It’s frustrating that we tried to sell CYB at $5.30 and its failed a few cents short to-date however we are flexible and open-minded, today we are considering moving the selling of half our position in CYB to best and allocating half of these funds to NAB, hence increasing our NAB position to 10% of the MM Growth Portfolio. Over the last month CYB is up almost +11% compared to NAB at +2.8%.

Investors who buy NAB today are positioned for their likely 99c fully franked dividend looming in November, plus 2 more over the next 13-months.

*Watch for alerts

CYBG Plc (CYB) Weekly Chart

NAB (NAB) Weekly Chart

2 Sell Santos (STO) higher.

We purchased STO for the Growth Portfolio earlier this week at $3.95 with a target of fresh 2017 highs towards $4.50. Last night energy stocks were strong in the US so it’s important to be prepared in case STO rallies strongly over the coming week.

We are sellers above $4.40, which would be a nice +11% return if / when it eventuates.

Santos (STO) Daily Chart

Conclusion (s)

No major change, remain flexible and be prepared to “tweak” portfolios when appropriate and this may well become one of the most exciting periods from investing we’ve ever witnessed.

*Watch for alerts.

Overnight Market Matters Wrap

· The US equity markets all closed higher overnight, the tech heavy NASDAQ the best performer up 0.8%.

· The USD was also strong as the AUD fell below 78c once again. Bond yields continued their climb as odds of a December rate rise in the US jumped to 75%.

· BHP is expected to outperform the broader market, closing the equivalent of 1.45% higher in overnight trade.

· The December SPI Futures is indicating the ASX 200 to open 36 points higher towards the 5687 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here