2 ‘Fintech’ growth plays

Donald Trump now has his nose ahead of Hillary Clinton according to the latest polls and the market doesn’t like it - this prompted selling of US stocks, buying of Gold and selling of the $US overnight. Since the FBI reignited their investigation into Clinton’s leaked emails, Trump has roared back into contention and clearly that’s a concern for markets.

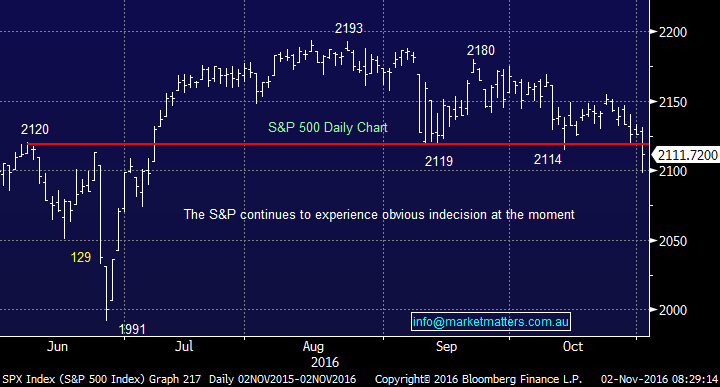

The S&P 500 broke through support overnight while the ASX 200 broke through last week prompting us to turn more neutral / bearish. It seems the market will remain under some pressure till we get an outcome in the US on November 8 – and if we do see a Clinton victory, expect a relief rally. If Trump gets in, which we still think is unlikely (but clearly possible) then a knee jerk reaction to the downside would probably play out – hence we made the decision to increase our cash levels to 21%.

S&P 500 Daily Chart

ASX 200 Daily Chart

Back on the 9th September we wrote about 3 more speculative growth stocks – FirstWave Cloud Technology (FCT), Cynata Therapeutics (CYP) and The Citadel Group (CGL). You can read the full article here however FCT has moved from 50c back then to close yesterday at 57.5c after being as high at 69c, CYP closed yesterday at 70c versus the 45c price in September while CGL has barely moved closing yesterday at $5.28 versus $5.30. 2 more smaller cap growth plays have caught our eye , both in the ‘fintech’ space which simply means they have some sort of technology that is used in providing financial services.

1 Zip Money 86c

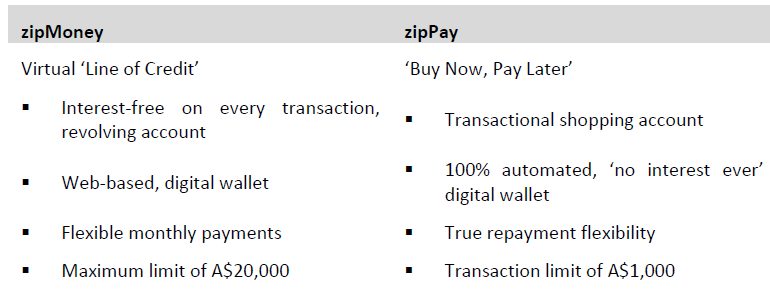

ZML is a platform retailers can use to offer credit to their customers. It’s a new form of ‘zero interest’ finance that was made popular back in the 90’s by the likes of Harvey Norman and other retailers of more highly valued items. The difference with Zip, is their technology allows them to offer a faster, smarter solution than what’s currently available, so it can be applied across lower value items. The other important aspect is around the speed at which a user can be approved (usually minutes) versus a credit card which typically takes weeks, and importantly, their ability to make good decisions on who they lend to – which in another component of their technology.

From the retailers side, they like it because it gives customers more purchasing power, and Zip will settle the purchase with them daily. Here is their two products;

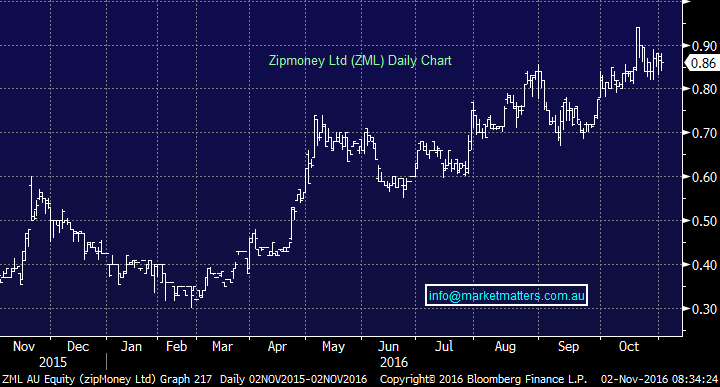

Zip is growing their loan book at a very fast rate – as shown in their latest quarterly numbers released on the 31st October, and importantly they’re signing some big name merchants. From what we can tell, the merchants (now 2000 of them) love the product as do users (about 300,000). Management are another highlight and the board is strong - we think they can grow this business into a substantial operation. It’s current market capitalisation sits around $200m.

We can buy ZML ~86c with stops under 75c

Zip Money (ZML) Daily Chart

2 OneVue (OVH) 64c

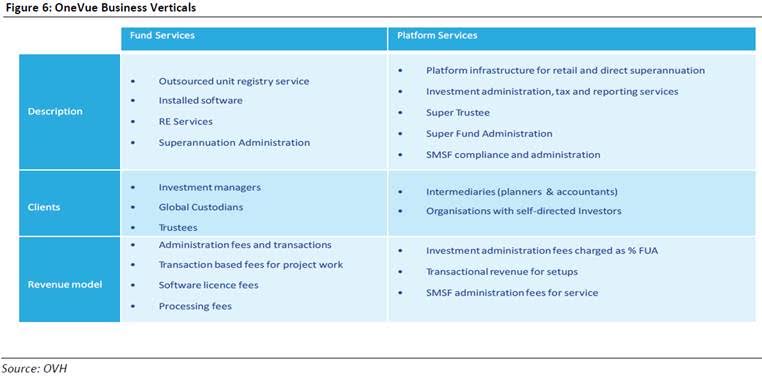

Financial services are ripe for disruption and technology is going to be the main driver by automating processes, reducing costs and giving the end client a better overall experience. Those companies exposed to the growth in retirement savings, particularly the growth in self-managed super should do well. Class Super (CL1) is a prime example of this and they’ve done exceptionally well since listing in December 2015 at $1 to now trade at $3.48.

OVH has been more of a slow burn after listing in July 2014 at 35c to now trade at 64c. They have a few different products but in essence, they provide the back end solution for fund managers to administer their funds. The fund managers concentrates on managing the investments, while OneVue looks after the backend. They also provide self-managed super funds, retail super, and other tech services. Here’s a breakdown of their services…

OVH has a market capitalisation of around $130m, a very big market to attack, have cash of $25m and should be profitable in FY17.

Technically, the stock has very little momentum at present trading in a range between 60c & 70c. We would wait to see some upside momentum come into this stock with reasonable volume before buying.

Onevue (OVH) Daily Chart

Summary

1. We expect markets will be impacted by polling leading up to the 8th November election.

2. We can buy ZipMoney (ZML) around current levels

3. We like OneVue (OVH) fundamentally, however there is not enough momentum technically to purchase now

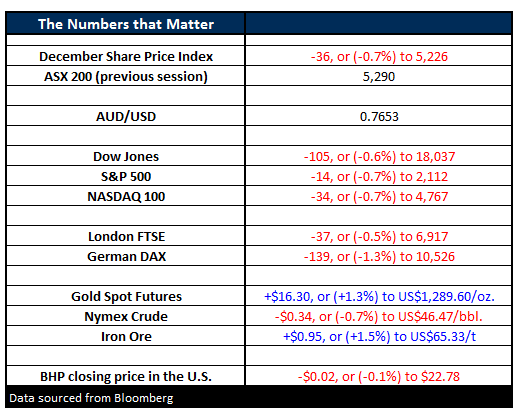

Overnight Market Matters Wrap

- The US markets fell on Tuesday, driven by recent election news, with the FBI again bringing fresh news to the email “scandal” and how that is boosting support for Trump, and an impending Federal Reserve report due Thursday morning our time. The Dow finished down 105 points (-0.6%) to 18,037, whilst the S&P500 closed down 14 points (-0.7%) to 2,111.

- Oil was stronger earlier in the day but finished lower to close down 34c (-0.7%) to US$46.476/bbl, its lowest point in a month.

- Precious metals (Gold silver and platinum) all finished stronger on the Clinton/Trump popularity contest heated up. Investors are worried that a Trump win will send the market into a “Brexit” moment, pulling the markets down, along with the US$. Gold finished up US$16.30 (+1.3%) to US$1,289.60./oz

- Iron Ore continued its strong move higher by finishing the night up 95c (+1.5%) to US$65.33/t.

- The December SPI Futures is indicating the ASX 200 to open down 37 points this morning, testing the 5,253 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/11/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here