Hot & Cold – The market today highlights some interesting trends

Hot & Cold – The market today highlights some interesting trends

Looking at the heat map of the market today tells an interesting story. The heat map looks at index point contributors and detractors and it doesn’t really make a lot of sense until you delve into the underlying sectors that are either adding index points or subtracting them. Only on very bullish days do we see the market rally as one. On days like today, where the market is fairly subdued / slightly lower we really see where investor appetite sits. If a sector rallies on a flat day, there is clearly some underlying demand for it. If a sector sells off on a flat day, then clearly it’s on the nose and probably should be avoided. More on this below…

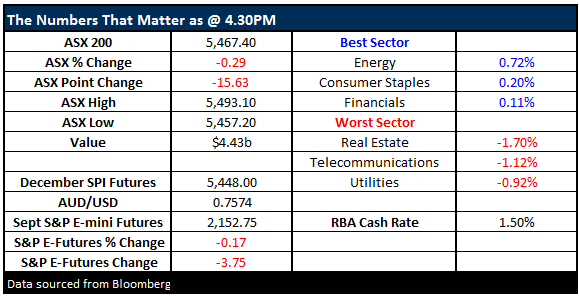

More broadly today, we had a range today of +/- 36 points, a high of 5493, a low of 5457 and a close of 5467, off -15pts or -0.28%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

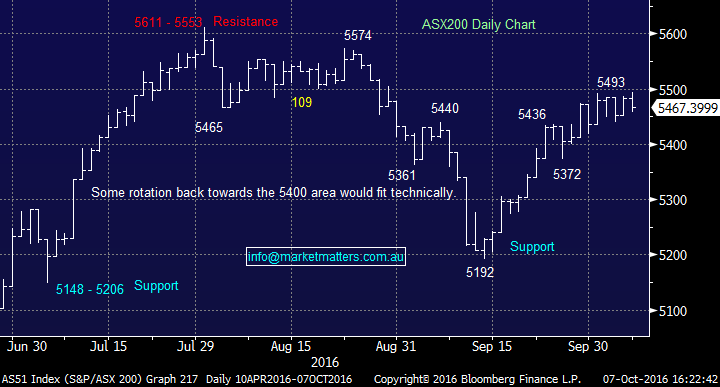

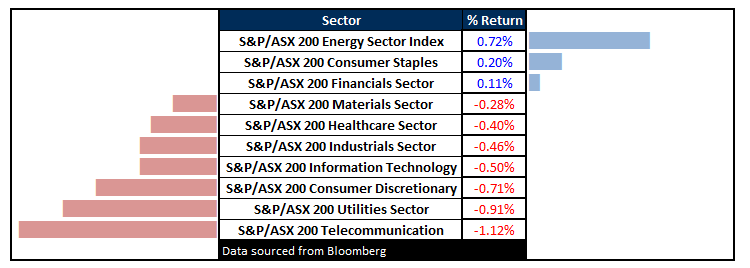

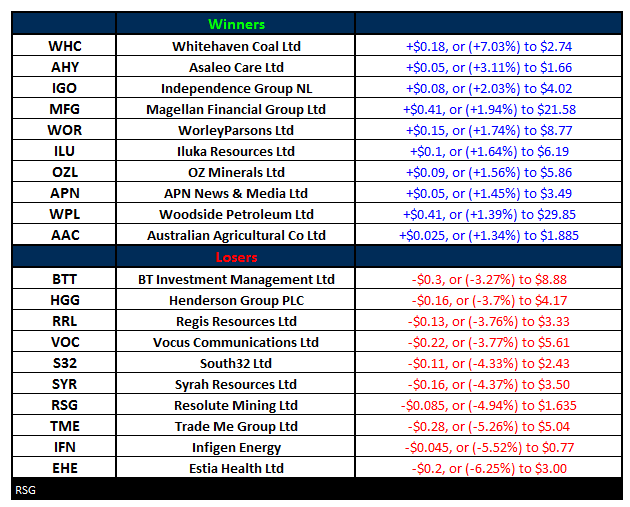

The HOT & COLD of the market; Oil is clearly coming back in favour and the best view of this comes from the discrepancy between the fate of BHP and RIO on the market today. BHP of course has a large exposure to energy – Oil & Gas in particular and they added +0.78% today v RIO was down a touch. The bulk of the energy coys were unsurprisingly higher, however if your eye’s are as good an mine, you’ll see the BIG red spot around the property sector. The REITs that have been market darlings for some time now however they are being sold as expectations for higher interest rates globally takes away some of the appeal.

More broadly, overvalued yield plays are starting to come under pressure – even in a flat markets – which tells a worthwhile story. Telstra (TLS) was weak taking 2 index points off the market closing at $5.01 after dropping sub $5 during trade.

The other interesting aspect is around banks – which continue to track higher while we’re seeing some weakness still prevalent in the Gold space – although Independence Group (IGO) finished up +2.03% to $4.02. Transurban (TCL) and Sydney Airports (SYD) lost another 1% while Dominos (DMP) – which is a very high PE stock and is extremely susceptible to some BAD news was down more than 3%...For those holding DMP, be careful – this is stock is just one ‘less positive’ announcement away from a very big drop….

Although we’ve touched on a few individual stocks, the heat map is more telling when looking at sectors. Banks are being supported, Energy is being supported, Property stocks aren’t, nor is infrastructure or telco’s. Within the resource space, energy is the clear standout, while the stocks exposed to base metals seem to be less appealing.

Sectors

ASX 200 Movers

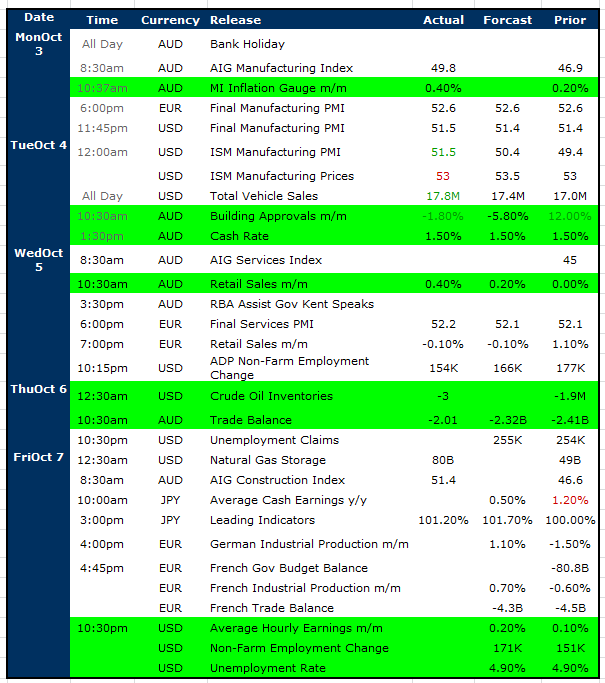

Select Economic Data - Stuff that really Matters in Green

**Chinese Bank holiday for the rest of the week**

What Matters Overseas

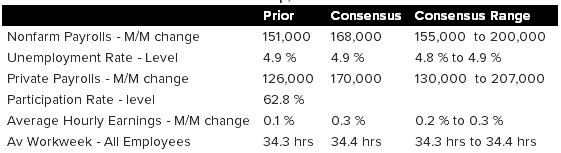

Non-Farm Payrolls tonight in the U.S. We covered the implications for the market in the morning report today….

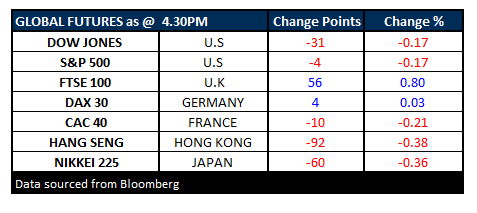

FUTURES mixed….