Healthcare underpins a decent market bounce (MIN, NBL)

WHAT MATTERED TODAY

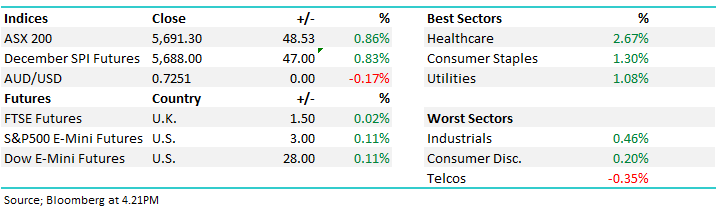

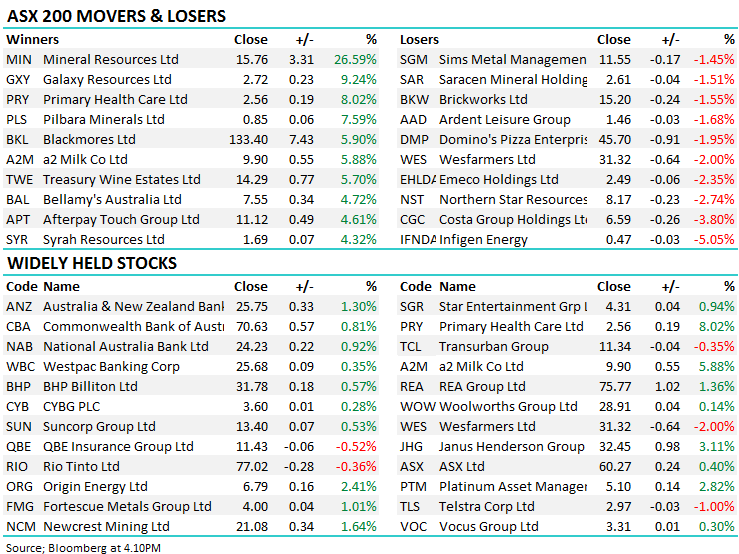

A better day for Aussie stocks with the market opening up and grinding higher throughout the session. A strong performance from the recently weak healthcare stocks – ASX:CSL & ASX:COH both did well up +3.34% & +2.85% respectively, however buying was pretty well spread across the board. Macquarie Group (ASX:MQG) appeared at the Royal Commission, however it was only brief relative to the other banks and the share price was bid up after they finished. MQG has been weak of late, obviously a result of equity market weakness but also concerns over their pending appearance at the RC – perhaps some clear air in front of it now.

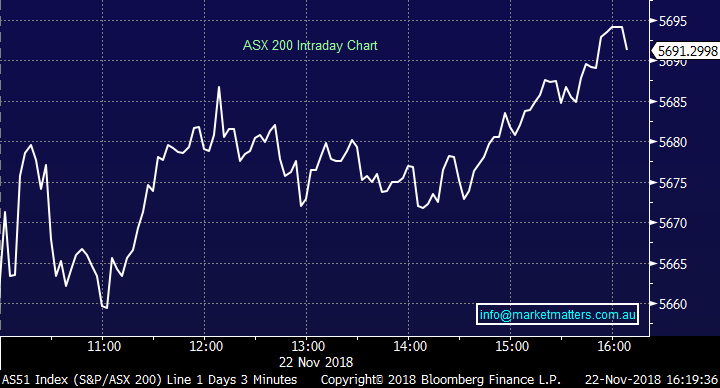

Overall, the ASX 200 closed up +48 points or +0.86% to 5691. Dow Futures are currently up +30 points or +0.11%. US stock & bond markets are closed tonight for Thanksgiving, with a half day on Friday – essentially they’re off for the rest of the week.

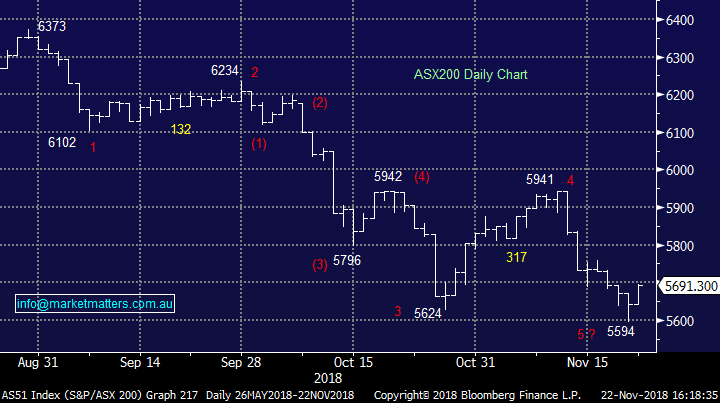

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves;

· Cochlear (COH AU): Upgraded to Overweight at Morgan Stanley; PT A$175

· Gascoyne (GCY AU): Rated New Buy at CCZ Statton; PT A$0.16

· NRW Holdings (NWH AU): Upgraded to Accumulate at Hartleys Ltd; PT A$2.11

· Pro Medicus (PME AU): Upgraded to Outperform at RBC; PT A$10.50

· Webjet (WEB AU): Upgraded to Outperform at Credit Suisse; PT A$14.40

· Wesfarmers (WES AU): Downgraded to Sell at Morningstar

Mineral Resources (ASX: MIN) $15.76 / 26.59%; Rallied hard today on the announcement of an exclusivity agreement in relation to a joint venture with Albermale to develop the Wodgina Lithium project. The JV purchase price for a 50% stake is around A$1.57b which puts a value on the project of more than A$3bn - this is a big number. MINs market capitalisation prior to this announcement was $2.34bn plus they also have other assets that add to the valuation by another ~$2bnish. Clearly the market had a reason to get excited today and it certainly did.

A few things to consider; The price is big, a lot bigger than I thought it would be when we owned the stock and it’s a credible deal with the acquirer having cash and debt facilities available, however the deal is not yet done (subject to various conditions) and within today’s announcement, MIN slipped through a 40% earnings downgrade with a huge second half skew to boot. In short, a cracking deal for MIN on the Wodgina asset but the rest of the business is struggling. If this deal does fall over, look out, the SP is going significantly lower. If we still held, we’d be sellers into this strength.

Mineral Resources (MIN) Chart

Noni B (ASX: NBL) $2.90 / +12.84%; the women’s fashion retailer jumped today whilst they held the AGM, giving a reasonable update to the year’s trading thus far. While not expecting much in the way of same store sales growth – like nearly every other retailer in the Australian market – Noni B was showing significant progress in the integration of the 5 Specialty Fashion brands it purchased.

The $31m acquisition was completed in July, and added Crossroads, Rivers and 3 other brands to the Noni B set up. While not expecting much in the way of same store sales growth – like nearly every other retailer in the Australian market – Noni B was showing significant progress in the integration of the 5 Specialty Fashion brands it purchased. The $31m acquisition was completed in July, and added Crossroads, Rivers and 3 other brands to the Noni B set up.

Originally the acquisition was not expected to add to the company’s bottom line in FY19, however today’s update showed synergies have been achieved faster than expected, and revised EBITDA guidance 21% higher to $45m, mostly thanks to the $30m annual savings. Despite the jump, the stock doesn’t excite us.

Noni B (ASX: NBL) Chart

OUR CALLS

No changes today

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.