Has the Christmas rally begun? (WEB, WBC, S32)

WHAT MATTERED TODAY

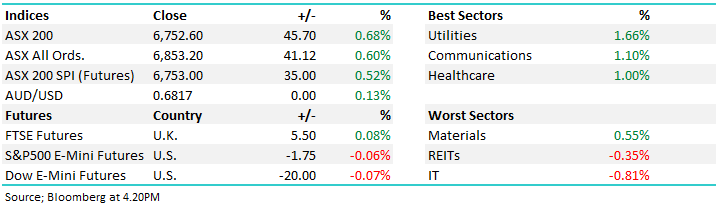

This morning we suggested the usual characteristics of a Santa rally was a market that rallies on a day when it’s not expected and then continues to advance 20 / 30-points per day even if global indexes wobble – watch this space with Christmas Day arriving in just 2-weeks. Today that was the case with a fairly subdued session overnight giving away to a volatile / choppy morning, before buying from around 1pm onwards pushed the market up into an afternoon high above 6750. Some of the more defensive utility plays led the charge today, Spark Infrastructure (SKI) a position we hold in the Income portfolio one of the standouts adding more than 2% - this looks good while some of the cheaper parts of the resource complex also started to move, South 32 (S32) catching my eye having rallied ~3% today, a stock on our radar.

While Ultities led the charge, Telco’s were also well bid - on the flipside the IT stocks lagged, closing down -0.81%. Overseas markets were fairly muted, Asian markets mixed, US Futures down a touch during our time zone. Thursday now shaping up as a big session overseas with the UK general election while My Trump is set to meet with his trade team and will likely make a decision on a deal or further tariffs. The market is positioned for a deal so anything that falls short would be taken on the chin.

Overall, the ASX 200 added 45pts /+0.68% today to close at 6752. Dow Futures are trading marginally lower by -20pts/-0.07%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

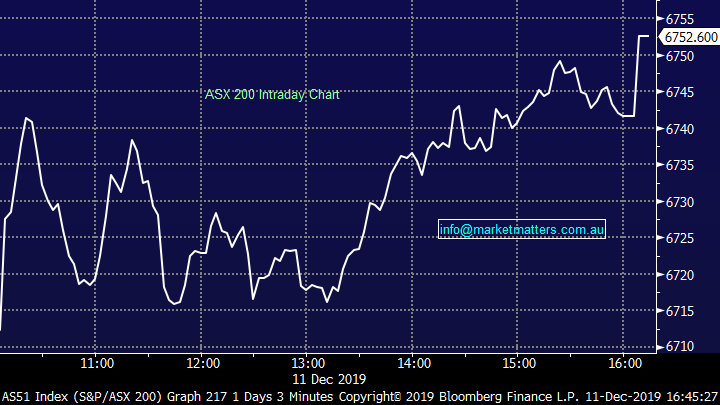

UK Election: Boris Johnson is tipped to win the UK election Thursday evening as the Brits head to the polls, although his lead in the polls contracted by around 50% in the last opinion poll before the vote (opinion polls – who trusts them!!). The Tories will win 339 of the 650 seats in the House of Commons, Labour 231, the Scottish National Party 41, and the Liberal Democrats 15, according to a YouGov forecast on Tuesday

His message has clearly been a simple one – GET BREXIT DONE – and to give some context around how much he has relied on this simple message, when asked about his girls friends Christmas present his reply was simply "What I want everyone to get for Christmas is to get Brexit done." Like the trade war, Brexit has become part of life however if Mr Johnson is elected tomorrow night, he has vowed to make it happen by the end of January 2020. Certainty in the region will be a positive, particularly for the likes of Janus Henderson (JHG), a stock we hold in the Growth Portfolio, Virgin Money (VUK) and even Macquarie (MQG) which has exposure there.

A Tories majority is the likely outcome with Mr Johnsons party currently at $1.33 to make that reality. A Labour minority is the next most likely outcome according to sportsbet paying $ 7.50.

British Pound v US Dollar Chart

Webjet (WEB) +9.61% travel booking site Webjet jumped despite telling the market there was nothing to yesterday’s media speculation that the company has a potential suitor. Journalists had reported whispers coming from Goldman Sach’s M&A team that there was a bidder out there for the company with PE money touted as a buyer. The company shot down the report, but investors love a good acquisition story and chased the stock higher throughout the day – where there is smoke, there is often fire. It appears we are set for more M&A chatter with PE seeing a huge windfall of investors’ money over recent years coupled with the ability to borrow on the cheap - the number of buyouts will grow. WEB now looks bullish

Webjet (WEB) Chart

Westpac (WBC) +0.7%; up today ahead their next opportunity to appease shareholders at their AGM tomorrow. Signs are pointing to a revolt by shareholders on remuneration where if 25% of investors vote against the report a spill motion would be triggered and all directors would need to seek re-election. Funds and proxy voters for a large portion of the register plan to shoot down the remuneration report and hence spill the board, however most directors are likely to keep their job.

The key will be watching new CEO Peter King talk to the bank’s progress in fixing the issues. For now, Westpac is looking pretty interesting.

Westpac (WBC) Chart

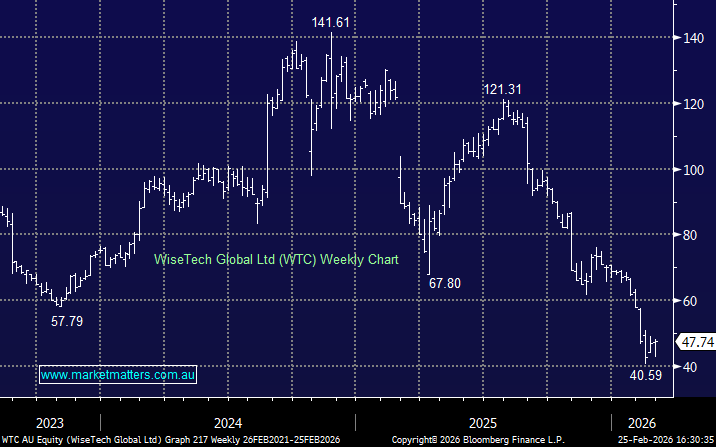

South32 (S32) +2.95%: A good session for the miner today and the stocks now looks great from a technical standpoint. This a cheap resource stock that provides leveraged exposure to the inflation trade we’ve been writing about in recent weeks. Western Areas (WSA) also now looking good after a pullback. We remain bullish mining stocks into yearend and into 2020.

South32 (S32) Chart

Broker moves;

· CSR Rated New Market-Weight at Wilsons; PT A$4.93

· Magellan Financial Raised to Hold at Ord Minnett; PT A$50.41

· Altium Reinstated Neutral at Goldman; PT A$33.55

OUR CALLS

In the Growth Portfolio today, we bought Bingo (BIN) and Beach Petroleum (BPT) while we also added to Sims Metal (SGM).

In the Income Portfolio we bought BHP and sold Transurban (TCL).

Watch for activity in the international portfolios in the coming days.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.